A weekly budget can be defined as summarizing the money and what you spend it on each week. It is critically important to be vigilant with your finances and make sure you are not overspending. However, most people find budgeting overwhelming, as it is generally hard to figure out what to include and exclude in a budget and how to stick to the laid-out budget plans. Whereas this is typically true, budgeting for your weekly income using a preferred template helps you visualize where your money is going.

Using a suitable and convenient weekly budget template, you can easily track your expenses as they happen, and analyze and monitor your spending.

Additionally, it allows you to identify the expenses to cut back on, enabling you to save some money for your short and long-term goals or investments.

This way, your life will be more organized, and you will have more control over your finances. This article will provide you with a complete guide for budgeting for your weekly income and will help you create a practical budget plan for your weekly income and spending.

Which Expenses to Include in a Weekly Budget Template

While creating a weekly budget template, you must consider various expenses that might apply to your unique expenses. Below is a list of typical expenses to include in a weekly budget template, but keep in mind that they only apply on a case-by-case basis-meaning; some of the costs might not apply to you.

Rent

Rent is the most common expense that comes into mind when people think of budgeting, and it is usually a fixed expense. However, in most cases, rent is usually due every month, and it may include other associated living expenses such as electricity, water bill, and heating or air conditioning. Therefore, you must deduct a portion of your weekly income and allocate it to your rent payment.

Food and groceries

This is a requirement for most households and families, as food and groceries are essential for survival. These expenses are also categorized under fixed expenses. Therefore, it is recommended that you include them in your weekly budget and set aside a specific amount of your weekly income to cater to these needs. Most of your food budget should be allocated to groceries to ensure you cook more of your meals at home and avoid eating out as much as possible.

Daily and emergency expenses

Daily and emergency expenses include coffee or snacks on the way to work and other daily consumables and a few emergency expenses that might crop up over the week, such as a broken car window, electric heater, etc. To ensure that you remain in control of your finances, it is essential that you set aside a portion of your weekly income and put it toward the miscellaneous or emergency expenses category.

Household maintenance

Household maintenance is a variable expense that you might incur over an average week. In addition, based on your specific location, the costs associated with household maintenance and repairs may vary significantly. Therefore, it is vital that you know these expenses and the applicable cost estimates and track them in your weekly budget template.

Wardrobe

Depending on what you buy and wear and where you work, your wardrobe costs may vary significantly. Thus, it is essential to budget for your unique wardrobe needs in your weekly budget template and set aside a certain percentage of your weekly income to cover your wardrobe expenses.

Subscriptions and data fees

Subscription expenses include cable service and internet to mobile phone and laptop contract bills and subscriptions to music services and online publications. Subscriptions and data fees are hard to avoid, and although they are variable, they can be anticipated in a way. Hence, they should be budgeted in your weekly budget template to ensure you live within your means.

Guests and traveling expenses

Depending on your lifestyle, there might be times when you have family, host a party, or entertain guests at your house. You may also need to travel from time to time, or you may need to budget for your guests’ travel expenses. You must plan for these expenses ahead of time and set a specific percentage of your weekly income to prepare for their eventuality.

Membership fees

Depending on your interests and hobbies, you may need to sign up for membership fees such as gym passes, yoga studio membership, and sports association. In most cases, membership fees vary according to your spending habits. As such, you may need to budget for these expenses in your weekly budget template

Medicine and health care expenses

Medicine and healthcare expenses can be unpredictable, but you must prepare for them by calculating and allocating a portion of your income each week to cater to these costs if they arise.

Pet care, bank, and parking fees

If you own a pet (s), you will need to budget for the pet’s food, grooming, veterinary costs such as checkups and vaccinations, and any other services that it might need to survive. Besides, suppose you are a bank account holder. In that case, you may also need to adjust your budget to include bank-account-related fees such as account maintenance fees, overdrafts, transfers, etc. in addition to these expenses, if you own a car and frequently park it in a garage or lot, do not forget to budget for parking fees in your weekly budget template.

Entertainment expenses

Entertainment expenses include everything from movies and theatre to sports events and other hobbies that you are passionate about. Entertainment expenses are classified under variable costs. Tracking these expenses in your weekly budget template is a great idea to ensure that you have more control over your weekly financial situation.

Gifts expenses

You may need to plan and budget for upcoming birthdays, anniversaries, and other special events in your social calendar. Planning will make it easy to budget for these expenses in your weekly budget template.

Charitable amount

Charitable donations are a discretionary expense that you can choose to give away to charitable organizations or allocate to help others in need every week or monthly. If you are willing to give some of your income to further charitable causes, consider budgeting for these expenses in your weekly budget template.

Steps to Create a Weekly Budget

Creating a weekly budget does not require advanced software or other high-level skills. You only need a clear idea of the kind of data you want to track and what information you need to include. The following is the standard step-by-step process for creating a feasible weekly budget:

Grab your paychecks

The first step in creating a weekly budget is to gather all your paychecks and other income data. This can be done by checking your bank account/credit/debit card statements, pay stubs, benefit invoices, loan statements, monthly bills, and store receipts.

Determine your weekly income

The next step involves determining your weekly income. This can be achieved by identifying your monthly income sources and noting them down. Given that your income varies from month to month, consider adding together your income from the past three months (minus all the applicable taxes and any necessary deductions) and divide the total by three. The result is your average monthly income. Once you have identified your average monthly income, you can obtain your weekly income by dividing your monthly income by four.

Create a list of all your expenses

After determining your net weekly income, it is time to determine your weekly expenses and the associated costs. This could include rent and the associated living expenses, food and groceries, subscription fees, membership fees, entertainment expenses, medicine and health care expenses, and travel expenses. To determine the dollar amount of money you spend on your weekly payments, add the unit costs of all of these expenses.

Identify discretionary and non-discretionary expenses

Once you have created a list of your expenses using either an excel spreadsheet or pen and paper, you will need to identify your discretionary and non-discretionary expenses. Discretionary expenses fall into things you may choose to spend money on, like meals out at restaurants or shopping at boutique stores or department stores. Non-discretionary expenses are those which you must pay for no matter what. They include things like rent and utilities, insurance payments, etc.

Your discretionary expenses should amount to no more than 30% of your weekly income, and non-discretionary spending should amount to 50% or less of your total income to create a realistic weekly budget. Your expenses should be listed in separate columns and marked as discretionary or non-discretionary expenses. This step will help you stay within your means and plan accordingly for your future.

Get your safe-to-spend

Then, you will need to add up all your discretionary and non-discretionary expenses, and the total amount should be deducted from your net weekly income. If there is a gap between your income and expenses, you have created your budget successfully because you have planned for the amount of money you will need to live comfortably. However, suppose you strike even or obtain a negative number while subtracting your expenses from your weekly income. In that case, you may need to cut back on some of your discretionary expenses or adjust your income by looking for more sources of revenue.

Once you have identified your safe-to-spend amount for each week, you can track how you are spending it using each of the following methods:

- Taking it out of the bank in cash

- Transferring it to your debit card account and using it to make purchases

Evaluate and make adjustments (if needed)

Once you create a feasible weekly budget, you should review it to evaluate what is and is not working, then make the necessary adjustments. This particularly applies when your weekly spending exceeds your weekly income or where you do not remain within a safe-to-spend amount. You can adjust your budget by cutting down on some of your discretionary expenses.

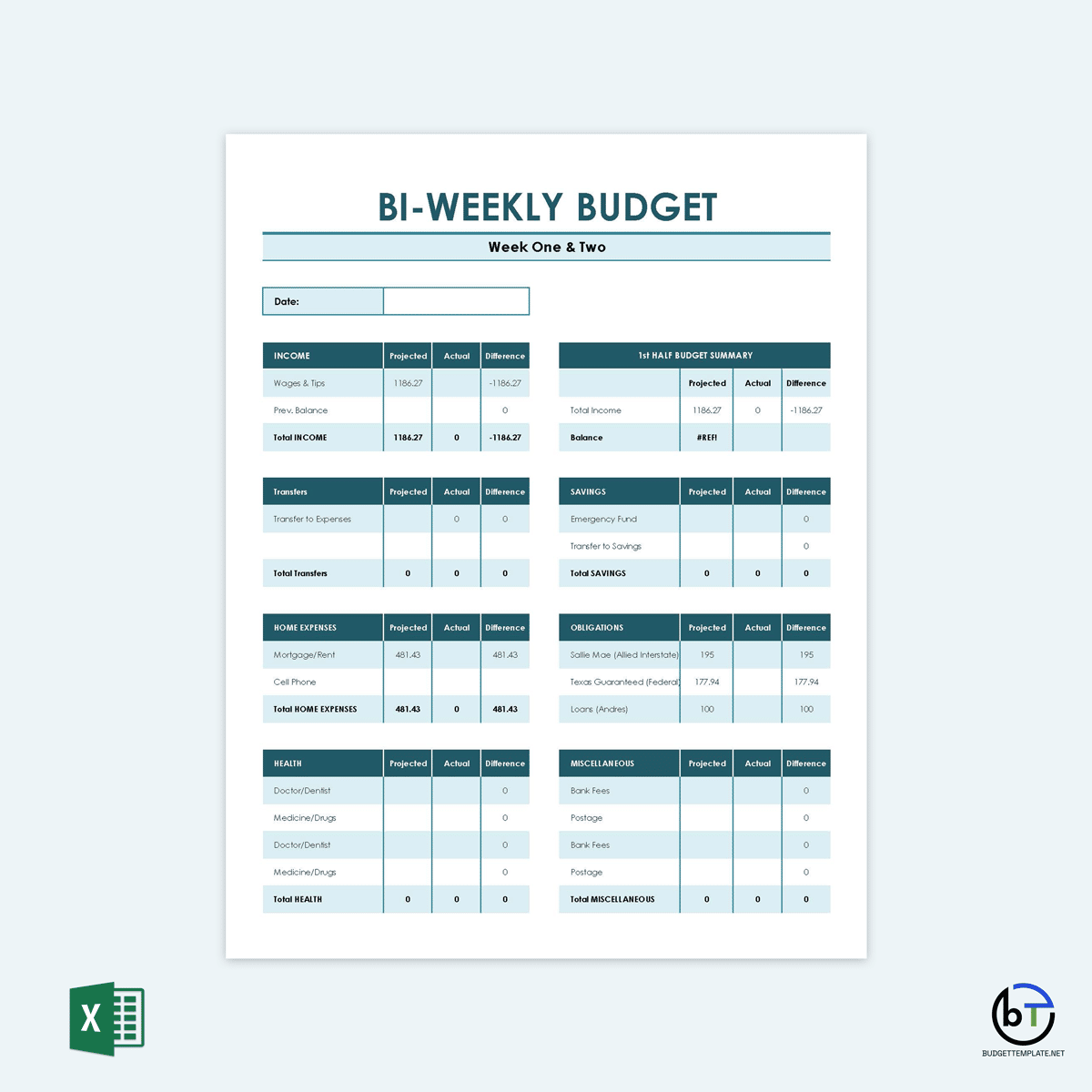

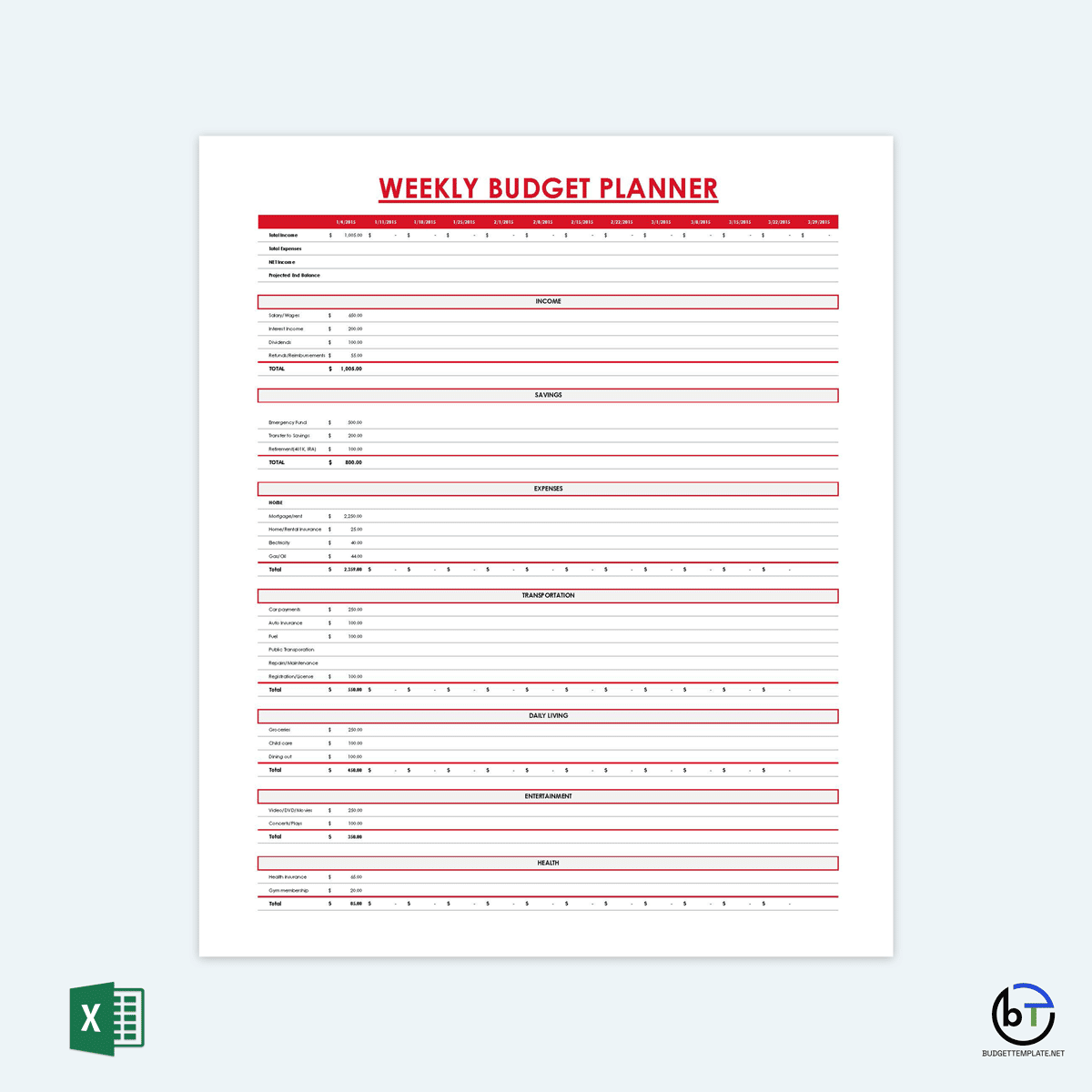

Weekly Budget Templates

Budgeting is one of the best ways to manage your income and expenses, as it ensures that you stay and live within your means. However, while it is an essential aspect of every person’s life, budgeting can prove difficult if you do not know how to properly include all the relevant weekly expenses in your budget template.

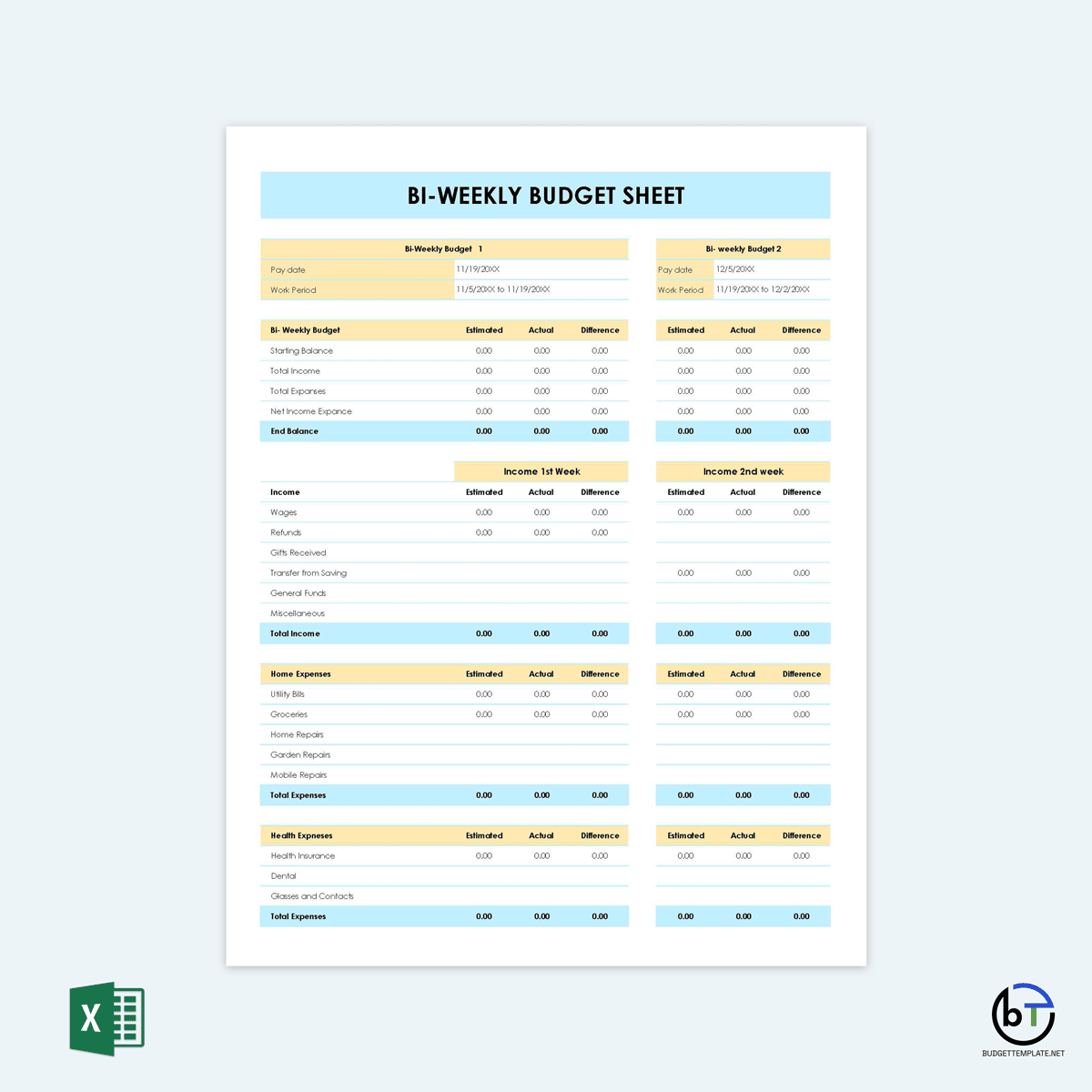

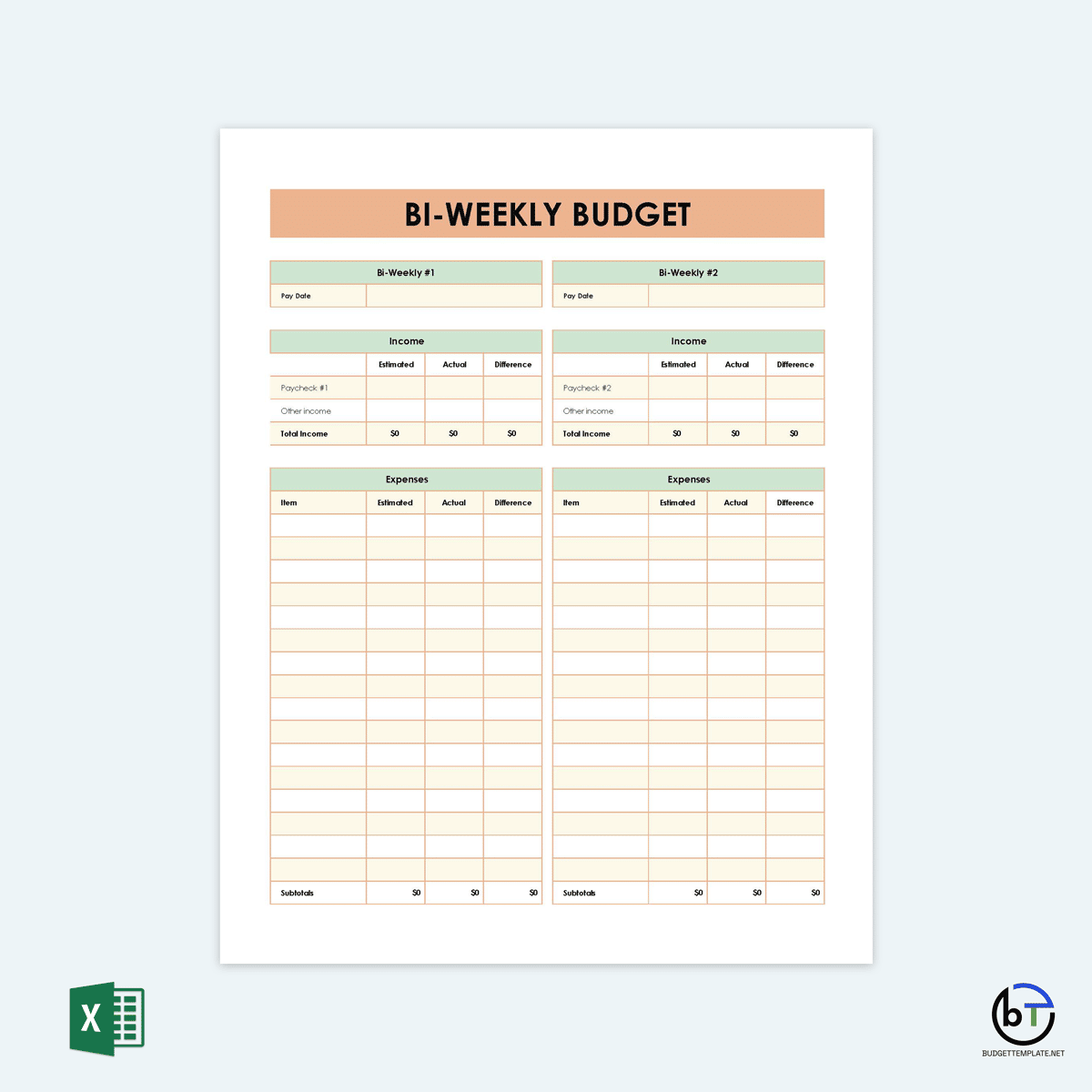

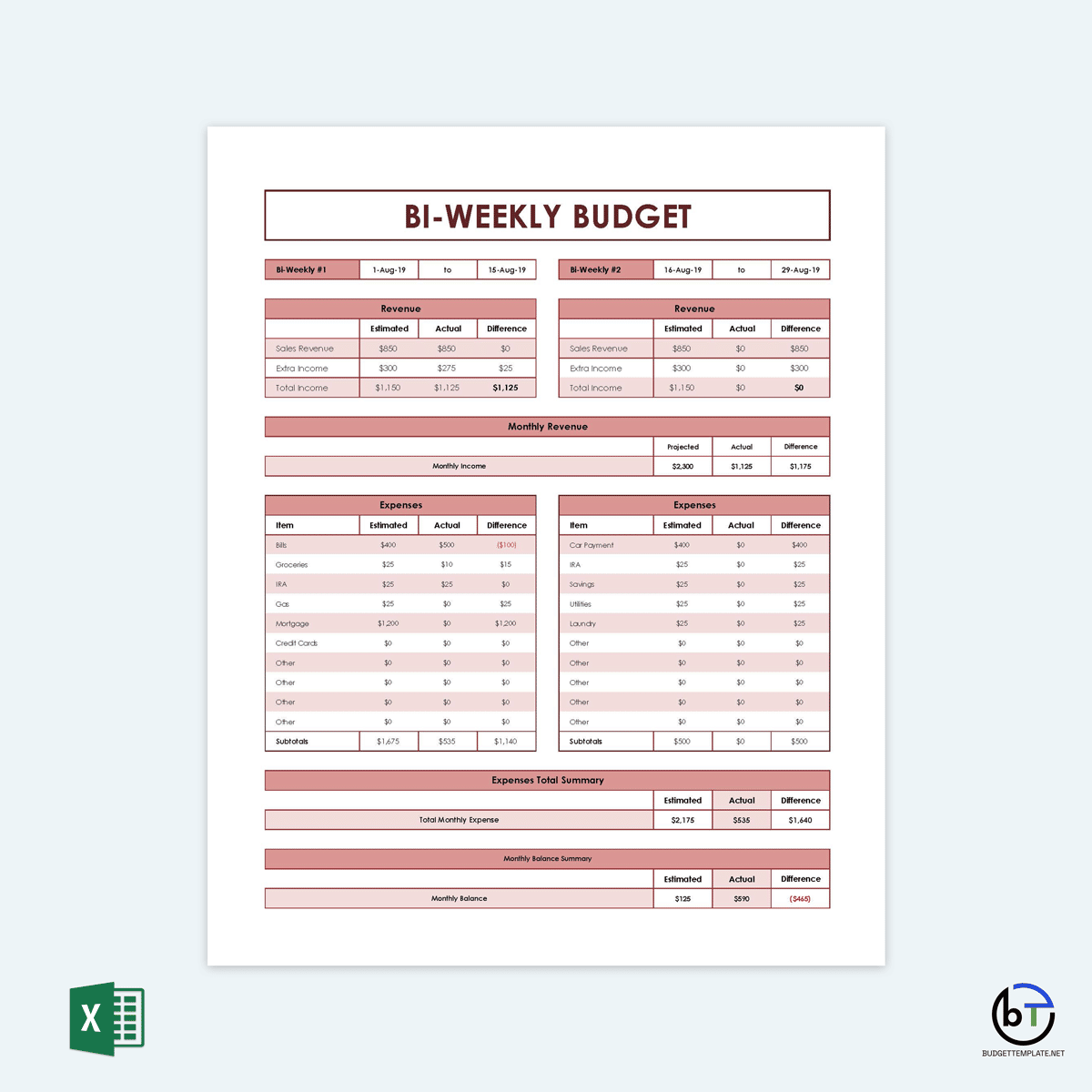

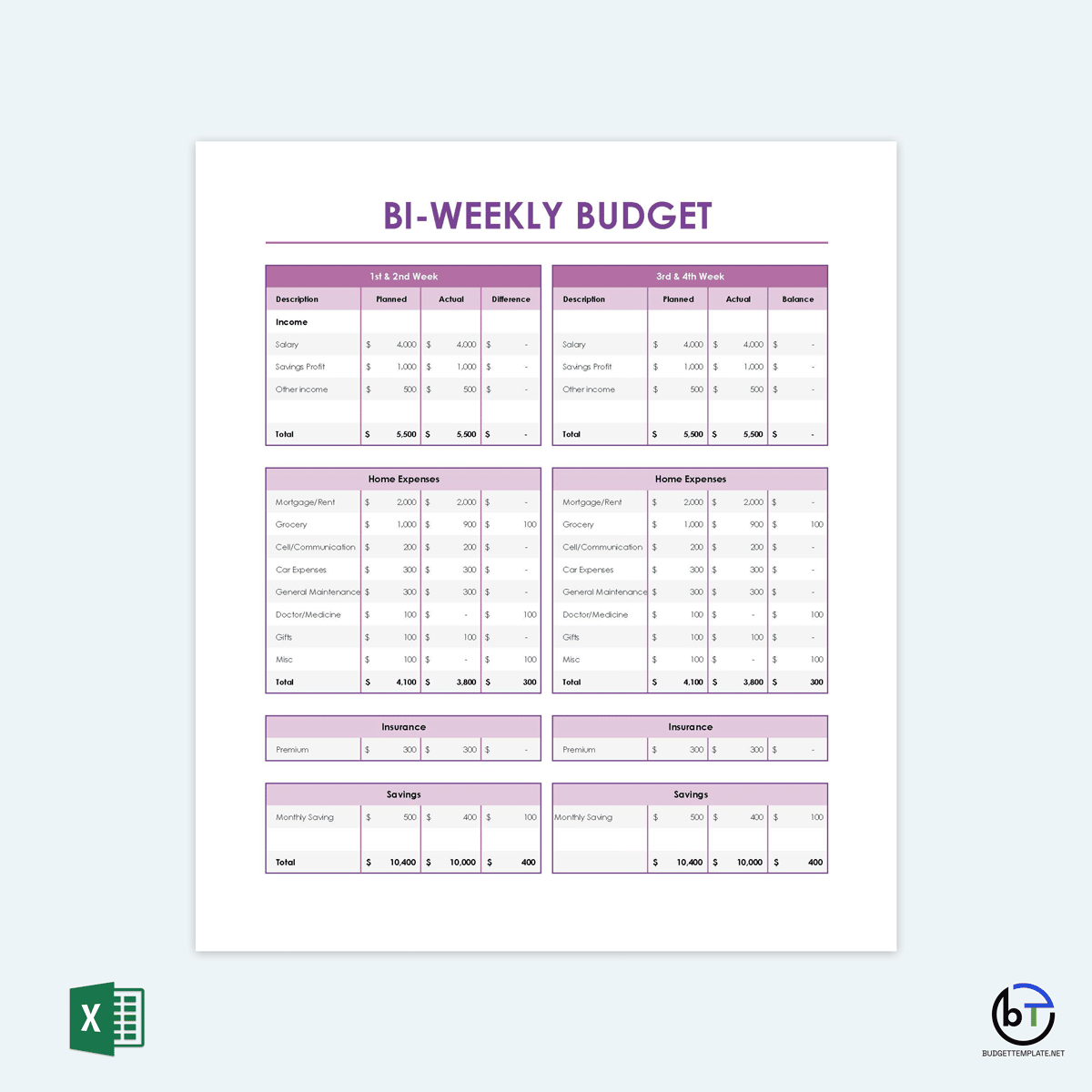

Since creating a weekly budget template from scratch using Excel spreadsheets or pen and paper is relatively time-consuming and challenging for most individuals, online downloadable weekly budget templates are highly advocated for. Online weekly budget templates ease your work and usually include all essential information. Besides, filling them out is straightforward. They also make your budget transparent and easy to track, as you can easily adjust them when the need arises, compared to creating a new template each time you need to change your budget. Such professionally-designed weekly budget templates have been provided on this website; you can download and use them now.

Professional Budgeting Tips

The average weekly cost of living varies from person to person, as each individual has different expenses and priorities. As a result, there is no standard one-size-fits-all solution for budgeting. However, to create an adequate weekly budget, you should consider the following essential tips:

- Know your paydays: It is essential to know which days you get paid and when you have to pay your bills. In addition, knowing exactly how much money is coming in each week can be very helpful in setting your financial goals and planning for your weekly budget.

- Schedule weekly planning: A budgeting template is an ever-changing document that requires an ongoing assessment of income and expenses. As such, you must create some time each week for budgeting, in which you analyze the previous week’s spending and decide which changes you need to make for the upcoming week.

- Contact companies for bill reduction: Companies often offer special discounts to customers if they pay their bills promptly and regularly. To find out if you are eligible for such extraordinary discounts, consider contacting your bank, utility providers, and credit card companies and ask if you may be able to get interest-free or minimum payment options.

- Save the leftover money: A simple calculation will show that a weekly budget needs to be flexible. The amount remaining after your expenses are paid should be saved, as this money can be used to cover unexpected expenses in the future.

- Create a separate account for bills: Creating a separate account specifically for paying bills on time is greatly recommended. You will not have to worry about missing any bill payment deadlines and incurring extra fees due to penalties and late payment fees, and paying your bills will be much easier.

- Be patient: Always remember that a weekly budget template is a long-term plan. You can never achieve your goals overnight. As such, you should be patient and avoid giving up too soon. Remember that every failure is just a step forward to your success. Make a weekly budget template and stick with it.

Frequently Asked Questions

What happens when you have too many bills due at a time?

Having too many bills due at the same time is a situation that could potentially lead to financial ruin and unnecessary debts. If you do not have enough money to cover all these bills simultaneously, you can consider contacting each company and requesting them to spread out your due dates by a week or two such that they are more manageable for you and you can pay them on time.

What if you do not have enough money to cover all your bills?

Suppose you are in a situation where you do not have money to cover all your listed expenses. As a result, you will need to either cut back on some of your costs, especially the discretionary expenses or find a way to increase your income.

How can I stick to a weekly budget, even when it is hard?

It can be challenging to stick to a budget, especially if it is not working according to your plans. However, if you learn to balance your money with priorities, learn what works best for you, and be patient, you will get a good handle. Remember that consistency and self-discipline are vital while budgeting, and always reward yourself for any small budgeting wins. Most importantly, use a suitable weekly budget template to make it easier to track your income and spending.