Budgets are designed to help you to plan and keep track of spending. That’s their entire purpose. However, it is widespread to find that you are spending more than you earn, especially if you receive multiple paychecks within a month. If the basic numbers (income and expenses) don’t match up, a line has been crossed into the territory called ‘budgeting gone wrong.’

Hence, a paycheck budget template can help create a solid and compelling budget to guide your financial decisions.

Conversely, if you are a person who knows how much money you make and how much is going out of your bank account, budgeting is a leap towards financial stability. This article explains why a paycheck budget template is the best way to start budgeting.

What is the Paycheck Budget?

A paycheck budget is a financial tool that helps you establish a realistic and attainable plan for different paychecks within a budgeting period, typically a month. You get to know how much money you will earn from paycheck to paycheck, what expenses are usually paid out of your pocket, and how much of your income is left for savings each month. Each expense is assigned to a specific paycheck in this type of budgeting. This budget-by-paycheck approach can be highly beneficial to individuals who find it difficult to utilize traditional budgets.

How Can it Be Beneficial?

The primary objective of a paycheck budget template is to set the groundwork for you to become financially secure. There are numerous reasons why this is necessary. First, it helps you understand where each dollar earned is spent or redirected. Income can be spent on utilities, mortgage, debt repayment, savings, etc. Having the income left over after essential expenses have been covered leaves you in a better position to plan for retirement, improve your lifestyle, and make more informed decisions regarding credit and debt.

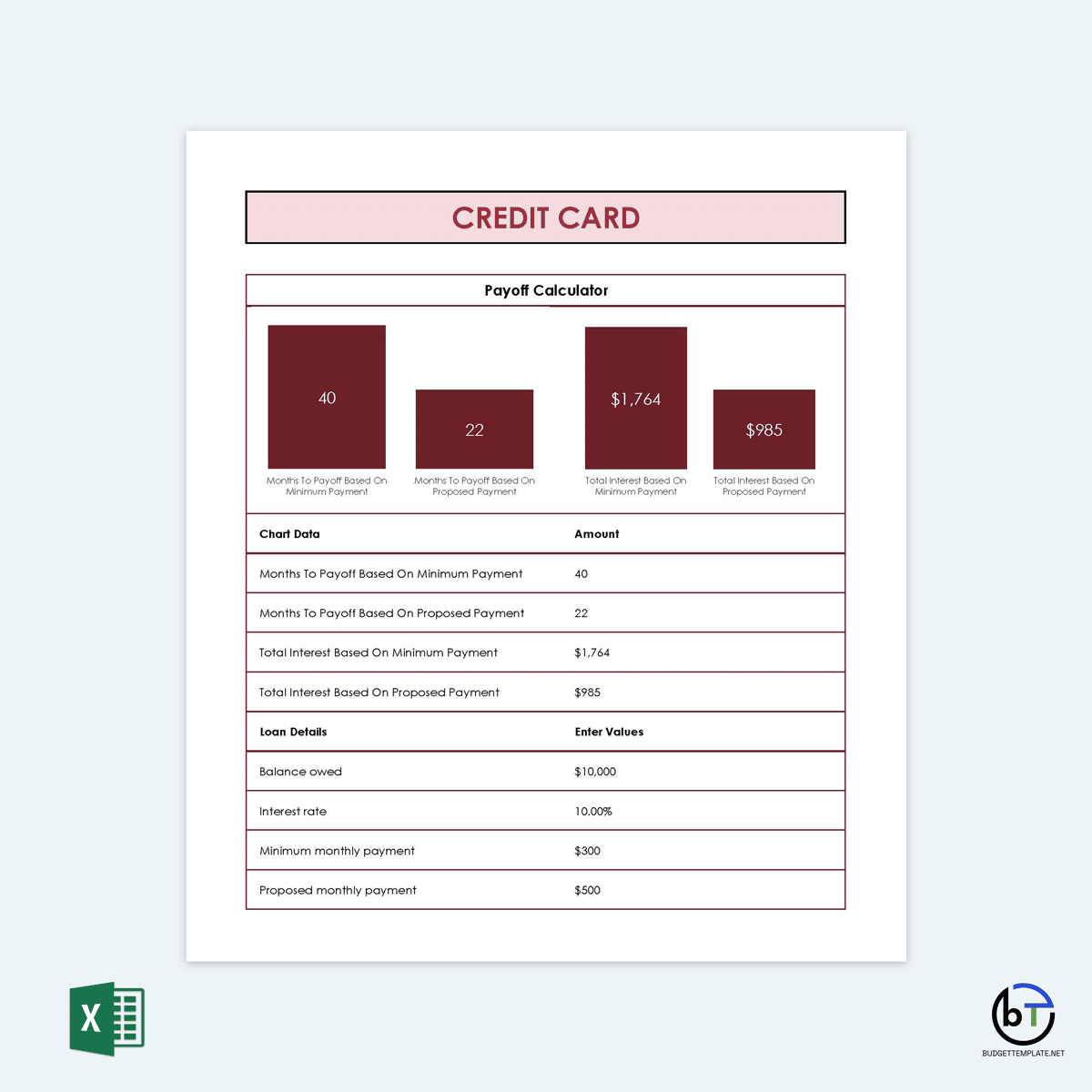

A paycheck budget template helps build confidence in your financial decisions in the long run. In addition, a template helps you achieve your financial targets quickly by preventing cash flow problems such as overdrafts, bounced checks, and late payments. Consequently, you get to know what percentage of each paycheck you can spend before the next paycheck, and you can thus avoid sinking into debt such as credit card debt. This makes it a potent tool for managing your finances and planning.

What does living paycheck to paycheck mean?

If your paycheck is usually spent by the end of the week or month, you live paycheck to paycheck. You cannot save and have no way to do so since you are consistently spending every dollar right away. It implies that if you do not receive a paycheck, you wouldn’t have the income to settle bills for essentials such as food and rent. Living paycheck to paycheck leaves you with no savings and increasing credit card debts due to the constant use of a credit card for purchases that cannot be postponed.

Who Can Use it?

Whether you are saving for retirement, making payments on debts, or paying for bills, a paycheck budget template is one way to make sure you’re making the best financial decisions available.

Commonly this type of budget is used by the following:

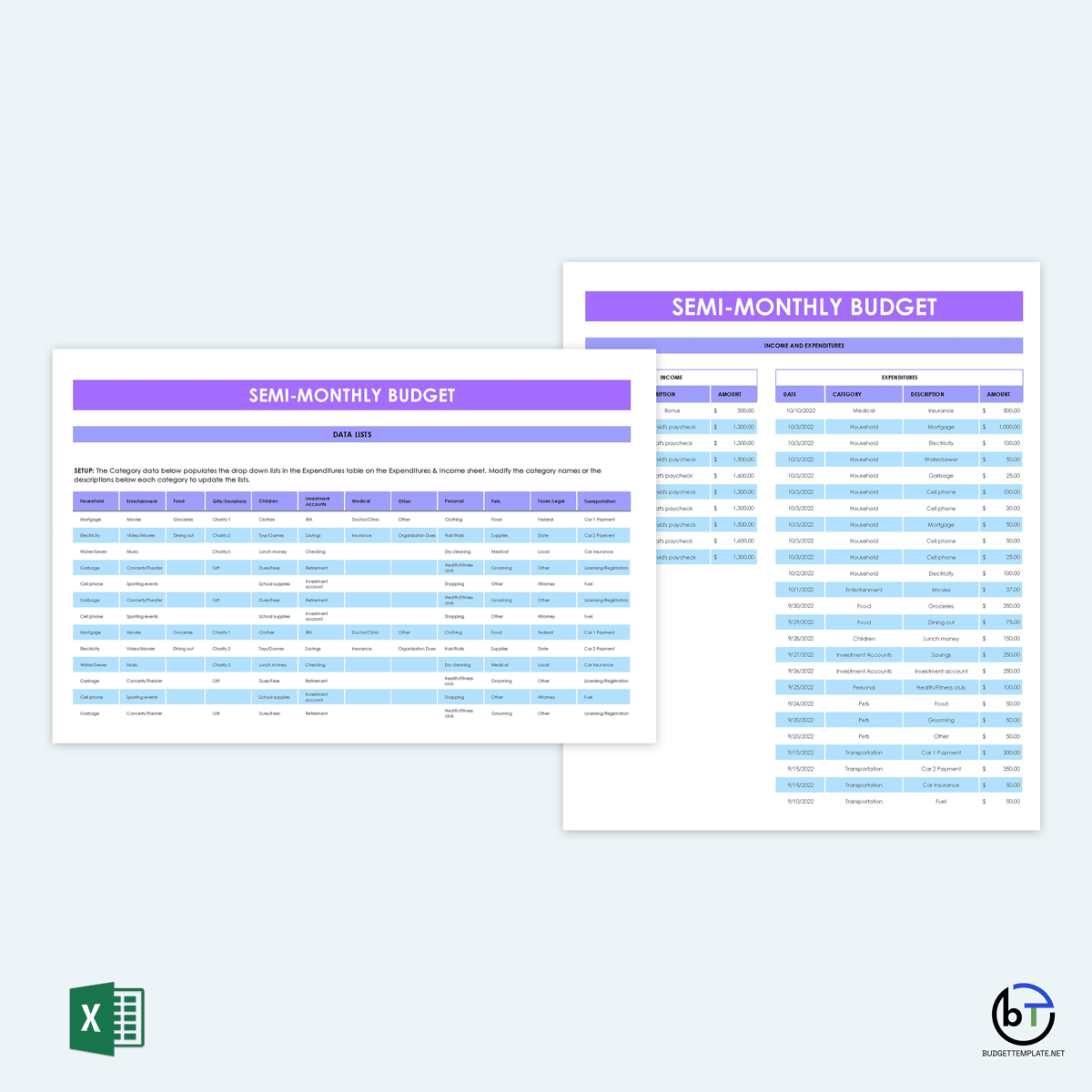

- Who gets paid more than once a month: Not everyone gets paid at the end of the month. Some people get paid every two weeks, every month, and some get their paychecks twice a month. So, people who get paid more than once a month need to know what percentage of each paycheck goes towards which bills. This includes teachers, babysitters, and short-term contract workers who get paid every two weeks.

- Who lives paycheck to paycheck: Paycheck budgets are used by people who live paycheck to paycheck. This is because, without thorough planning of their finances, things can quickly spiral out of control. So, people who live paycheck to paycheck need to create a budget that will help them spend only their money, which is the whole point of using a template. Then, with proper budgeting and financial habits, they can break the paycheck-to-paycheck cycle.

- Who is new to budgeting: Budgeting can be a tedious process. If you’re new to budgeting and don’t know how to do it well, a paycheck budget template is a good way of simplifying the process. Using the paycheck budget will know how much money you can spend on which things. This can be more beneficial for individuals with an irregular income, such as freelancers and self-employed individuals who cannot use traditional budgets.

Steps to Create a Paycheck Budget

Creating a paycheck budget is simple, and anyone can do it. As long as your financial situation is clear to you, this budget can work wonders in your financial life. Follow the steps below to create an adequate budget for your paychecks:

Know your paydays

First, establish the exact days you expect to receive your paycheck(s). You will have two paydays every month if you’re paid twice a month. Record this information on a monthly calendar or monthly planner. If your income fluctuates from time to time, you need to create a detailed spreadsheet that shows your income for each month.

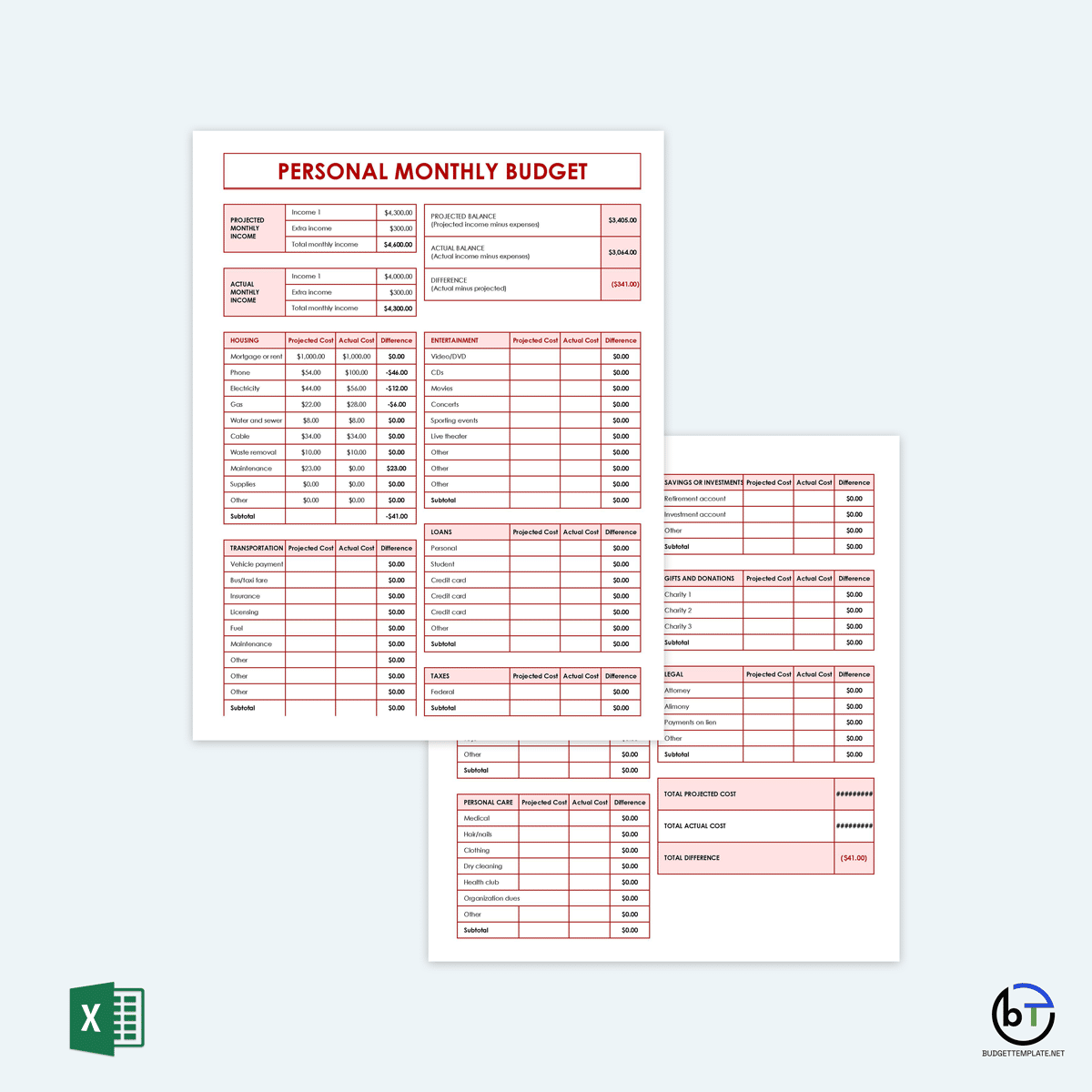

Figure out your income

Next, you will have to know your total income for each month. You can use a supporting document such as your paycheck stubs or W-2 Federal Form. This can be helpful, particularly if you are getting paid by multiple employers or if your employer does not pay you consistently throughout the month. Next, determine how much money you make per paycheck. For instance, if you get paid twice a month, every two weeks is a paycheck. In this case, all income received is classified as a paycheck, even if it happens to be made up of different amounts. Finally, list all sources of income, whether it’s fixed or variable, regular or irregular.

Write your bills on the blank calendar

Using a blank calendar or spreadsheet template, write down the bills or essential expenses to be paid out of your paycheck. You have to pay these expenses even if you don’t receive your paycheck. Such expenses include rent, electric bills, water bills, phone bills, and car loan payments. Also, you can add any other recurring bills such as grocery or gas bill payments if they apply to your situation. The key is to know how much will be deducted from each paycheck for each bill. Ensure to capture the due dates of each expense so that you don’t miss any payments and incur late fees.

Tally your variable and fixed expenses

Next, categorize your variable and fixed expenses. Variable expenses vary from time to time, such as groceries, clothing, entertainment, transportation, and utilities. Fixed expenses stay the same regardless of when you pay them, such as car insurance. If you have a long list of bills or expenses to go through, a paycheck budget might prove to be helpful.

Assign expenses to paycheck

Once you have figured out the amount of money allocated to each bill, assign the expenses to a particular paycheck. Due dates are crucial in this step. Therefore, it would be best to aim to align your due dates with your paydays. Once you do this, you can decide how much of your paycheck is necessary to pay the bill.

For example, if you spend $100 on groceries every month, you can divide that amount in half and include it in the budget as two separate expenses to be covered by different paychecks within the month.

Assigning your bills to paychecks helps you keep track of your money and provides you with a better idea of how much you can spend during each pay period.

Include savings and emergency funds

When creating your paycheck budget, you may realize that you have some extra money left after paying all your bills. This is money that you can use for savings and emergency funds. Savings are for long-term goals, and emergency funds are for short-term needs. So, if an expense arises that wasn’t in the budget, you know exactly where to go to tap into funds for it. Once you have created a template, it’s crucial to follow it religiously and modify it as changes in your financial status occur.

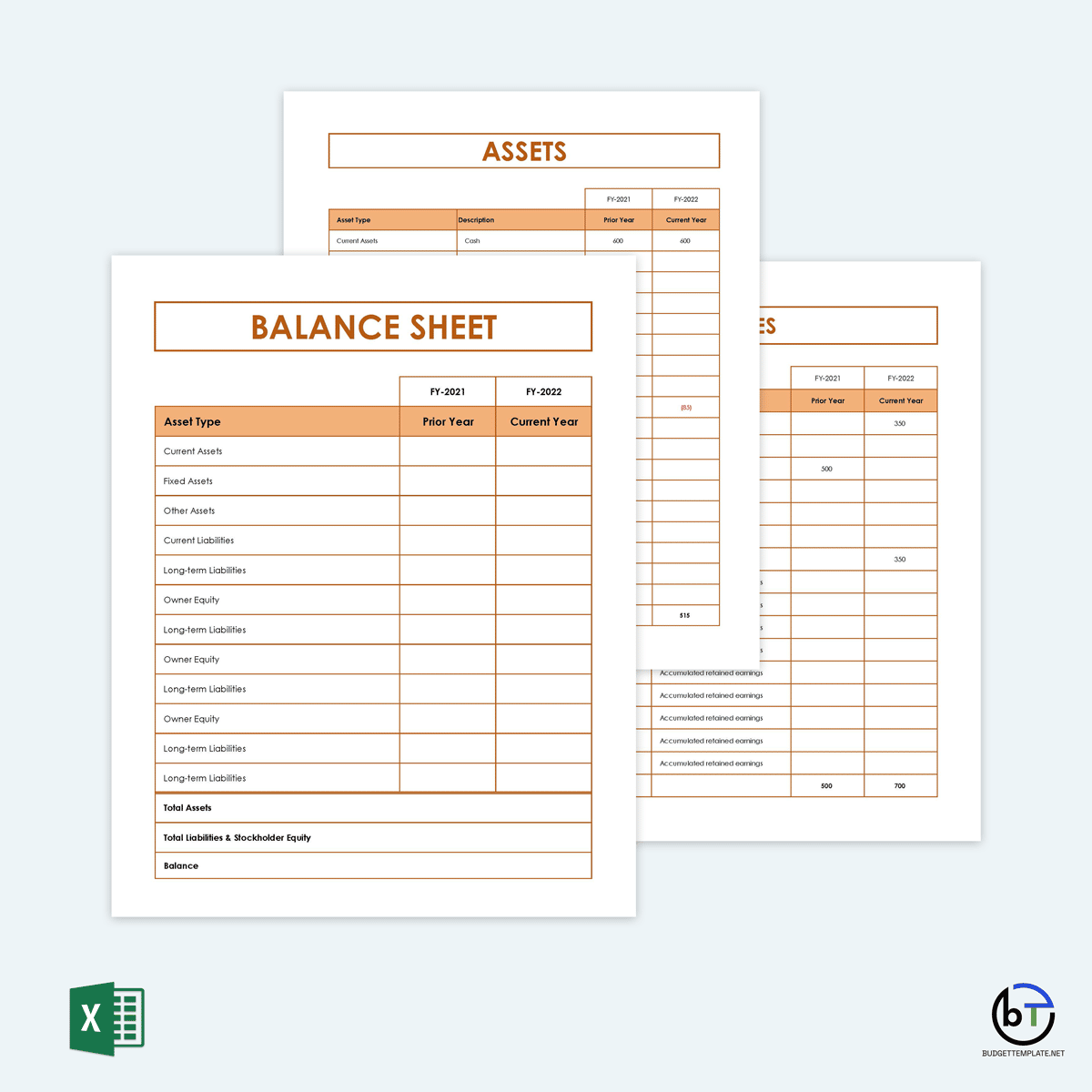

Paycheck Budget Templates

Creating a personal budget is difficult for most people because they don’t know where to start when creating one. If you have been wondering how to create a budget for your paychecks, it is recommended to use a template. The templates will help you create your budget without any hassle or stress.

They are easy to understand, and all you need to do is fill in the blanks according to your requirements. All templates come with detailed instructions, so it should not be a problem even if you are a beginner at creating budgets. Many different paycheck budget templates are available for free download on this website. You can download them for your ease.

Professional Tips

Below are some tips you should keep in mind while creating a paycheck budget template:

- Use leftover money wisely: When you have leftover money in your paycheck, it might be tempting to spend it frivolously. But it would be better to focus on putting the money in your savings account and either increasing the balance with extra income or moving it to an investment account. This way, if there is ever a need for spending this extra money, which may be from an emergency expense or from something as simple as buying a large item that falls under small business loan requirements, you will have the funds available for your use.

- Create a separate checking account: A good practice is to open a separate checking account just for your paycheck. This way, you can deposit extra income into the account. This money can be accessed later on should the need arise.

- Setup a weekly budget meeting: This is a brilliant time to review the budget you created and discuss any changes that need to be made. First, go over your budget template with your spouse or financial advisor, and then set up a meeting with your spouse every week to go over the budget, compare notes on spending and compare receipts. Make sure that you have reconciled all expenses at the end of the month and will know precisely how much money was available for spending.

- Give yourself some grace period: Finally, let your paycheck budget be a guide/assistant, not a dictator. Life is unpredictable, so allow yourself some grace period to adapt to the budget, typically 3-4 months. This will motivate you to commit to the plan further and prevent feeling discouraged when you realize that the plan is unrealistic.

Tools for Setting a Paycheck Budget

Many free and paid online tools are available to help you create your paycheck budget. Some of these tools help make decisions on income, expenses, and disposable income, while some only provide a template to follow. Some of the budgeting tools include:

1. A monthly calendar

This is a handy budgeting tool to help you manage your expenses according to your paydays. It also allows you to record notes, reminders, and goals. The spreadsheet allows you to enter your bills, due dates, income, and expenses. In addition, the tool helps you visually map out how much money is available for spending every week.

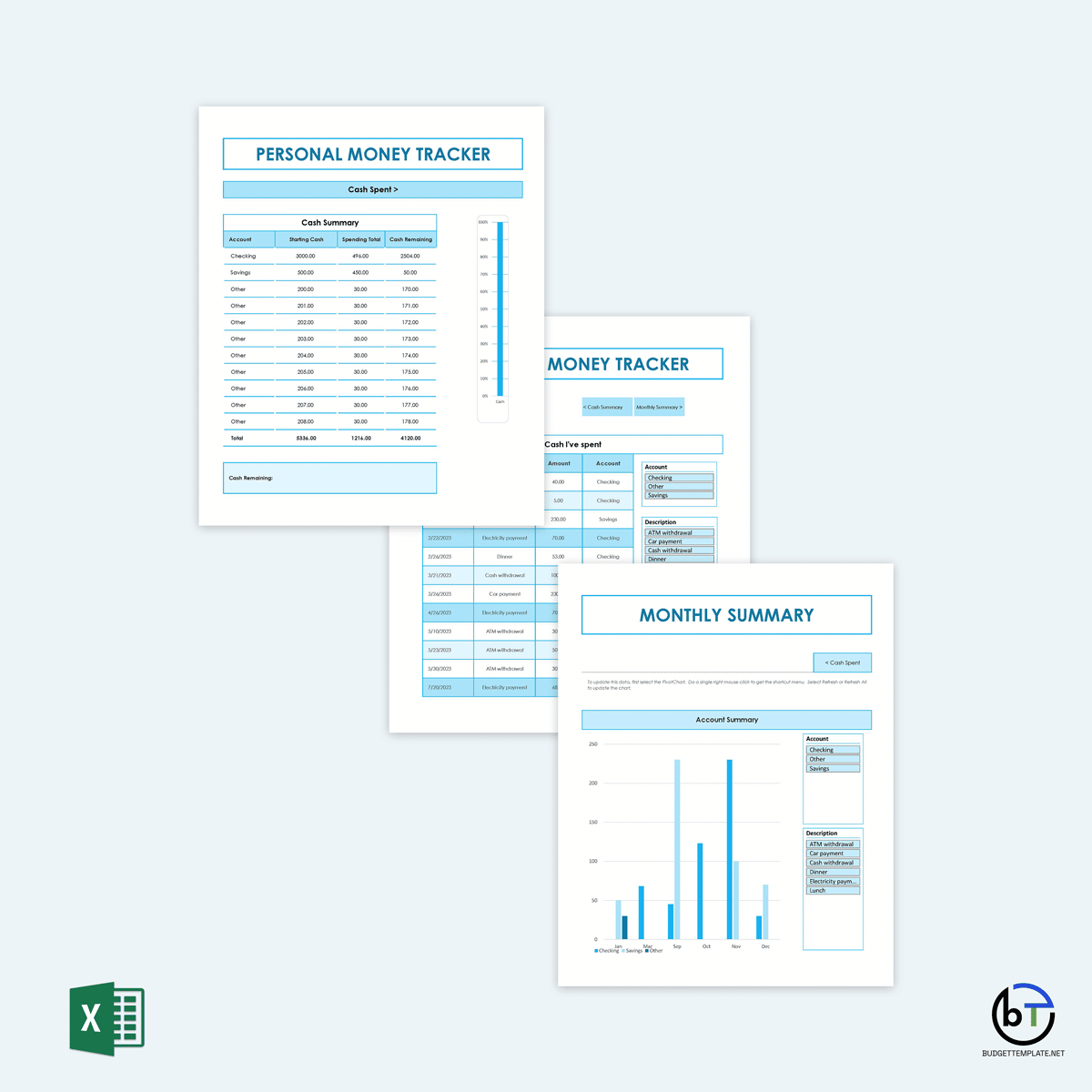

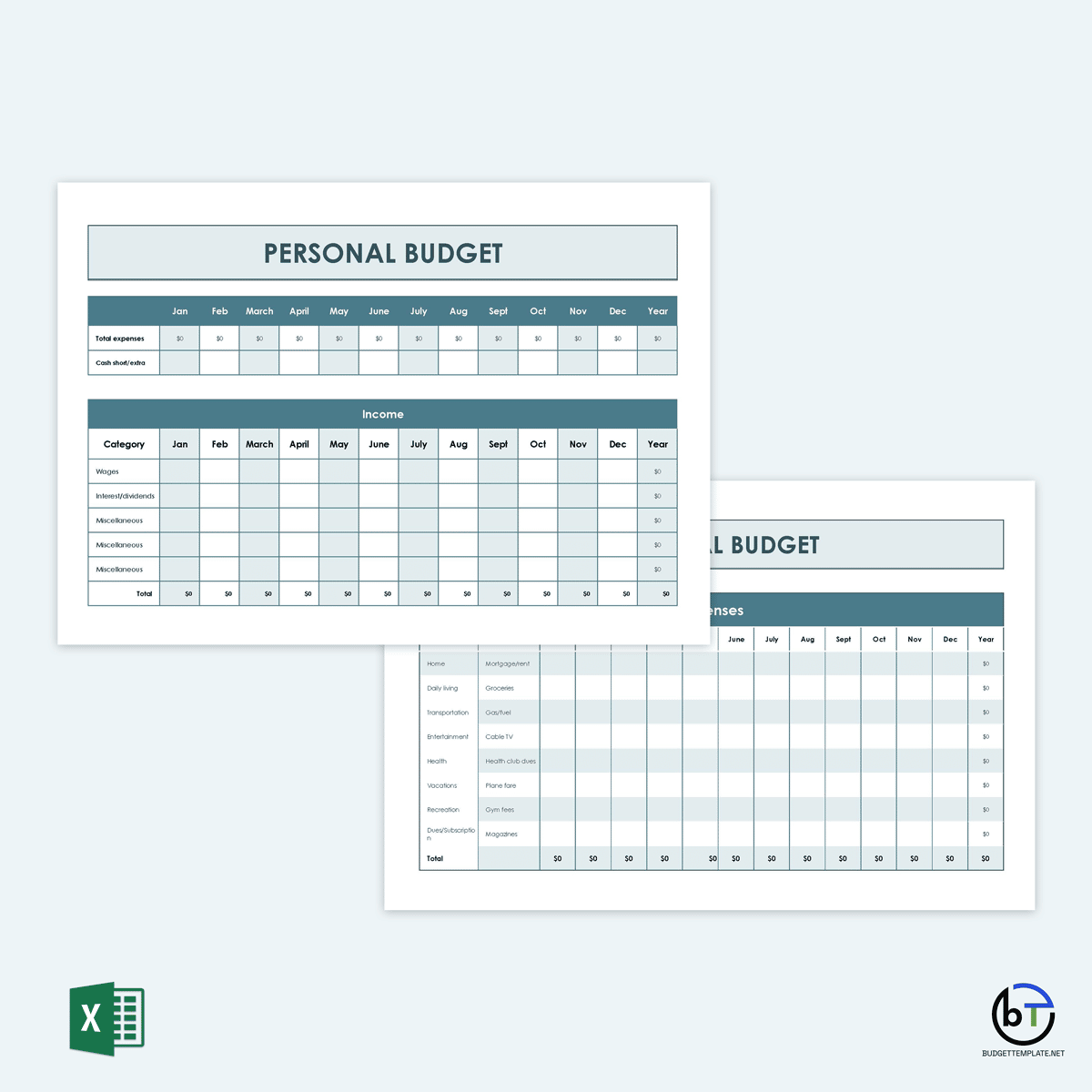

2. Budgeting templates

You can use budgeting templates to create your paycheck budget. You can categorize your expenses, assign them to a particular paycheck and add notes about what you spent during the month. These free budget templates also provide information on how much money you will have left each payday and how much of it is disposable income. The templates are often printable or online.

3. Cash envelopes

Cash envelopes are tools used to hold money allocated for different bills until the due date arrives. Cash envelopes can be physical or digital. You can also put receipts and bank statements into the envelopes to help you track expenses.

Frequently Asked Questions

Is the paycheck budgeting method right for you?

The main objective of the paycheck budgeting method is to help you make a plan for spending money. Whether the method is correct for you depends on your financial goals. If your goal is to build a financial emergency fund, this method might not be proper because it won’t help you accumulate much money. However, if your goal/objective is to stop overspending, the budget-by-paycheck method could be helpful.

What happens when you’ve too many bills due at a time?

If you’ve too many bills due at a time, you may run out of available income. In such a situation, there are some steps you can take. You can include expenses according to what is due first and try to spread the other expenses throughout the rest of the paychecks. If possible, try reaching out to associated companies and requesting the due dates to be moved. They will often be open to such changes rather than risking default. Also, reducing your expenses so that some money is left over after paying all your bills is another long-term method you can explore.

What if you do not have enough money to cover all your bills?

If you don’t have enough money to cover all your bills, you can do one of two things. First, you can look into other options that will enable you to increase your income. Alternatively, you can look into ways of reducing your expenses.