Budgeting your money is one of the best things you can do to help you track your income and your spending. When the money is organized correctly, you will never have to worry about whether you are running low on money or why it seems to disappear faster than you can earn it. In addition, each dollar you earn should have a job to help keep your money organized.

A basic budget template can help you, no matter the budgeting technique you would like to use. There are many budgeting options that you can choose to help you manage your finances. Some combine your expenses into basic categories, and others ask you to monitor every penny spent. All of them can be utilized to help you reach any financial goals you set for yourself. Without a budget template, it is hard to know how much money is coming in as income and how much is going out as spending.

What does a Basic Budget Template do?

When you are ready to take control of your finances and reach some of your goals, you will hear a lot of information about the importance of forming a basic budget. Any time you want to control your spending and work to any financial goal like retirement or a nice vacation, you need to set up a template for a basic budget.

A budget is a written financial planning tool that helps to determine how much of your income you will save or spend during the month. Setting up correctly will give you an easy tool to track your spending habits to see where to cut out expenses for the things you see as the most important.

Many people dread setting up a basic budget. They feel it will limit them and restrict what they can spend. A basic budget template can give you more freedom because it helps you reach the most important goals. Budgeting helps to learn how to balance out the money, spending less in categories that are not important, allowing more to put into the savings and reach all of the goals. Always remember that your budget will only work if you are honest all the time.

The 50/30/20 Rule

One simple budgeting technique that you can try is the 50/30/20 rule. This helps you maximize your money and allows you to make adjustments based on your current income, no matter what that income is. With this method, you will spend:

- 50% of your income on all of the necessities like your home and utilities

- 30% or less on your wants

- 20% on your savings and any debts you need to pay back.

Many people like this plan because it is simple. It keeps the numbers easy to manage and gives you room to manage your debt, have some fun, and put money into savings at the same time.

How to Create a Basic Budget?

Keeping things essential is one of the best ways to take control and make sure your money will work for you. Some of the best steps that you can use to create a basic budget include:

Figure out your monthly income

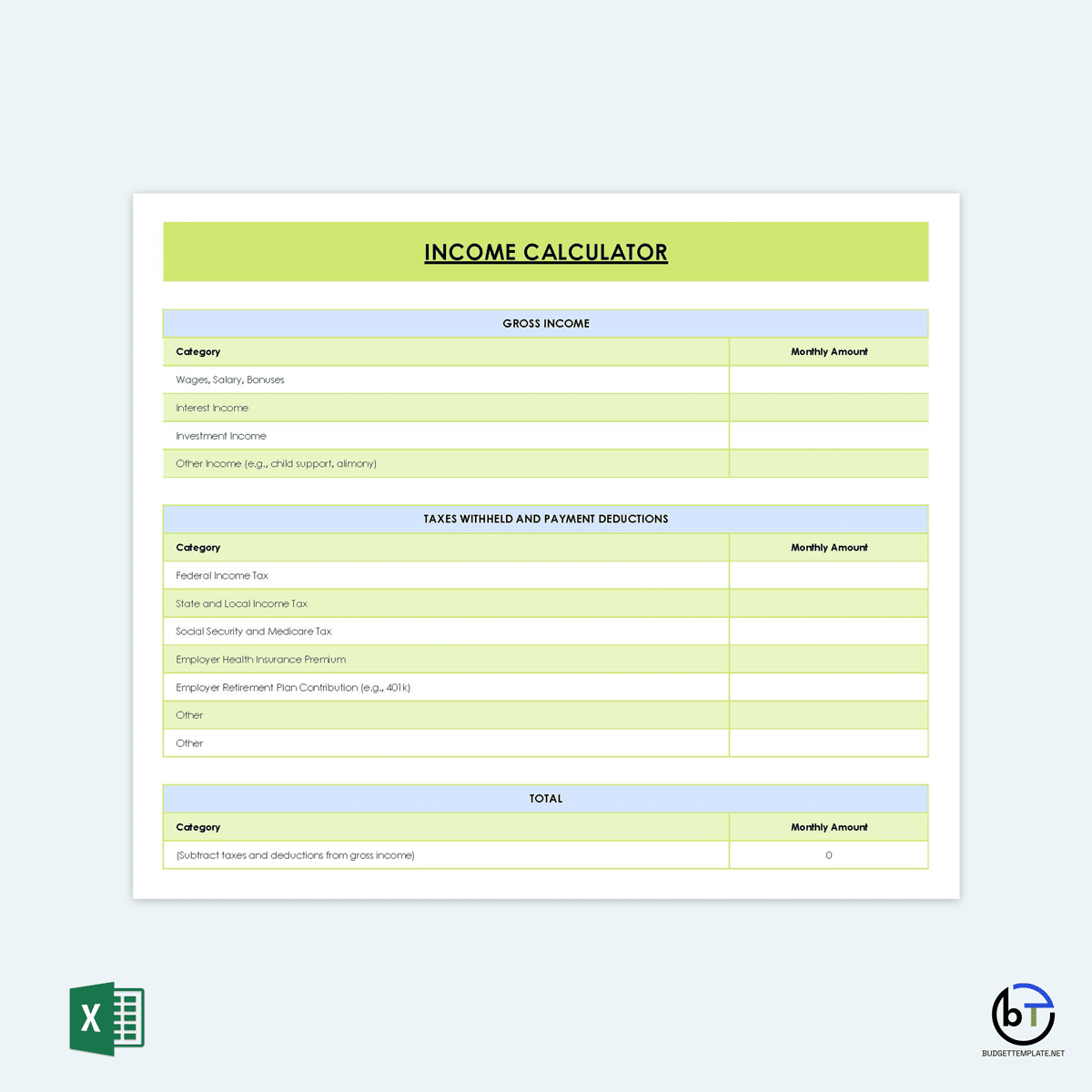

Before deciding where all of your money should go, you need to know how much money you have. So the first step is to figure out your income after taxes. You can look at your paycheck, but make sure to add back in the money you automatically take out for 401 (k), health and life insurance, and savings if those are taken out of your income. It would be best to have your total income after taxes to help you see the big picture of your income and spending.

Take inventory of all your income sources. Your paycheck is the first step but considers any money you make from your side gigs. You can subtract anything from the side gigs that will make it smaller, such as your business expenses and estimated taxes. Then, write that total number down so you will remember it.

Choose a budget plan

Now that you know your total income, it is time to pick a budgeting plan. Your basic budget needs to cover all of your needs, some of the things you want, your savings for the future, and your emergencies. You can choose different budgeting plans. So do some research to find the one that will work the best for your income and style. The 50/30/20 budgeting plan, envelope system, and zero-based budgets work well.

Add necessary expenses

Once you choose the budgeting plan, it is time to add up all necessary expenses in the basic budget template. It can include fixed expenses and any variable expenses. Fixed expenses generally stay at a similar amount each month. You probably know some fixed expenses, such as your rent or mortgage. Some of the other fixed expenses that you should include are:

- Car payment

- Child support and alimony

- Insurance

- Daycare expenses

- Student loan payment

- Internet and mobile phone use

However, you may also need to include groceries, credit card payments, car repairs, medications, and medical appointments in your basic budget. These variable expenses must be paid on time, but the amount you will pay each month can change. For example, your heating bill may be higher in the winter and lower in the spring. You still have to pay it, but the amount will change, which makes it a variable expense.

Add “pay yourself.”

While figuring out your basic budget, add a category for paying yourself. This will be your savings, whether for an emergency fund or to help you reach some of your big goals. This needs to be included in the plan because it is so easy to forget to do it, and then you do not have the money you need.

An excellent place to start is by jotting down a few financial goals you would like to meet. Whether you want to build up an emergency fund, help with your retirement, save for a big purchase, or pay off debt, make sure that you actively add this to your basic budget from the start.

Evaluate the budget

It is time to get to work evaluating your basic budget. First, decide whether you have any money left between your income and what you spend each month. If you are spending more than you earn, it is time to look at where you can make some cuts. You can also consider adding more money to savings or your retirement to help you reach some of your financial goals. A thorough evaluation of your basic budget can help you see where your finances are right now and make a plan for reaching your goals in the future.

Make adjustments according to your needs

With all of the money given to a task, it is time to put the basic budget. Give that budget a try for a month or two and see how well it works. You may find that some categories have too much money in them and others do not have enough. This is the time to make the adjustments and make it work. Remember that your budget can be personalized according to your needs. If you have a unique situation or want to speed up your debt repayment plan, then add that into the budget at this time too.

Implement and track spending

With a balanced budget, it is ready to put your new spending plan into action. Based on the new budget, this is the time to start spending and saving. You will need to take this time to track your spending to make sure that you can maintain the basic budget that you set up. If a significant change happens to your life, you can re-evaluate the budget and make changes later. First, you need to maintain your basic budget template, which is done by tracking your expenses.

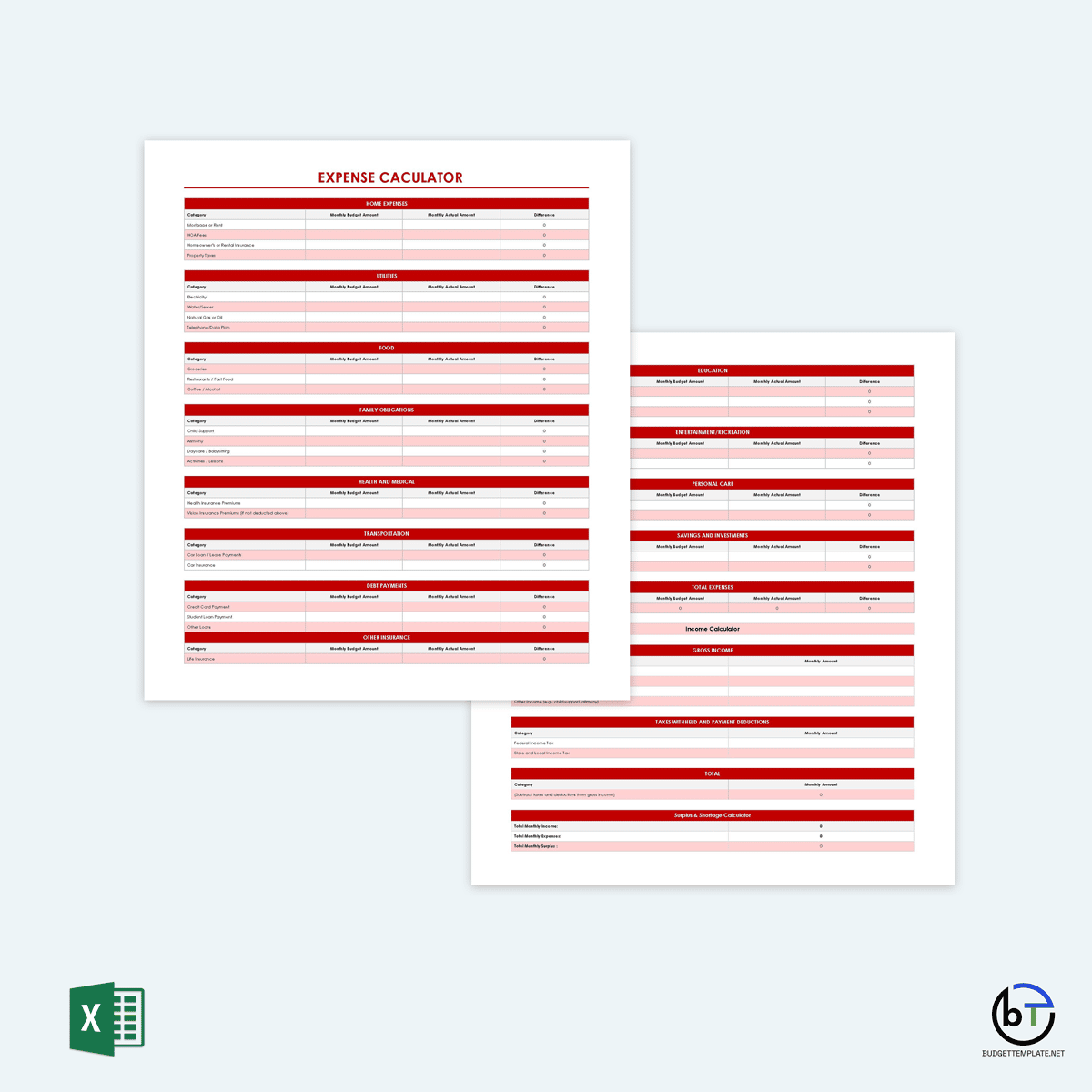

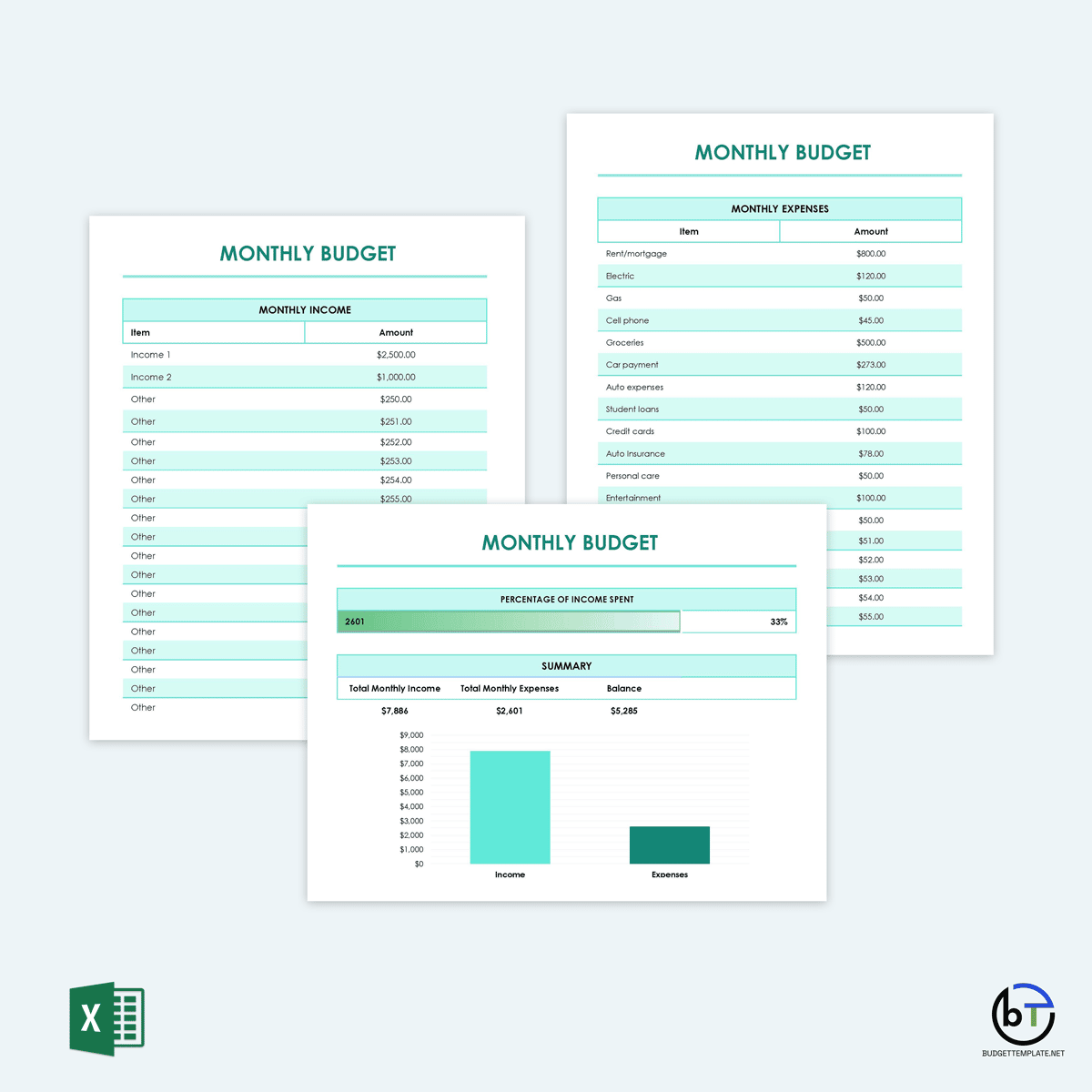

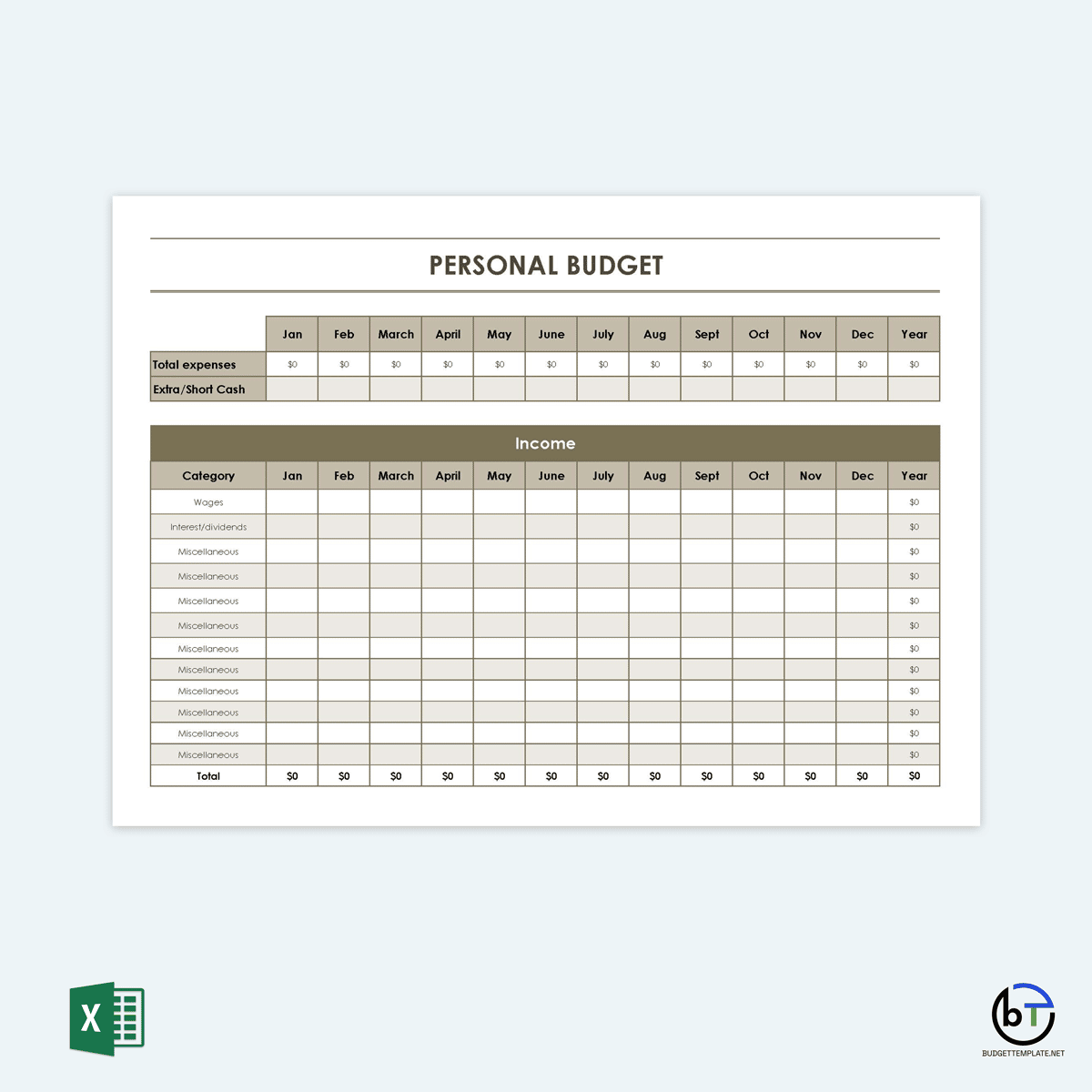

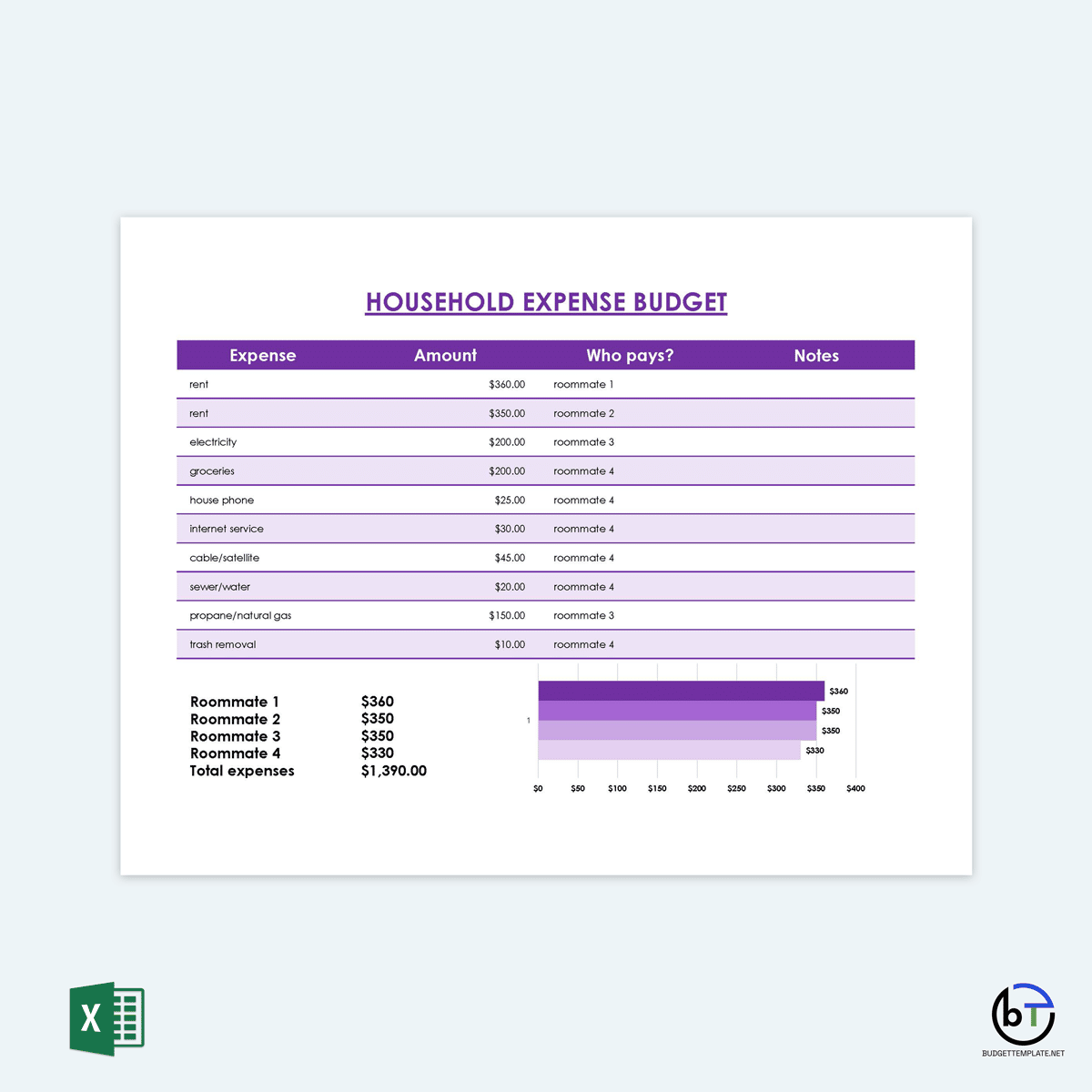

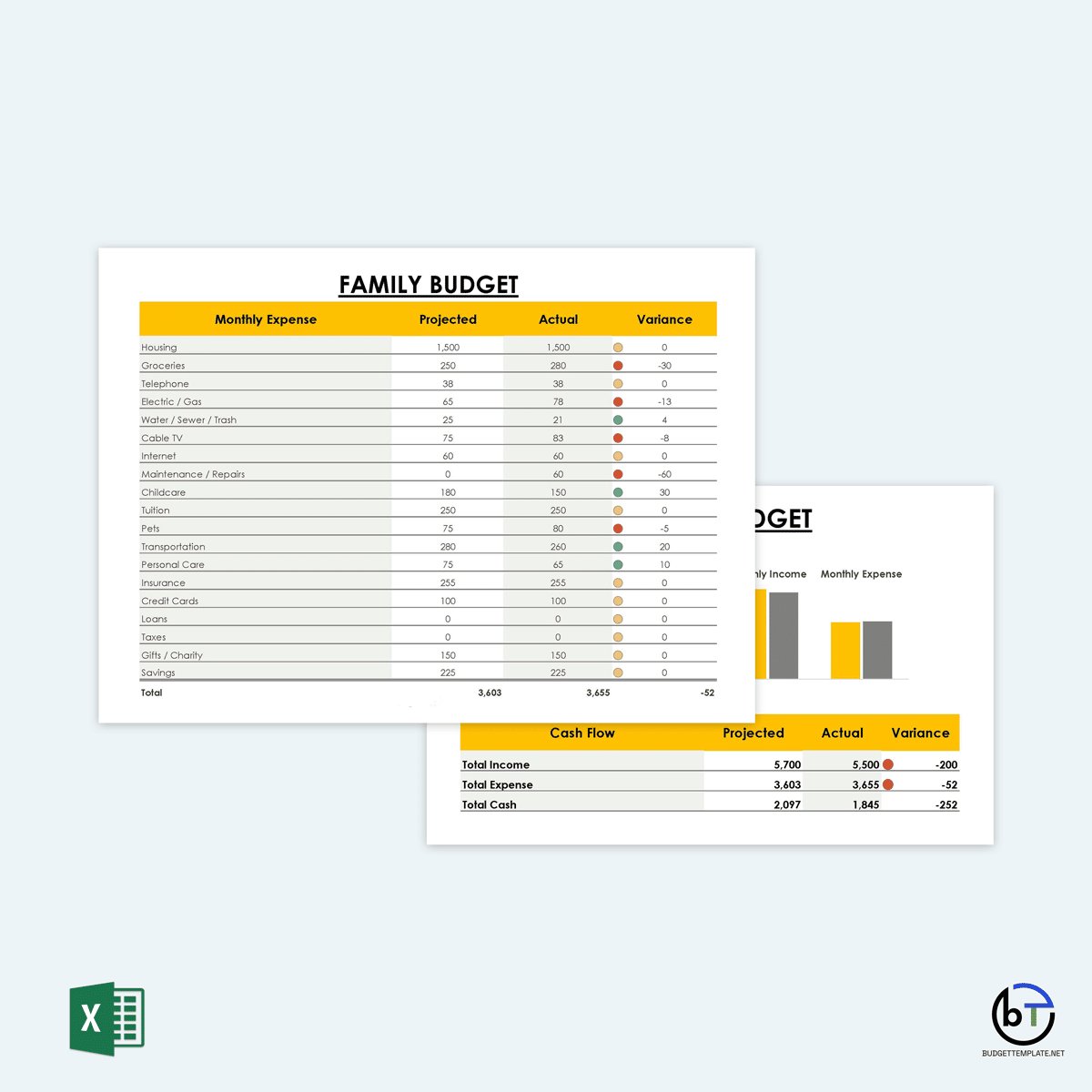

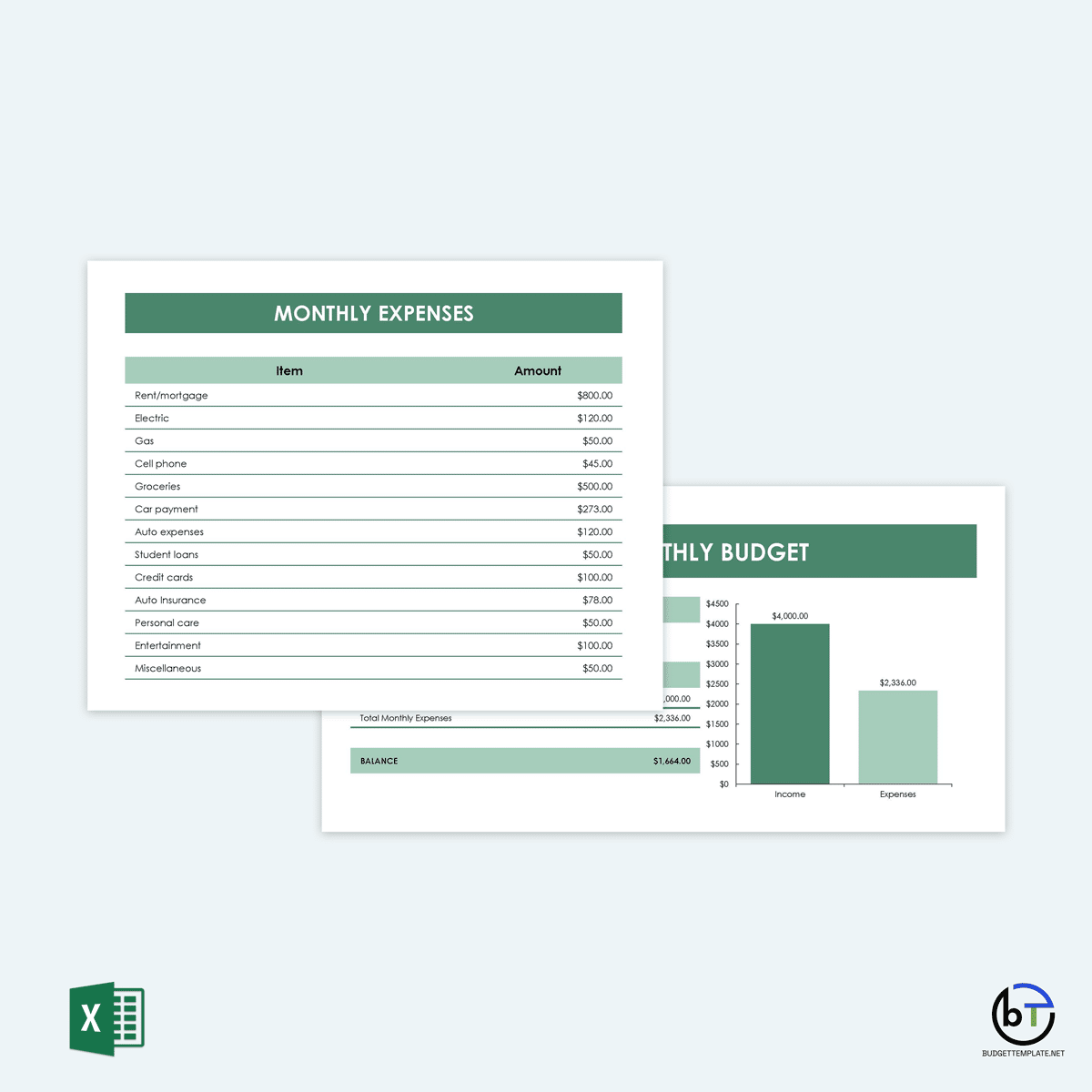

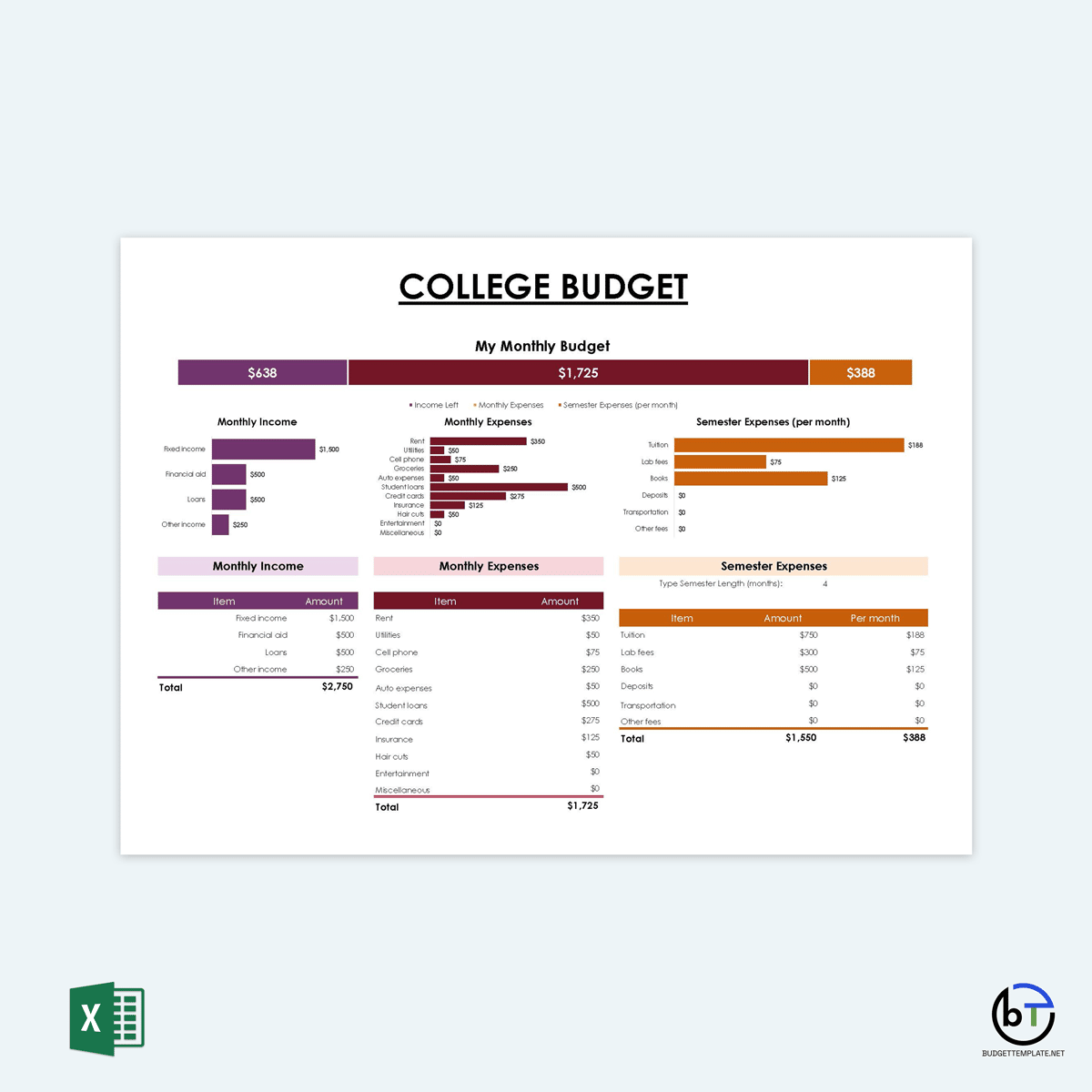

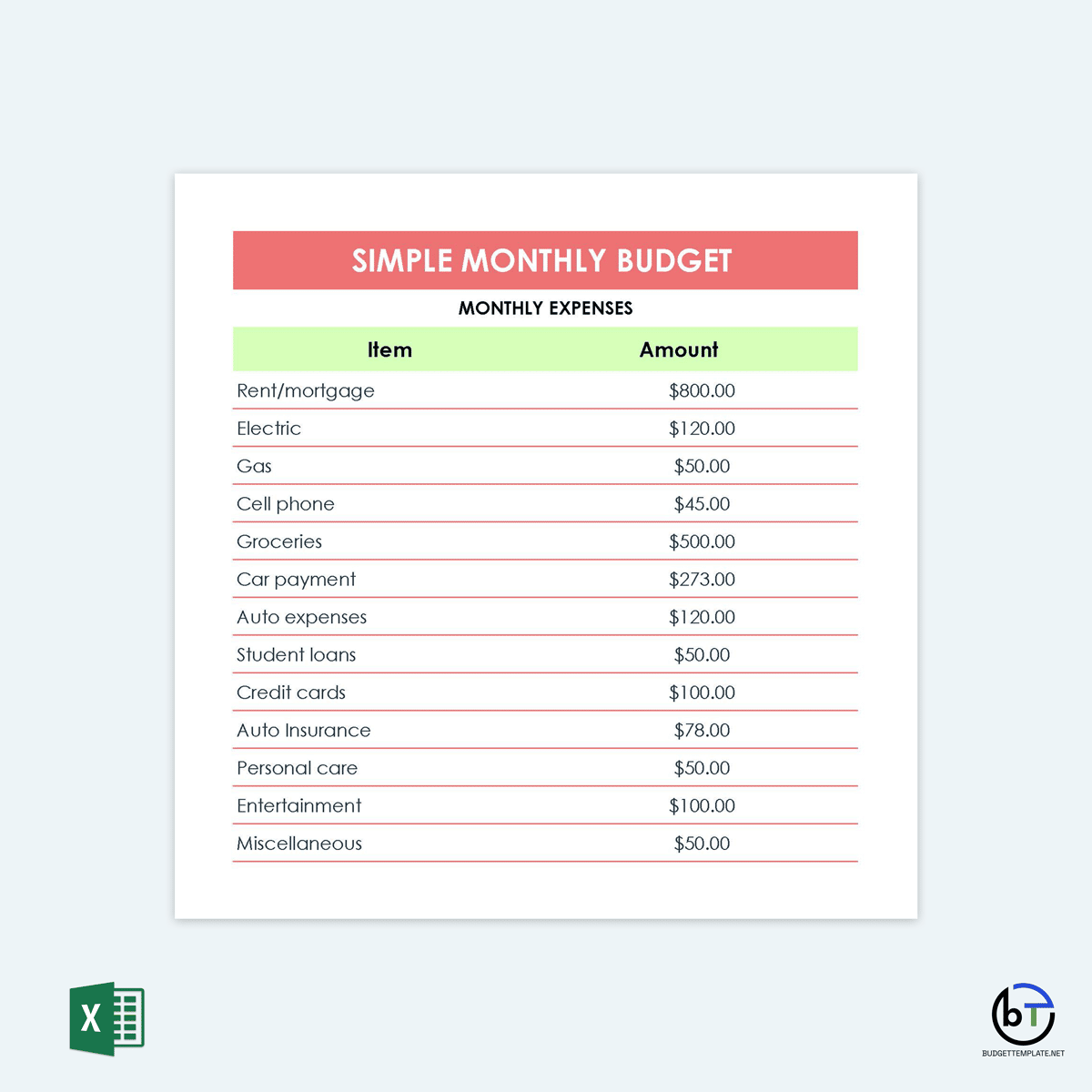

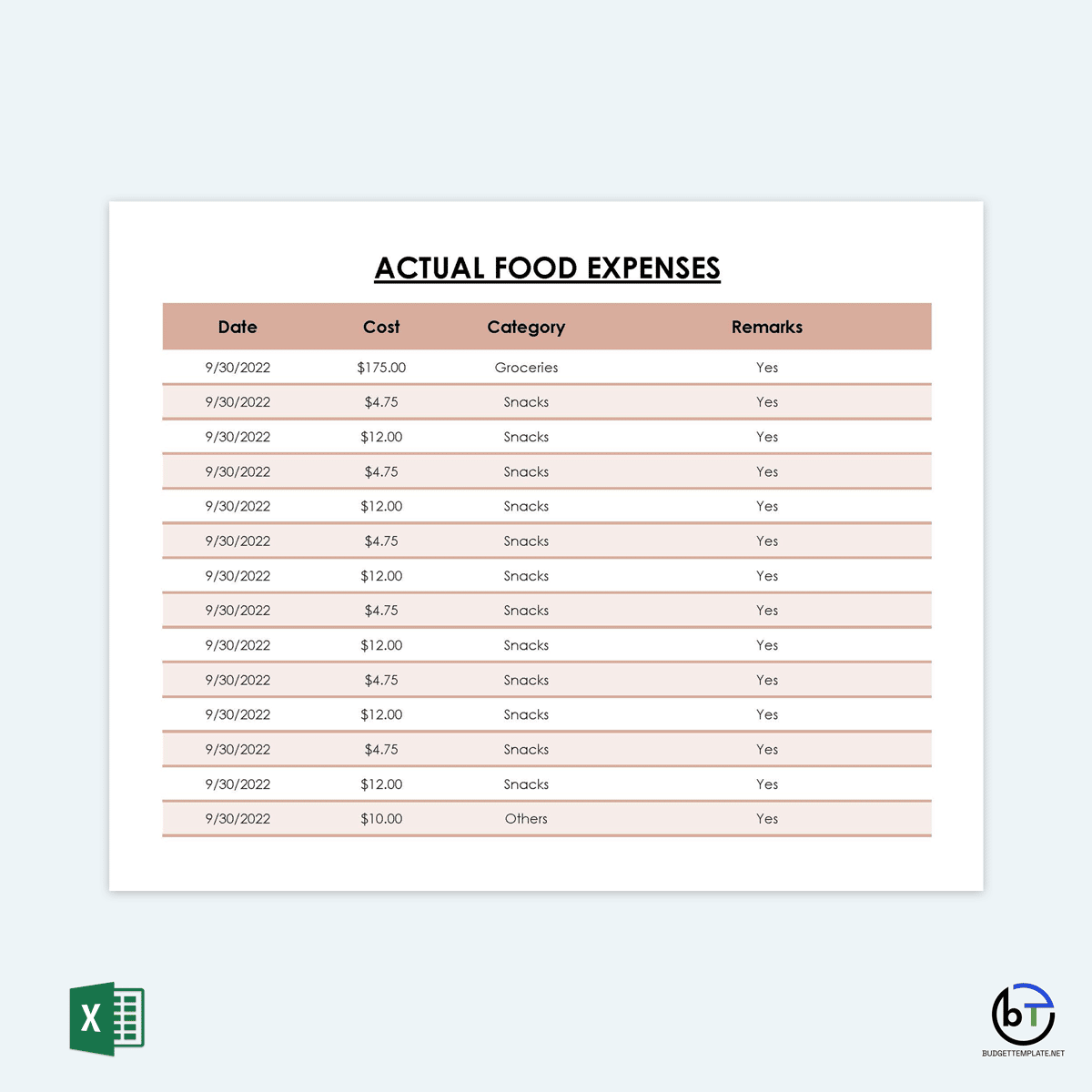

Basic Budget Templates

A basic budget template can help you manage your finances in an easy-to-use format. This website will provide free downloadable basic budget templates that can separate all of your expenses and make it easier for you to manage your money, no matter what budgeting method you decide to use. In addition, these templates for the basic budget are easily customizable and can be easily customized according to your needs.

Tips for Sticking to the Budget

Setting up a new basic budget can take some time, mainly if you have never managed your money and tracked your spending in the past. Some of the tips that you can use to help the process of setting a basic budget easier include:

- Avoid big purchases: It can be tempting to purchase a new car or get that fancy new appliance you want. But these can mess with your budget and throw your financial goals out the window. Before making a big purchase, take some time to think about it. The larger the purchase, the more you should think it over, but a good rule is to wait a week or more. Then, weigh the benefits to make sure that they add value to your life rather than stressing you out.

- Don’t spend more than you have: Debt is a vicious cycle that many people will worry about. You will pay for things you can’t afford and spend a ton of money on the interest for that item that you will regret after a few weeks. It is much better to save up for that big-ticket item you want or that vacation. Make a plan to add it to your budget rather than going into debt.

- Stick to lower credit card limits: Credit cards are happy to lend you way more money than you can afford. The higher the limit on the card, the easier it is to spend too much and the harder it is for you to pay it down. This is a temptation that the credit card companies want you to fall for because it becomes a trap that makes them rich. If you keep your credit limit to a minimum and only use the card to cover emergency purchases, you can avoid falling into this trap.

- Budget to zero: Budgeting to zero means giving every dollar you earn a job. When you take your income and subtract the expenses, you will be at $0. This does not mean that you will spend every dollar. Some will go into savings, retirement, and paying off debt. But all of the money needs to have a task to do before your budget is done for the month.

- Do not spend unnecessarily: It is straightforward for you to buy things because they look fun or are on sale. However, a spending freeze can be a significant challenge to limit your spending. You will go a week, or a month, challenging yourself not to purchase anything except necessities. First, determine what a necessity is ahead of time. Then see how much you can limit your unnecessary spending during that time.

- Plan your meals: When you plan your meals ahead of time, it is easier to stay on a basic budget. You will know what to eat each day of the week and can pick up only the ingredients that you will use. This can prevent you from purchasing items you do not need and wasting money. You should check the pantry before shopping to ensure you have the right ingredients each time. This method can help you eat healthier too, which keeps your hospital bills to a minimum and saves money on eating out.

- Do grocery shopping online: As you walk down the aisles of your favorite grocery store, it is easy to grab a few extra things that you are there. Each one may cost $2 to $5 each, but adding just five of these into your weekly cart can add $200 to your total grocery bill. Shopping online allows you to pick out just the groceries you need and save on those impulse buys that ruin the budget.

- Compare brands: Name brands are great at advertising to you and getting you to spend more on them because you think they are better. But these name brands will also cost you an extra 8 to 9% on each grocery trip. Name brands are not much different than generic brands. The two brands may be made in the same facility by the same company. Don’t pay for the advertising and shelf costs the company pays. Choose a generic brand to save money.

- Connect your spending to your work: You spend a lot of time working for the money that you earn. When you connect your spending to the labor you do to generate that money, you will start to spend less. To do this, calculate the amount you get paid per hour, and then when you purchase something, figure out how many hours you would have to work to pay for all of this. You may find that an expensive item is not worth your time once you do this.

Frequently Asked Questions

How do you keep a budget?

While each budgeting method is different, the biggest key to helping you keep your budget is to track your spending often. This will give you a good picture of where your money comes from, where it is going, and where you would like the money to go. There are several steps that you can choose to get this done. They include:

-Check your current statements

-Put all of the expenses into categories

-Track this consistently

-Explore options for budgeting

-Find ways to improve

An online basic budget spreadsheet and template will make budgeting more accessible than before for your needs and help you keep your budget, no matter your financial goals.

How do you figure out a budget?

A financial self-assessment is an excellent place to start. First, you need to know where your current finances are to help you pick out the proper budgeting method and keep you on track. Once you know where your strong and weak points are, you can make improvements to help you get ahead.

What is a balanced budget?

A balanced budget is simply one where you have been able to get your expenses and your income equal. You are not spending more than you earn, and you do not have any extra money in your account at the end of the month. Every dollar you earn has its job to help you reach your goals.