Personal budgeting is a practice that most people often struggle with, but it is manageable with a bit of planning and using the right resources. It is generally defined as the art of planning and managing money on behalf of an individual or entire household. It has several vital functions, such as keeping track of your income, expenses, savings, and investments.

The first step to effective budgeting is often creating a suitable template to outline the items to include in the plan. This article will provide you with a complete guide to personal budgeting, including the steps to create it, important budgeting strategies, and the essential tips to keep in mind to ensure you make a more realistic personal budget.

Purpose of Making a Budget

A personal budget is a planning tool to help you keep track of your expenses concerning how much money is coming into your household each month. To have a well-defined budget, you must first understand its purpose. In most cases, the primary goal/purpose of creating a budget is to be able to keep track of your expenses and income.

It is essential because it can be used to figure out your monthly bills, set savings goals, separate your wants from your needs, and identify fixed expenses from those that can be adjusted to ensure you are living within your means. While creating a personal budget template, you can feel overwhelmed with all the numbers and details in the plan. Still, ultimately you will achieve more control over your finances and keep your financial situation in order.

Strategies of Budgeting

Several different strategies can be employed to create a personal budget that is highly effective. However, the overall strategy often depends on a person’s financial needs and goals, varying from one person to another.

Here are a few popular methods that you can use to ensure that your budget is practical and more realistic to follow:

Zero-based budgeting

The zero-based budgeting method usually provides the most significant amount of flexibility and control. It is not based on how much money you make each month. Instead, it uses the income you made in the previous month to pay for your current monthly expenses. The “zero” is derived from the idea that you will start with a blank slate at the beginning of the current month, which will allow for more accurate calculations for dividing your money between different expenses each month.

The 50/30/20 rule

The 50/30/20 rule is also known as the “rule of thumb.” It is a budgeting technique that is based on a person’s income. It involves breaking down your spending into three significant categories: essential spending, non-essential spending, and savings. The 50 percent pertains to your essential fixed expenses such as rent and utilities. The 30 percent pertains to your lifestyle and non-essential expenses such as entertainment. Finally, the remaining 20 percent is allocated to savings and personal expenditures.

The envelope system

In this strategy, you set up individual envelopes for each of your expenses that are fixed in nature and cannot be changed, such as rent or mortgage payments. Then, each month, you transfer the cash needed to settle these fixed bills into a designated envelope. You then use these envelopes to track your expenses to ensure you do not overspend. The envelope budgeting strategy can benefit people who often have difficulty sticking to a budget.

Pre-budgeting Groundwork

Before you embark on creating your personal budget, you should keep certain pre-considerations in mind to ensure you make a realistic and easy-to-follow budget plan.

These include the following:

Set financial goals

It is essential that you first have a clear understanding of your financial goals before starting the process of personal budgeting. Doing so will ensure that you have a better and more practical idea of what you need to do to achieve the financial goals you have set for yourself.

Make a plan

Once you have your financial goals set in place, you must allow yourself enough time to develop a realistic plan of action to achieve them. This includes creating a budget plan and deciding on the amount of money you can afford to save from your monthly income after sorting your monthly fixed and variable expenses.

Know your priorities

Knowing your priorities before creating a personal budget will also go a long way in enabling you to develop an adequate budget. Understanding your most essential needs and knowing what you want but you might survive without will help you create a budget plan that is likely to help you achieve your short and long-term financial goals.

Automate your budget

Budgeting templates are practical tools for keeping track of your finances, but only if you make an effort to stay on top. You can do this by using automatic withdrawal from your bank account or by having automatic debits scheduled at the beginning of each month to ensure that your most important bills are paid promptly.

How to Plan it?

To create an effective personal budget template, you may use a journal, notebook, or spreadsheets or download and use pre-designed online templates. However, regardless of the form and format you choose to use, consider planning your budget following the steps explained below:

1. Determine your monthly income

Creating an ideal personal budget involves determining the amount of money that comes into your household each month. You can obtain your income information from your bank statements, pay stubs, W-2 forms, investment accounts, credit card bills, 1099s, receipts from the last three months, mortgage statements, recent utility bills, or auto loan statements.

Given that your income is in the form of a regular monthly paycheck, your net income is your take-home pay after the applicable deductions, including taxes, have been deducted. If you have any other sources of income, consider adding them to your monthly net income. If you are a freelance worker with a variable monthly income, consider using income from your lowest-earning month within the past year as your baseline income when setting up the budget.

2. Make a list of fixed and variable expenses

Once you have identified your monthly average income, you should list all your expenses, including fixed and variable expenses, and allocate a specific amount of your average monthly income. Fixed expenses include monthly bills such as rent or mortgage payments, utilities, insurance, car loan payments, childcare fees, and any other regular payments that you need to pay every month. Variable expenses include food and groceries, personal care and clothing, transportation costs, entertainment, car maintenance, etc.

3. Breakdown the expenses into categories

Next, you need to break down your fixed and variable expenses into separate categories. First, identify all the non-essential costs such as transportation, entertainment, and clothes and list these. Next, divide your budget by these categories and locate the money allocated for each type. This information will be used later when determining how much money is available for savings or if you need to begin increasing your income if it is low.

4. Make a total of all expenses

After this, you need to add up all these expenses. Finally, you will use the total to determine how much money you need to ensure that all these expenses are met each month. Depending on your income, the number of dependents, and other factors, this amount may vary from one household to another.

5. Determine your monthly spending

After categorizing your expenses into various subcategories and allocating a specific amount of money to cover each of your listed expenses, you should add up all your monthly bills and subtract the result from your total monthly income to determine your average monthly spending.

6. Evaluate the expenses

This step of effective budgeting entails evaluating the expenses you have listed in your budget plan. This is a very crucial step as it helps you determine whether you can stick with the laid-out budget or if you need to modify it. Ideally, your monthly payment should be more than your total monthly expenses. However, sometimes you may get a negative number. If this is the case, you need to change your budget, including cutting back on some of your non-essential expenses or simply finding ways to generate more income.

7. Make adjustments according to the needs

As your budget evolves, you can always make necessary adjustments to ensure that it can meet all your changing needs and demands. There is no such thing as a perfect budget plan or one-size-fits-all solution when it comes to budgeting. There is always room for modifications. To ensure it is easy for you to track and modify your budget, you must consider using a budget template that is flexible and easy to update, such that your financial situation remains balanced.

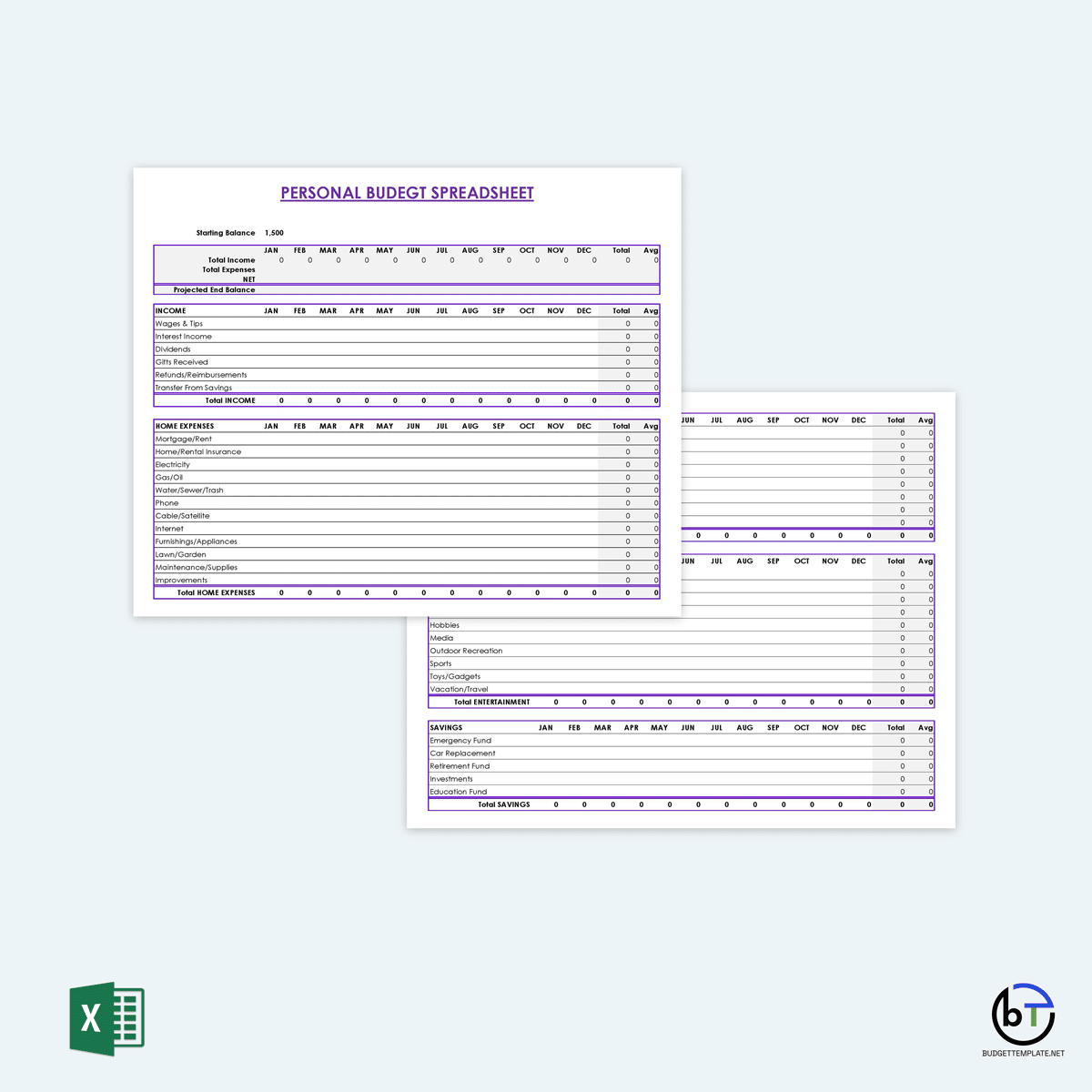

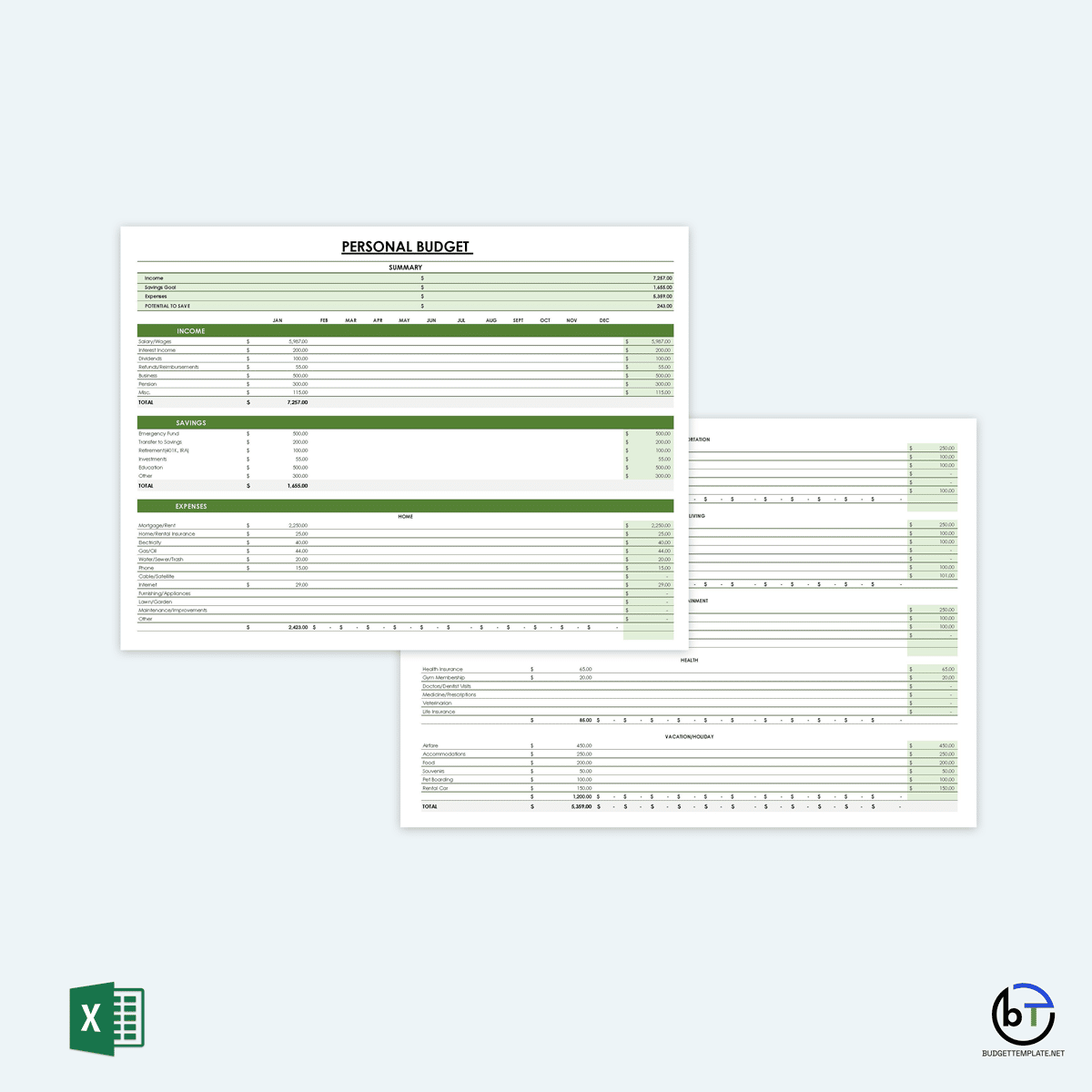

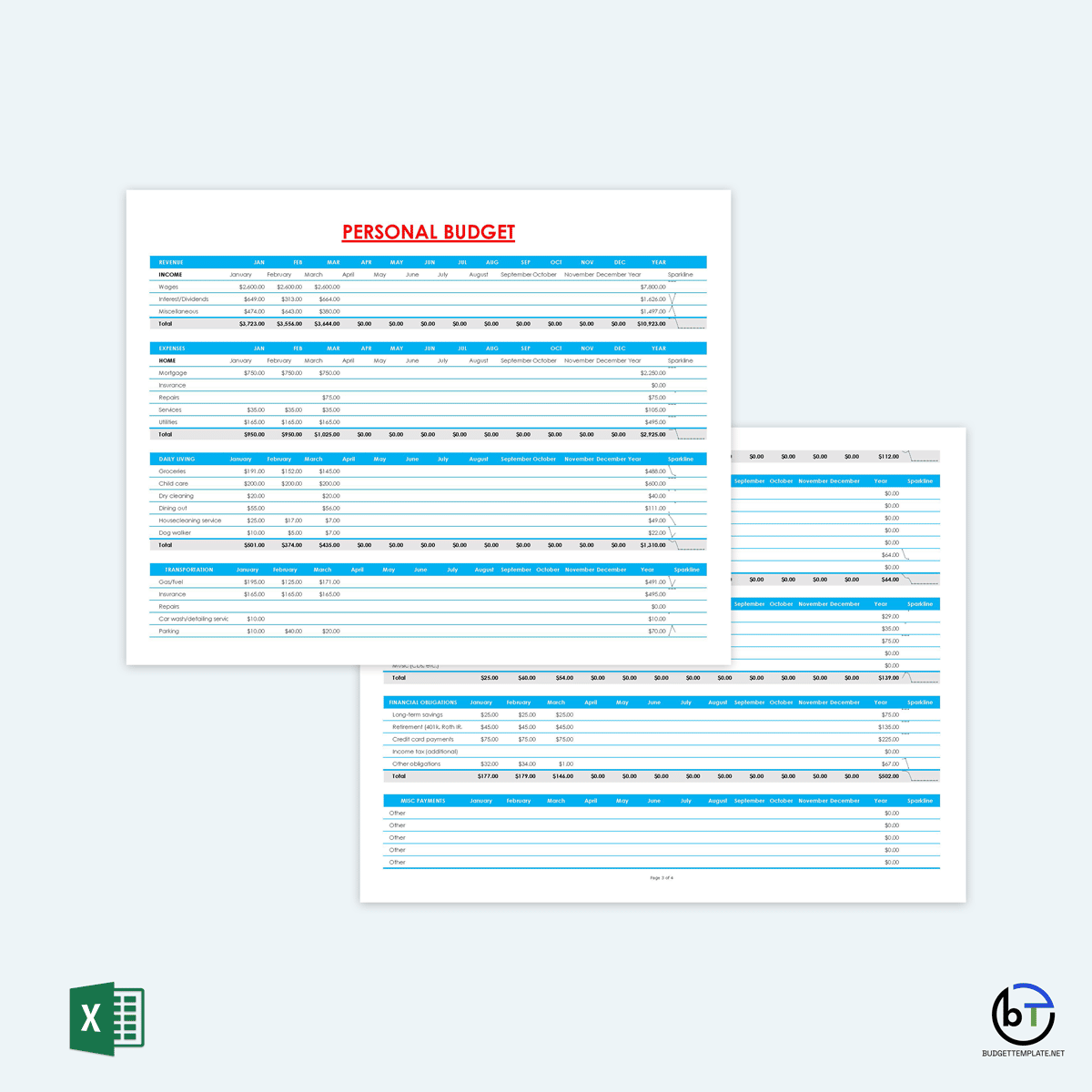

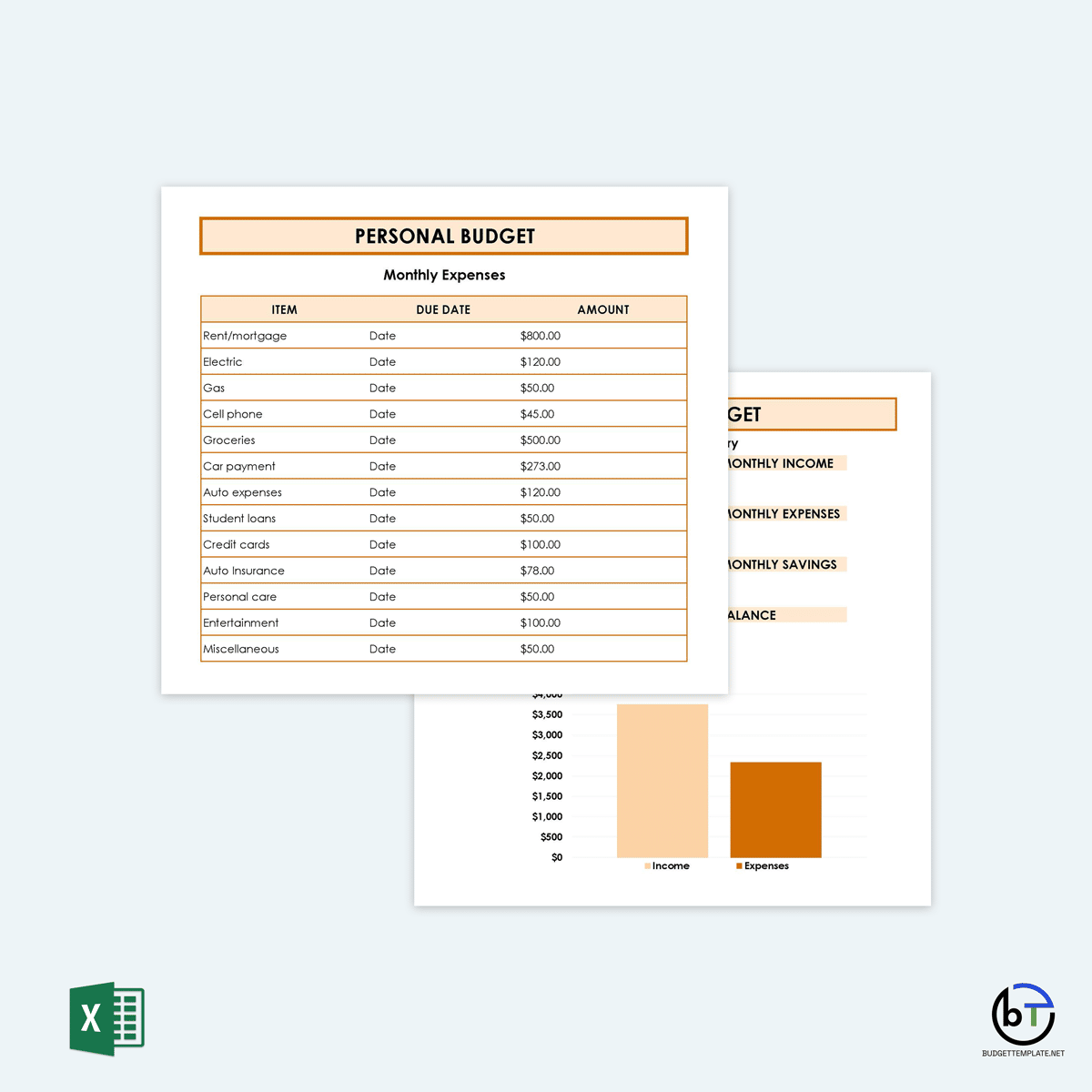

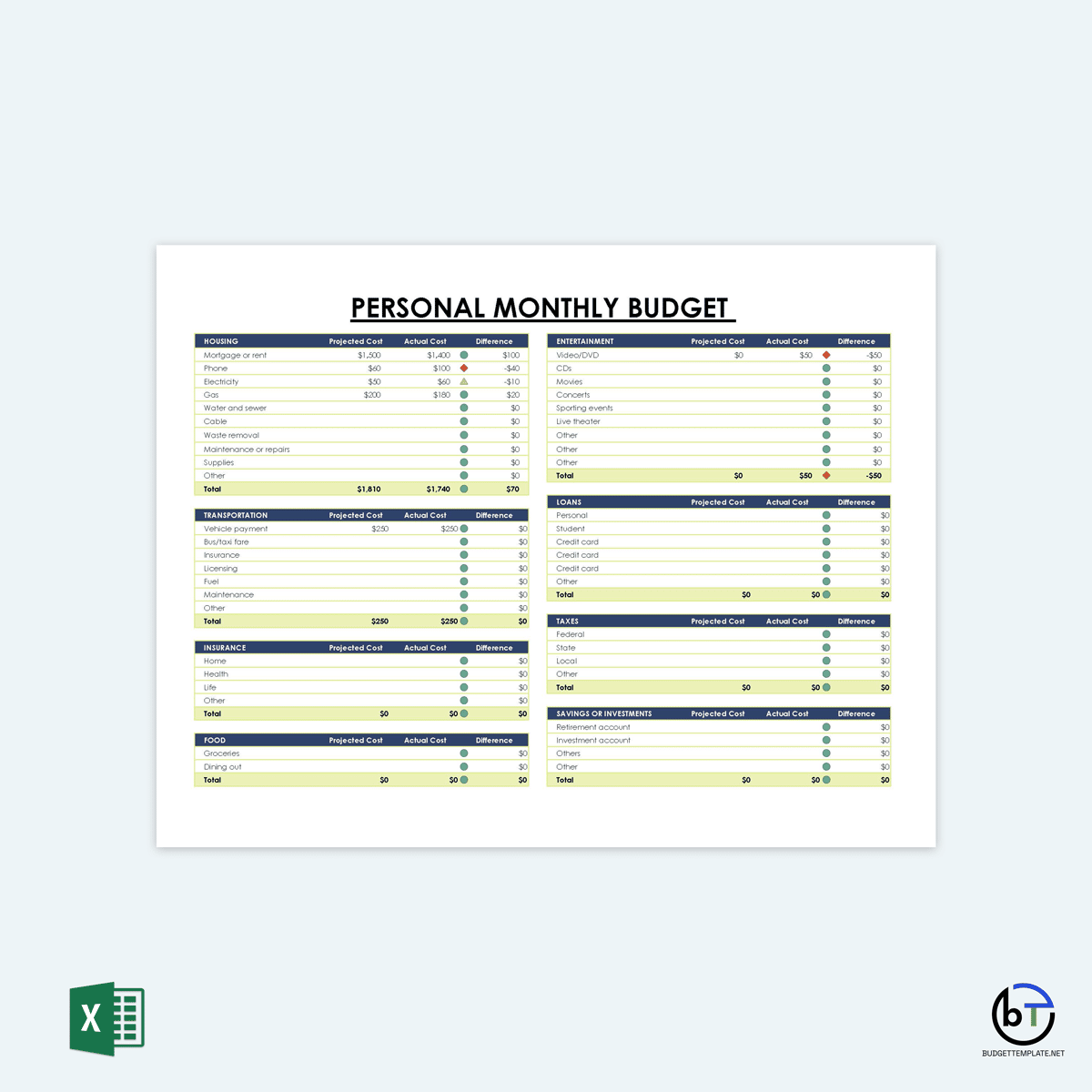

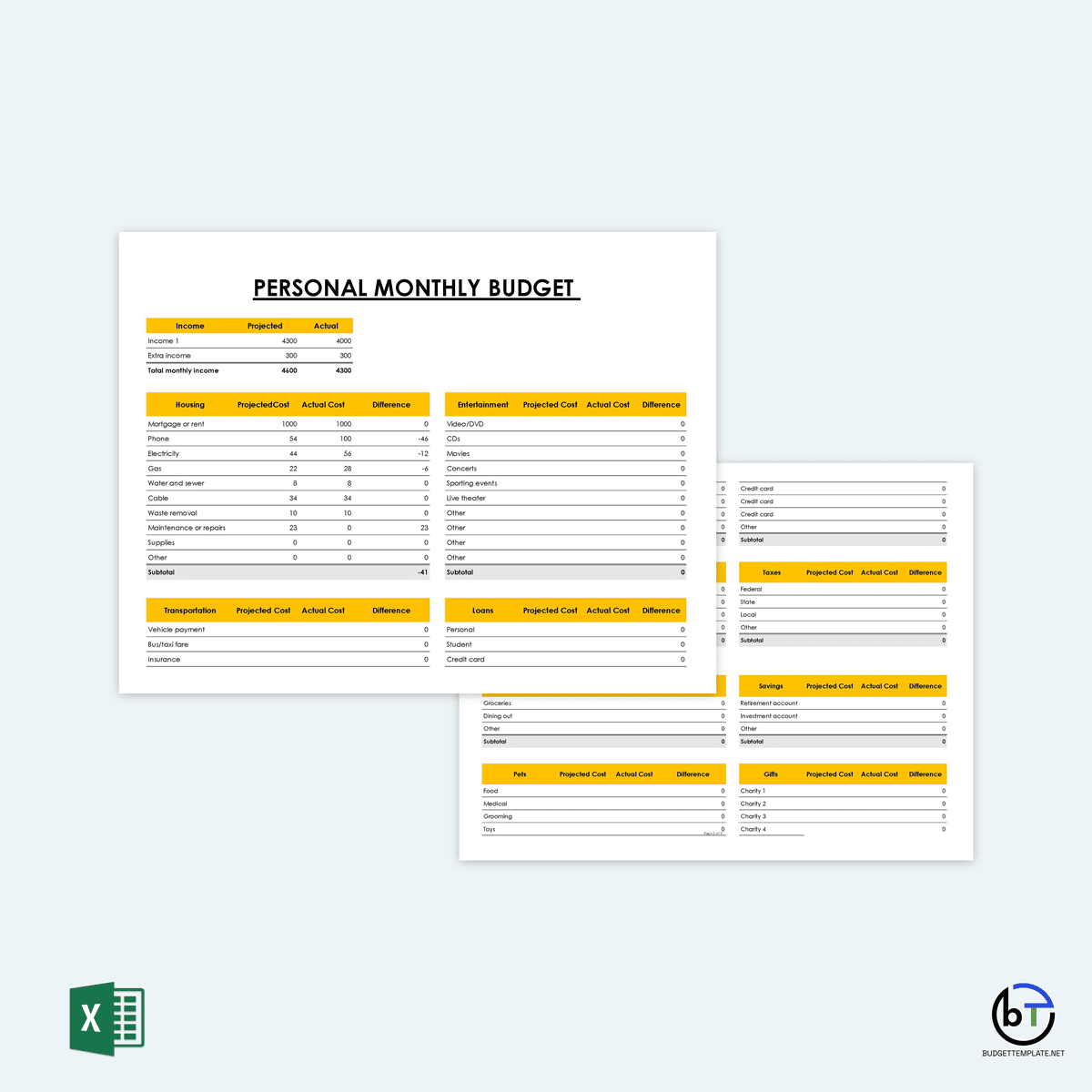

Personal Budget Templates

You can use a journal, notebook and pen, Excel spreadsheets, or downloadable templates to create a personal budget that you can use to track your income and spending. However, while the first three methods of creating a personal budget plan are effective, using a pre-designed personal budget template is relatively straightforward and allows for flexibility. Online templates also ensure that you include all the essential information. You’ll also save a considerable amount of your time and effort if you choose to use an online template compared to starting from scratch. Such professional personal budget templates are available on this site. You can download these templates for free and customize them according to your needs.

Review and Keep Track of Your Spending

Once you have created a budget that is in line with your financial goals and priorities, you should use it to monitor and keep track of your spending. Review it at least once or twice each month to ensure that it still effectively serves your purpose and is up-to-date. Additionally, you must regularly review your budget, for example, weekly, to ensure you are sticking to what is already on the plan and focusing on your financial goals and realities. In light of this, it is crucial to create a personal budget template that is tailored to meet all of your changing needs and one that you can be able to change every time the need arises.

How to Track and Record Your Progress?

You need to review your personal budget regularly to track and record your progress and ensure you consistently use it until you achieve your financial goals. However, monitoring and recording your progress may prove difficult if you use a budget planning tool that is rigid and does not allow for flexibility, such as the pen and paper method or using a journal, as you will need to create a new budget plan each time you need to make some changes.

Therefore, online budget templates, spreadsheets, and record-keeping apps are highly advocated for as they allow you much ease in keeping track of your progress. Nonetheless, creating a spreadsheet might prove difficult as it requires a lot of effort, and you may not include all the required information; thus, your final budget may not be as accurate. On the other hand, using a template or any suitable record-keeping app might prove helpful and has several benefits, including the following:

- They are easy to use: Using personal budget templates and record-keeping apps is not rocket science. However, using these templates is often more accessible as they have pre-made fields and information that allow you to fill in the gaps without going back and forth quickly.

- Increases flexibility: Online personal budget templates allow flexibility as you can constantly adjust their layout and information to suit your individual needs.

- Source of inspiration: You can use templates as a source of inspiration and ideas, especially if you have no idea where to start. This can also help you create a personalized budget plan and inspire you to save more.

Conclusion

Creating a personal budget is essential in helping you track your income and spending habits, enabling you to meet your short and long-term financial goals and investments. However, creating a practical and easy-to-follow budget is often easier said than done, mainly if you are new to budgeting or have no idea where to start and what to include in a budget plan. In addition, keeping track and recording your progress manually is also very difficult.

Therefore, it is always advisable to use readily available personal budget templates downloaded from the internet to increase flexibility in creating, updating, tracking, and recording your progress. You can also use the vast array of Microsoft Office spreadsheets or record-keeping apps. Regardless of the method you choose to create your budget, this article has shed light on personal budgeting. In addition, the tips which are discussed here will also help you create a budget plan that serves you well in saving money and making financial decisions.