Creating a personal budget is a brilliant idea if you would like to get control over your money and want to quit running out of money by the end of the month.

Following a suitable personal budget template and coming up with your budget can make it easier to get ahead and reach your financial goals.

A budget is not meant to restrict you. Instead, a personal budget template creates a simple way to take care of your money and control where it goes. Without a budget in place, spending more money than you earn each month is easy, forcing you to live paycheck to paycheck and miss out on all of your financial goals. When a budget is in place, it is much easier to direct your money where to go, and you may find that you have more money left over at the end of the money than before.

Setting up a personal monthly budget can seem daunting at first, but with the right tools and a personal budget template to help, you can get all of your finances in order in no time.

What is a Budget?

A budget will estimate your income and expense over some time. This can be done each month or for a whole year. A budget is not a static thing. You can’t set it up once and rely on it for the rest of your life. However, as you experience life changes, you can update the budget to ensure that it still fits your current lifestyle and monetary needs.

A budget is an essential tool to help individuals manage their monthly expenses, prepare for unpredictable life events, and purchase more significant items, such as a home, without being stuck in a debt pile. A well-designed budget allows you to track how much income you bring in each month while monitoring your spending habits.

Types of Budgets

There are two types of budgets that you can choose for your finances. These include a flexible budget and a static budget. A static budget will stay the same for the whole budget term. So no matter what other changes occur during that period, all of the figures and accounts you calculated will remain the same.

You can also choose a flexible budget. This will be a budget that may change based on specific variables. For example, you may change the budget based on how much you earn each month if you work freelance, account for holidays and birthdays, or provide more money for an emergency.

Both of these budgets can be great for your financial management. You may need to give both a try to help give you the right solutions for managing your money.

What is a Personal Budget?

A personal budget is one that you can make for yourself or your family. Everyone can take benefit from adding a budget into their lives. Those with a personal budget will have all the tools to manage their finances better. They know how much money they have coming in, either on their own or with a spouse, and how that money is being spent at any given time. This budget can help pay off debts, keep expenses low, and even reach important financial goals like retiring.

The importance of a personal budget

You most likely have a significant financial goal that you would like to reach. You may want to pay down your debts, save for retirement, or save up emergency funds. Unless you have a large inheritance that can hand you money all the time, you are limited to the amount that you can spend and use every month. If you spend more than your income, you will have a deficit you must deal with.

A personal budget will help make sure your income and spending match up. You can make this for a short period to help you reach a goal or create a long-term budget that will help cover several years to make your money last. It is impossible to control your money or reach financial goals without a personal budget.

Steps for Creating a Personal Budget

Each individual and family will have the income stream they earn from their job, side income, and business. This is the maximum amount you can spend on your new budget. Creating a personal budget helps you to manage your current income effectively. Some of the steps of creating a personal budget include:

Gather all your financial papers

It is time to get all of the financial papers out. You will need as much information as possible to get this started. Bring out the available bank statements, credit card statements, and pay stubs. This will help you manage your spending and income without searching for it later.

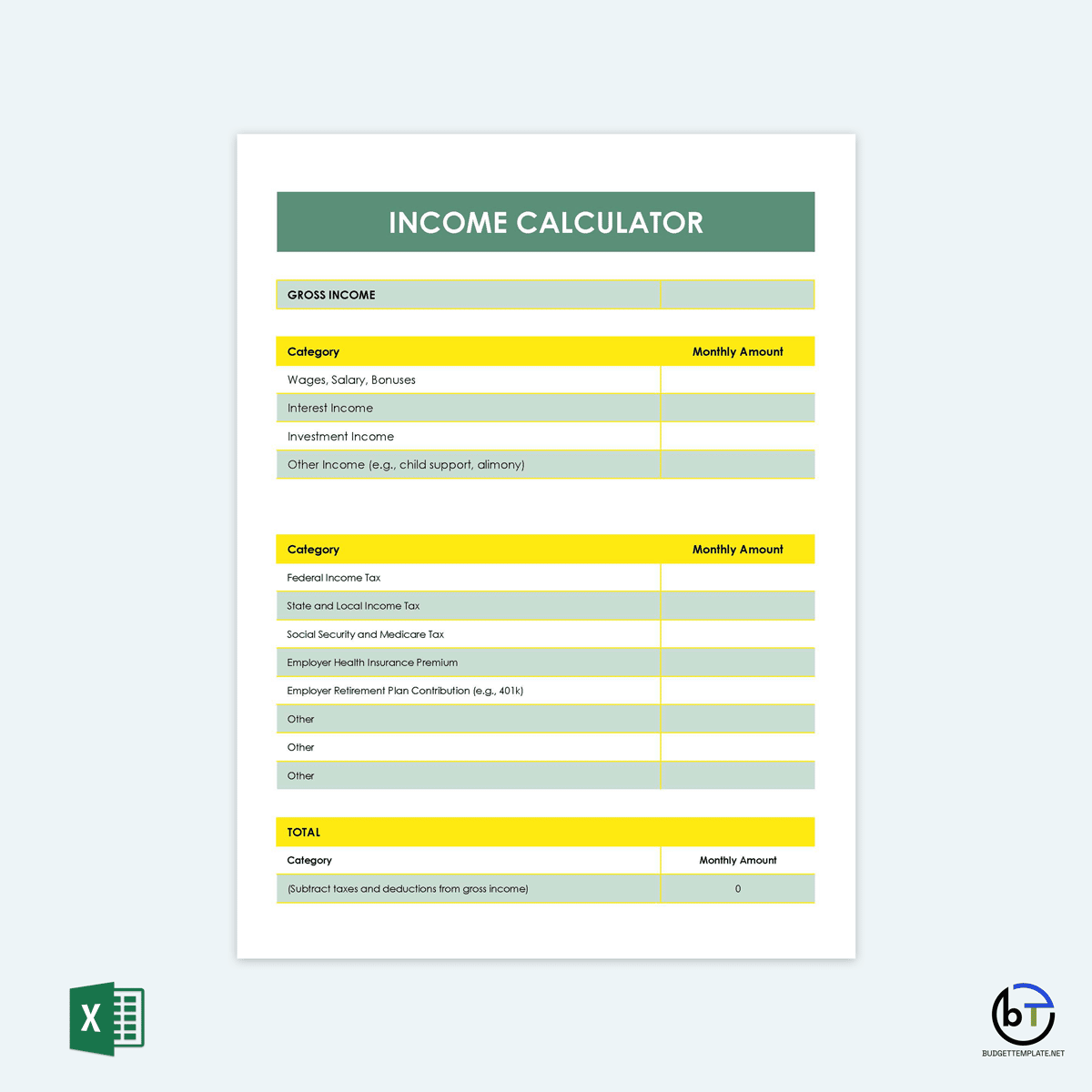

Identify your income

To create a reasonable personal budget, you need to know the amount of money you have available from the beginning. Therefore, it would be best to have a good idea of how much money is available to you each month. This should not be too difficult if you make the same amount each month.

Not all families have a fixed income. Seasonal work and freelancing can cause your income to change from one month or season to the next. You have two choices to help with your personal budget. First, you can average the income from the year and use that as your base amount for the budget. But a more effective method is to look at your lowest-earning month and use that as your baseline income.

Create a list of your monthly expenses

Many people are not sure how they spend their money each month. Listing out their monthly expenses can help them get a clear picture of their financial responsibilities. Look through your bank and credit card account statements to see what you currently spend your money on.

Some of the expenses you can list out in the template for the personal budget include:

- Housing payment

- Taxes

- Grocery bill

- Eating out

- Student loan debt

- Gas

- Utilities

- Clothing

- School supplies

- Car payment

- Insurance

Your expenses will be unique to your family situation. Writing them down gives you a clearer picture of your current expenses as you work on the personal budget template. You can make adjustments to the numbers later, but right now, we want to see where our current spending habits are.

Determine fixed and variable expenses

As you write down your expenses, figure out which ones are fixed and variable. Fixed expenses are the mandatory expenses that you will need to pay the same amount for each time. Your rent or mortgage, car payment, internet, and regular childcare can fit this. The variable expenses are the ones that can change each month and include gas, eating out, gifts for others, entertainment, and groceries. Separate all of your expenses into these categories in your personal budget.

Analyze mathematically

Now you need to do the math. You have a list of the amount you earn and spend. When you add up all of your expenses, your goal should be for it to be lower than your net income. If it is higher, then you need to cut back. Even if the numbers are close to the same, you may need to make some cuts to help you start saving and reach your financial goals.

Your spending habits may be different than someone else’s. Your income may be already higher than what you spend in any given month. This gives you some freedom on how you would like to manage that extra money. Plan for it in the personal budget template and put it to work for you.

Identify areas to cut expenses

You may have started a personal budget to cut down on your spending because your costs were too high. It is now time to find areas where you can cut down on expenses. There are many budget areas that you can cut back on each month. You can start meal planning rather than eating out five times a week. You can cancel the extra subscriptions that you never use. You can look at clipping coupons and shopping at sales to cut down on your grocery bill.

Make adjustments

Your budget is going to change and fluctuate all the time. It is fine to use it for a month or two and then make adjustments if something is not working the way that you want. For example, some categories may be too hard to limit as much as you choose, while others may have too much money. Make these adjustments as necessary to help you get the most out of your money.

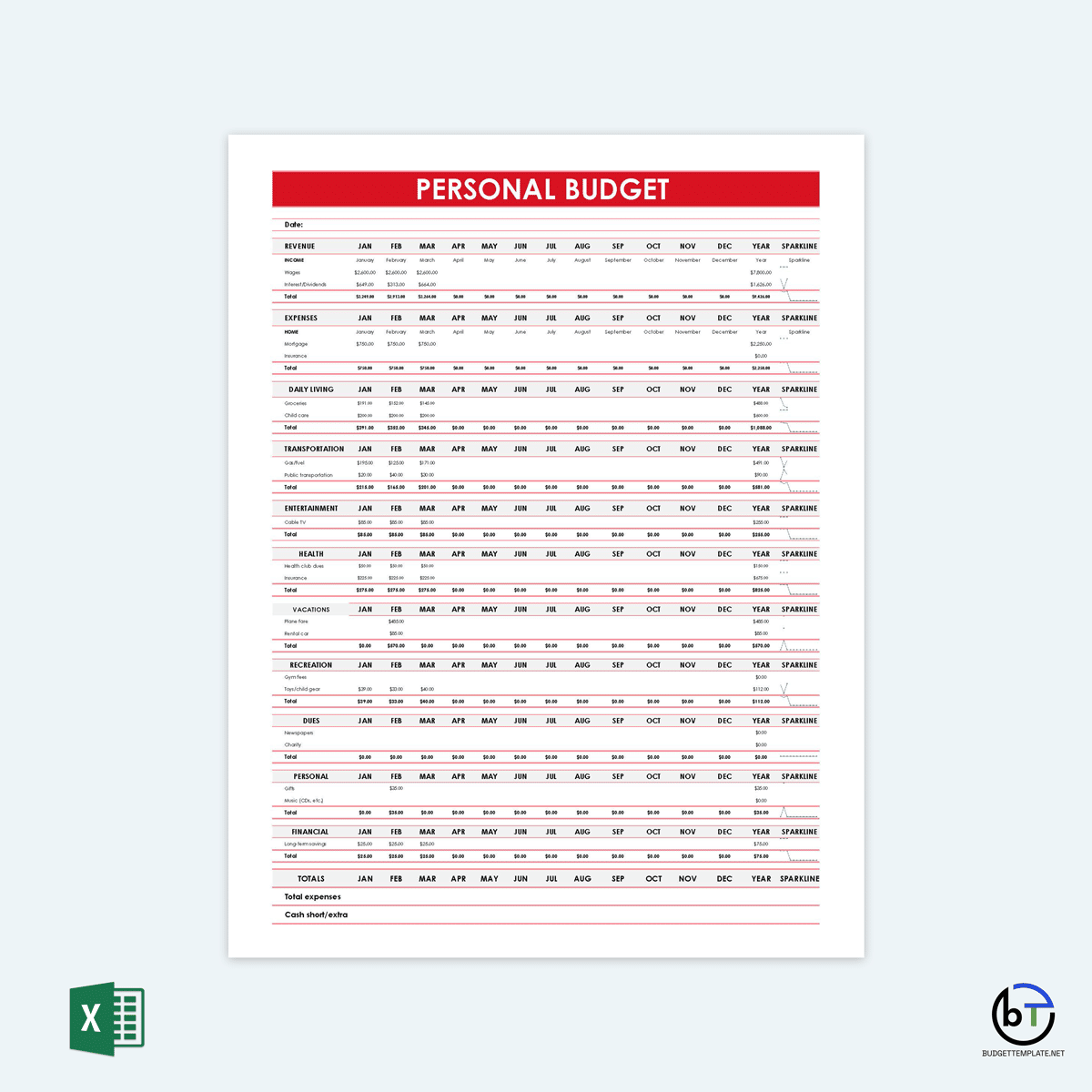

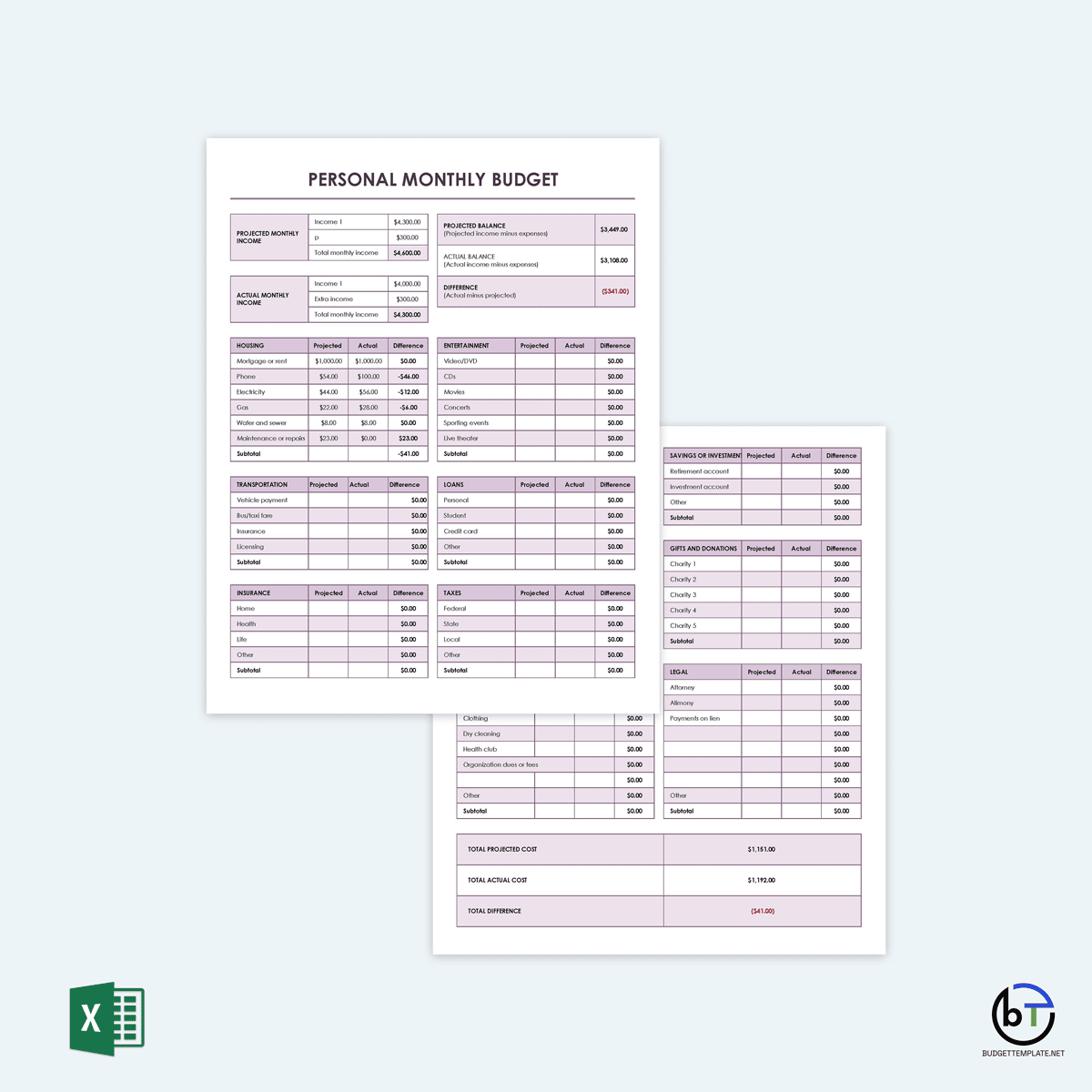

Personal Monthly Budget Templates

Creating a personal budget can be a new experience for some people. They may have spent years working but never considered how they could track and manage their finances to help them reach all their financial goals. This website provides free personal budget templates to help you categorize your finances and track your spending, all in one place. In addition, these templates are easy to customize and ensure you enter each necessary information in your monthly budget template.

Tips for a Personal Budget

Now that you are ready to set up a budget, you can put it to work to make sure you are seeing some of the best results. A few tips that you can use to help you get ahead with your personal budget include:

- Think about how you want your future: The personal budget you create will make it easier to reach your future goals. Think about some of the things you would like to accomplish in the future, and then create a budget to help you get there without adding more debt.

- Eliminate those options that allow you to cheat on the budget: Impulse purchases can ruin your budget. You need to set up barriers to slow you down and make it harder for you to make that unnecessary purchase. Remove your payment information from those online shops you often visit, take yourself off the retailer email lists, and avoid going into a store if you do not need to go.

Find some support: When everyone is spending money on new cars, vacations, and other significant expenses, it can be hard to stick with your personal budget. To make this a little easier, find some like-minded people to help make this easier. Find a monthly meeting, some great friends, or online forums with others who can give you support and suggestions to get ahead.

Adopt old ways: The old ways can sometimes be the best when creating a personal budget. Use cash to help you see how much money you spend, rather than using a credit or debit card. Pay your bills with a check and write them down in the register rather than doing it automatically. Handling these transactions the old way can make it seem more real how much money you spend.

Reward yourself: There is nothing wrong with a bit of reward. However, focusing only on what you need to give up can make the budget seem oppressive. Set up a plan that allows you to have a reward when you reach your goals or stick with your budget, even if it is small.

Schedule a budget evaluation time: It is not enough to set up a personal budget and walk away. A periodic budget evaluation lets you see what is working and make changes when things need to be fixed. Set up these appointments with yourself every few months to ensure you are on the right track.

Downsize and substitute: It is easy to run out and purchase a new item when you need it. But downsizing will help you to save more money. Find substitutes for the things you need and downsize on the items you no longer need.

Resolve cash flow issues: A cash flow issue can appear when you are only paid once a month. You can fix this by dividing the payment by weeks and keeping the cash in a different account until you need it. Come up with a plan to help you avoid some of these issues.

Prioritize cash: It is effortless to overspend when you can put the purchase on a credit card. These are so convenient, and you will spend too much before you know it. Switch as much of your spending over to cash to avoid this problem.

Use the budget to achieve goals: The whole point of having a personal budget is to help you achieve your personal goals. When a budget is lined up and works well, it is easier for you to focus on your personal financial goals and put together a savings account, retirement, etc. Choose a budget method that will help you to get this done.

What if You are Financially Broke?

The different budgeting strategies can sound like a good idea to most, but you may be suffering from large bills and a bad financial situation that seems impossible to overcome. However, when everything seems hopeless, there are a few steps that you can take to protect yourself and help you get ahead financially.

These steps include:

Avoid sudden disasters

While you will need to make changes to your budget and get the bills paid off, you may have some options to choose from. First, talk to your creditors to see if they can set up a payment plan or a bill extension with you. Even with a few fees, this is better than skipping or delaying your payments.

Prioritize the bills

Pick the most important ones if you can’t pay all of the bills at once. You can set up a payment schedule based on when you get paid and what needs to be paid first. If you have some late bills already, you should call the billing company and discuss how much you can pay and how to get up to date.

Ignore savings

This is not the time to work on your savings. You will need to focus on dealing with the debt and getting caught up on bills. You can put the savings on hold for now and restart it when things are better.

Remove unnecessary expenses

It is time to look at your expenses and cut down on anything that isn’t necessary to your current lifestyle. Cut back on any items you will not miss and plan out your grocery bill. Limit how much you drive around and avoid eating out, snacks, and anything else you can get rid of. You may even need to look at selling some items to help you get ahead.

Keep a budget journal

Once these steps are done, you should monitor your progress for two or three months. Write down everything you spend money on either in a notebook, a budgeting app on the phone, or some other software. The method you use to track the money will not be as crucial as the tracking is. Focus on accounting for your expenses to see how well you are doing on the budget.

Seek new income sources

As you do these other steps, it is time to seek new income sources. Consider working more, getting a better-paying job, finding a second job, or picking up freelance work. Do this long enough to get back on track and start some savings.

Frequently Asked Questions

How can you account for financial goals in your budget?

Any financial goals you would like to reach should be included in your budget’s savings section. You will need to look into your income and see when to reach those financial goals and how much you need to reach them. You can choose the financial goals you would like to reach, but having a good plan will help.

What is a balanced budget?

When your budget is balanced, your income and your expenses or spending are equal. Therefore, you will not have a surplus or a deficit when you are done with your budget for the month because every dollar has a purpose.

How much should I be spending?

This can depend on your income and finances. Your situation may not be the same as everyone else, and you may need to adjust to get the spending to work for your goals. The 50/30/20 budgeting method is suitable to help you know how much you should spend based on your income. This method requires you to use 50% of your income on the necessities like housing and groceries, 30% on eating out and discretionary funding, and the final 20% for your savings and retirement.