Your small business is an important asset, and you want to make sure that it will last for years to come. Unfortunately, many small business owners assume they do not need to put a budget together because they are so small. However, handling all the complexities of a business and crunching the numbers in your head can make it easier to run out of cash and lose money on the business.

A small business budget template can be the solution a small business owner needs for maintaining and handling their financials. Before focusing on your small business finances, you must have a small business budget template to make a budget for your business.

This will help give you an overview of your current and past finances to make intelligent decisions about where to take your business in the future. Gain control over your finances and your business in the future with an innovative small business budget template to help.

A small business budget template is a great tool that business owners can use to help them plan out how to use the income for the business. It will outline information on the current revenue and spending of the business, allowing the business owner to see their financial strengths and weaknesses. Once the business owner knows their current income and spending habits, they can make financial decisions that will help them to cut waste while spending in critical strategic areas that help the business grow.

A reasonable business budget will help you make sound financial decisions. All small business owners need to create a small business budget to help them get a complete picture of their business finances. With that budget in place, it is easier for them to create and meet financial goals for the business in the future.

A small business budget template keeps a closer eye on the finances so you can stop unnecessary spending. Many companies will have goals of growing in the future. If you plan to raise funding from investors or apply for a business loan, you must show a detailed budget outlining all business income and expenses. Having this prepared ahead of time will make this a reality.

Why is it Important?

A small business budget template is essential for helping you figure out where your finances are right now and where they will go in the future. Without a small business budget template, it is hard to create a small business budget, and you will not be able to know whether financial goals are being met or if you are behind on your targets.

A small business budget template for many companies will help them catch potential problems early. A small business budget will help you become more efficient and can point out funds that are extra each month that you can use to reinvest in your business. As your business grows, you can use your budget to predict when slow months will occur, giving you a chance to save for these times and get ahead.

Intelligent business owners will be able to use their budget to help look into the future and gain more control of their business. This will get a chance to look at the whole picture of their finances and make intelligent decisions to help them get ahead.

Start with PPS (Profit Per Sale)

Your small business budget template will give you a good idea of how much money is coming in and going out for your business. Knowing your profits per sale can be an excellent place to start.

Some of the other aspects to consider include:

Analyze costs

Business owners need to analyze all of their costs to get a good idea of what it takes to run the business. You can then see what to cut out without messing with items that are critical to the functioning of your business. Without understanding your operating costs from the beginning, you may jeopardize your goals and not have enough to help run your business.

Analyzing your costs will allow you to have enough money for essential tasks while reducing the items that seem to waste money. It would be best to work with your team to analyze which expenses are necessary before cutting anything out.

Negotiate costs with suppliers

It is possible to negotiate your costs with your suppliers. If you are brand new to the industry, this will be harder to do, but those in the industry for longer may have the power to negotiate a bulk rate or other discounts to keep their costs lower. Of course, the lower your costs, the more you can earn in profits while still providing a high-quality product to your customers. In addition, many suppliers will be happy to offer discounts to larger companies because it allows them a steady stream of income.

The exact agreement you will make with your suppliers will depend on the materials you choose, the amount of product you order from them, and the timeline you give them to get the work done. No matter the type of negotiations you can make with the suppliers, the goal of these deals is to help reduce the costs of doing business. Therefore, if the supplier is willing to provide you with discounts, it can help improve your bottom line.

Know your gross profit

To create an excellent small business budget, you must know your gross profit. This will be the total revenue left after you pay all your expenses each month. It will tell you whether the business is succeeding or if you need to make changes to help the business grow. A positive number shows that the business made a profit that year, while a negative number indicates the business spent more than it earned.

How to Create a Small Business Budget?

You need a small business budget to help keep you on track to reaching all of your financial goals. A suitable small business budget template will make budgeting easier for you.

Some of the steps that you can use to create a small business budget include:

Examine your revenue

The first step to your small business budget is to look at your income/ revenue. Your business may have more than one stream of income, so add all of those streams together to help give you a complete picture of your earnings. Keep in mind that revenue and profit are two different things. Revenue is the gross amount you bring to the business, while profits are what you have leftover after you pay all your expenses.

Your revenue may change from one month or another. To get a good idea of your yearly budget, look at your revenue over the past twelve months. This will help you find trends in your income to create a better plan.

Identify fixed costs

The first expenses you need to consider are your fixed costs. These are the costs that you will need to pay to operate the business, and you will not have much control over them if the business is to succeed. Many of these will be due monthly, like your payroll, rent, and insurance, while others will be due several times a year, like your taxes.

Determine variable costs

The next type of expense you need to work on is the variable costs. These are the costs based on how much you use a service and can often go up or down. They are still necessary for the function of your business, but you have more control over the cost compared to your taxes or rental income. Some items that may fit into your variable costs include utilities, replacing old equipment, marketing costs, etc.

Project cash flow

Projecting your cash flow will give you a good idea of how much money is available for your business to spend on all expenses. However, determining cash flow is difficult because your customers may not make their payments on time. When a customer is delayed in paying you and has already rendered the service, you may be short on cash until that payment is made since you had to pay for the parts, materials, and labor to get it done.

An excellent way to prevent issues with your cash flow is to set up clear policies for customers in terms of payment. Offering discounts for those who pay on time and strict deadlines for when the payments are due can help keep your cash flow positive.

Predict one-time spending expenses

Your business will experience a lot of one-time spending situations. Whether it is an upgrade to your software, new business furniture, or that company holiday party, these are things you will still need to spend money on, though they do not show up regularly. Try to look at the calendar and determine when these one-time expenses are. Most of these one-time expenses are things you can plan on. For example, if you know the software needs to be updated every August, you can add that into your August budget.

Set aside contingency funds

One-time costs for your business will never come at the most convenient time. Therefore, it is good to plan for these contingency funds from the very beginning. Setting aside a bit of money during the good months, instead of wasting the money when you have a surplus, can help you handle these variable expenses and keep your business afloat when times get tough. Always assume that something can break or a significant expense will come up and make a contingency fund to handle it.

Create a profit and loss statement

With all of the information gathered above, it is time to put it together to create a profit and loss statement or P&L statement. You have done all of the work at this point; now, it is time to bring in the math to see where your business finances are.

Start by adding up all of the income you earned for a month and then subtracting the expenses. The hope here is to get a positive number. If you do have a positive number, you have made a profit. If your number is negative, do not panic. Many companies are not profitable each month or even each year. But now you have a complete picture of your finances and can make changes to help you become more profitable.

Example Small Business Budget

Income

Total Sales: $10,000

Client Hourly Earnings: $2500

Savings: $5,000

Investment Income: $8000

Total Income: $25,500

Expenses

Fixed costs

Rent: $1500

Internet: $100

Payroll: $5000

Insurance: $150

Accounting Services: $150

Total Fixed Costs: $6900

Variable expenses

Contractor Wages: $1000

Utilities: $450

Printing Services: $200

Digital Advertising: $1000

Transportation: $200

Sales Commissions: $1500

Total Variable Expenses: $4350

One time spending

Office Supplies: $500

December Holiday Party: $1200

New Software updates: $1000

Gifts to clients: $2000

One Time Spends: $4700

Total Income: ($25,500) – Total Expenses ($15,950) = $9,550

The final amount you are left with will be your profit which is 9550.

Profit and Loss Account

With your P&L statements handy, you will be able to look for some significant trends that will help with your planning. You want to look for specific trends to help you plan your small business budget. Seasonal trends can be an essential thing to consider. If you usually have lower sales during lousy weather, you can plan for the winter months and lower your expenses to prepare for those storms.

Many companies have seasonal trends, where they may make more money during the summer or tourist season. This is an excellent time to invest in the company by spending more on training, new equipment, or other essential items that you need. As you look through your profits, you may notice some profits are higher than in the past or can’t be explained.

Dig deeper to discover more about these profits and whether they are part of a more significant trend or something you should not rely on. Big purchases can cut your profits, but these are considered a beneficial loss because they will help your business grow.

As you examine your P&L statement, your goal is to look for explanations for any fluctuations and changes that occur in your business. This will help you to prepare for similar situations in the future.

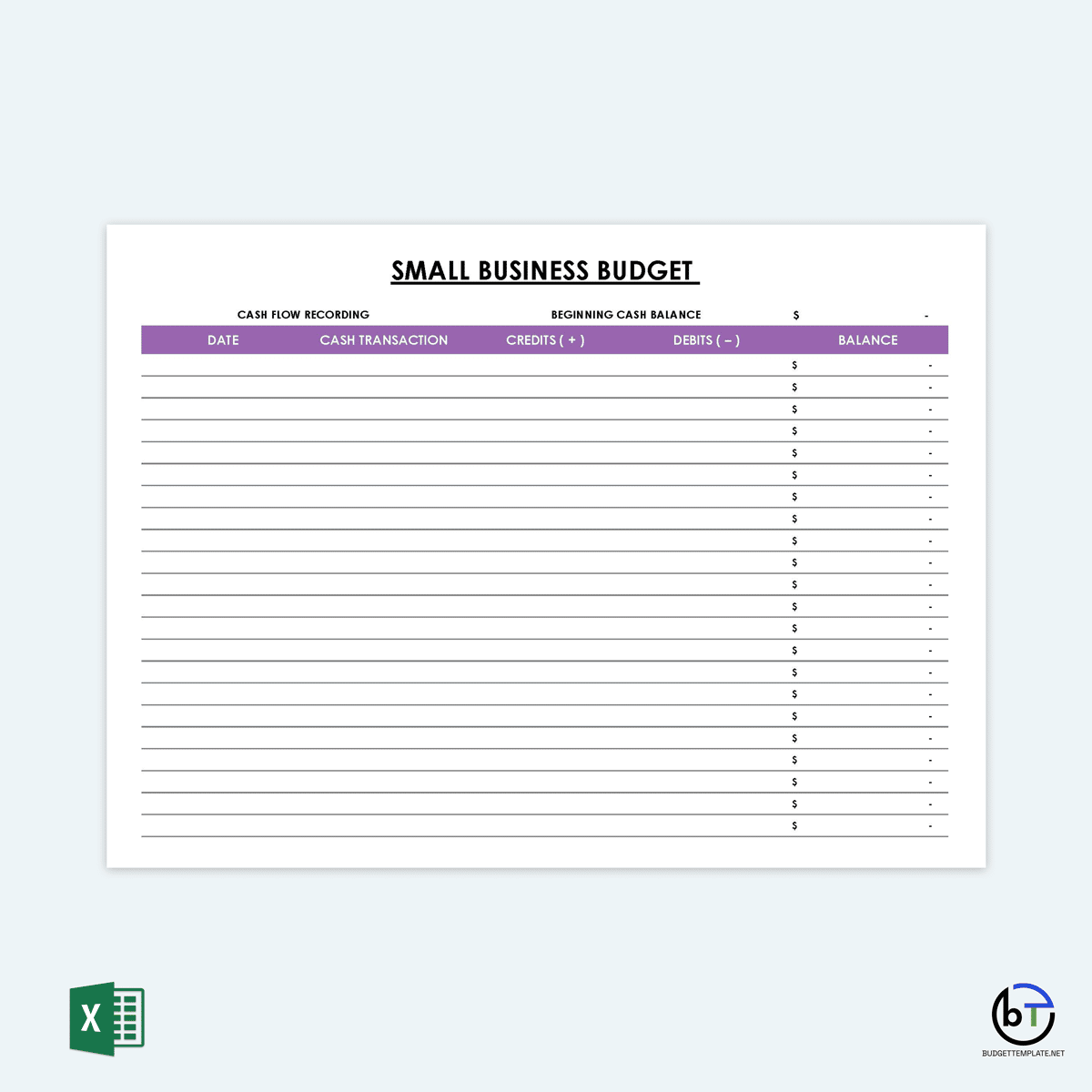

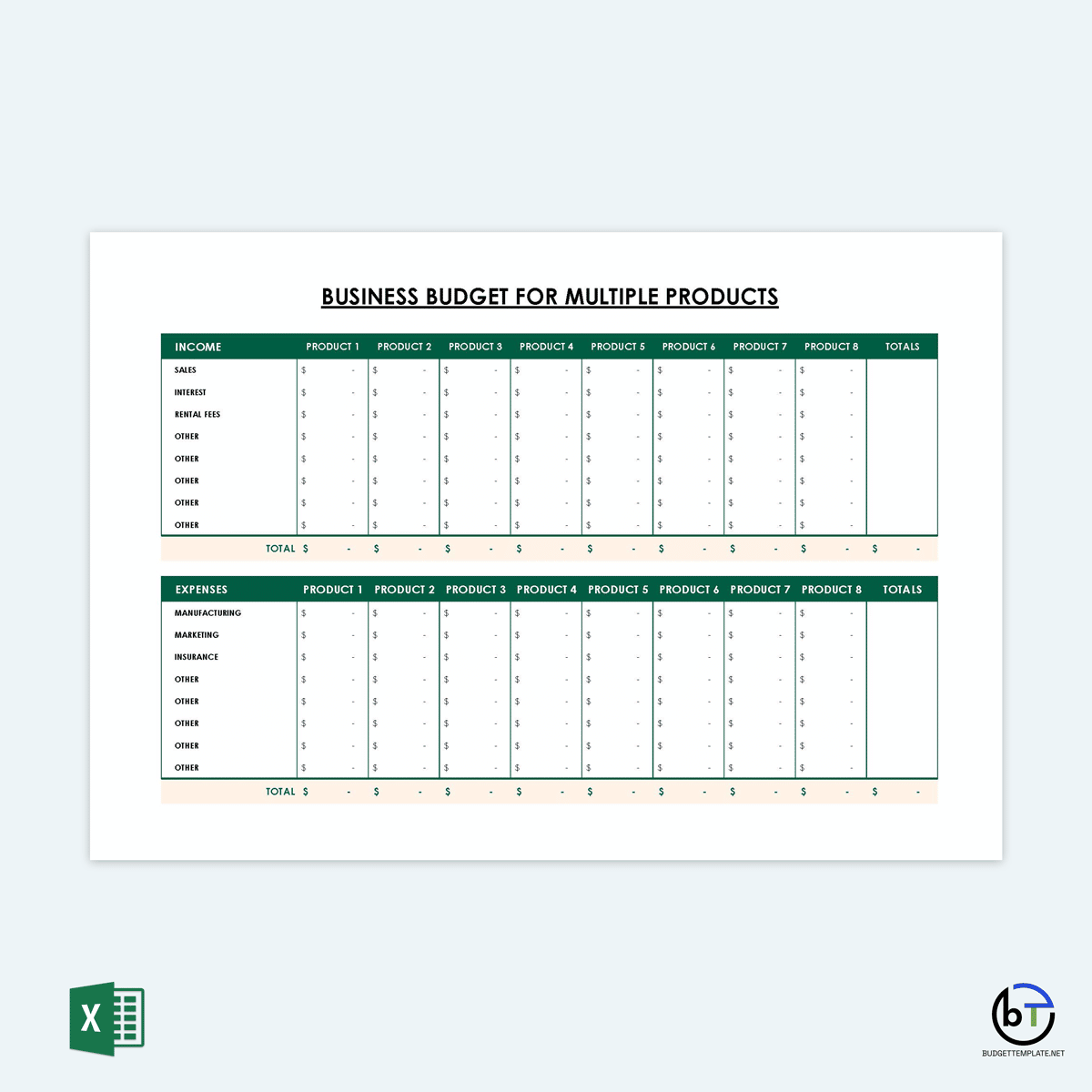

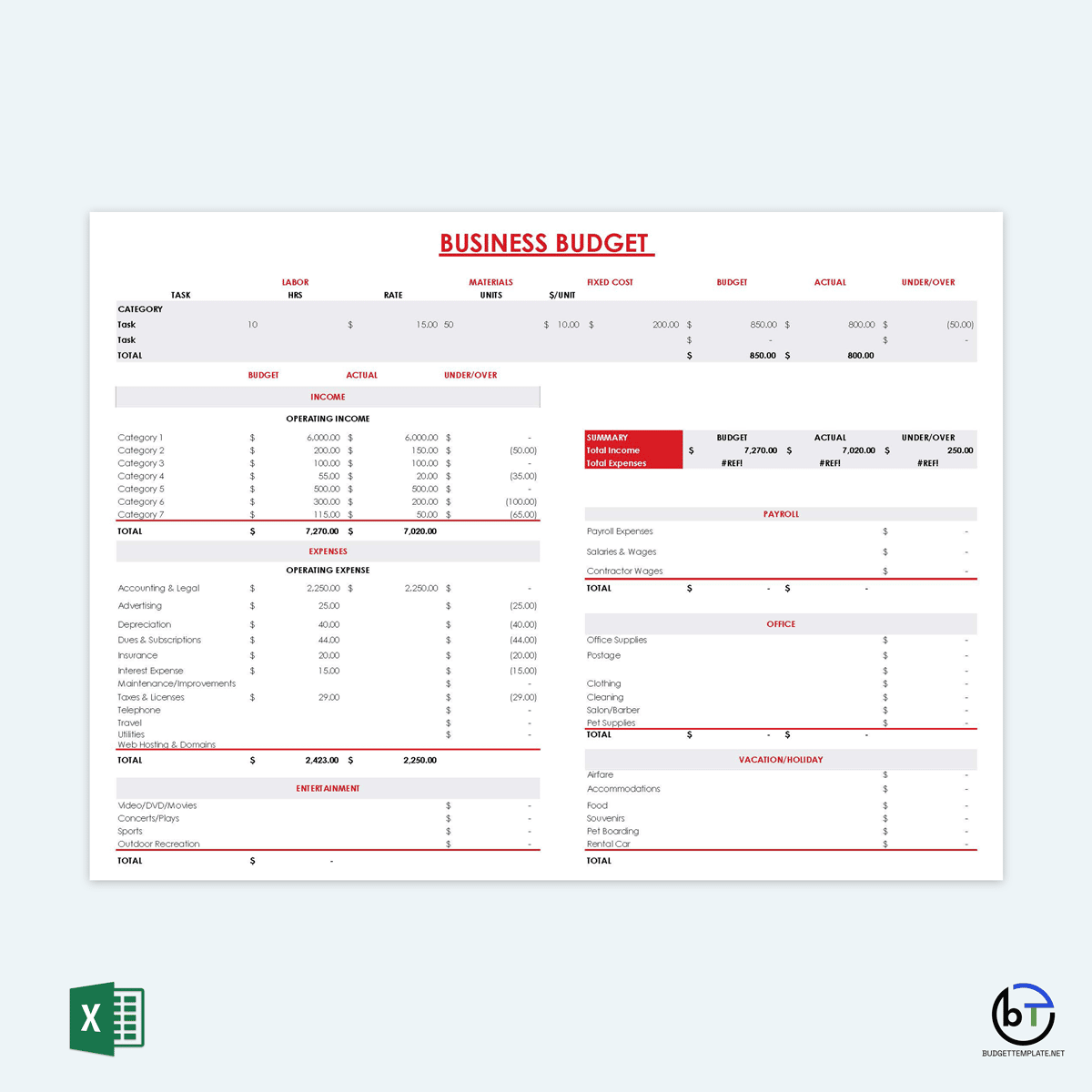

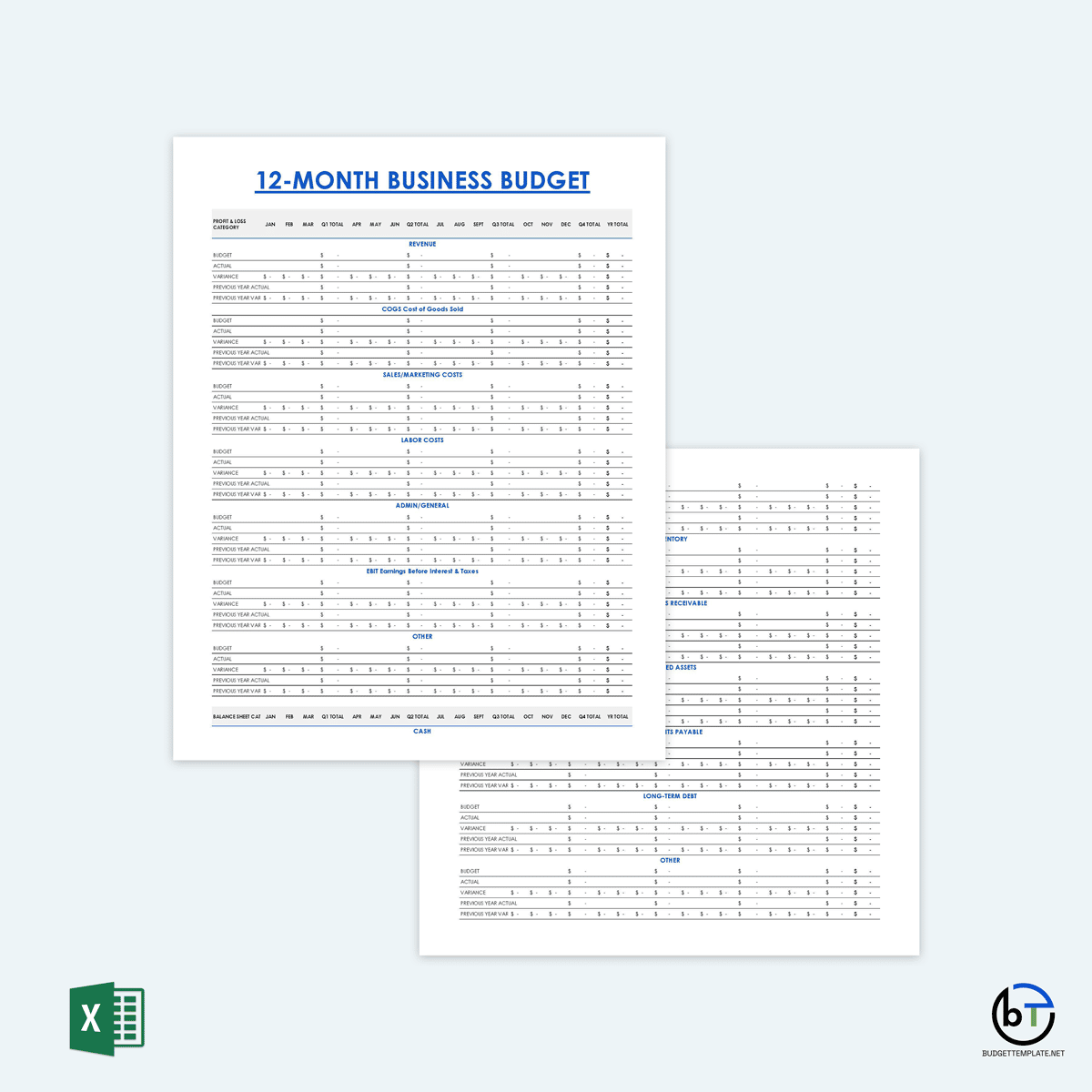

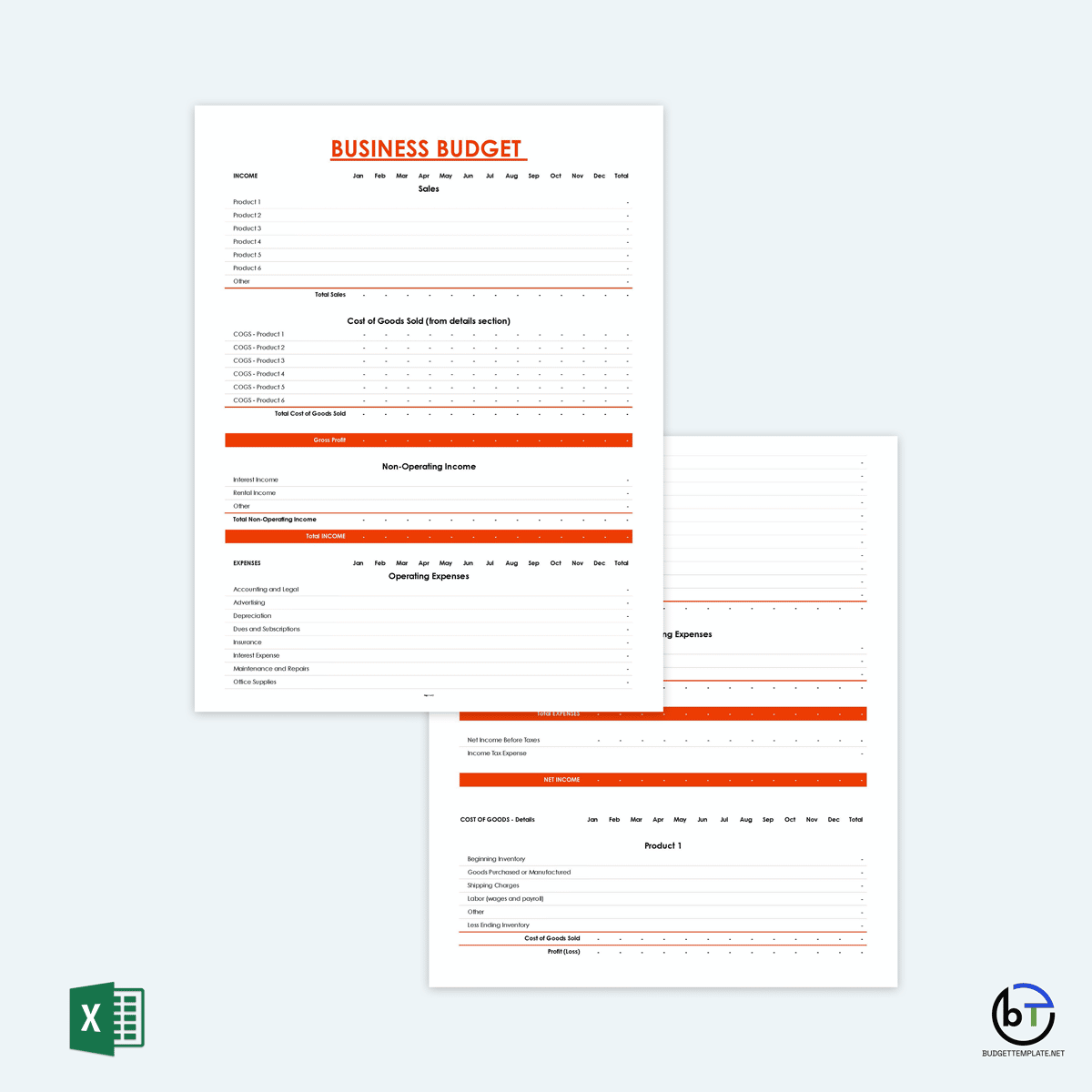

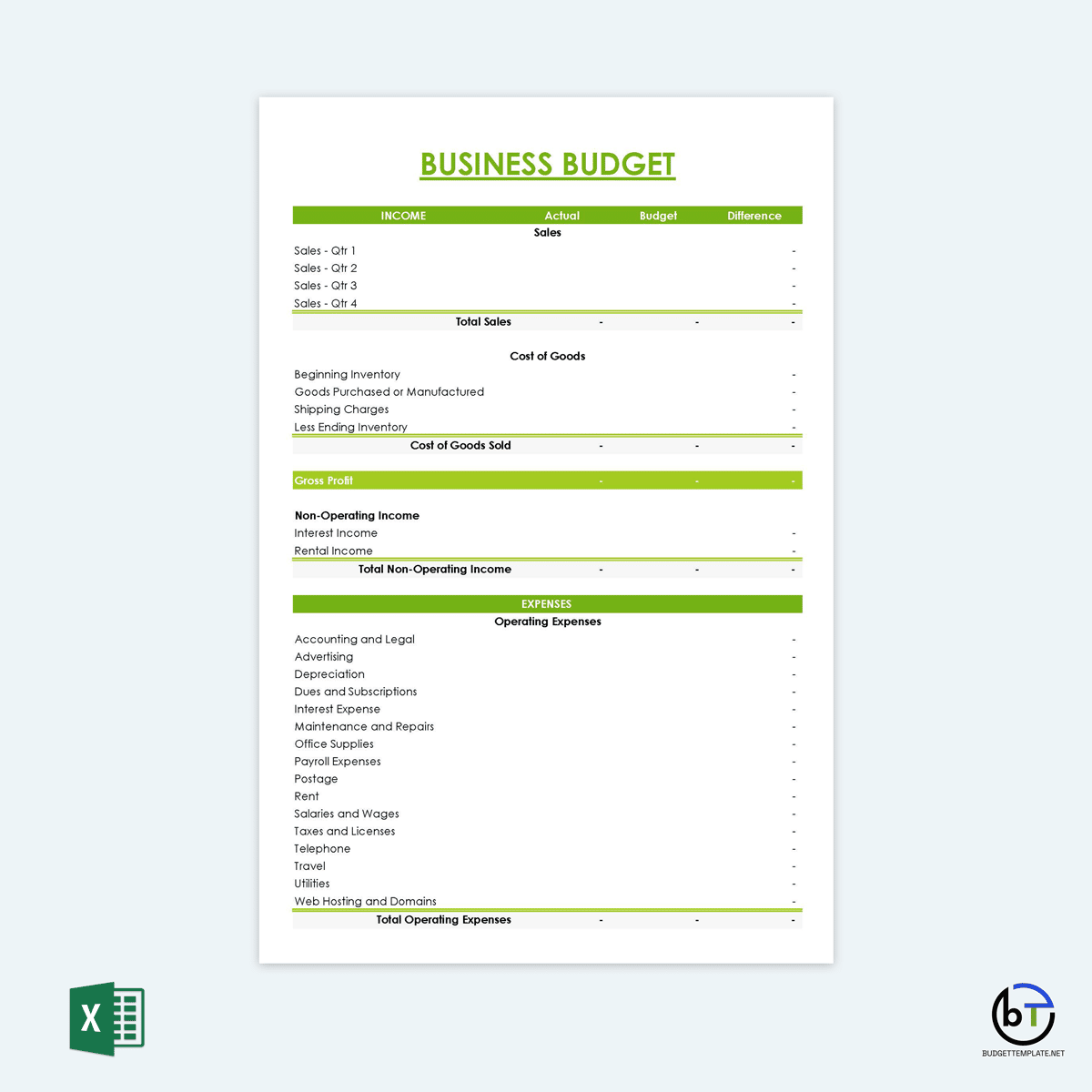

Using Budgeting Tools: Free Templates

Setting up a small business budget can take time and may seem overwhelming if you haven’t had time to do one yet. Therefore, this website provides the readers with free downloadable small business budget templates to make budgeting your small business expenses more accessible. These templates for the small business budget are customizable and are less time-consuming. You can customize them according to your needs.

Tips to Follow

- Keep margins of seasonal and industry trends factors: Your business will see seasonal trends in profits. Some parts of the year will be busy, and you will make significant profits, and at other times of the year, you may struggle to pay all of your bills. The longer you are in business, the easier it is to recognize and plan for these trends. If you are a newer business, look at industry trends to help determine when you may have struggling months and make a plan to help keep you afloat during those lean times.

- Set spending goals: While you create your small business budget, you need to set goals for spending in different categories. The exact categories you choose will depend on what is essential to your business. To help you set these goals, consider what you have spent in different categories over the last year and then decide if these are relevant now or if one category should be smaller or larger. These goals will help ensure that your money does not go to waste.

- Hire an accountant: Managing all of your business expenses on your own can be a challenge. Hiring a professional accountant will be an intelligent decision to help here. They will take a look over your budget, can help you track your income and spending, and can make suggestions on which business goals you should work too.

- Use your budget to stay on track: The goal of writing a budget is to use it to stay on track. It takes some dedication and time, but you can track the money coming in and going out of the business with a reasonable budget. You will be amazed at the financial insights you can gain from this budget. And when you start to go off-track with something, it is much easier to catch it and make adjustments before it ruins your business financials. Overall, the business budget will give you the resources you need to grow and scale your business in the future.

Wrapping Up

A small business budget template is one of the best ways to help you stay on track with your business income and expenses. Taking a good look at your business financials can help you see where you are spending too much, locate trends during the year, and make smart financial decisions to benefit your business.

Writing a small business budget does not take a lot of time, but it can help you succeed with your financial goals. Take a look at some of the simple steps above to see how you can create a small business budget template to reach all your business goals and manage your business finances.