For companies to run efficiently, they must create an effective plan on how they will utilize their resources. The resources include time, capital, and the company’s products or services. The most crucial resource that the company must manage is capital, as it impacts how much product or service a company can provide and how long a company may be able to carry out its business. Therefore, a budget must be created to manage a company’s capital every year.

Understanding an annual budget, its role, why it is needed, and what is included will enable a company to create an adequate budget. This article contains crucial information that will ease a company’s ability to create its budget.

What Is It?

An annual budget is a detailed description of a company’s projection of its income and expenses for the upcoming 12 months. It enables individuals, corporations, governments, and other organizations to keep track of their finances. An annual budget where the revenue is equivalent to the expenditure is considered a balanced budget. On the other hand, a company is considered in deficit if the expenditure exceeds the revenue or income. Conversely, if the revenue exceeds the expenditure, the company is said to have a surplus.

What Is Its Role?

It plays an essential role in enabling a company to create a financial plan for the following year. It eases the company’s ability to run operations by planning assets, equity, and liability and managing the cash flows used for reinvestments, debt management, and discretionary purposes. It also helps the company manage its money by enabling it to make adjustments to meet the financial goals it has set for itself. Finally, it also helps break down the company’s annual financial goals into monthly goals. This eases the company’s ability to compare the budget to the actual monthly performance.

Why Do You Need It?

Creating an annual budget enables a company to compare expenditure against revenue yearly. Therefore enabling the company to improve its predictions over time. It also provides the company with an accurate financial picture to help ensure that it does not underestimate or overestimate its financial capability for the year. Finally, it also allows the company to analyze the feasibility of the budget every year to ensure that operations are based on a sound financial point of view.

What Should be Included in the Annual Budget Template?

It should contain information that will enable the company to understand the revenue and expenditure for the coming year. Therefore it is crucial to consider what should be embedded in the budget template. Using an efficient budget template that contains adequate information will aid in business success.

Therefore, the following should be included in it:

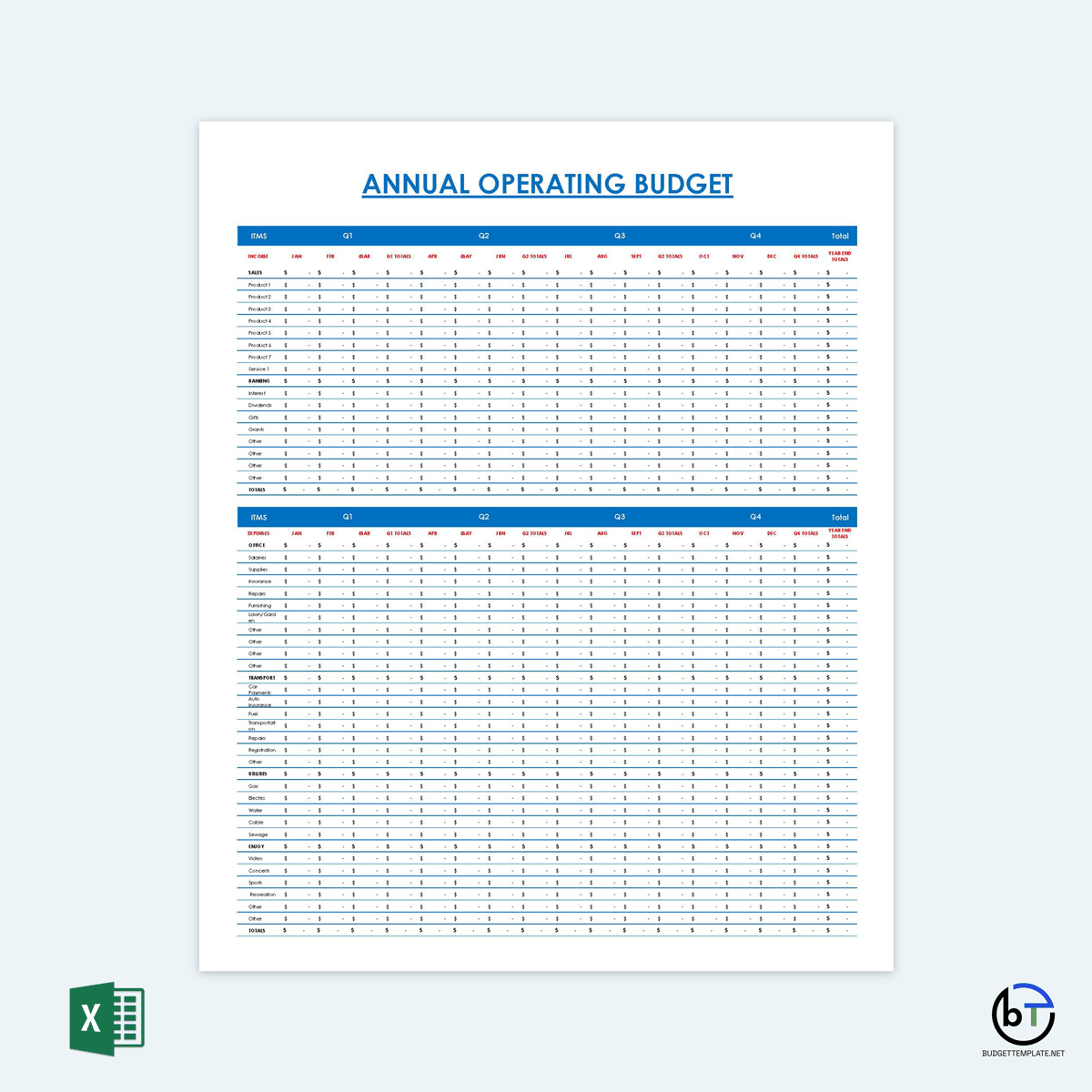

Employee’s costs

The template should begin by providing the projected and actual account of labor costs. Indicating the employee’s costs will help the company determine the direct and indirect price it pays for its labor. The employee’s costs should include salaries, wages, benefits, insurance, and bonuses.

Office’s costs

Secondly, it should contain the actual office costs. Understanding the office costs will help the company determine how much it requires to maintain its physical space. The office costs should include leases, water, electricity, internet access, office supplies, and security costs.

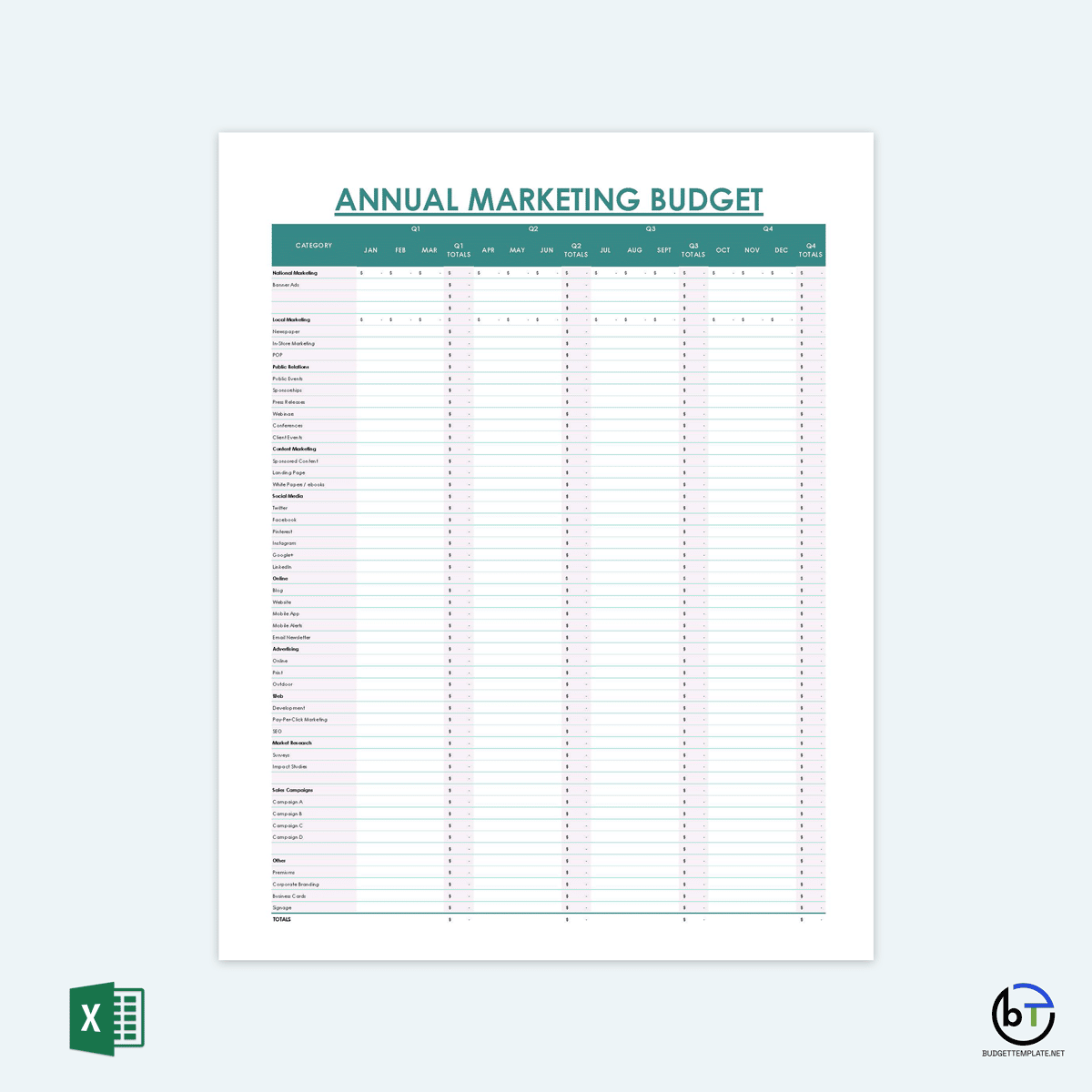

Marketing costs

Marketing costs refer to expenses that are directly related to selling a product. They include website hosting, trade shows, and collateral production. The annual budget template should contain detailed projected marketing costs. These details help the business determines where to focus its promotional efforts.

Training/travel costs

It should also contain employees’ planned and projected training or traveling costs. These costs may include classes, certification, webinars, and travel-related costs. They help the company manage and deduct business travel expenses.

In house income

The planned and projected in-house income or revenue source should be indicated in this template. The revenue sources may include sales, fees, service charges, and commission. They help the company determine how it will generate revenues.

Investment income

The annual budget template should contain information on banks’ funding and investors’ contributions. These details help establish how the company will obtain the investment necessary to enable operations to run smoothly. The investment income may include dividends, loans, or interests.

Expense variance

The expense variance measures the difference between the projected and actual expenses. Depending on whether the budgeted expenses are more or less, the variance may be harmful or positive. The data obtained from expense variance will help improve performance.

Income variance

Income variance measures are the differences between projected and actual income and expenses. The variance is considered favorable if the actual figure outweighs what is expected. On the other hand, the variance is considered unfavorable if the actual figure is less than expected.

Summary

The annual budget template should contain a summary with the data on variance to help provide the business with an overall detailed realistic budget. In addition, a well-outlined summary will help communicate the business’s priorities.

How to Create It?

When creating an annual budget, a well-outlined step-by-step process should be followed. These steps will help the company successfully maintain its budget. The following steps should be followed when creating it:

Consult all departments

The process should begin with a consultation of all departments. Obtaining feedback, insight, and expectations from all the departments will result in a more accurate budget. The individual creating the budget should talk to the sales team, research and development team, manufacturing or service team, and other departments that can provide valuable input.

Estimate revenues

Secondly, the annual budget should outline estimated revenues as accurately as possible. The estimated costs have a significant impact on the company’s finances. The company can achieve a more accurate projection by considering its monthly growth rate, industry guidelines and other expert publications on the industry, available financial information from other competitors, customers’ expectations regarding products or services, and expected sales.

Determine expenses

Next, the annual budget should determine the company’s expenses. The expenses can be determined by considering the costs directly related to revenue like inventory or employee services. Inventory costs usually do not fluctuate substantially unless the company develops a new product. Fixed costs like rent, lease, insurance, and other purchased services should also be considered. Fixed expenses usually do not change; however, the company should consider reviewing policies surrounding some of these expenses, such as insurance.

The company should also consider employee compensation to ensure that revenue aligns with related growth of the coming year. If it does not, then the company should consider making adequate changes in how it compensates and provides raises to employees. Finally, the company should consider employee headcount by identifying when it hires, the time it takes to hire new employees, and the expensive levels that can improve operations.

Identify capital expenses

Next, the company should identify its capital expenses. Capitals expenses are the significant or expensive purchases made by the company, which are crucial to the business’s success. They include computers, systems, vehicles, furniture, and machinery. In addition, capital expenditure attached to newly hired employees and investment in the process or equipment that directly relates to the product or services should also be considered.

Calculate cash flow

The expected cash flow of the business should then be calculated. If the customers do not pay their bills fast enough, the company needs to plan how to acquire inventors for sale so that the slow cash flow does not impact its ability to deliver. The income statement, AP/AR turnover rates, and other balance sheet metrics can calculate this kind of cash flow.

Monitor and evaluate

Finally, the company should monitor and evaluate its effectiveness once the annual budget is complete. It should be monitored monthly or weekly, depending on how large or small the company is. Changes should be made to the budget if the circumstances of the business change.

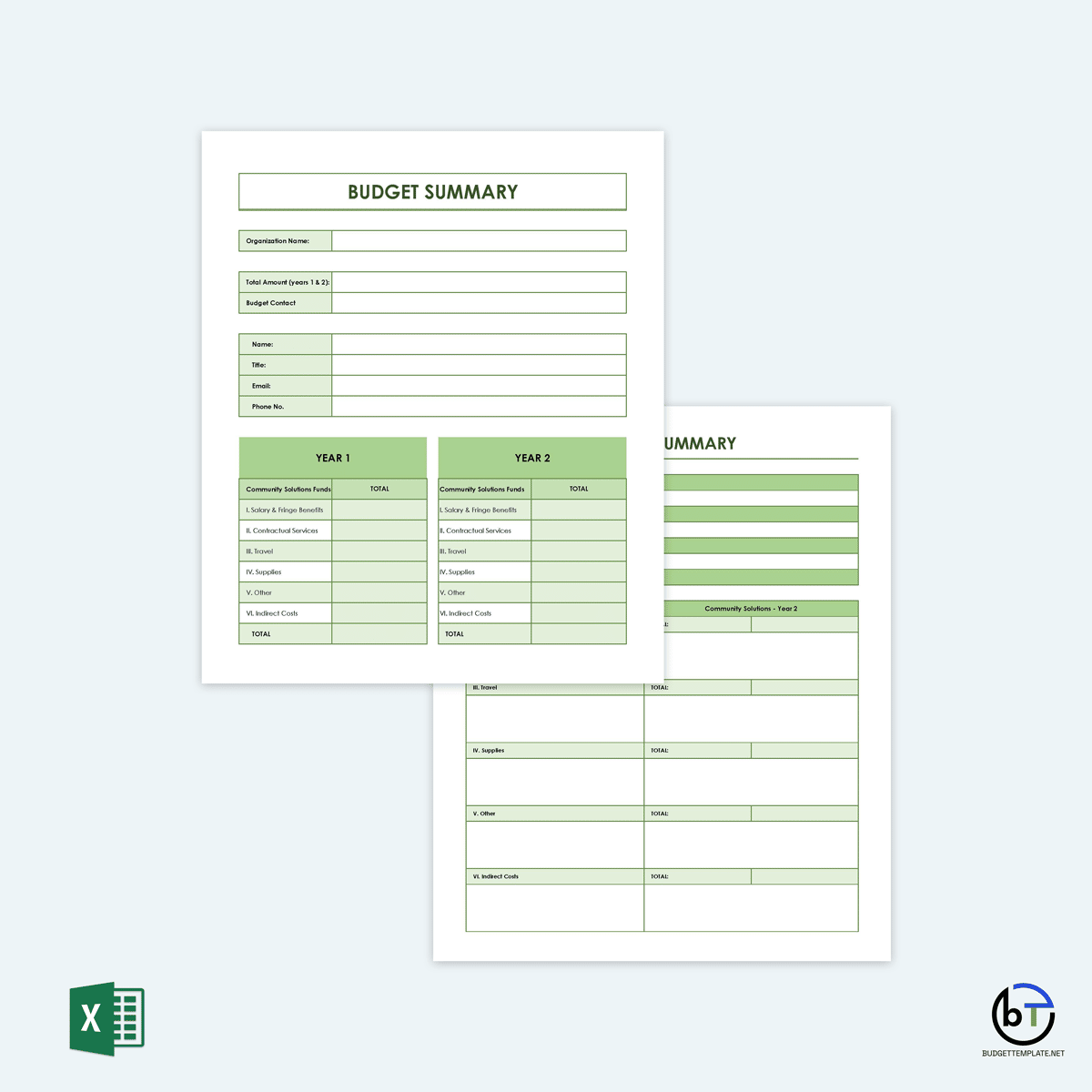

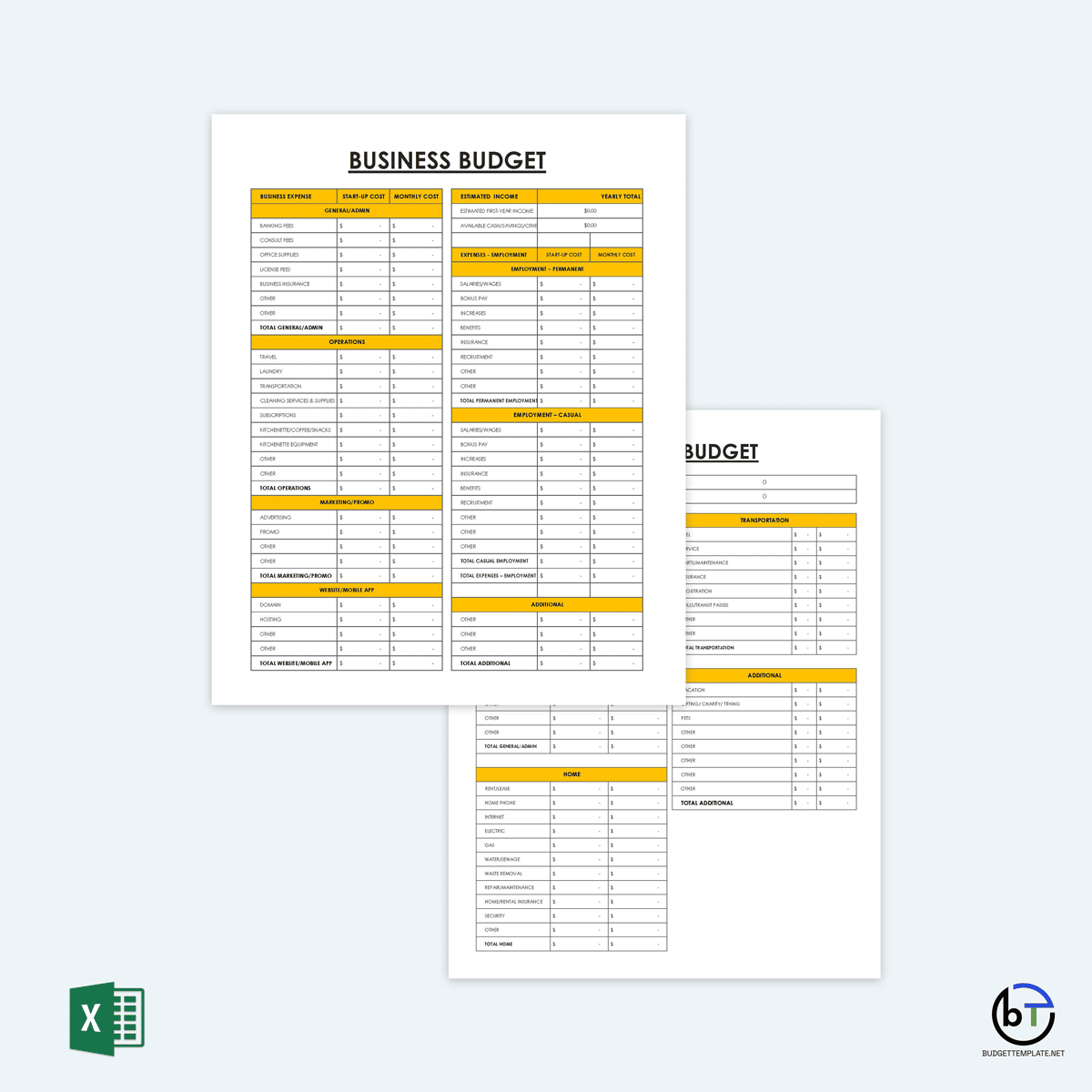

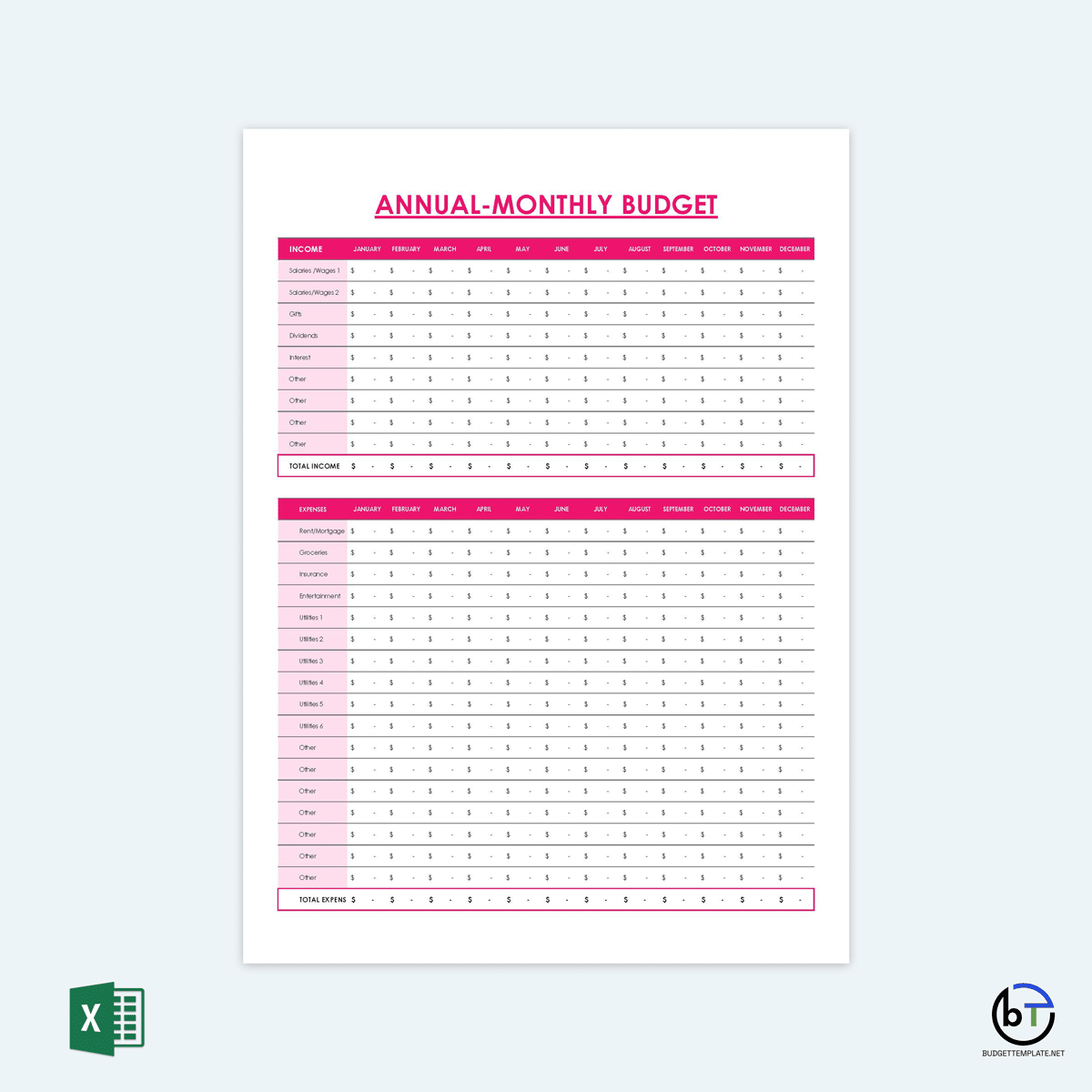

Annual Budget Templates

Annual budget templates enable you to focus on providing the necessary content with a predesigned structure. They are also pre-formatted, which makes them easy to use. The templates also provide uniformity and consistency, which will ease your ability to carry out comparisons as they can repeatedly be used. This website contains such templates for the ease of the users. These templates are free to download to help save the time and money associated with creating an annual budget template.

Professional Practices

A few practices should be considered when creating an annual budget. These practices will help make the budget more effectively. They include the following:

- Be conservative: The budget should be conservative to ensure that investors are not disappointed if the company does not reach its sales goals. It also helps ensure that business decisions are not made based on a projection that may not be released.

- Start early: A company should begin creating its budget early to ensure ample time to create detailed estimates. This can be done in October before the year ends.

- Use the preset criteria: The preset criteria should be used as a base for the projections of the next budget. The data contained in the previous debt can help determine overhead and administrative costs related to products and services. The company can use this information to make adjustments to its current budget.

Final Thoughts

An annual budget is a valuable tool that enables a company to control and manage its finances for the next twelve months. Before creating it, a company must clearly understand its role and why it is needed. The company must also consider the components of a well-laid out budget, such as investment income and employee costs. The budget creator must follow a well-laid step-by-step process to ensure that crucial information is not left out when creating this budget. They should also consider using a template to help speed up and ease the process of creating the budget. Tips such as starting the budget creation early should be considered to help make the document more effective.