Budgeting is an essential part of financial management. And when you get paid once every two weeks – like the majority of employees in the United States – it is ideal to have an expense budget in place. Having a budget will help you manage your expenses and put a cap on your spending. A budget will also quickly help you track where your money goes every two weeks. Creating a bi-weekly budget and sticking to it cannot be easy, especially if you are new to getting paid every two weeks.

However, what makes it easy is the availability of numerous bi-weekly budget templates all over the internet.

To simplify the process, we will discuss all there is to know about the bi-weekly budget template in this article. Then, you will learn how to create one and successfully manage your monthly expenses even when you get paid twice a month.

What Is It?

In many companies in the United States, the bi-weekly pay model is the most common. Your annual salary is broken down into 26 paychecks when you’re on bi-weekly pay. In essence, you will get paid by your employer on a set day every other week, and for two months in the year, you’ll get three paychecks. However, it is essential to note that it isn’t the same as getting paid twice a month. In the bi-weekly payment model, you will receive 26 paychecks, but if you get paid twice a month, you’ll receive 24 paychecks instead.

Similarly, a bi-weekly budget is the budget plan of someone who gets paid every 14 days. It helps you break down your monthly bills and essentials into two. As a result, you can make plans for all your bills for two straight weeks, track your expenses, and avoid spending more to save up for unexpected events. In addition, since you know the expected timing of your paycheck and understand where your money goes, budgeting makes it easy to save, invest, or settle debts.

How Does it Work?

When on a bi-weekly pay, what happens is that you get paid twice a month for ten months in a year. Then for two months, you receive three paychecks. In other words, a bi-weekly budget will make it easy for you to set the extra cash aside for other essential needs or savings – since your bills will most likely remain the same every month.

Another reason a bi-weekly payment is different from getting paid twice a week is that in a bi-weekly payment, you are sure to get three paychecks for two months in a year. And this isn’t obtainable if you get paid twice every month.

What to Include in a Bi-Weekly Budget Template?

When you earn bi-weekly, dividing your monthly bills and overall budget into two is ideal by using the bi-weekly budget templates. If you get paid bi-weekly, you’ll receive an average of two paychecks monthly. So, it would help to plan your budget by dividing it into two payments.

In your bi-weekly budget template, you will need to identify all your expenses and categorize them as fixed (fixed) or flexible (variable) expenses. As the name implies, fixed expenses are recurring bills that you pay. They include rent, mortgage, credit card bills, utility bills, health insurance, etc. On the other hand, flexible expenses include money for eating out, birthday gifts, vacation bills, car repairs, emergency funds, etc.

How to Create and Manage it?

Now that you have familiarized yourself with adequate information about the bi-weekly budget template and what it entails, it’s time to try your hands on one.

Here are the steps to follow:

Make out a budget calendar

There are calendars everywhere. You can print out one or use the calendar app to track your budget by writing all your expenses and due dates. Using a calendar while planning a budget gives you an overview of everything expected to happen over the month. That way, you’ll leave nothing out.

Create a budget for each bi-weekly paycheck

Since you’re expecting two checks on an average every month, have a budget for each one. It would be best to list what the first check would cover and do the same for the second one. By doing so, you’ll understand where the money from each check goes and be able to make better plans if necessary.

List and organize your expenses

As stated earlier, you need to highlight and organize your expenses according to priority. You have to pay fixed expenses (utility bills, rent, or mortgage). However, there are also variable expenses you are expected to incur once in a while (gifts for your friend or birthday dinner, food, entertainment, and so on). Ensure you note and sort every single expense.

Mention variable expenses

For every individual, variable expenses differ. So, in line with your choices and the events on your calendar that require you to spend money, you should identify your variable expenses for every month.

Split more considerable expenses into half

As you already know, you’re working with a bi-weekly budget, so it’s a no-brainer to split your monthly expenses into two, especially if you have huge bills to settle. These bills include mortgage, rent, car payment, insurance, etc. To make the bills easy on you, you can calculate each major bill for a month, divide the bills into two halves, and save half of the bill from each of the two paychecks. By doing so, you will be able to settle the bill at the end of the month without any difficulty.

Keep tracking your spending

To have total control over your money, you must track your expenses. Writing down a budget is good, but having the budget is pointless if you don’t stick to it. You can track your daily expenses every two weeks by writing them down or using a digital expense tracker. You won’t spend more than you have budgeted for each expense category.

By tracking your day-to-day expenses through the bi-weekly budget template, you’ll be able to realize and make adjustments if you’re overspending on a particular category as well as you will be able to save money. Then, you can move things around and look for alternatives like adding a buffer to your budget or cutting down on another category.

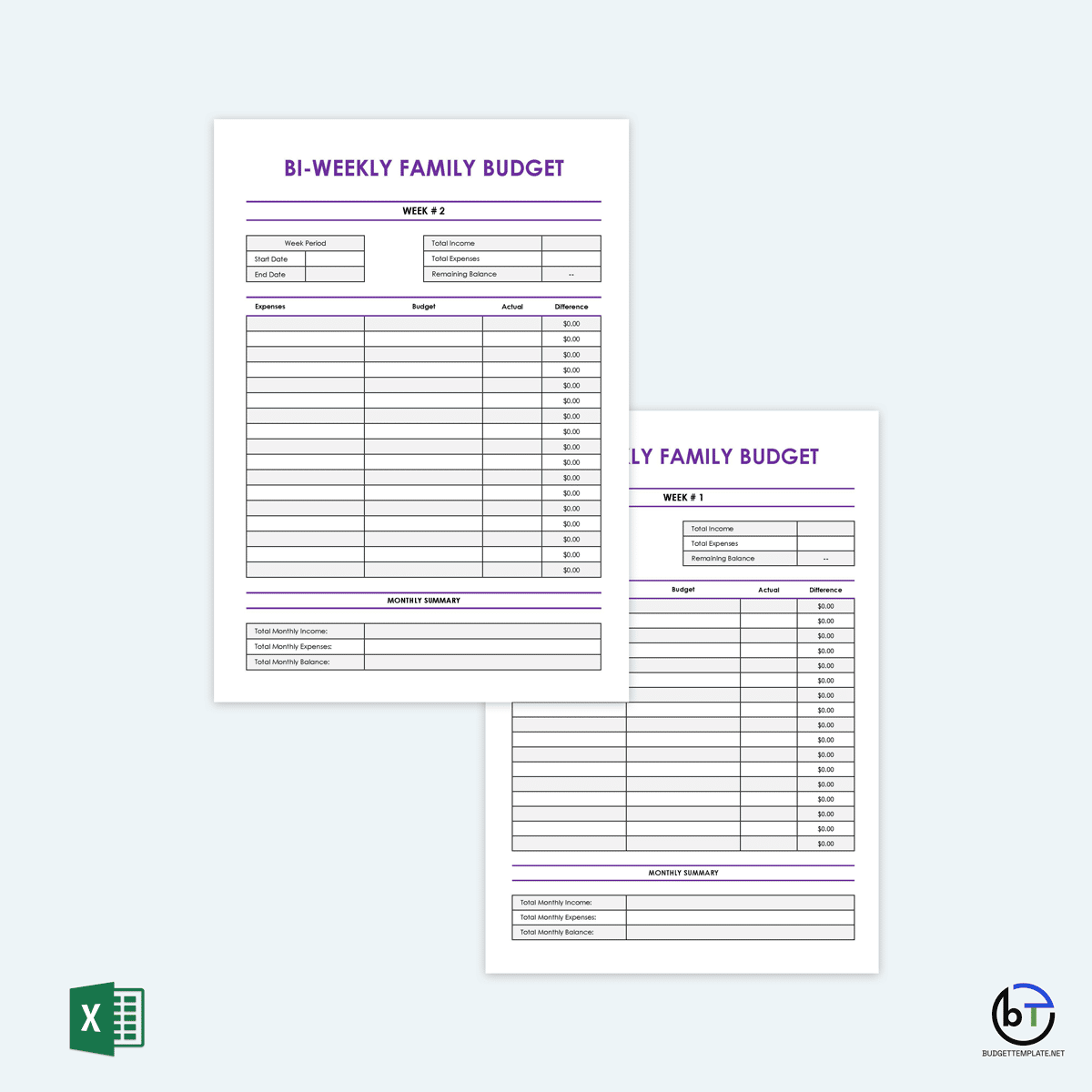

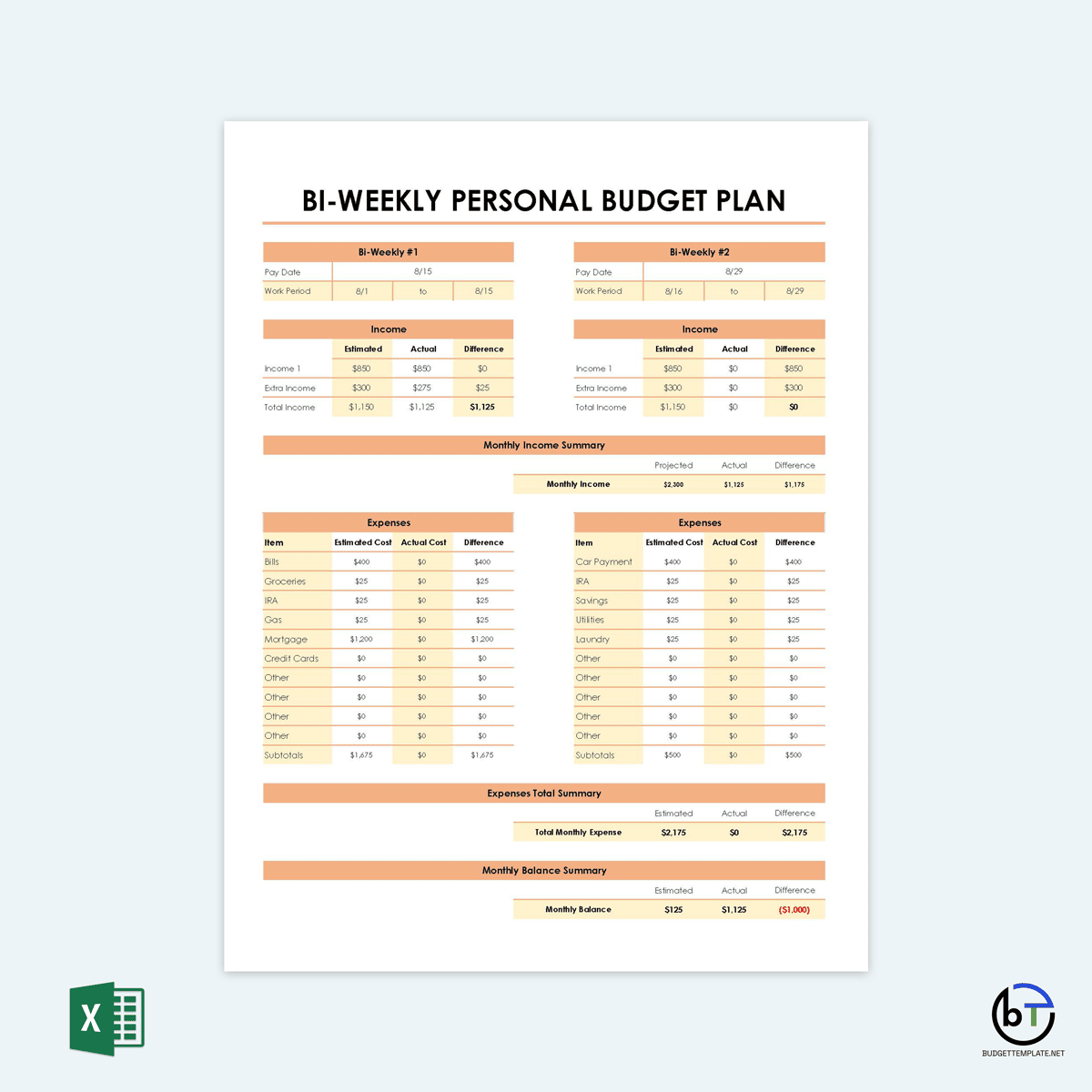

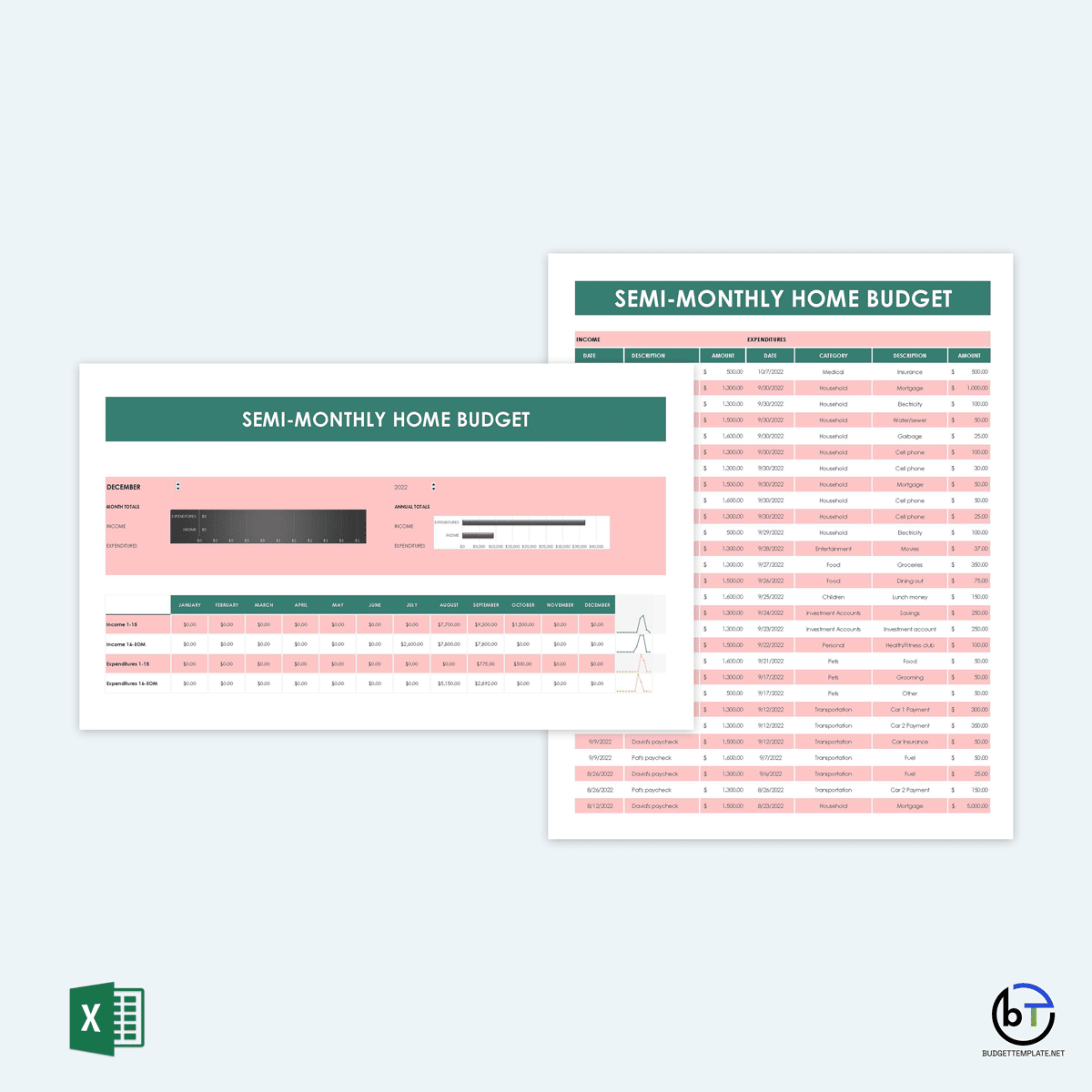

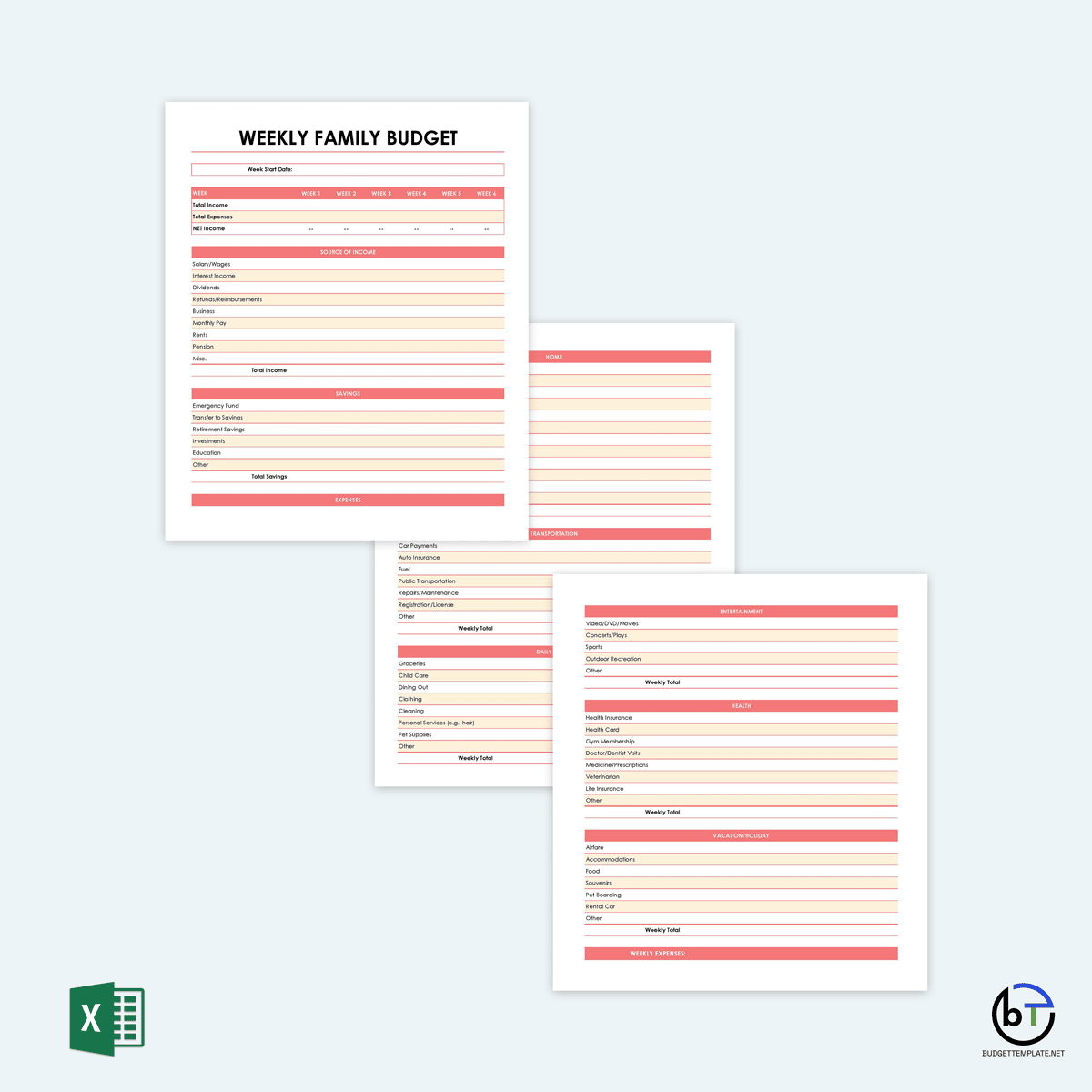

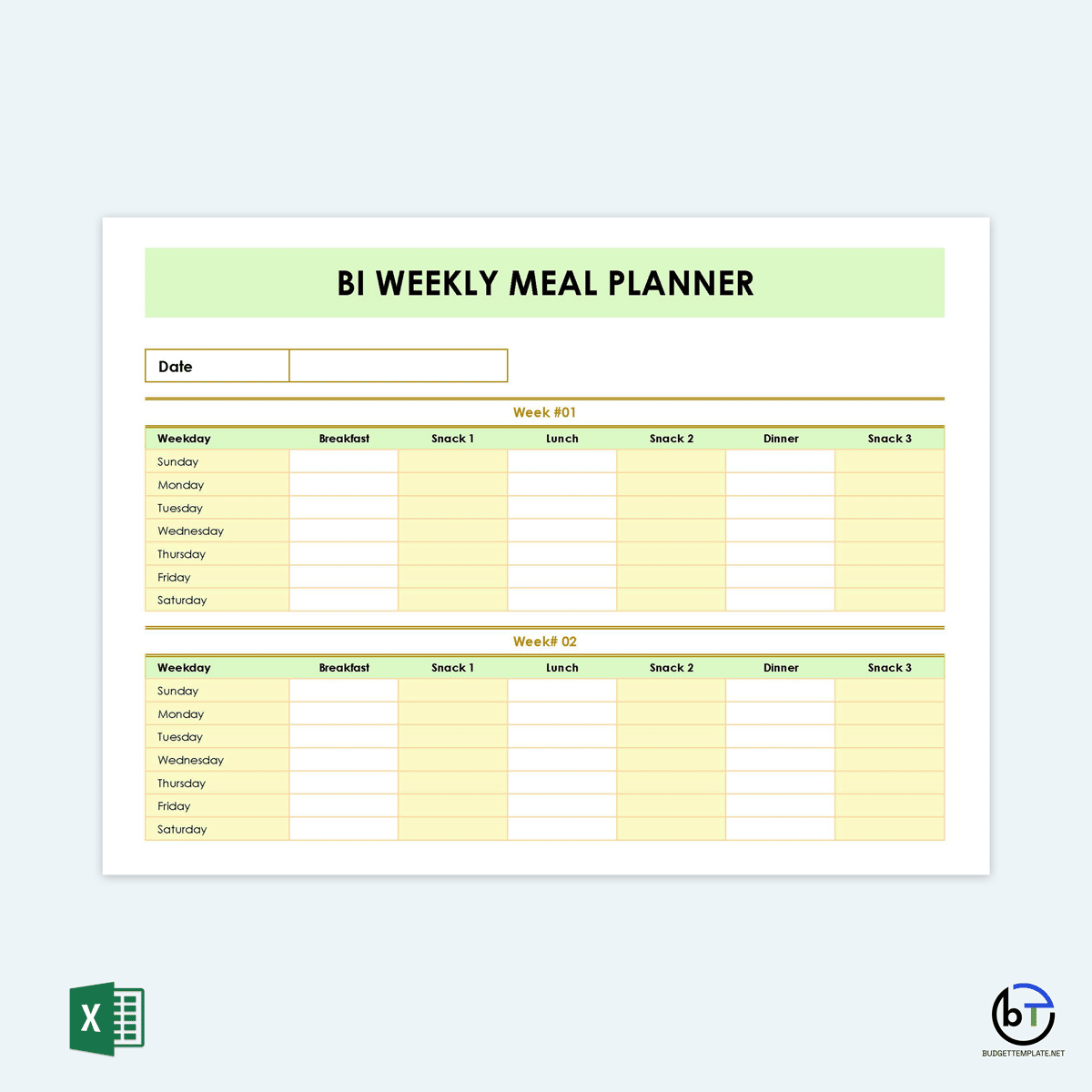

Bi-Weekly Budget Templates

Budgeting can be tricky but using the online bi-weekly budget templates to manage your income and expenses every two weeks will help simplify the process. With these bi-weekly budget templates, you don’t have to create your budget from scratch or perform any manual action. These bi-weekly budget templates contain tables, rows, and columns that will help you work on your budget. All you need to do is enter the necessary information in the spaces provided for them on the bi-weekly budget template.

Pros and Cons of Bi-Weekly Budgets

There will always be benefits and downsides to every financial decision one makes. However, the most important thing is to be sure the pros outweigh the cons and find reasons to be dedicated. Here are some pros and cons:

Pros

- Gives no room for excuses to not budget: Many people have unending excuses about budgeting is very hard, especially for some income types. However, as complicated as budgeting may seem, a bi-weekly budget template makes it easier to budget. And no matter how low or inconsistent your income is, you have no excuse since you can always keep your finances in check with a bi-weekly budget.

- Helps to have control over finances: With inflation rates constantly rising, gas prices increasing, and our wants continually unending, it is straightforward to lose track of how you spend money. But with this budget, you will have a complete understanding of your cash flow. You know how much comes in and what every dollar is spent on. That way, you can cut costs where necessary or make better financial decisions.

- Helps to save and pay off debts: You’ll see many people living from paycheck to paycheck if you look around. However, if you earn bi-weekly, you can set aside the money from the extra paychecks you’ll get in some months. The extra money can be added to your savings or used to settle your debts since you’d have already made a budget for all your monthly needs without the extra pay.

- Makes it easier to track expenses: If you don’t track your expenses, you’ll mismanage funds, and that’s the truth about money. Every human is insatiable, and our needs and wants are unlimited, which calls for severe financial management. So, with a bi-weekly budget and template, you’ll have a detailed record of all your bi-weekly and monthly expenses so you can be prudent with your spending.

- Takes into account the time of paychecks: When you have a budget in place for your expenses, you’ll know when your bills are due and will be able to move things around if necessary. At the same time, you’ll have a thorough understanding of your cash flow and which days you get paid every two weeks.

Cons

- Takes work to get everything right: Getting started with a bi-weekly budget plan requires immense effort. A lot goes into drafting a plan, from figuring out the best layout for you (whether digital or manual) to finding the perfect time to get the budgeting done. But, once you get the hang of it and remain consistent, it gets easier, and you’ll be happy with your finances.

- Consumes time: Another downside to using this budget is the amount of time you have to devote to getting the best layout or template. And after setting up the bi-weekly budget template, you still need to take time to record your expenses, make confident financial decisions, and reconcile your income and expenses. However, this should not discourage you from doing the right thing for your financial health.

- Overestimates and underestimates income: Bi-weekly pay is irregular by default because there are no fixed paydays or income. As a result, you can overstate or understate your income from time to time. And not getting your income right can create a problem when balancing your income and expenses in those uncertain months.

- Does not allow for the appropriate use of a third paycheck: You already know that you are sure to get a third paycheck in some months with bi-weekly salaries. However, the truth is that when this extra money comes in, you may mismanage it because you already have your bills covered without it. Sometimes, people get carried away and spend the extra cash on cravings, food, partying with friends, etc.

How to Manage Bi-Weekly Income?

You can manage your bi-weekly income by the following:

Create a first bi-weekly budget

After identifying which bills you want to cover with your first paycheck, create the first bi-weekly budget containing these bills and their payment dates for the first two weeks. You should also know when you will get paid to know which payments will be sorted with the first expected bi-weekly income. Be sure to add other miscellaneous expenses like gas, lunch money, and any minor need you’ll have before the next paycheck.

Create a second bi-weekly budget

Similarly, identify the remaining bills and expenses that fall within the remaining two-week period to receive your second paycheck. Then spread these bills across the remaining days of the month.

When you have your monthly bills separated this way, you’ll be able to track your expenses, make adjustments when needed, and factor in how much is left to set aside for savings or debt settlement.

Do’s and Don’ts

For every financial activity, there are set guidelines and instructions. However, money is a susceptible subject, so you want to ensure you are on the right track and avoid any errors that can set you back on your financial management journey. The following are the do’s and don’ts you must follow:

Do’s

- Keep finances organized: Whatever method you choose to manage your bi-weekly budget – whether pen and paper or bi-weekly budget template – you should ensure you are detailed and organized with your documentation. That way, the process is quicker and easier.

- Include a buffer in the budget: There is always a possibility of unexpected expenses with money, no matter how much budgeting you do. Having a buffer for such unforeseen bills as the additional cost of items like groceries or gas will help you not overspend after you have prepared your budget.

- Schedule a specific time to work on your budget: There are many activities to keep up with, and sitting every two weeks to prepare a budget might be discouraging. To prevent this, you can set a day apart to cover an entire month’s budget and work on your finances for a couple of hours.

- Move the due date around: Life happens, and sometimes, your first paycheck may not be able to settle your lined-up budget, but you can add it to your second bi-weekly budget. In a case like this, you can contact your billing company to move your payment date forward. And if the reverse is the case, you can also ask to move your billing date forward.

Don’ts

- Don’t spend your entire third paycheck: Once you have your bills covered by your two bi-weekly paychecks, it’s tempting to want to spend the extra money that comes during the months when there is a third paycheck. But instead of seeing the third paycheck as extra money, you can add some of it to your savings or settle some debts.

- Don’t get off track: When working with a bi-weekly budget, you always have to remind yourself why you began the journey. You shouldn’t lose track of your budgeting and payment schedules so that you don’t leave any bills unpaid or attract extra charges for delayed payment.

- Don’t fail to plan for the month: The common saying is that failure is imminent if you fail to plan. The same rule applies to budgeting. It would be best not to forget to plan for your monthly expenses. Without planning, you will surely fall into the pit of debt. Making plans will ensure the smooth flow of your expenses.

What to Do with Extra Paychecks?

While your third paycheck will augment your income when it comes in a month, you shouldn’t see it as extra money to spend or a bonus for more expenses. Instead, set the money aside in your savings account for your next vacation, settle a debt, or keep it as an emergency fund.

You can also use some of the money to settle some bills on your next bi-weekly budget, so you still have enough money left from the first paycheck of the new month.

Final Thoughts

Now that you have reached the end of the article, you should be comfortable getting started with setting up a bi-weekly budget and managing your expenses from time to time. You can set aside a day to get it all sorted – and you are good to go!

Interestingly, if you earn daily, weekly or monthly, you can also use a bi-weekly budget template to manage your bills and expenses. So, as you are looking for financial stability through better financial management, these bi-weekly budget templates will help you find financial stability.