Creating a budget to plan for your finances is a significant financial step. Whether you are doing it weekly or monthly, having a budget will help you create the perfect balance between saving and spending your money. With a budget, you can stay financially prepared and achieve your financial goals. Of course, a budget does not entail restricting yourself when spending your money. However, having a budget is all about keeping track of your finances to establish financial stability and security.

Since a budget involves keeping a record of your finances and tracking your expenses, you need to have a proper budget planner to achieve this successfully. Of course, you can choose to prepare a budget by hand by writing down all your finances and tracking your expenses and savings. However, the best and easiest way to create a proper budget is by using a spreadsheet template.

A budget spreadsheet template will be more accessible to identify how you spend and save your money while keeping up with your bills.

This article will guide you on creating a budget spreadsheet, the importance of using it, and the different aspects.

What Is It?

A budget spreadsheet is an electronic document that offers you a way of planning your finances over a chosen period. It entails a detailed breakdown of your income and expenses while comparing them to ensure that you are not spending more than you earn. In addition, it helps you stay organized, ensuring that you avoid falling into debt or getting late when paying your bills. With a budget spreadsheet, you can easily manage your money and track all your expenses during a set period with ease.

Importance of it

There are several benefits of using a budget spreadsheet to plan for your finances. First, it ensures that you are financially healthy by aiding you in sorting out your bills on time and tracking your expenses. You can also use this spreadsheet to budget or plan how you will spend your money weekly or monthly. It also helps you stay financially prepared by establishing an emergency fund, having a savings account for certain purchases, and focusing on profitable investments for the future. This way, you will be able to achieve your financial goals.

What Your Budget Spreadsheet Should Answer?

You must have some components in your budget spreadsheet to ensure you don’t miss adding anything. With those components, your spreadsheet will be effective as it will answer the following:

Your financial expenses, including bills

It would be best to have a section of all your financial expenses concerning your weekly or monthly bills in your budget spreadsheet. Ensure that you go through all your financial paperwork and electronic information to gather your bill details. Also, make sure that you specify your fixed and variable bills using information from your bank account statements, pay stubs and W-2s, 1099 forms, mortgage or rental statements, utility bill statements, credit card statements, auto loan statements, student loan statements, phone bill, and car insurance statements alongside childcare expenses.

Your monthly income from all sources

This spreadsheet should also contain information about your monthly income from different sources. For full-time employment, your income mostly comes from paychecks every month. Ensure that the amount you indicate in your budget spreadsheet is the money you remain with after paying your taxes. This section can also include alternative income sources and side hustles that generate some of your monthly income.

In the case of a freelancer or seasonal worker, having a distinct monthly income might be difficult to track. However, you can indicate the monthly income from the month you earned the least in your spreadsheet. This type of spreadsheet should properly include all your sources of income alongside the amount you receive from each source. This may include regular paychecks, investment income, business income, side gig income, child support, alimony payments received, disability, and other government benefits.

A list of all the expenses

The budget spreadsheet should also list all your expenses to keep track of how you are spending your money. You can use your bank statement, credit card statement, or any other financial record, like receipts, to determine your actual monthly expenses and project your monthly expenses.

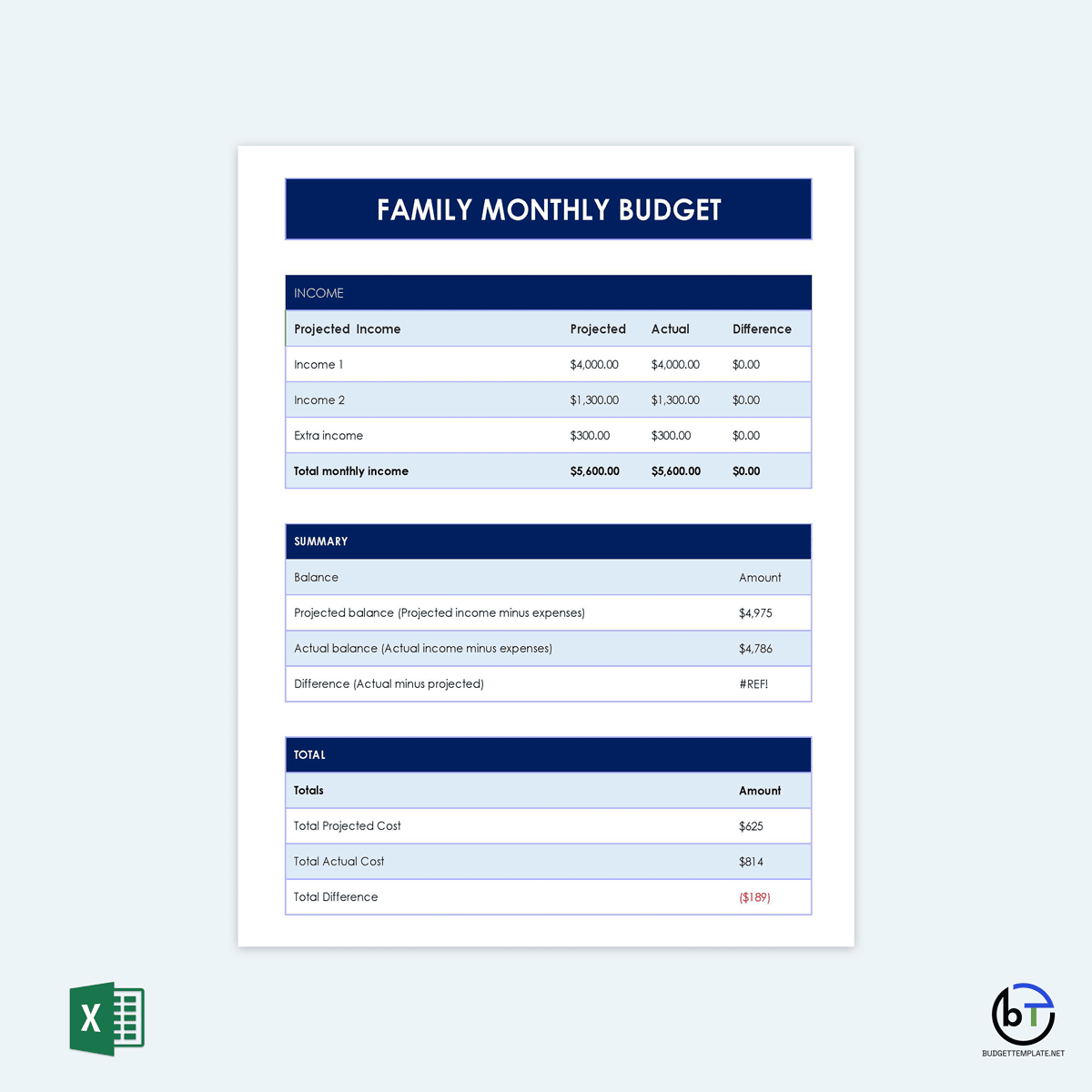

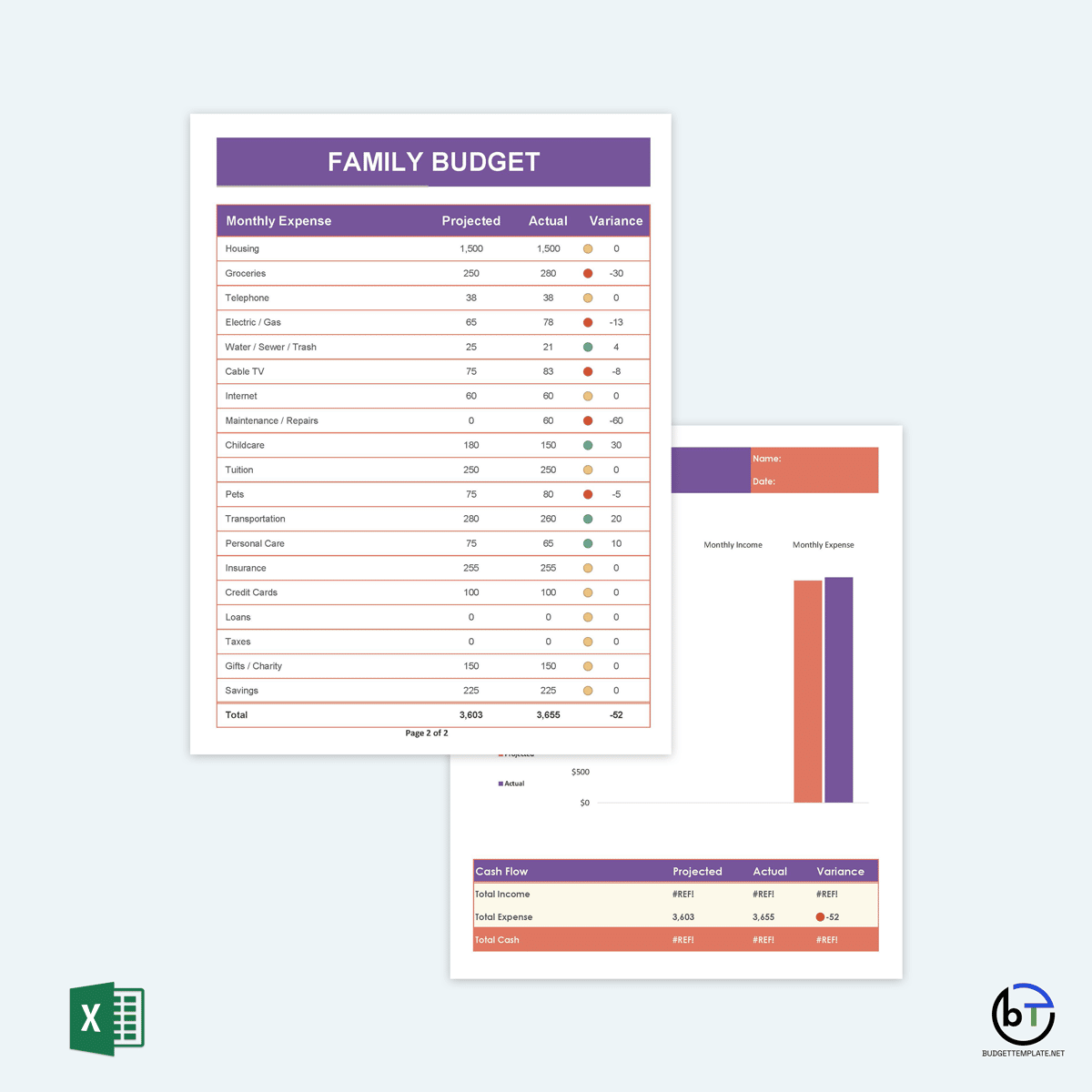

The fixed and variable expenses might include health insurance, groceries, personal care, car insurance, gas, subscription services, internet, clothing, pet care, cell phone service, childcare, after-school activities, rent/mortgage payments, utilities, dining out, recreation and entertainment. Ensure you have different columns for actual and projected expenses in your budget. However, always use the actual expenses to make calculations and determine the total for your monthly expenses.

The spending limit on each expense

After highlighting all your fixed and variable expenses, you need to specify the spending limit for each expense. This includes highlighting the amount to be spent on each fixed expense like rent and utilities while setting a limited amount that you can spend on your variable expenses. Remember, your fixed expenses tend to remain the same every month, while your variable expenses may fluctuate depending on your spending habits.

That is why you need to set a limit regarding variable expenses. By setting spending limits, you can create an emergency fund, plan your savings and even clear your debts. It is also best to include these financial goals in your budget and specify the spending values.

Expenses and income comparison

The other important task that your budget spreadsheet should be able to complete is comparing your total expenses and total income. This is to ensure that you manage your finances well by ensuring that your expenses are not more than your income. It would be best to create a “Difference ” section to record this comparison. The amount to be included in this section is the result of subtracting your total expenses from your total income. Being financially healthy, in this case, means that the result is positive.

Whether you are financially healthy

The final part of your budget spreadsheet should confirm if you are financially healthy based on the totals, that is, your income and your expenses. This will allow you to identify how you can adjust your budget to ensure that you spend less money than what you are making every month. If this is not the case, you can go through your budget and reduce any unnecessary expenses. Adjusting your budget will aid you in achieving your financial goals.

While adjusting your budget, it is best to observe the 50/30/20 budget rule where 50% of your budget is meant for essential expenses, 30% is meant for non-essential expenses, and 20% is for savings and clearing debts. Ensure that you focus on variable expenses first when cutting back some expenses from your budget. You can also find a way of increasing your income to cater to your expenses.

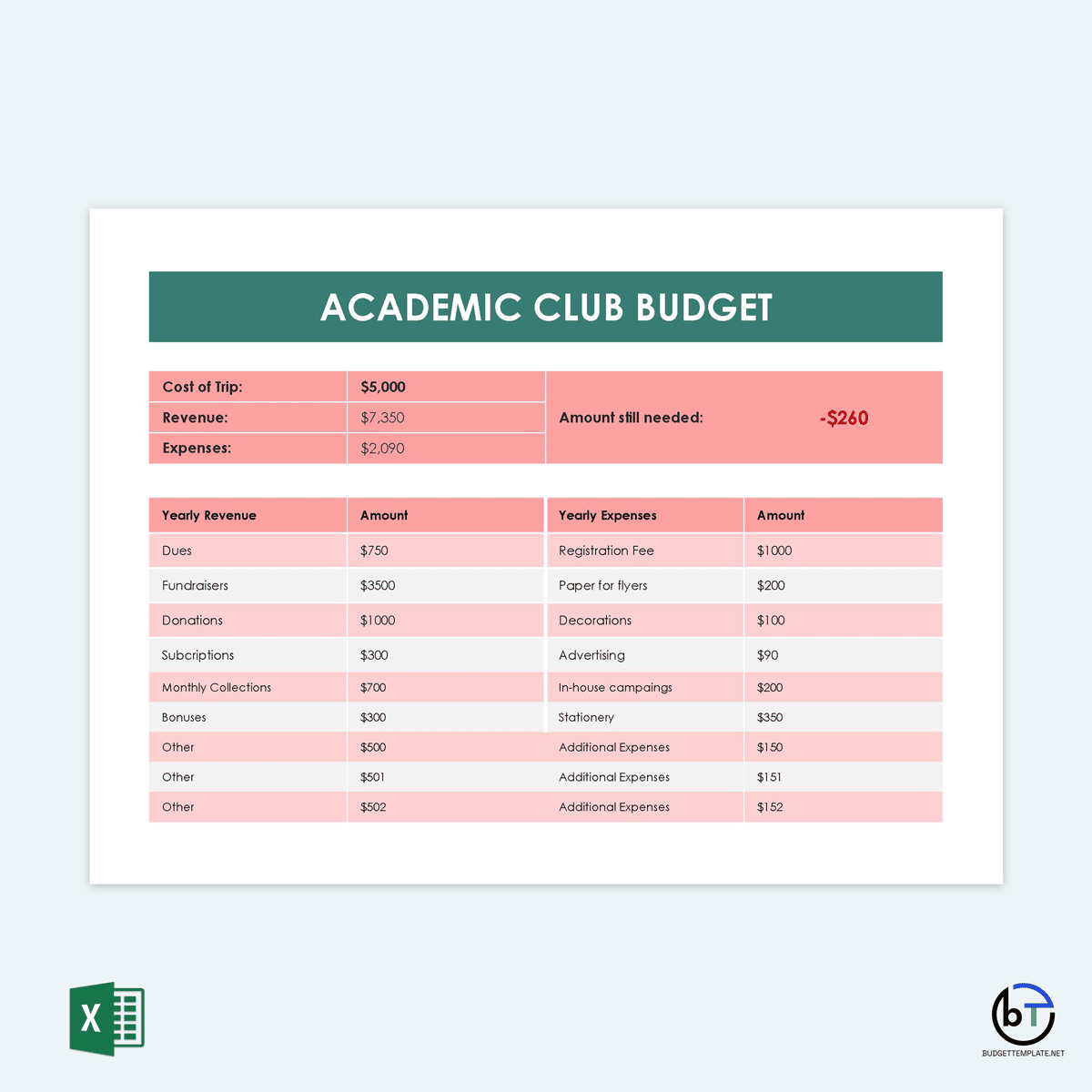

Budget Spreadsheet Templates

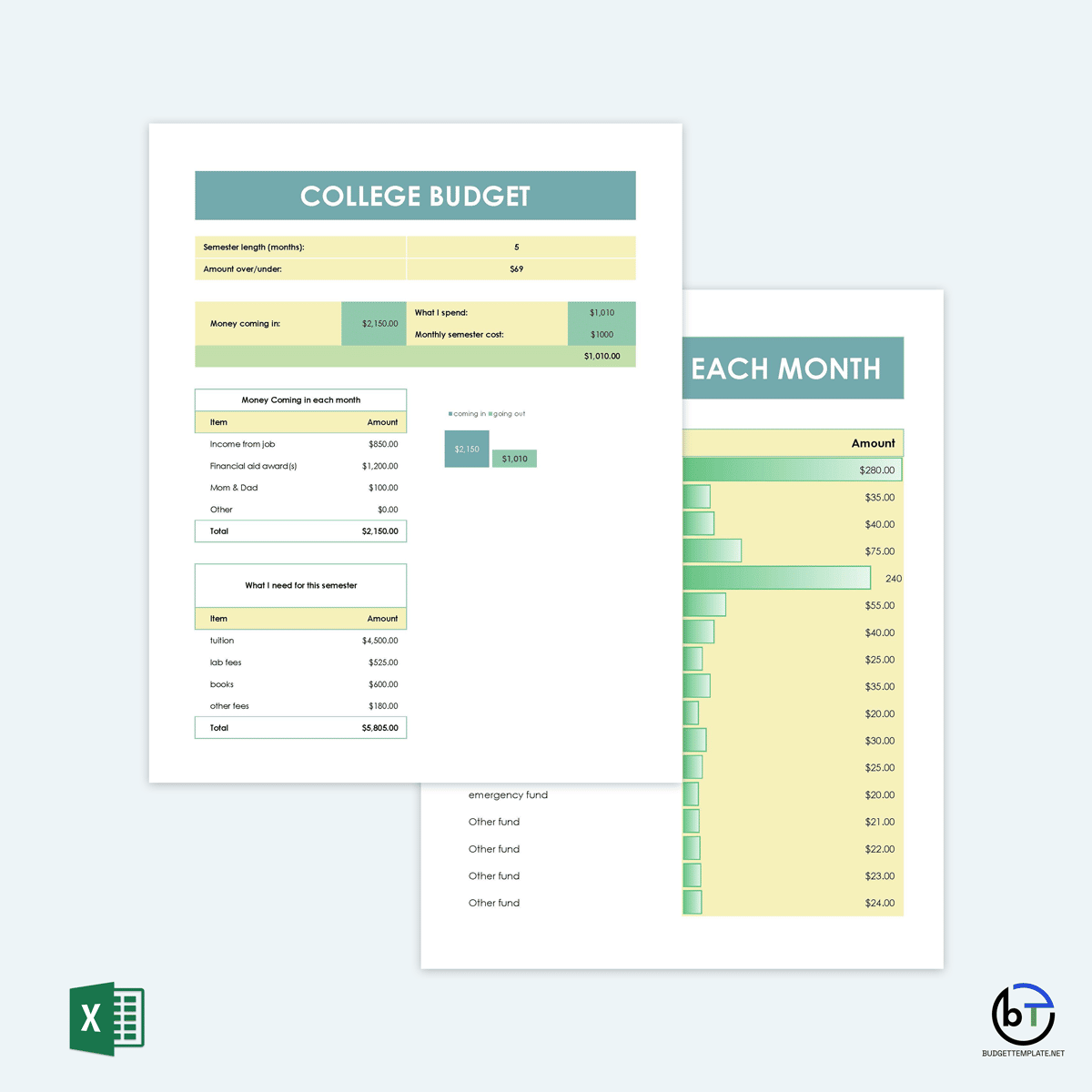

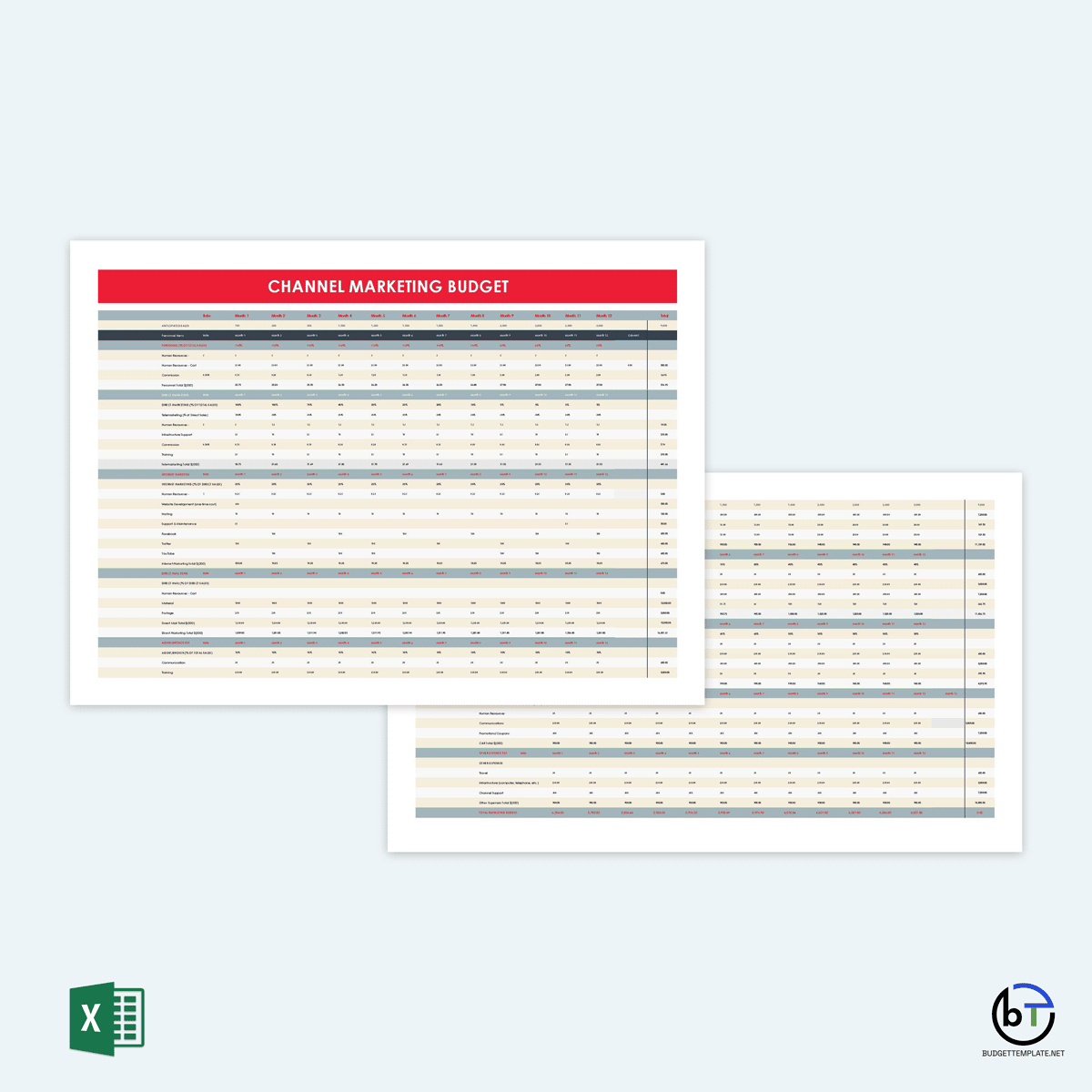

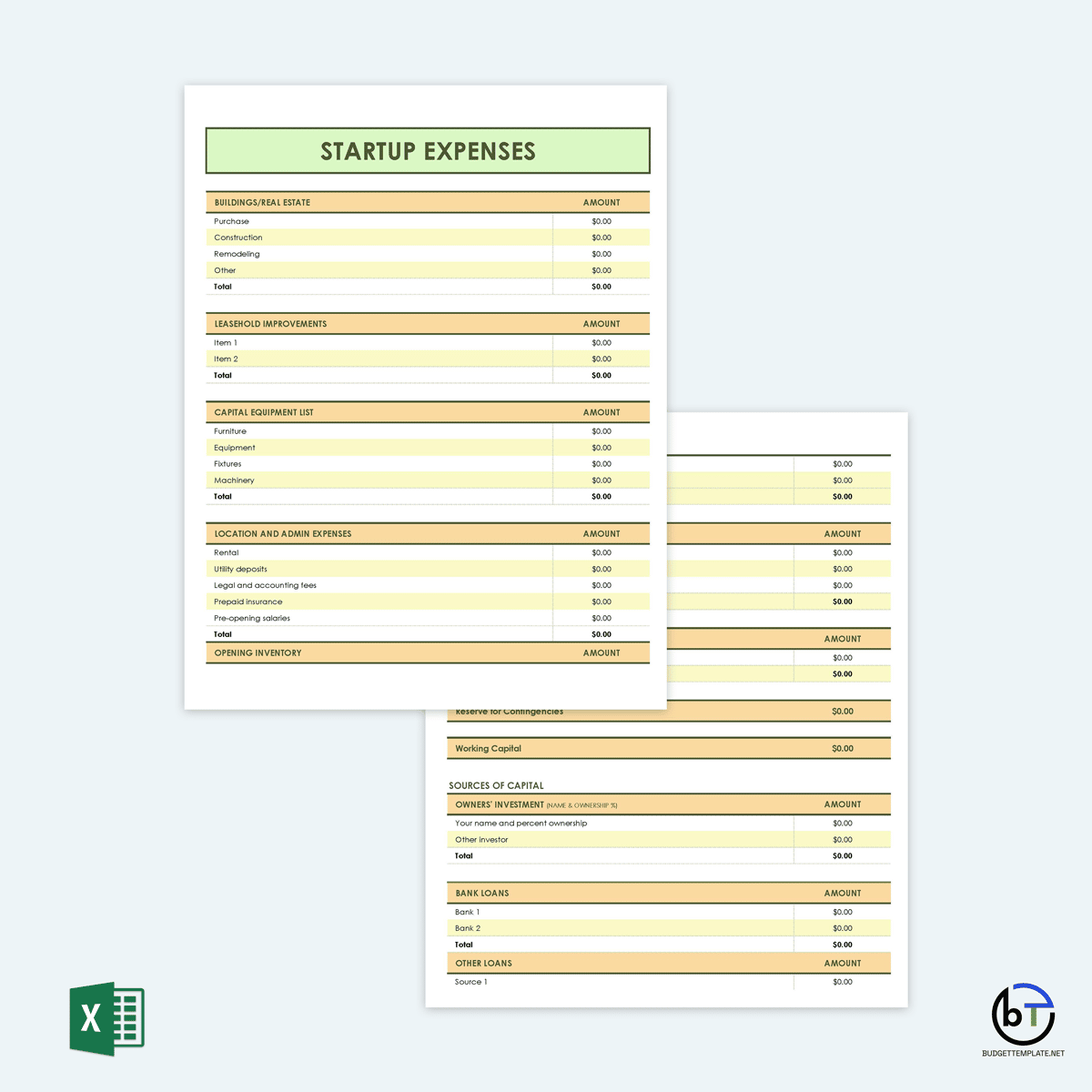

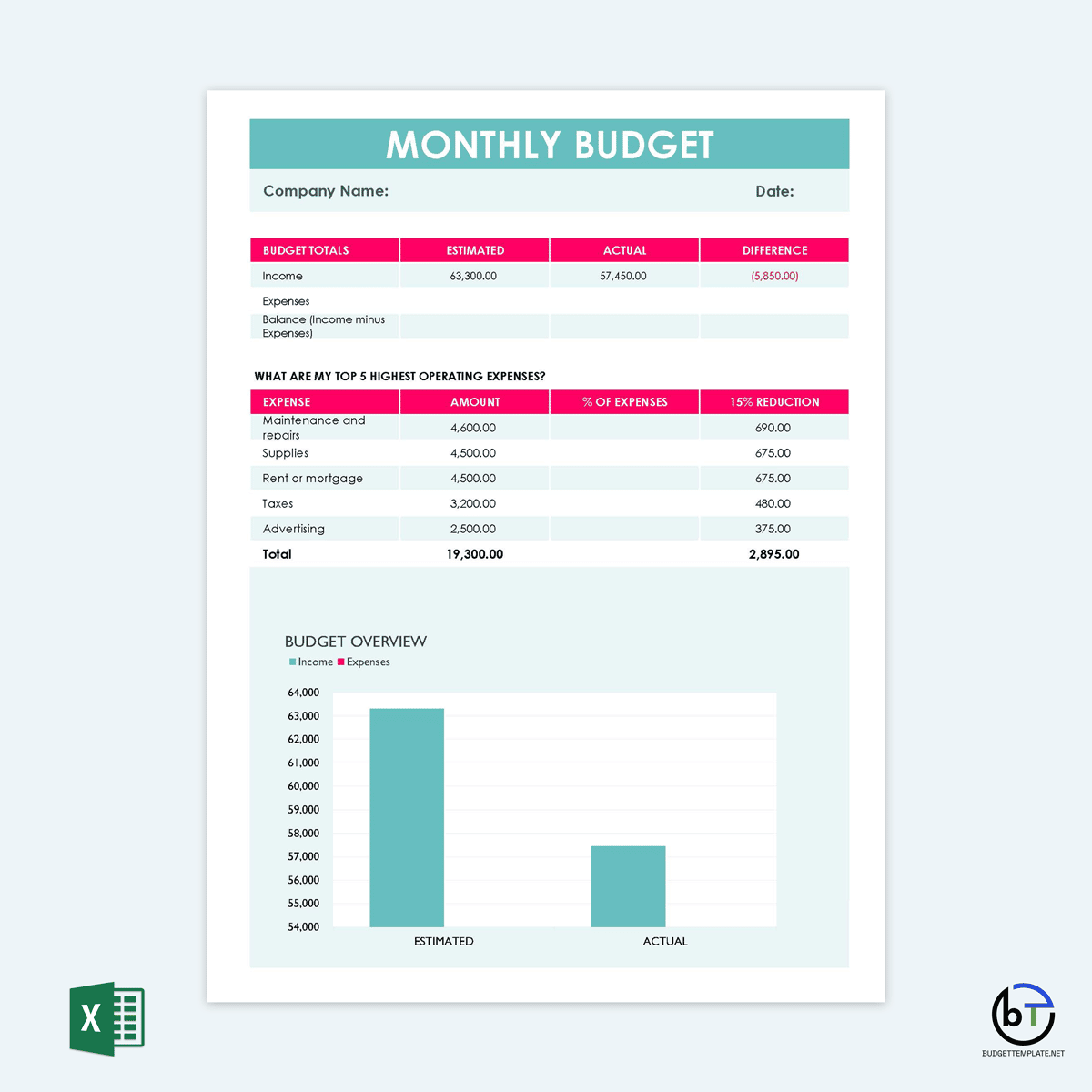

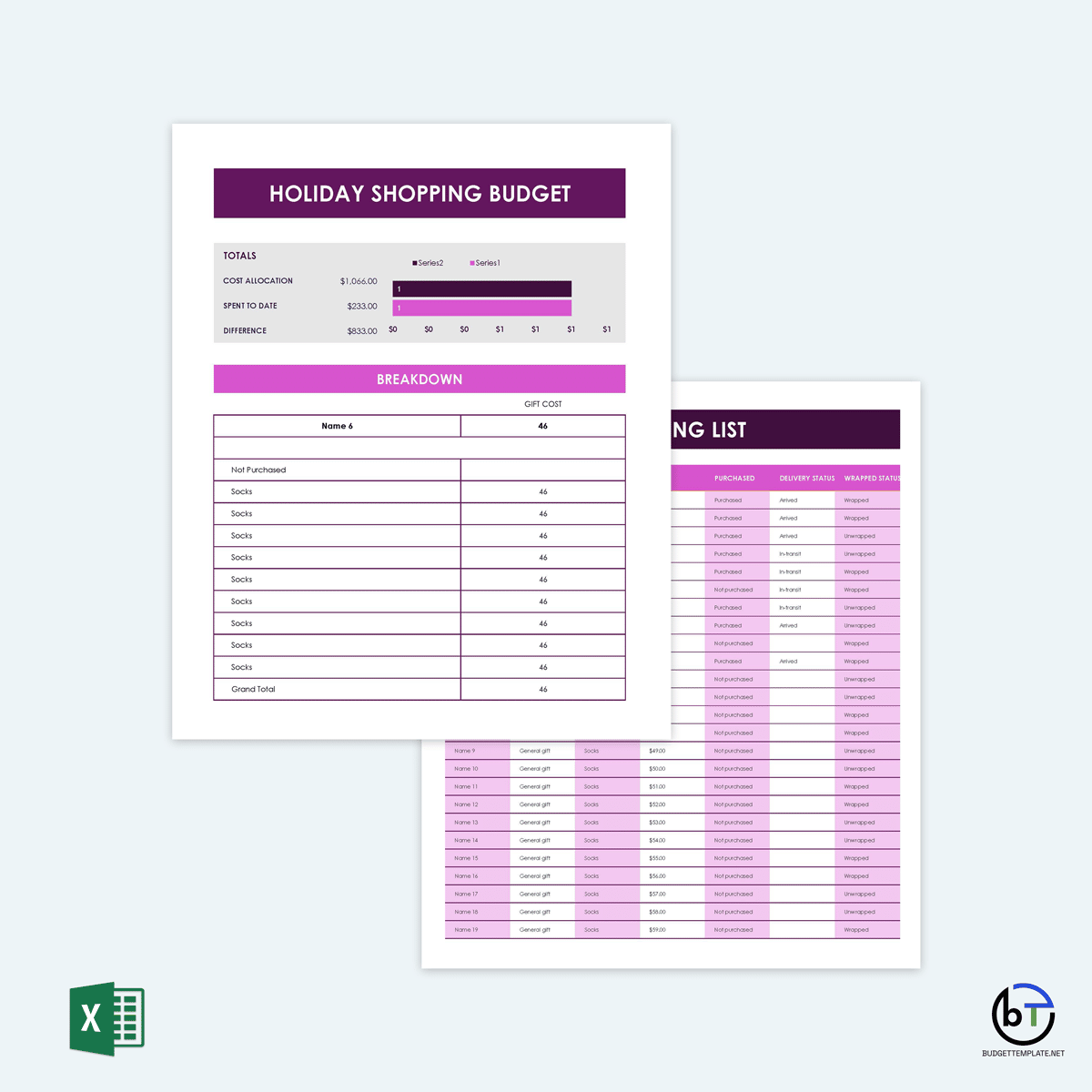

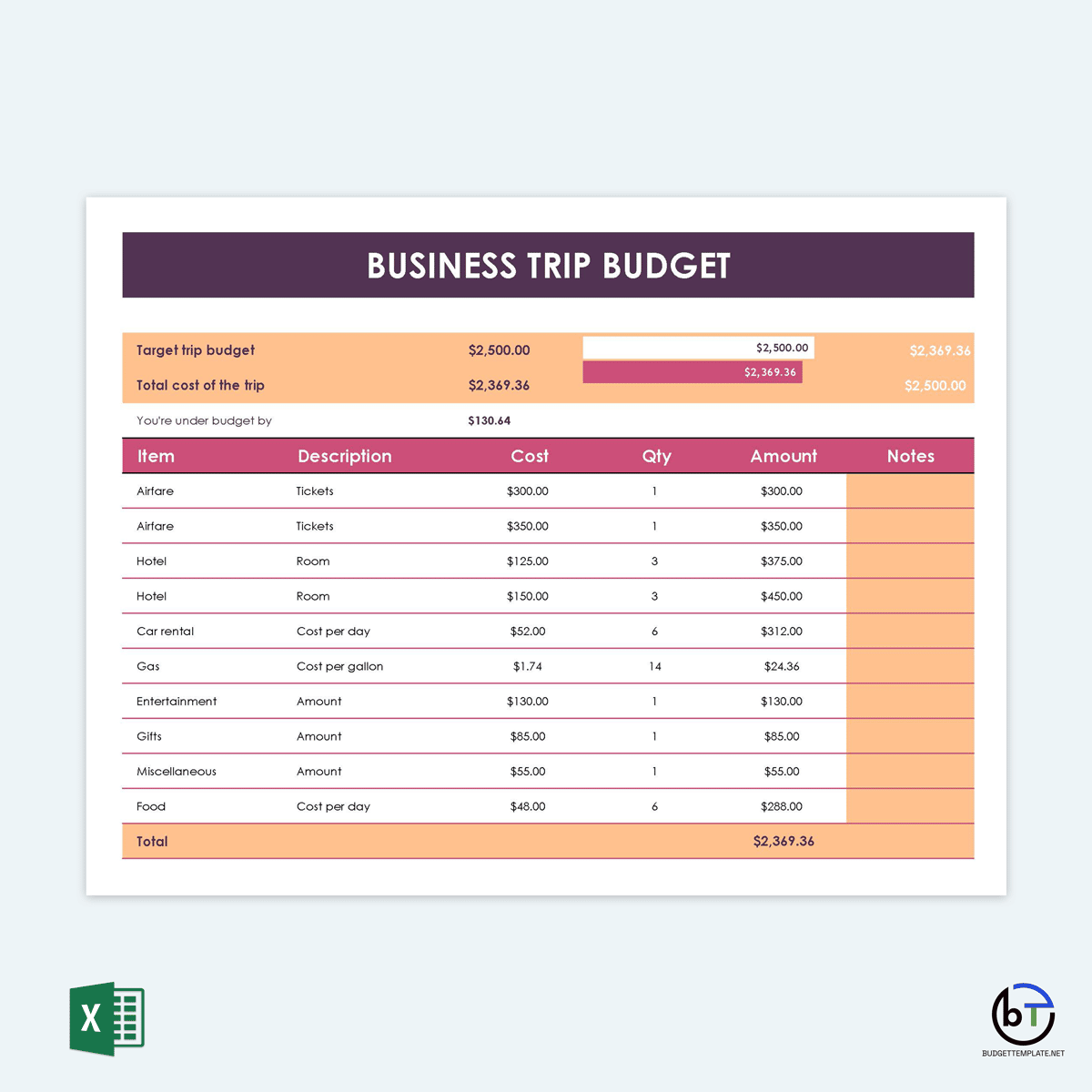

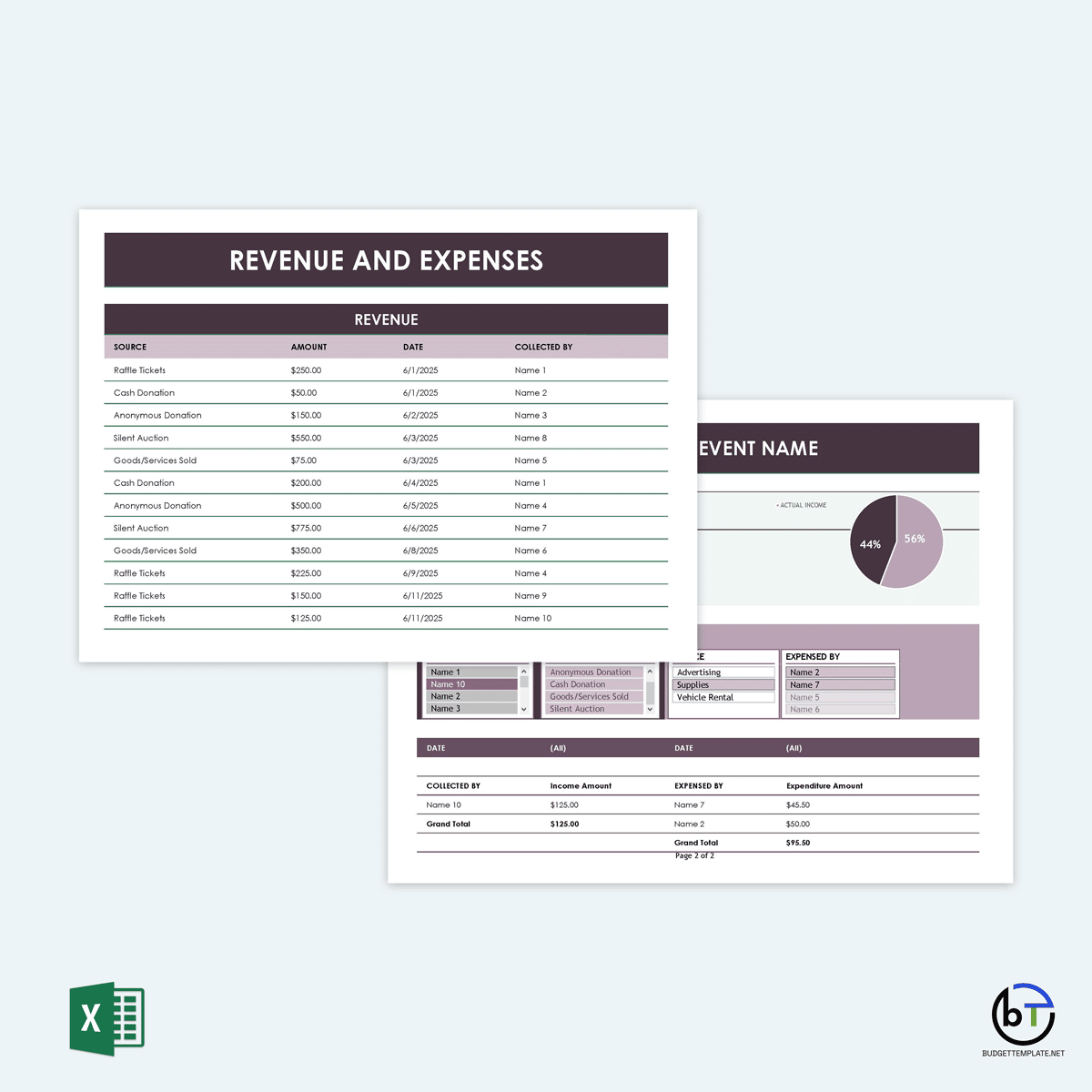

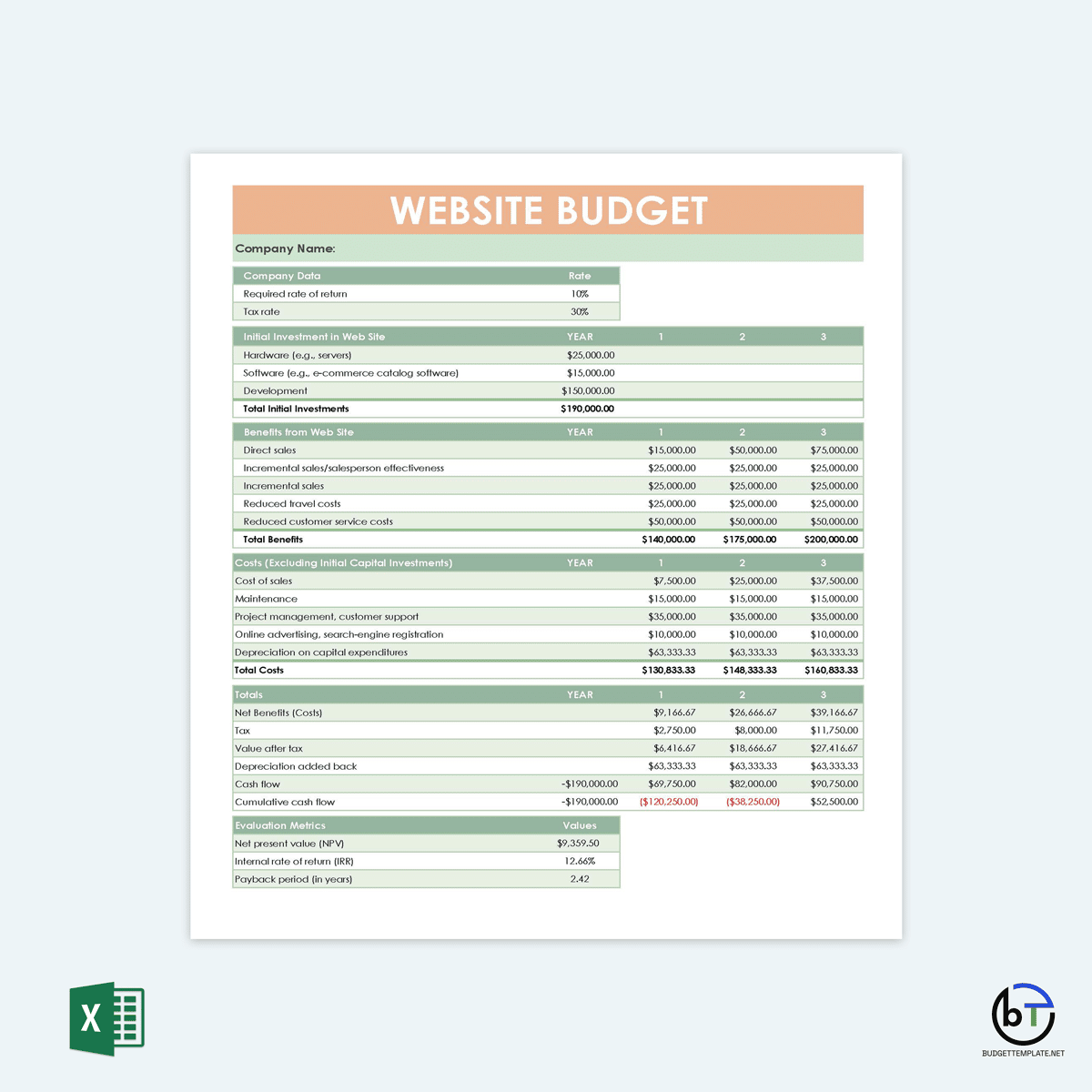

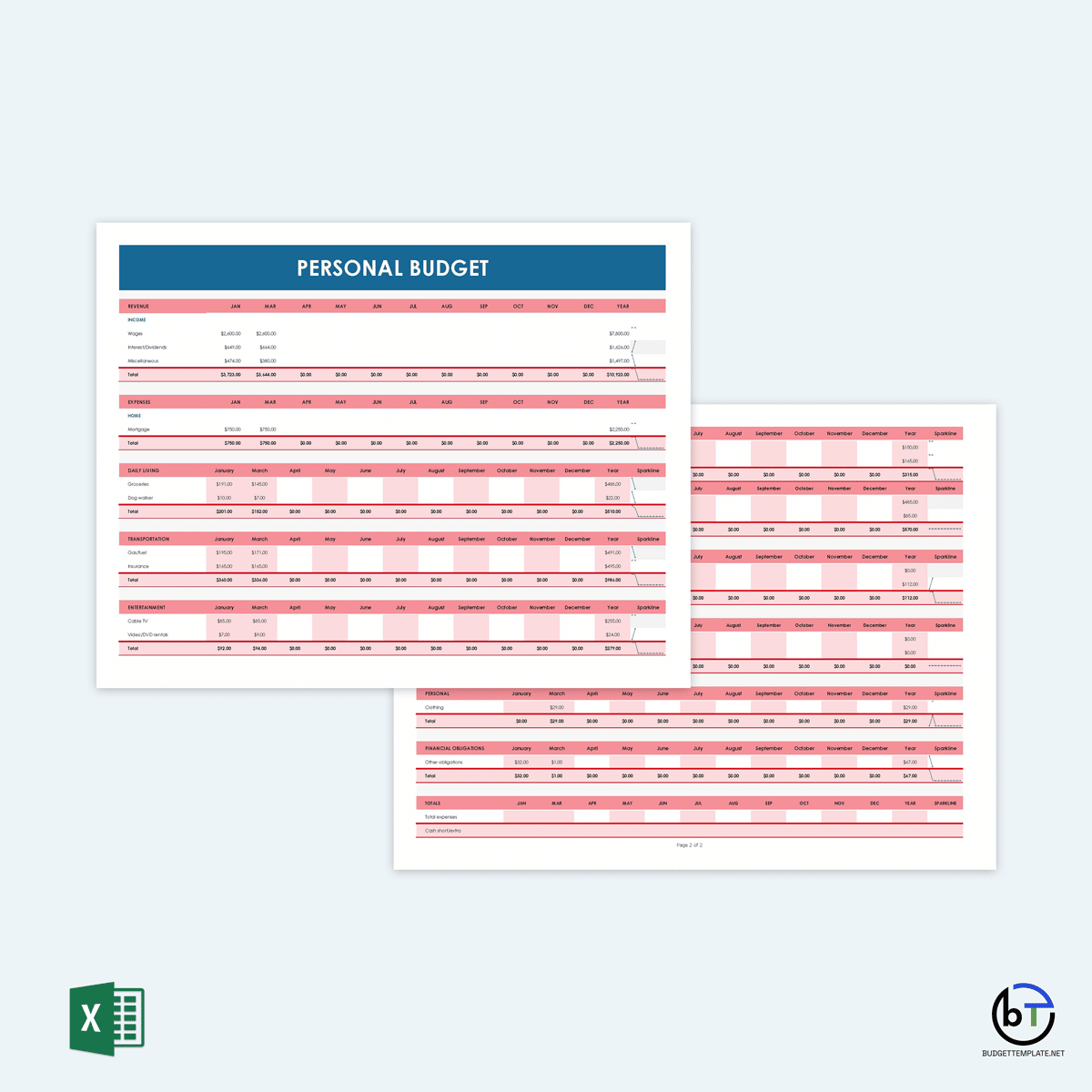

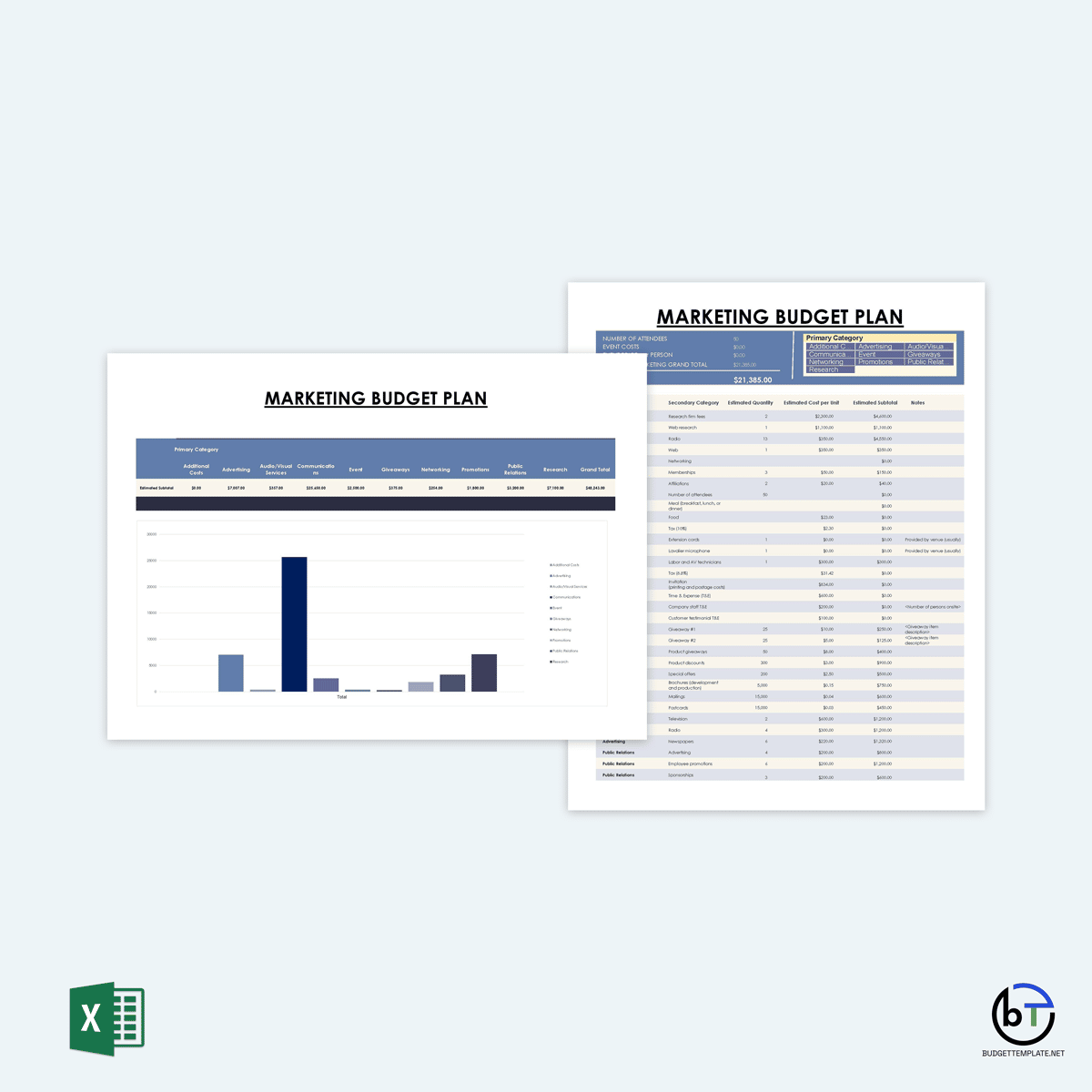

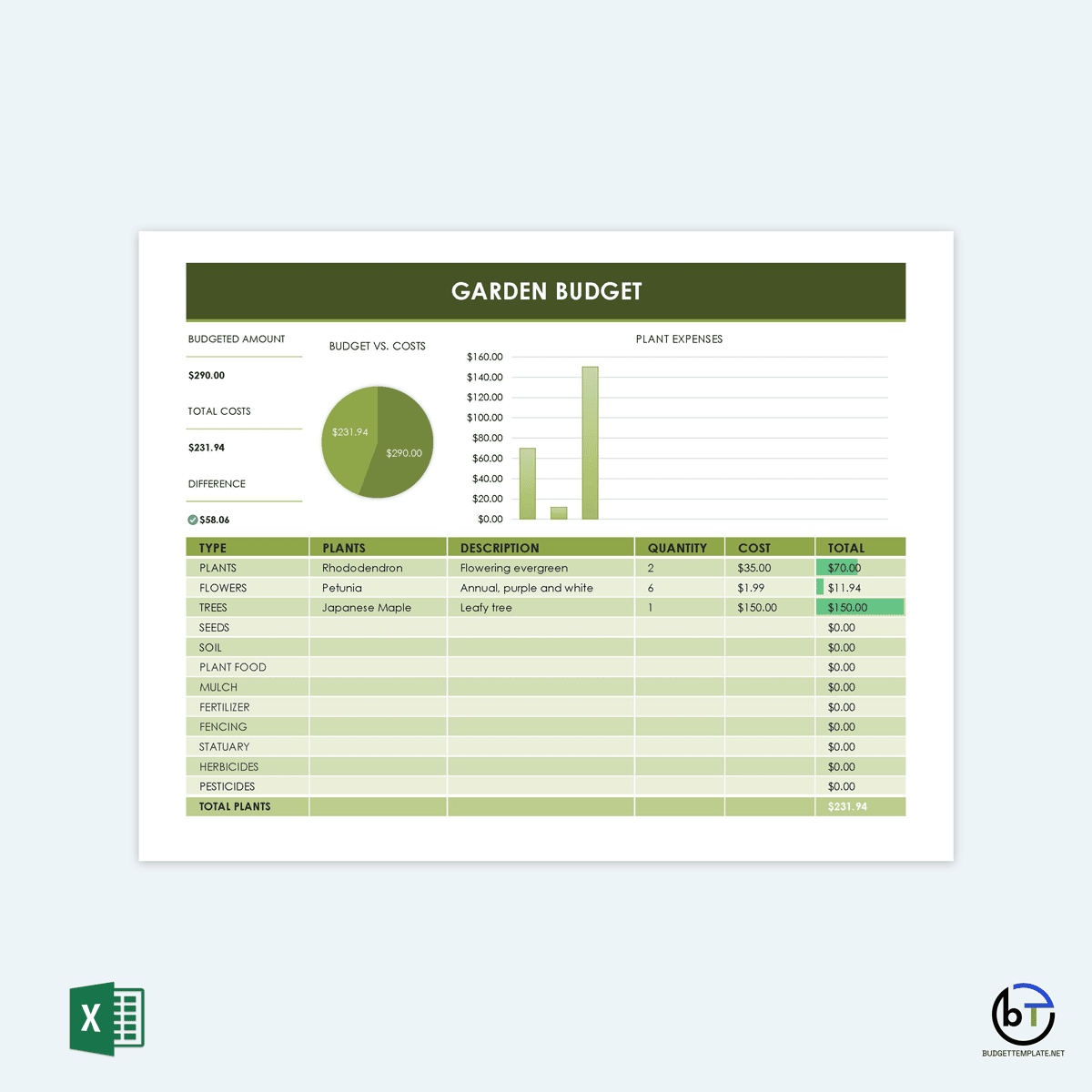

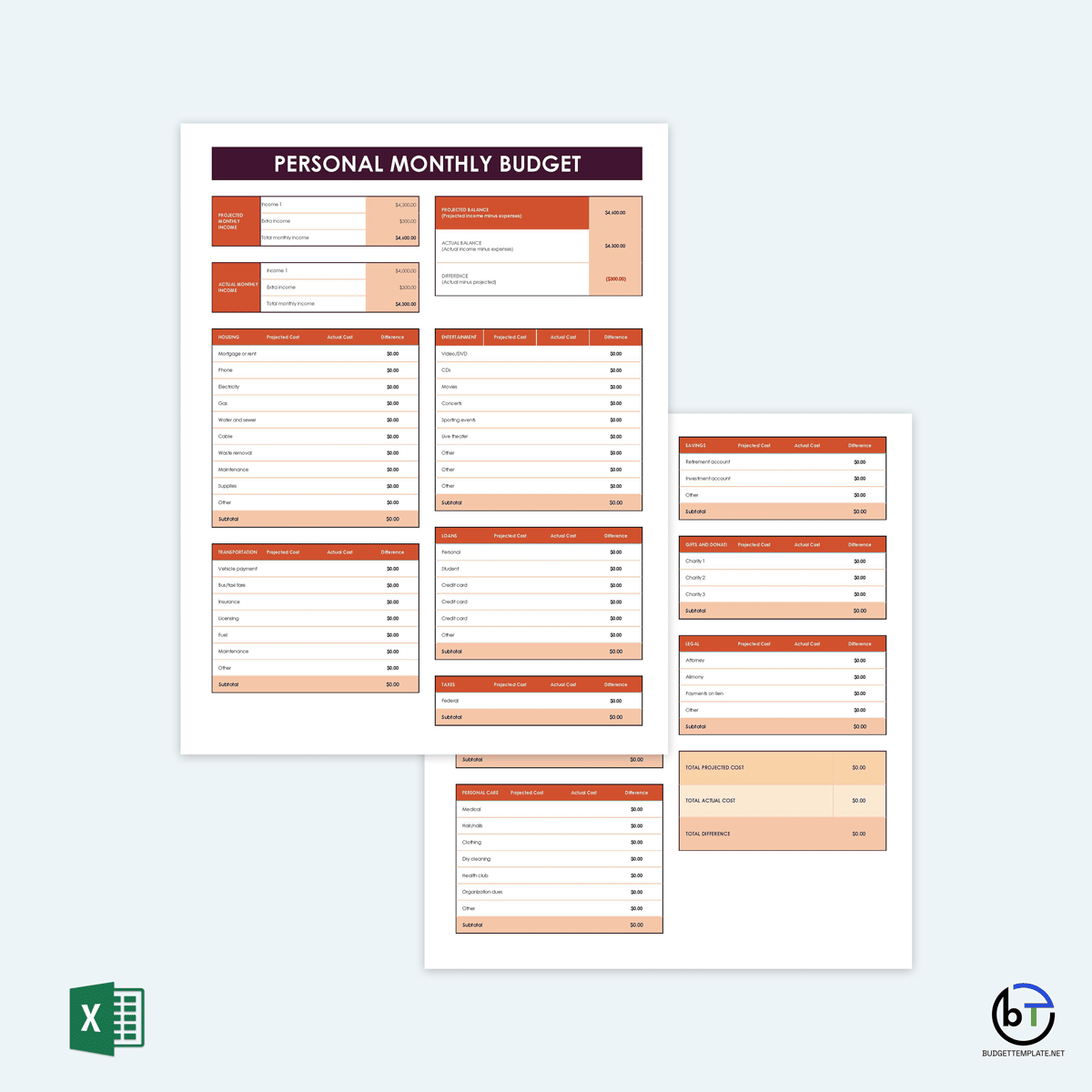

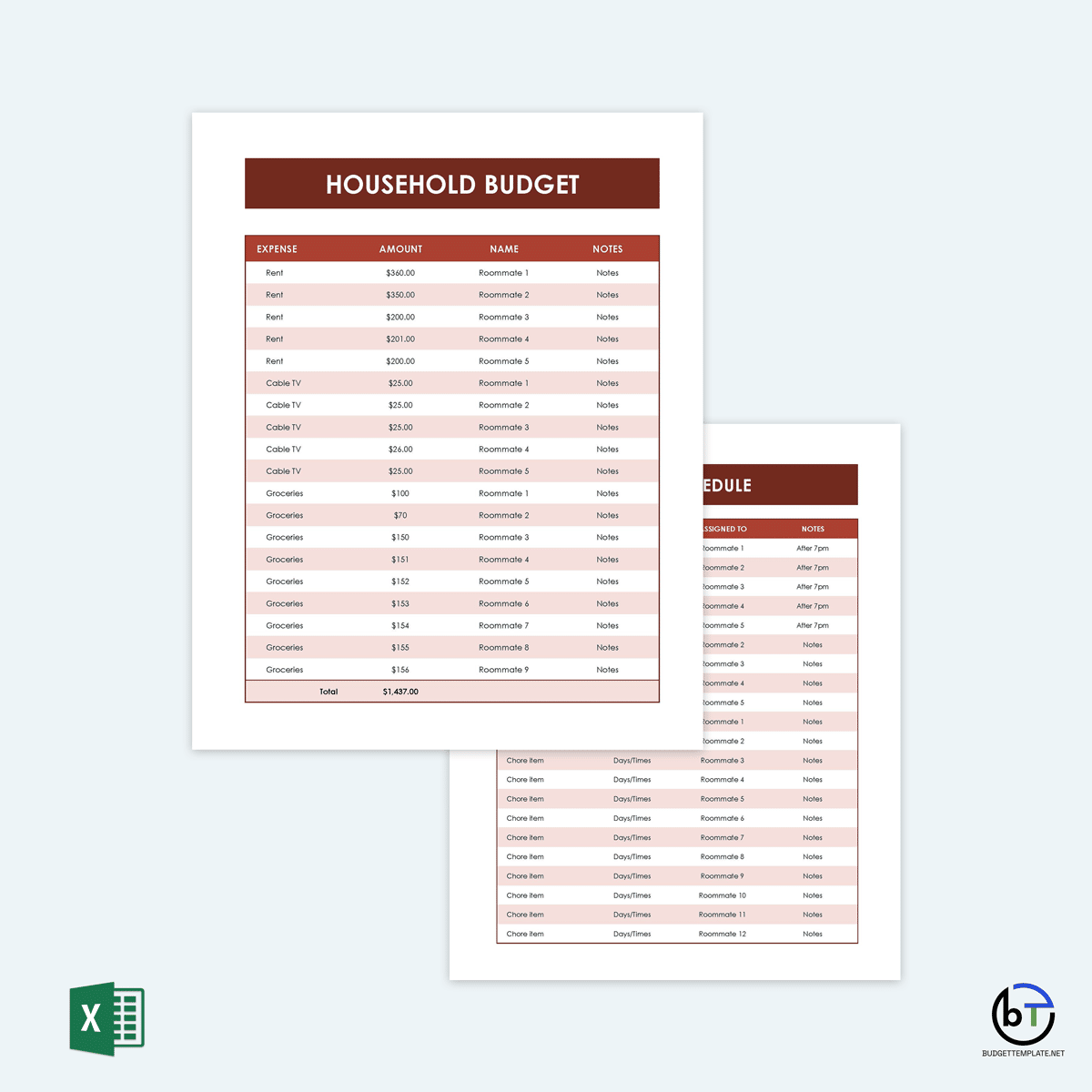

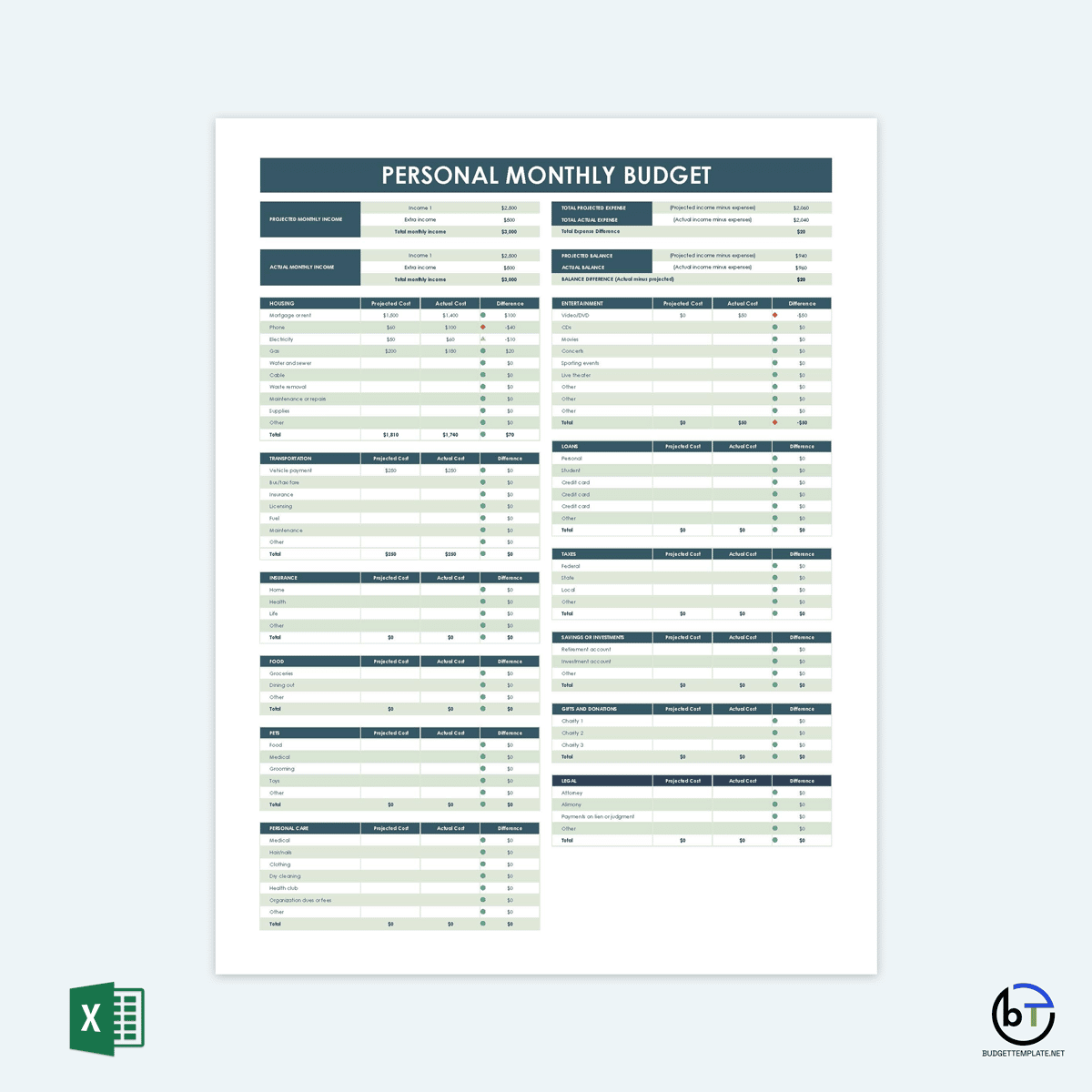

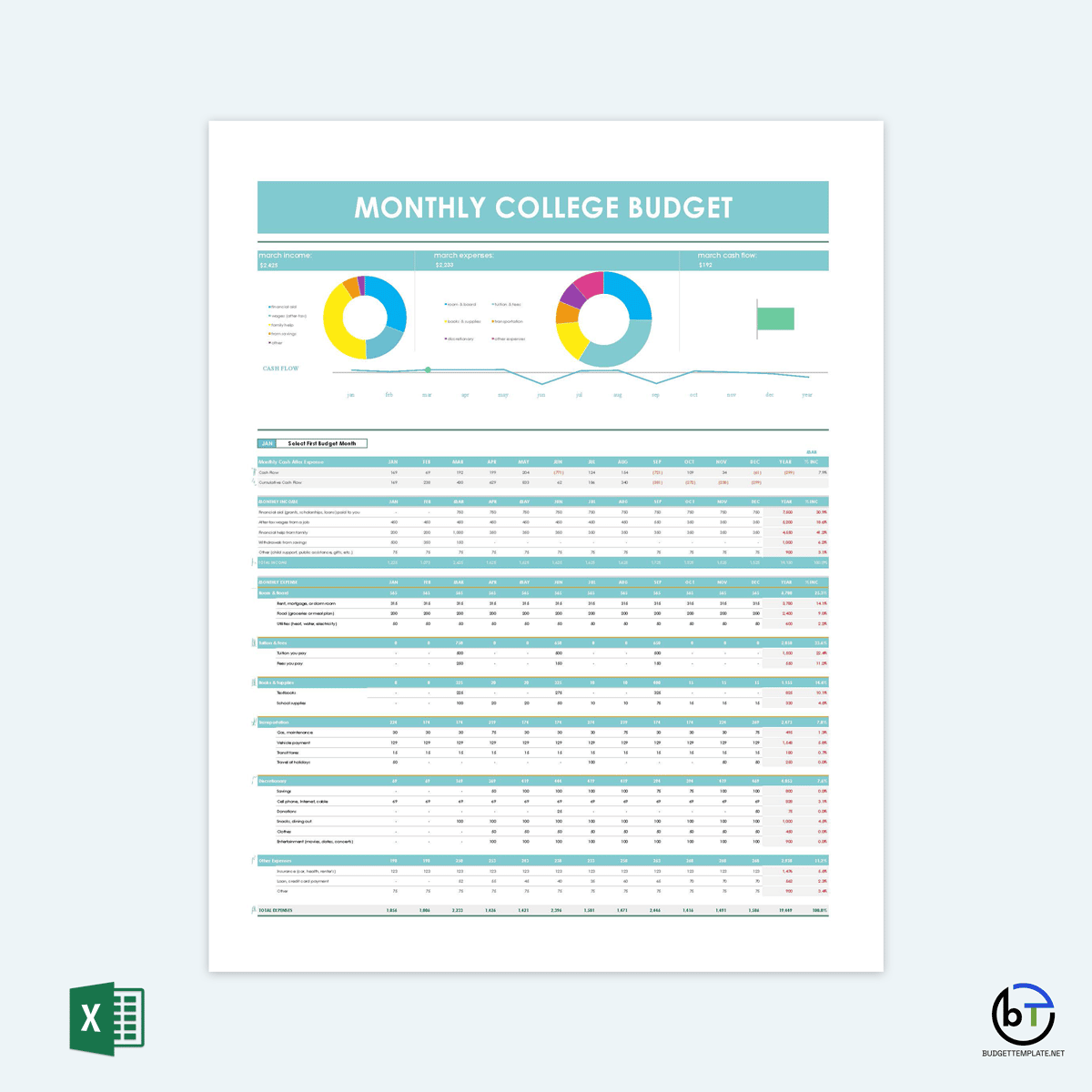

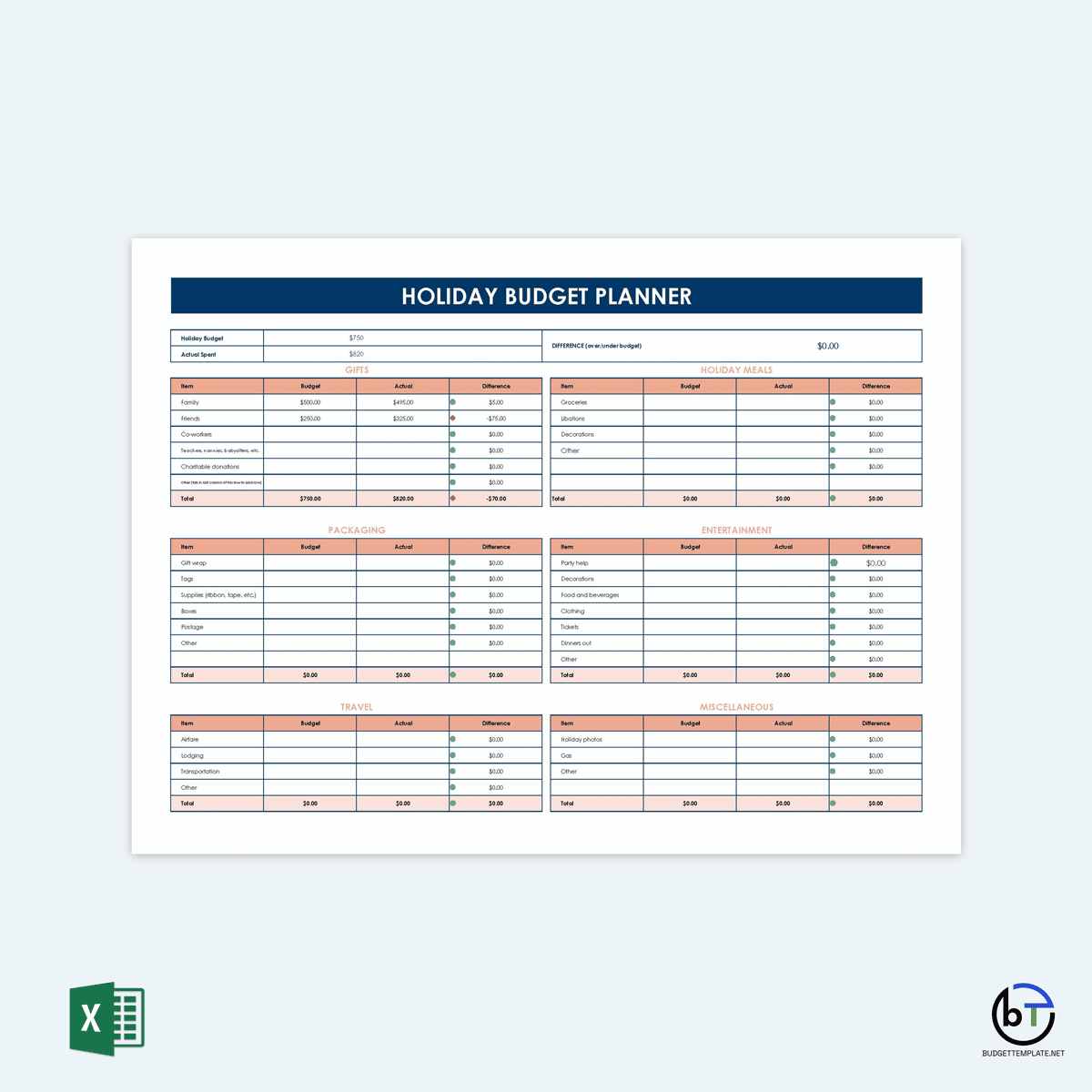

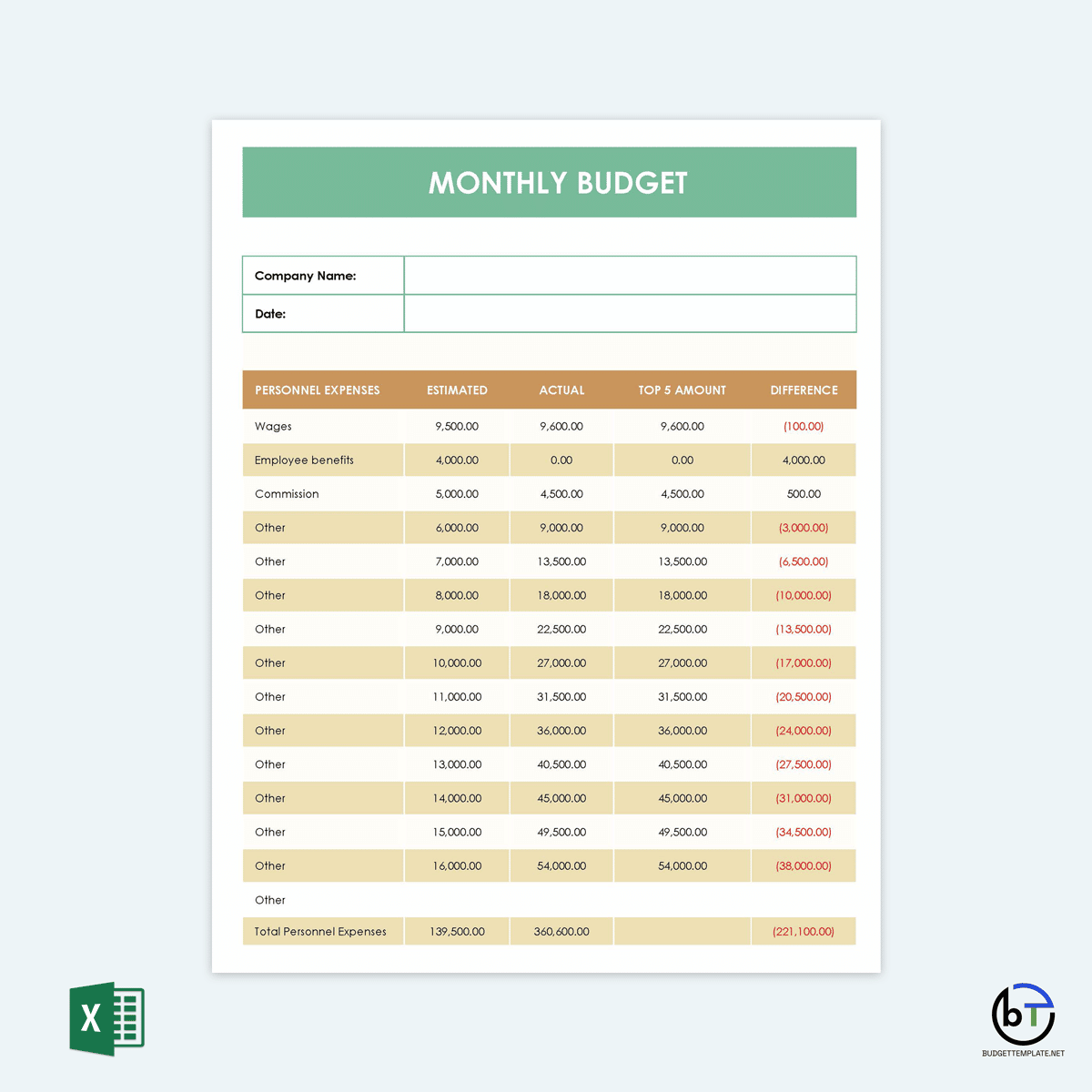

Since using a spreadsheet is the best option for creating a budget, you need to find a better method of preparing this spreadsheet. The best way to do this is to have a budget spreadsheet template to make your work easier and faster. You can access the different budget spreadsheet templates provided on this website. These templates are free to download, easy to use, and can be customized to suit your needs.

They have built-in formulas, can be downloaded on different electronic gadgets, printed out, and have distinct fields to break down your finances into income, expenses, bills, savings, and any other relevant sections. In addition, the budgeting process is more straightforward and more accessible with a budget spreadsheet template.

Tip: Create savings goals

It is also essential to focus on creating savings goals when creating a budget. This involves setting aside the money that remains after all your expenditure has been subtracted from your total income. You can choose to save this money for traveling, big purchases, future projects, investments, or even start an emergency fund. This is an effective way of creating savings goals instead of spending the remaining amount on unnecessary or random things.

How to Create a Budget Spreadsheet on Excel?

Apart from using a template to create a budget spreadsheet, you can also create it in Excel. The Microsoft Excel program is easy to use, and even a beginner can easily use it to create a budget spreadsheet.

To create it in Excel, ensure that you observe the following steps:

- Ensure that you have a computer or a laptop installed with MS Excel. After confirming this, run the program and open a new spreadsheet by double-clicking on the program.

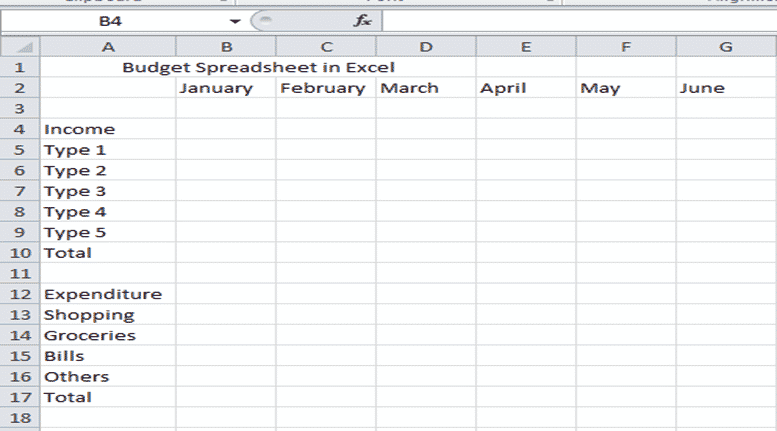

- You should then proceed to fill in the necessary details in the spreadsheet. Your columns should be labeled with Income and Expenditure, especially in the case of budget Excel programs.

- Ensure that you also label an entire row depending on the time frame of your budget. This may include weekly, monthly, or half a year. For instance, a budget for half a year means that you will label each cell along one row with January to June.

- In a cell one row below the months, type Income and list the different types of income you will receive for each month in one column under the title cell. In the next cell, you should write the ‘total’.

- The next step is to ensure that you skip another cell on the next row after the Income section before including details about your Expenditure, the type of expenditure, and the total in one column.

- With all these details in place, you should then include all the information (amount of money) and calculations in your spreadsheet to determine the total for your Income and Expenditure.

- Ensure that you click on the Menu button, Formulas, and Autosum after highlighting the cells containing the information you want to add together for the Income and Expenditure section.

By following all the steps mentioned above, your budget spreadsheet is meant to look like the image shown below. Ensure you include the correct amount details to have an adequate and proper final budget.

How to Stick to the Budget?

Creating your budget, either using a spreadsheet template or a spreadsheet in Excel, may not be as challenging as sticking to it. However, to succeed in that area, you need to observe the following tips. These tips will help you learn to stick to the budget after creating it:

Think twice about big purchases

It is essential to think deeply before spending your money on big purchases that are non-essential and don’t fit your budget. You should set money aside for such moments, and in case that is not an option, ensure that you analyze the importance of the purchase and determine whether it will cause you financial stress before going for it.

Avoid going into credit card debt

Also, avoid making purchases using your credit card. Even though you have a reasonable limit and want to make big purchases using your credit card, always keep in mind that it is a debt you will need to repay at the end of the month. Therefore, if you do not have enough money allocated to debt repayment, you should avoid using your credit card to steer clear of the interests you might incur due to late payment.

Plan out weekly meals

Another way to stick to your budget is to plan out your weekly meals. Again, you will avoid spending more money than budgeted at the grocery store or on take-outs. Planning your weekly meals may involve finding recipes, making a grocery list, and shopping once a week to actualize your plan. Also, you can choose to shop for your groceries online to avoid those sudden urges to eat out while shopping.

Wrapping Up

When it comes to your finances, it is essential to take control by finding an effective way to manage them. This is best done by preparing a budget to stay focused on your financial goals; hence, remain financially healthy. You will need a budget spreadsheet to effectively and successfully prepare either a weekly or monthly budget as per your financial needs. Of course, you can always use MS Excel or download the free templates to prepare a proper budget. In addition, you can closely monitor your income and expenditure while tracking your expenses to make the correct financial decisions.