It is essential to be aware of your income and have a set plan for spending and saving this money when it comes to your finances. As a single person, you need to track your income and control your spending effectively, especially when it comes to your personal and household needs.

The best approach for an effective financial habit is to have a single person monthly budget template. Your finances are necessary, and developing a beneficial habit of planning and holding yourself accountable will be rewarding. With a single person monthly budget template, you will be more focused and responsible when making financial decisions.

A single person monthly budget template shows you how much you earn and spend. With this knowledge, you will be able to identify the areas you need to adjust to achieve your financial goals. Living on a budget is an essential financial step, and the best thing to do is learn how to create and use a budget.

What is a Monthly Budget?

A monthly budget is a written document highlighting the best plans for appropriately spending and saving money earned each month. Since most expenses occur every month, for instance, rent, loan payments, and utilities, a monthly budget is an effective way of planning for your money. In addition, a monthly budget offers you an ideal way to keep track of your spending habits to ensure it is less than what you earn per month.

As a single person using a monthly budget template, you must ensure that your expenses and spending do not exceed your income, as this will lead you into debt. Therefore, it is best to have this plan before bills, costs, and emergencies arise. Then, you can assign each expense the appropriate amount of money and cut down those expenses that exceed your income.

Apart from helping you prioritize essential expenses, a single person monthly budget template will also help you balance how you spend and save your money. In addition, it helps you to stay honest about your income and spending ways. Finally, a monthly budget for you as a single person is vital in that you will be able to make better financial decisions which will help you stay focused on your financial goals.

How to Make a Single Person Monthly Budget?

Since it is essential to have a single person monthly budget, you need to know how to make the correct one. With the steps listed below, you will be able to make an appropriate and effective monthly budget for yourself as a single person:

Gather financial papers

You need to gather your financial papers, including bank statements, investment accounts, recent utility bills, W-2s and pay stubs, 1099s, credit card bills, and receipts from the last three months’ mortgage or auto loan statements. You need your financial paper to have the correct information regarding your income.

Determine your income

The next step is to determine your average monthly income, which should be the amount you remain with after taxes have been deducted. Your total income may result from paychecks, freelance, self-employment, child support, or even social security. It is best to include consistent sources of income when budgeting. However, use the lowest amount earned over the last three months in your budget for variable income.

Create a list of monthly expenses

Then you will need to list down all your monthly expenses, including mortgage payments or rent, car payments, insurance, groceries, utilities, entertainment, personal care, eating out, child care, transportation costs, travel, student loans, and savings. You can check your bank statements, receipts, and credit card statements within three months for your spending expenses. It is also vital to include annual and unplanned expenditures in your list.

Think about your priorities

You need to think about and determine your priorities once you have correctly established your expenses and spending habits. Your priorities are usually expensed you cannot avoid, such as rent, groceries, and bills like electricity, internet, and water. In addition, establishing your priorities will help you identify any non-essentials you have been spending money on, like shopping online or buying coffee every morning to work.

The idea is not to focus only on priorities and essentials but control the money you spend on non-essentials. As a result, you are more likely to focus on savings and other financial goals with your priorities in check.

Identify fixed and variable expenses

The next step is to identify the fixed and variable expenses. Your fixed expenses are essential and always require the same payment, such as rent, car payments, internet service, credit card payments, child care, a fixed amount of savings, debt or loan repayment, and mortgage.

In the case of variable expenses, these are expenses that change every month based on your choices, including groceries, gasoline, entertainment, eating out, and gifts. Identifying your fixed and variable expenses will help you assign the amount needed for each expense section. It is also essential to include a section for emergency or surprise expenses in your single-person month budget template.

Make total

Your single person monthly budget template should also have a section when you include your total. Here, you will establish if your total expenses are higher or lower than your income. If your monthly budget has a higher income and lower expenses, you can save that extra money. However, if your expenses are higher than your income, you are overspending and likely to get into debt.

Evaluate and make adjustments (If needed)

The final step in creating your single person monthly budget template is evaluating the information and making any needed adjustments. This is s requirement in case your expenses are more than your income. You will need to find ways to cut down the expenses, such as shopping for groceries at discount stores or reducing eating out. These adjustments aim to ensure you spend within your income and avoid debts.

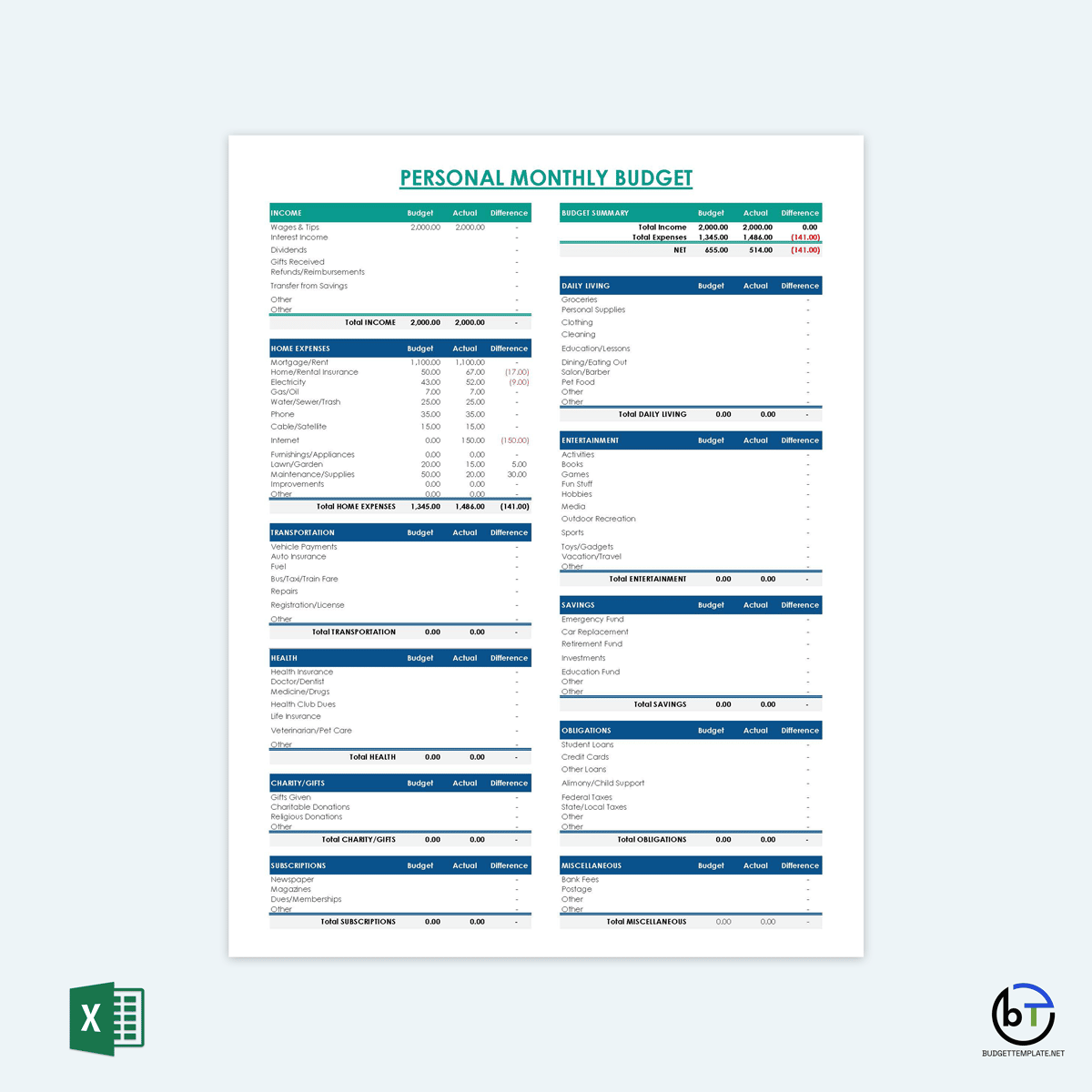

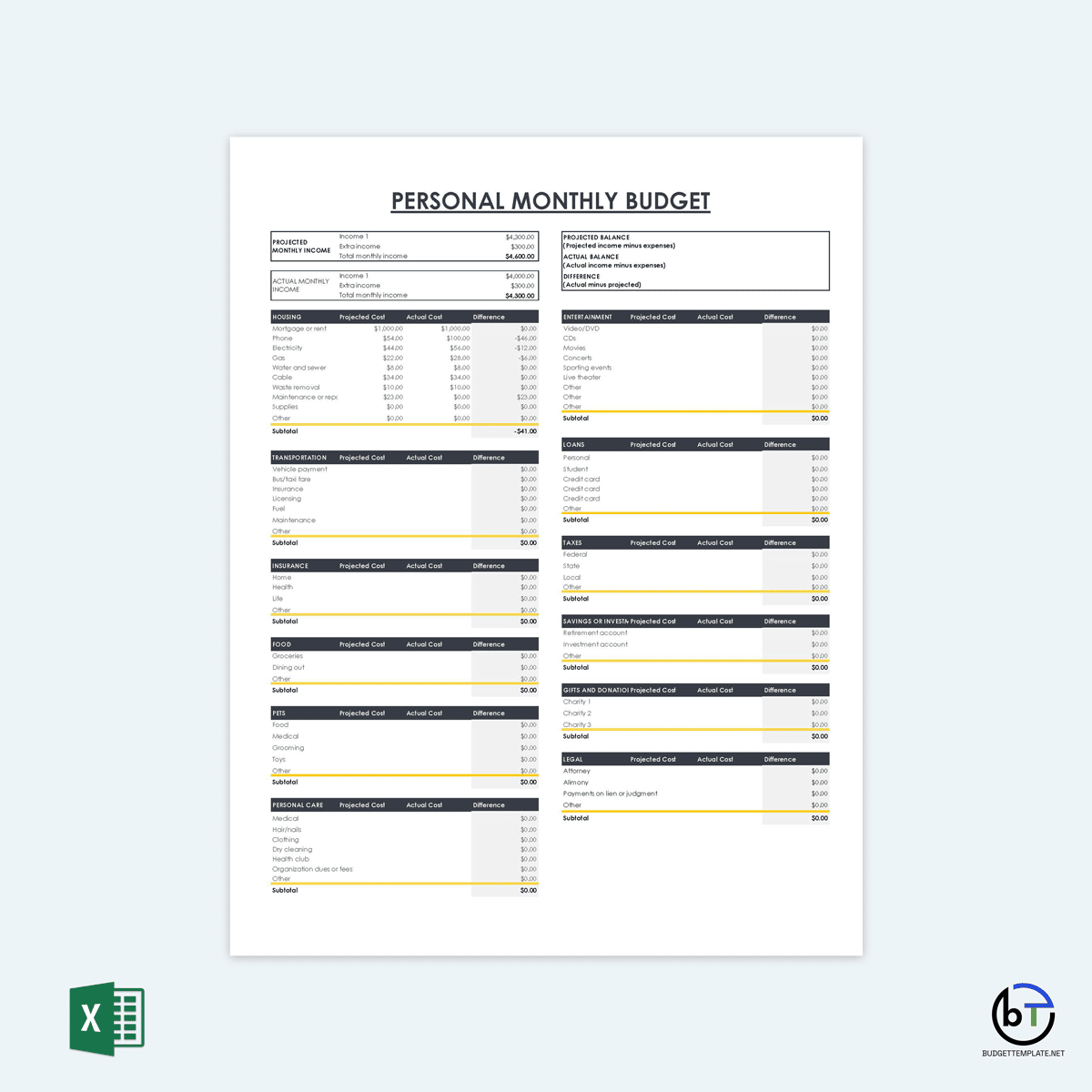

Single Person Monthly Budget Templates

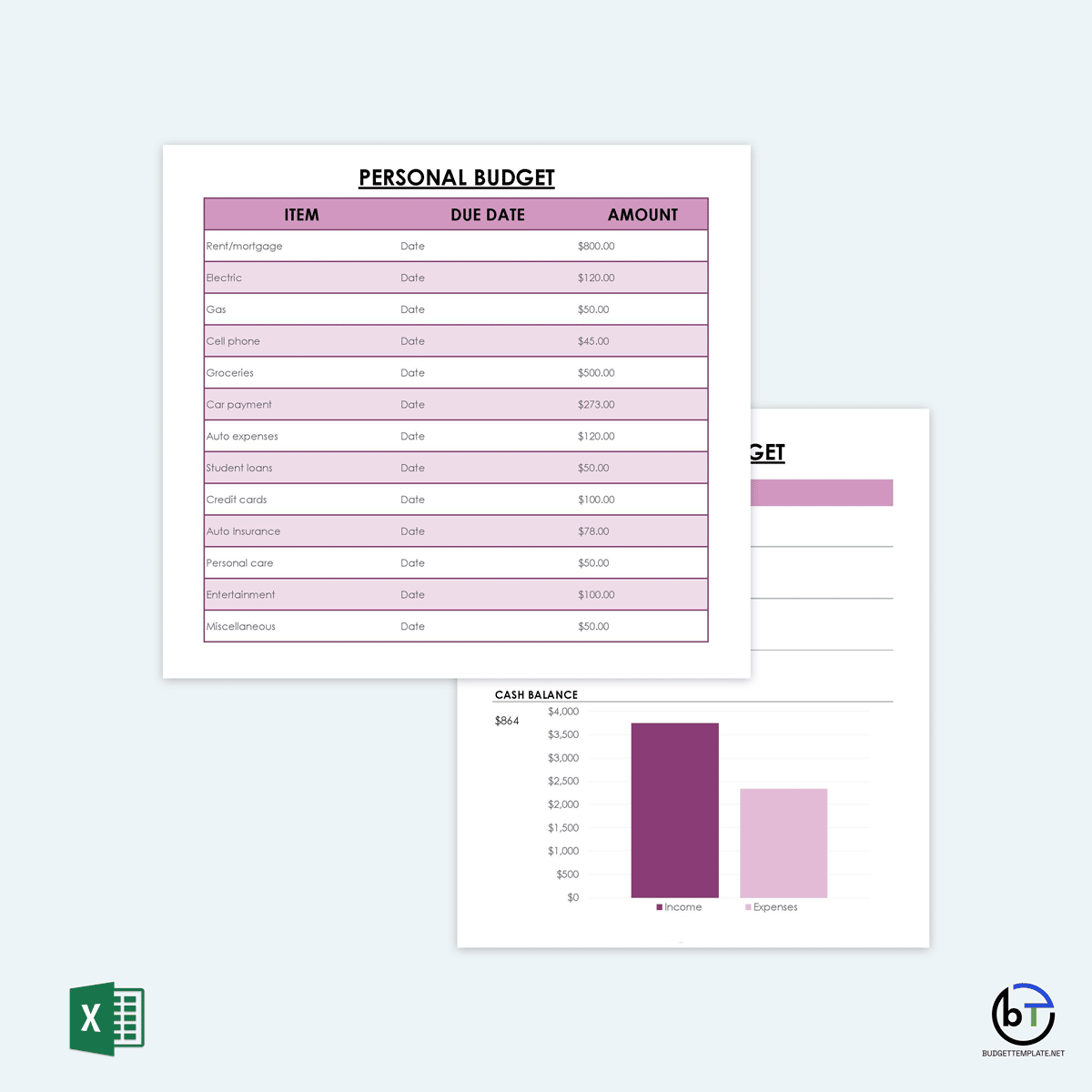

Creating a budget may seem like a challenging and time-consuming task. From identifying your total income, breaking down your expenses, and prioritizing your financial needs to saving some money for the next month or other financial goals, budgeting requires the right tools to execute the planning effectively. That is why you need to have a single person monthly budget template.

You can access single person monthly budget templates online on this website. With these templates, your whole budgeting process will become easier and faster. These templates are free to download and easy to use. To prepare a proper monthly budget, you can customize the single person monthly budget templates to suit your financial needs. So use the templates provided on this website to create your single-person monthly budget.

Personal Budgeting Tips

When creating your monthly budget, it would be best to have some special considerations in mind. These tips will help you prepare a proper and effective monthly budget.

Here are the tips you should keep in mind when creating a single-person monthly budget.

- Review and re-plan your budget after a few months: Ensure you spare some time after a few months to check and review your budget. There might be changes in your finances regarding income and expenses. Therefore, you need to review your budget and re-plan to fit your current financial goals and realities. Your budget should suit your financial needs, and that is why it needs to be reviewed after a while.

- Be aggressive in savings: Depending on your sources of income, you need to be aggressive when it comes to savings. For instance, if you depend on commissions, tips, and daily wages, you need to improve your savings skills. This is because you will be financially safe if your sources of income are suddenly cut or stopped.

- Resolve cash flow issues: If your cash flow only comes at the end of the month, staying on a monthly budget might prove challenging. That is why you need to resolve your cash flow issues. First, you should divide your monthly income into weeks and put the remaining amount for the other weeks in another account.

- Use cash to avoid interest: Try and always use cash to buy or pay for bills and expenses. Using a credit card to pay and buy stuff will lead to additional interest when it is time to repay your credit loan. With cash, you will avoid interest and have the required amount of money to budget for at the end of the month.

- Keep an eye on significant expenses: As you create your single monthly budget, you need to create space in your template to deal with significant expenses like insurance payments. In addition, you should adjust your budget to fit any overestimated and underestimated expenses. Finally, it is vital to have an effective plan to avoid failed or delayed payments for significant expenses.

- Move towards savings goals: Your budget is meant to keep you in check-in that you spend less than what you earn. With that being the target, it is also essential to focus more on savings than spending once you can achieve this. If you have that extra money after spending less than your income, focus more on savings to achieve your financial goals.

- Pros of making a single person monthly budget: There are some pros of making a single-person monthly budget that you should know. This is because, once you create a monthly budget for yourself, you are more likely to enjoy the following positives regarding your finances:

- Helps to take control over expenses: A single-person monthly budget will help you take charge of your expenses by controlling your spending. You will be able to spend within your income hence regulating the expenses you incur per month. Moreover, you will have the exact amount for your expenses; hence, you can control your spending habits to suit your financial abilities or income.

- Keeps you on track: A budget will also help keep you on track in achieving your financial goals. A single-person monthly budget offers you a plan to help you stay focused. In addition, since you can track your expenses when using a budget, you will be able to save more.

- Helpful in planning future: A monthly budget is also beneficial when planning for the future for things like getting into a marriage. As a single person, once you have learned how to budget, you are likely to be more prepared for the financial changes in being in a marriage.

- Gives financial contentment: Financial contentment results from good financial habits in that you stay away from spending money that you do not have. That means you can quickly achieve financial contentment if you have a single person monthly budget. A budget will ensure that you spend less than your income and avoid spending in a way that will lead to debt.

- Keeps you away from financial stress: If you want to avoid financial stress, the best thing to do is have a single person monthly budget template. With a monthly budget, you will have a proper breakdown of what you earn, how you spend, and what you save. That means you are unlikely to be financially overwhelmed by the stress of personal finance.

- Helpful in avoiding debt: Staying out of debt is most likely your number one priority in managing your finances. You can successfully avoid debts with a budget since you will stay in check and avoid spending more than what you are earning. Also, you will be able to assign the required amount to your different expenses and bills; hence, avoid having debts.

- Keeps you organized: A monthly budget will help you stay organized to identify where your finances go quickly; hence avoiding having a messy financial life. You will be able to break down and assign all the money needed for your necessary expenses, loan payments, and other monthly bills. Being organized will ensure that you do not forget to deal with any of your expenses

- Helps you prepare for emergencies: A budget is also beneficial when it comes to preparing for emergencies. With your monthly budget, you will always have money set aside for sudden repairs, hospital bills, and other emergencies that may occur during the month. With an emergency fund, you can also cushion yourself if you lose your job. This way, you can avoid any form of financial difficulty.

- Helpful in saving money: The most important aspect of having a single-person monthly budget is that you will be able to save money. Saving money can be difficult if you do not have a proper plan to deal with your expenses and bills. However, you already have a proper breakdown with a budget that will help you increase your savings.

Final Thoughts

Among your many financial habits, the most beneficial for you as a single person is to have a monthly budget template. You need to have a monthly budget to ensure that you can identify your incomes, list down your expenses, keep track of your spending habits and improve your saving goals. You are less likely to forget bills or feel overwhelmed when breaking down your money for your personal and household needs with a budget.

Also, keep in mind that you need a budget to achieve your future financial goals and still stay out of debt. With the single person monthly budget templates, you will be able to enjoy the budgeting process and ensure that you have included all the required information.