The 50/30/20 budgeting rule sometimes referred to as the “rule of thumb,” is a simple budgeting strategy designed to help working-class people determine their priorities and plan for their future instead of living from paycheck to paycheck. The ratio can be applied to almost any income category, but the rule’s original purpose is to help people on a set income manage their financial situation effectively.

Making a 50/30/20 budget is still a great and straightforward tool for budgeting. Still, it is usually recommended that people take a more comprehensive look at their financial situation before using it. This article provides complete information about the 50/30/20 budget, including what it is and how it originates, how it works, and the pros and cons of using it.

What is the 50/30/20 Rule of Budgeting?

The 50/30/20 budget was Popularized by US Senator Elizabeth Warren and her daughter Amelia Warren Tyagi in their book, “All Your Worth: The Ultimate Lifetime Money Plan.” The rule was derived from the observation that a consumer should divide their after-tax income in the ratio of 50:30:20 and spend it on basic needs, wants, and savings, respectively. This will enable them to build a savings fund for their future and any contingencies.

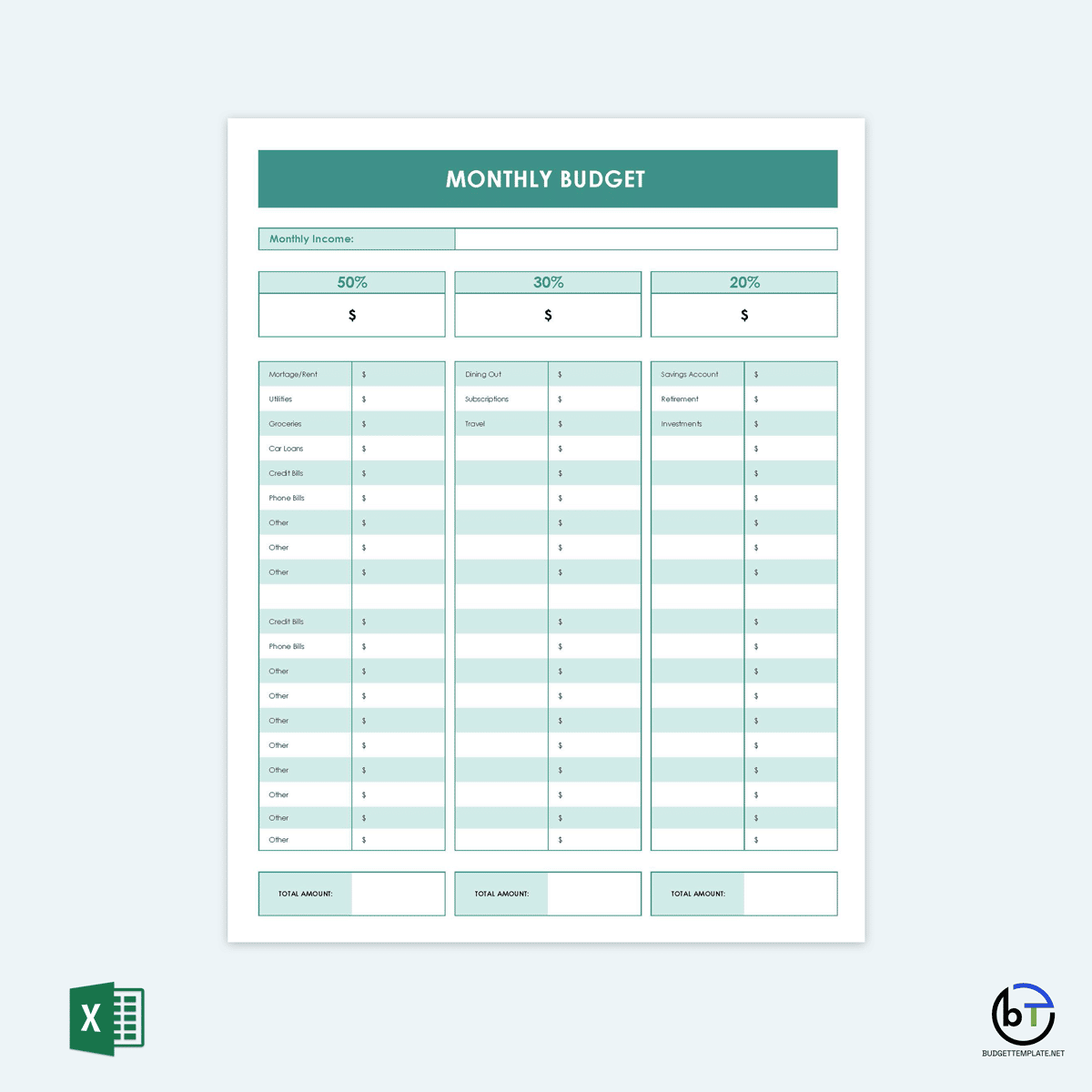

The 50-30-20 rule is a budgeting method designed to provide a general guide on categorizing and allocating a person’s income. The ratio guides consumers to apply their income as follows:

Needs

The first 50% of a person’s after-tax income should be allocated towards their needs. Needs are the bare minimums, which are the things we need to live. Needs include rent or mortgage payments, utilities, food and groceries, clothing, transportation/car payments, medical care, insurance, and minimum debt payments.

Wants

The second 30% of a consumer’s income should be allocated towards their wants. Wants can be described as items considered luxuries and conveniences or things that we desire but don’t need to survive. Wants include expenses such as home entertainment bills, for example, Netflix or Hulu subscriptions, trending clothes or latest handbags and shoes purchases, tickets to sporting events, leisure activities, dining out, purchases related to the latest electronic gadgets and devices, ultra-high-speed internet subscriptions, gym membership subscriptions, vacations, among other lifestyle expenses.

Wants vs. needs

According to the 50/30/20 rule of thumb, the needs category takes up the most significant portion of a consumer’s income. Nonetheless, most people often consider wants as needs, making their list of essential expenses grow. A person’s needs are the bare minimums to maintain a sustainable living, whereas wants are the luxuries and convenience items that add to one’s comfort. For the 50/30/20 budget to work effectively, one must draw a clear line between their essential needs and wants.

The needs category should only include non-negotiable items such as rent or mortgage payments, minimum debt payments, utilities, staple groceries, childcare expenses, recurring medical costs, commuting expenses, and insurance premiums. On the other hand, the wants category should incorporate costs related to leisure activities, membership subscriptions, digital streaming expenses, vacations, etc.

Savings

The last 20% of a consumer’s income should be allocated towards their savings. Savings can include money set aside for emergency expenses, retirement savings plans, IRA contributions to mutual fund accounts, stock market investments, debt repayments, etc.

Why Use the 50/30/20 Rule of Budgeting?

Budgeting for one’s finances is often considered a tiresome process, especially if a consumer is uncertain of where to begin or what to include in their budget to make it effective. However, the 50/30/20 budgeting strategy is reputed for helping consumers budget efficiently and effectively as they only need to determine their net pay, then allocate the required percentages to their needs (50%), wants (30%), and savings (20%).

Furthermore, the simplicity of this budgeting method makes it easier for consumers to stick to their budgeting plan, even if they do not necessarily keep track of how well they stick to the established targets.

How Does it Work?

The rule of thumb for budgeting can be a very effective and practical method for making and sticking to a budget, provided that it’s used appropriately. The rule effectively enables consumers to clearly understand how their money is being spent and allows them to achieve financial security.

The following is a step-by-step guide to making a 50/30/20 budget:

Calculate monthly income

The first step of budgeting is to determine the net income. This consists of all the household income that a person receives every month minus any applicable deductions such as taxes, medical cover payments, insurance premiums, etc. It is vital to note that a consumer’s income includes all income from working, investments, and any capital gains one may have received. In addition, the figure that one calculates should include any social security checks received and child support or spousal or other personal support payments.

Calculate an estimated spending amount

The second step is to calculate the estimated monthly spending amount. This figure consists of all the expenses that a consumer must incur to live comfortably. Therefore, the estimated monthly spending amount should include all the essential costs, discretionary spending, and savings. As a general rule to determine one’s estimated spending amount following the 50/30/20 rule, the consumer should multiply their net income by 0.50 to obtain the dollar amount to allocate towards needs, 0.30 for wants, and 0.20 for savings.

Plan the budget according to these categories

Once consumers have estimated their spending amount based on the 50/30/20 rule of thumb, they should find ways to follow these requirements without feeling like they are depriving themselves of much-needed items to achieve financial security. It is recommended to create separate bucket lists, list items under the needs and wants category, and tally them to find the estimated spending amount. This step is crucial as it allows consumers to establish whether they spend more or less than the monthly targets they have identified in step two above.

Follow the budget

The final step of budgeting using the 50/30/20 budget rule involves following the plan accordingly. But, again, the consumer may review and modify the budget where necessary to stick to the established budget proportions.

A practical example of how the 50/30/20 budget works

Jane is a single lady who works full-time as a computer engineer and earns $50,000 annually. Following the 50/30/20 rule of thumb, she should divide her $50,000 into three main categories; needs, wants, and savings, to see how much money she can allocate for each month. To simplify jane’s task of budgeting, it is essential that she first determines her monthly income and monthly spending.

To find Jane’s monthly income divide the $50,000 by 12, which equals $4167 each month. This is the amount of money she needs to allocate to needs, wants and savings. The first step following the 50/30/20 budget rule is to divide her estimated monthly spending amount into percentages.

Her needs will take up 0.50 x $4167= $2084

Wants will take up 0.30 x $4167= $1250

Savings will take up 0.20 x $4167= $833

According to these budget proportions, jane should allocate $2084 of her money to necessities such as food, utilities, rent or mortgage payment, commuting costs, etc. $1250 of her income should cover her wants, including membership subscriptions hobbies, and leisure activities, entertainment, etc. The last figure, $833, is how much she has leftover to allocate towards her savings and investment accounts.

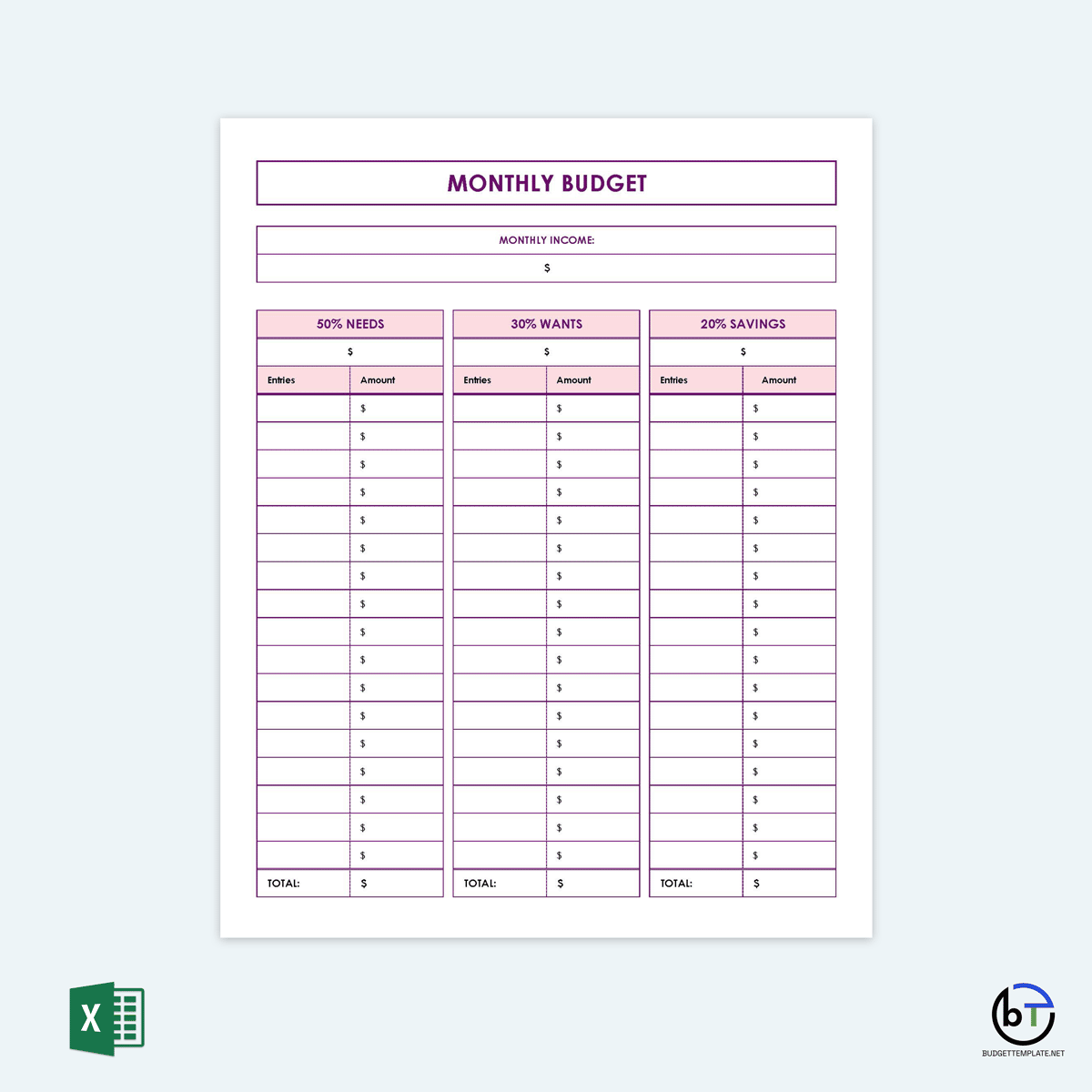

50/30/20 Budget Templates

While the 50/30/20 rule of budgeting might seem easy and straightforward to implement, individuals who are just starting with the process of budgeting may still find it challenging to create their budgets using this method. Therefore, this website has provided our readers with a wide range of downloadable 50/30/20 budget templates to help them plan their budgets more effectively while saving them money, time, and effort. You can download such professional 50/30/20 budget templates here and kick start your budgeting journey conveniently with no potential setbacks.

Why Take the 50/30/20 Budgeting Rule Skeptically?

Despite the 50/30/20 budgeting rule’s great potential to help consumers achieve financial security and goals, it should not be taken lightly. Since this budgeting rule is based solely on averages and projections, it might not work for everyone. This is the main reason consumers are advised to closely assess their financial situation before considering using the 50/30/20 budget.

This section discusses the various cons of using the 50/30/20 budget:

Potential for gray areas

The first significant con of using the 50/30/20 budget is that there are no specific definitions for the three categories of needs, wants, and savings. This means that shoppers may be able to make different decisions on categorizing items to fit their budgets appropriately. This can lead to discrepancies between how consumers allocate their budget and spend their money.

Difficult for low-income people

Another major setback of the rule of thumb is that it may not work for everyone, particularly for individuals with a low net income. If a consumer only gets enough money to make ends meet and they still have a family to support, they might not be able to set aside 20% of their income for savings.

Savings might not be enough

This budgeting rule is also not likely to help a consumer who wants to allocate more of their money to savings rather than their discretionary expenses to achieve their financial goals or obligations.

Consumers still need to track the budget

Another drawback of using the 50/30/20 budget is that consumers still need to track their expenditures and monitor their spending in the long run. This is mainly because the technique does not allow for precise calculations. As a result, it may be possible for consumers to spend more or save less than what they intended if they fail to evaluate their spending habits.

50/30/20 Rule of Thumb vs. Other rules

The 50/30/20 rule is often used as an introductory tool in budgeting. It is an excellent way for consumers to understand how much money they need to allocate towards savings, needs, and wants. Financial experts have developed additional budgeting methods such as the 80/20 rule and the 70/20/10 rule. These strategies are great ways to help individuals set their priorities straight.

While these methods use the same budgeting concepts, they differ from the 50/30/20 rule in that the 80/20 rule demands that an individual allocates 20% of their income to savings. The remaining 80% can be spent on necessities and wants with no tracking. On the other hand, the 70/20/10 rule is typically similar to the 50/30/20 rule, but it is more advanced. It requires consumers to allocate 70% of their income to basic needs and wants 20% to debt payments and 10% to savings.

Frequently Asked Questions

What debts should be considered in the 20% of savings and debt?

Minimum debt repayments are included in the 50% of needs category, including mortgage payments, credit card payments, auto-loan payments, etc. However, any debt payment above the minimum requirement should be included in 20% of savings, including extra payments on a mortgage, car loan, credit card debt, and business financing loans.

Is the thumb rule of budgeting effective for you?

The rule of thumb for budgeting is an excellent technique for individuals looking to live within their means. Nevertheless, it should not be blindly applied as it might not fit all consumers’ financial requirements. First, the 50/30/20 budget rule does not consider variable expenses and each consumer’s personal financial needs and wants. Second, the 50/30/20 budget may be impractical for low-income earners since they would have to distribute their earnings into three distinct categories. Finally, consumers may still need to track their spending habits to ensure they can stick with the budget. Therefore, it may or may not suit you depending on your unique circumstance; thus, you need to evaluate your financial situation before applying this rule.

How does religious tithing figure into the 50/30/20 budgeting rule?

This entirely depends upon the specific consumer and their specific circumstance. The consumer should decide whether paying their tithe is a basic need or a want.

Where do credit card debt payments go in the 50/30/20 budget?

Credit card debt should be included in the 20% savings and debt category because it is considered a financial goal.

How much of your income should you spend according to the 50/30/20 rule?

The 50/30/20 rule is just a rule of thumb for budgeting, and it should not be taken as a rigid principle. It focuses on the concept that consumers should allocate 50% of their income to essential needs, 30% of their income towards wants, and 20% to savings and debt payments. It does not dictate how much money a consumer should spend off their paycheck. This depends on their 20% financial goal category. If they need to reduce their debt, they will allocate more of their income to cover the debt repayment. If their goal is to save up a contingency fund, they may need to save more of their income.