A significant factor in successfully running and managing a household is controlling its finances. Controlling the household finances using the right tool will help an individual keep track of spending habits. A budget is a financial planning tool used to forecast future income and expenses. A household budget enables the budget makers to control and manage how income and expenses are spent and saved over a defined period of each month. The household budget can also be referred to as a personal budget.

To utilize a household budget appropriately, the budget makers should use a household budget template and must clearly understand the various budgeting techniques that can be used and how to create the household budget, among other crucial details.

Budgeting Techniques

There are two budgeting techniques that a budget maker should consider using when creating a household budget. Using budgeting techniques will help the budget maker understand the household’s finances.

The following techniques should be considered:

The 50 /30/20 rule

The 50 /30/20 rule is a technique that divides the monthly income into three categories. 50 % is allocated to needs like rent or bills, 30% is allocated to wants like hobbies and shopping, and 20 % to financial goals, savings for college or retirement, and debt payments. It helps create structure and sustainable money management. Keeping the money balanced across these three main spending areas helps the budget maker put the money to work efficiently, which can help save time and reduce the stress associated with digging into details every time money is spent.

The envelope method

The envelop method is a cash-based saving system that assigns spending categories to different envelopes. It limits the budget maker to spend an only portion of the money available in each envelope. It can be used in a household that is yet to adopt a cashless way of spending. It helps instills discipline in how money is spent to avoid overspending. It is also an easy way of tracking expenses.

Seven Priorities to Consider

- When creating a household budget, the budget maker should start by prioritizing emergency funds of at least $500 to cover minor emergencies and repairs.

- The second priority should be 401(K) budget makers, which the employer should match.

- The third priority should be dealing with toxic debt, including high-interest credit card debt, personal and payday debt, rent-to-own payments, and title loans.

- The next priority should be saving for retirement, designated as 15% of the gross income.

- Again, the emergency fund should be prioritized to help build three to six months’ worth of giving expenses.

- Paying off debt payments beyond the minimum should be prioritized as they are lower-rate debts.

- Lastly, the budget maker should prioritize saving for irregular expenses that aren’t emergencies like a new roof or car.

Steps to Create a Household Budget

When creating a household budget template, the budget maker must follow a detailed step-by-step process. The steps followed will help ensure that the document contains adequate information.

They include the following:

Choose a budgeting plan

The budget maker should select a budgeting plan covering all their needs, some wants, and emergency savings. Selecting the appropriate budgeting plan provides the budget maker with an accurate picture of the money coming in and going out of the household. It also eases their ability to compare the effectiveness of each month’s budget. For example, they can choose between a zero-based budget plan and an envelope system.

Know your cash flow

Next, the budget maker should know how much money is coming in and going out of the household. Understanding the household’s cash flow eases the budget maker’s ability to manage the household budget. Rather than relying on memory, the budget maker can create a budget worksheet to ease their ability to keep track of cash flow, or they can also store the information online in a secure document. These documents should be easy to access and updated to keep track of changing circumstances.

List and add your expenses

A list of expenses should then be created. Some of the expenses may be recurring, such as rent, property tax alimony, and others, while others may be non-recurring, like the water bill or entertainment. The maximum amount spent on non-recurring expenses should be indicated to ensure the expenses are not underestimated. Finally, these expenses should be added up to enable the budget maker to determine the household’s total expenses.

Calculate your net income

The budget maker should also calculate what they have left over after paying their bills, otherwise known as net income. The net income can be calculated by subtracting expenses from monthly income. It can either be positive or negative. A positive net income enables the budget maker to meet financial goals like saving or paying off debts.

Adjust your expenses

If the net income is negative, then the expenses must be adjusted. A negative net income means that the budget maker will spend more than their income. The non-recurring expenses are the most accessible place to adjust as the money does not cater to crucial needs. Some fixed expenses may also be adjusted by either reducing or eliminating wants. For example, the budget maker may opt not to take a vacation or reduce the use of their cable.

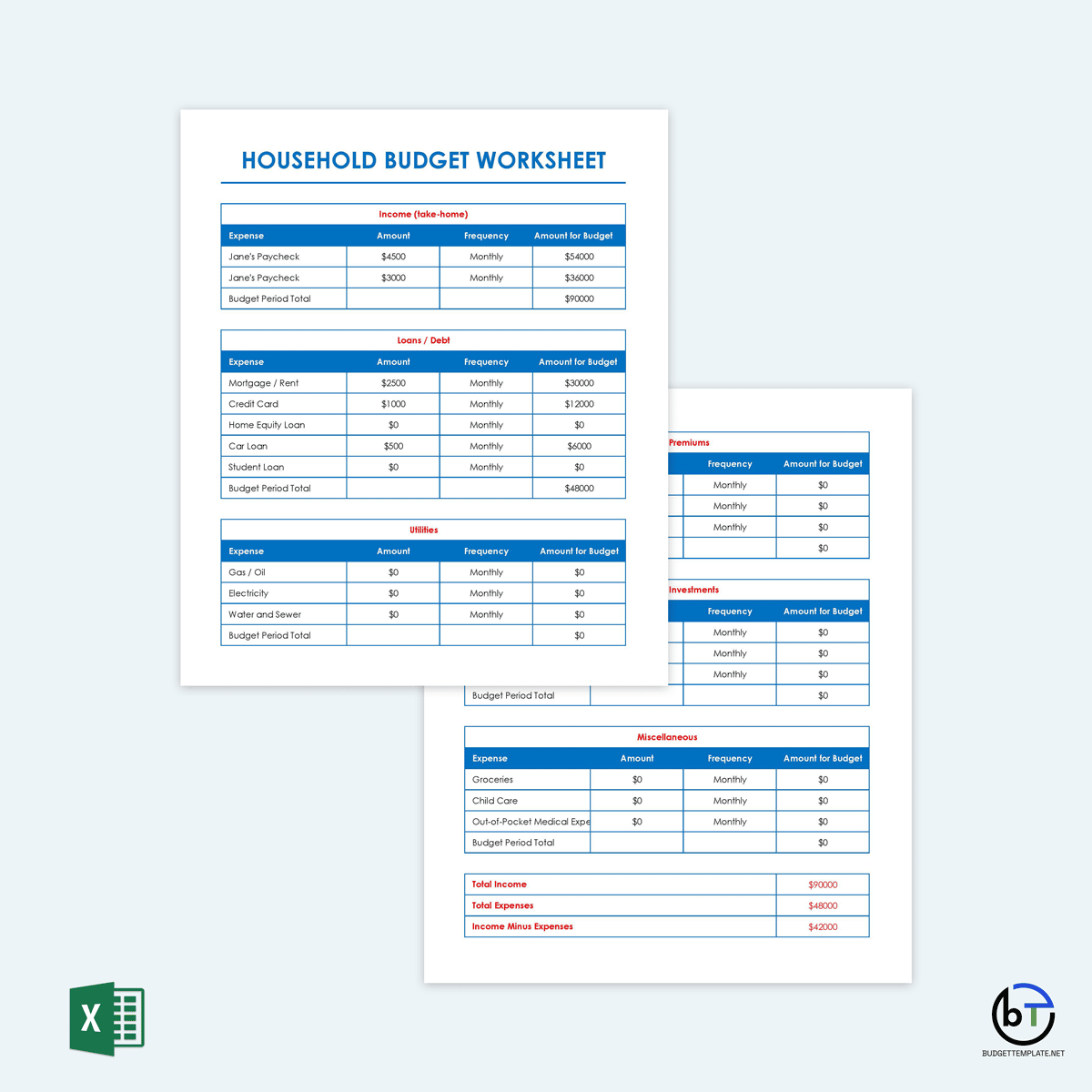

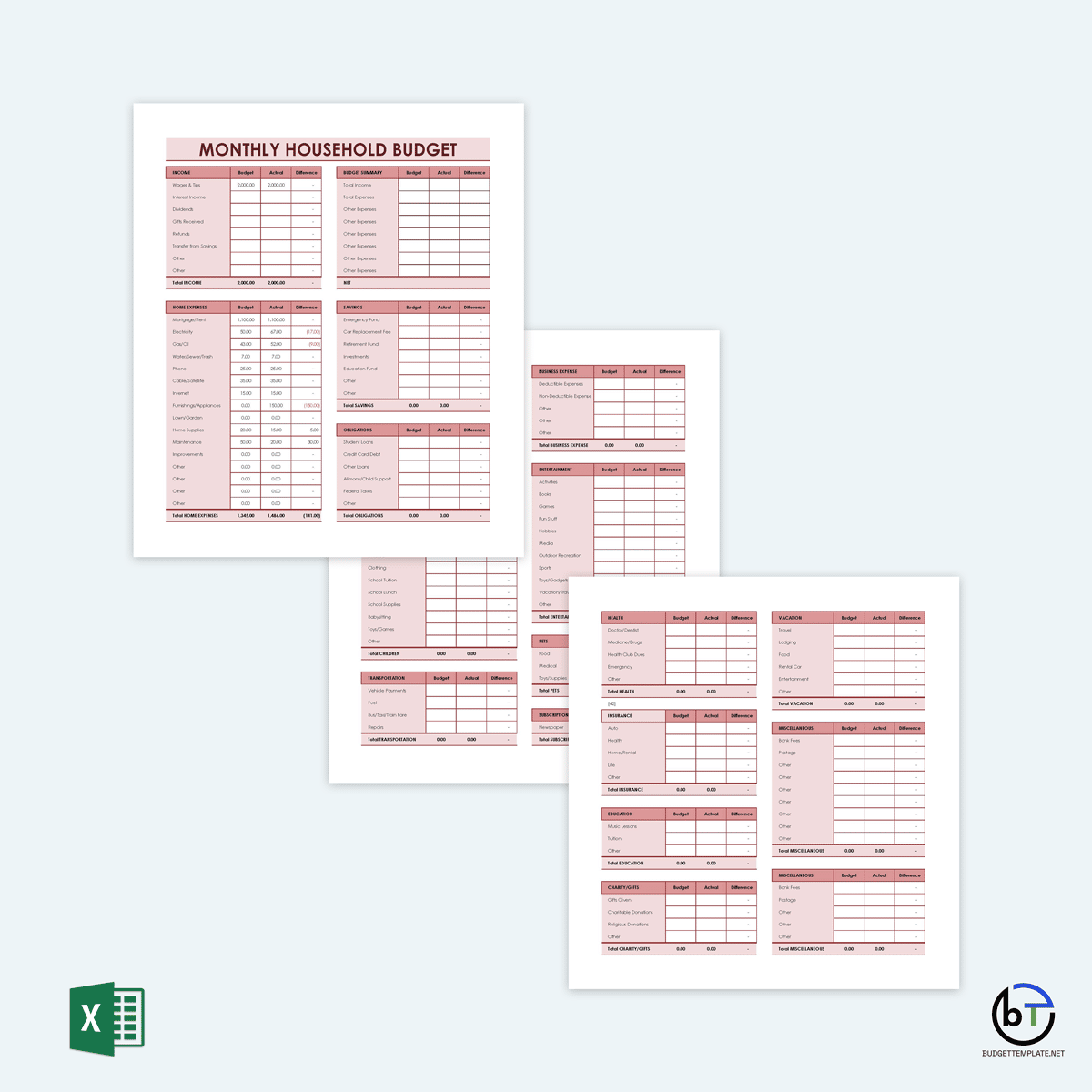

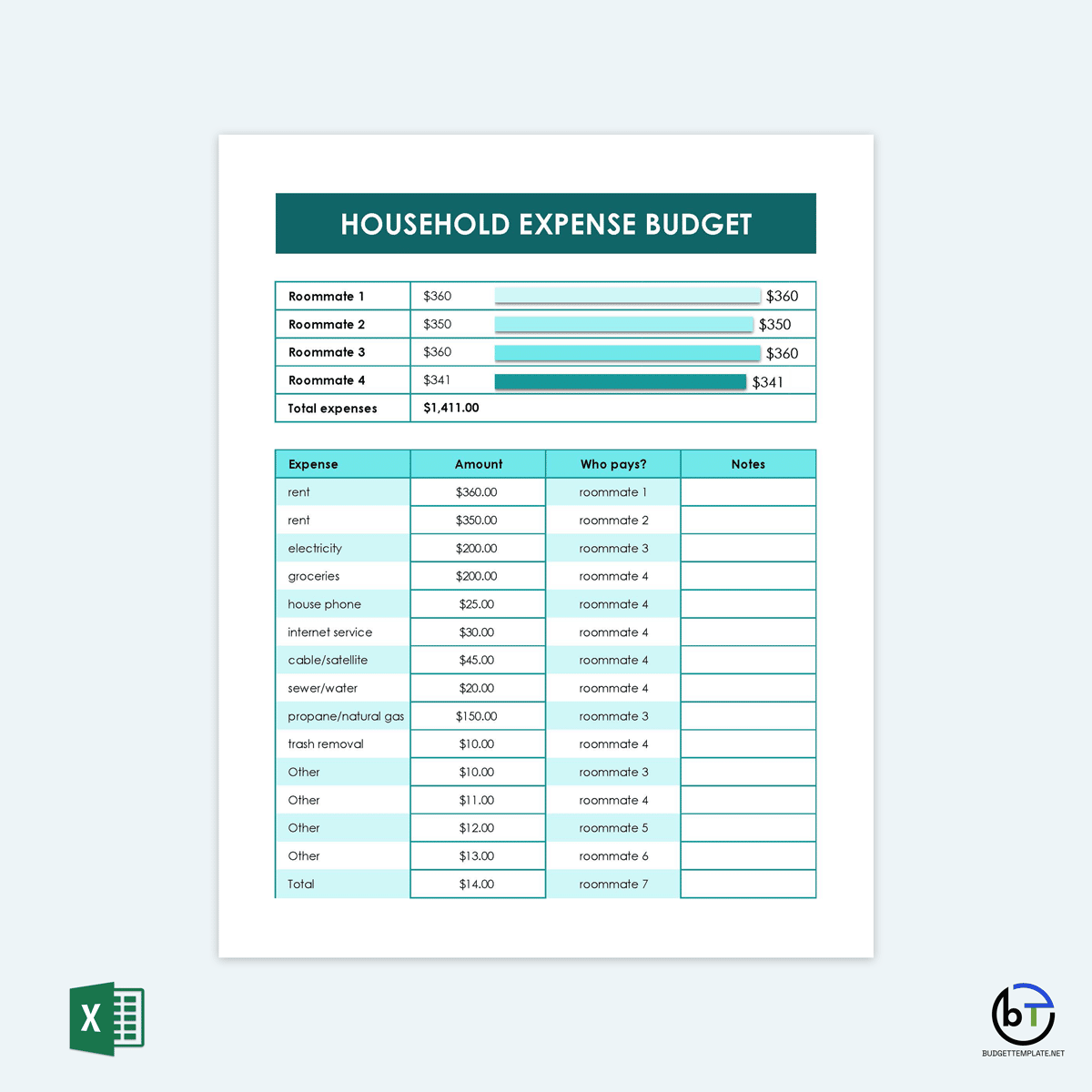

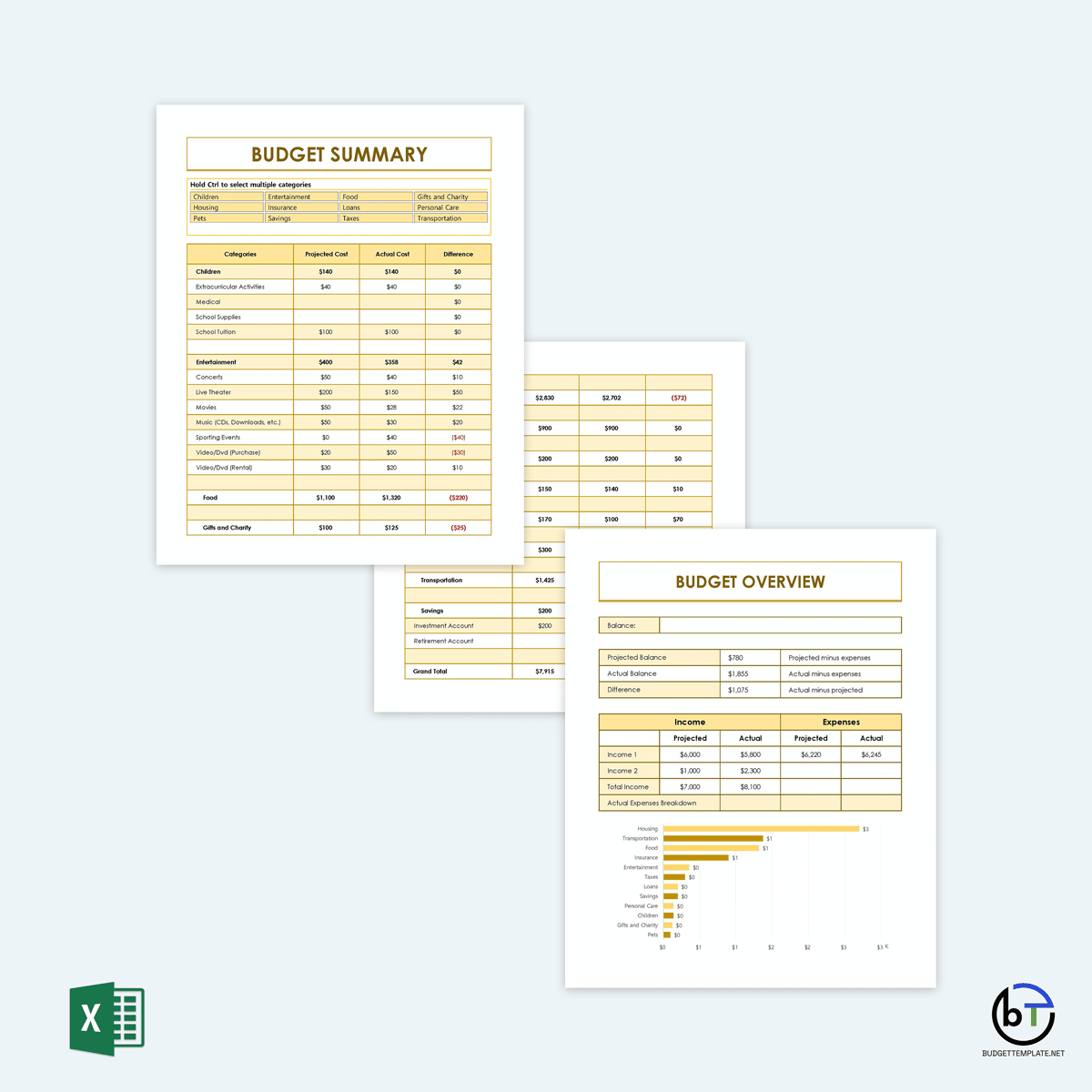

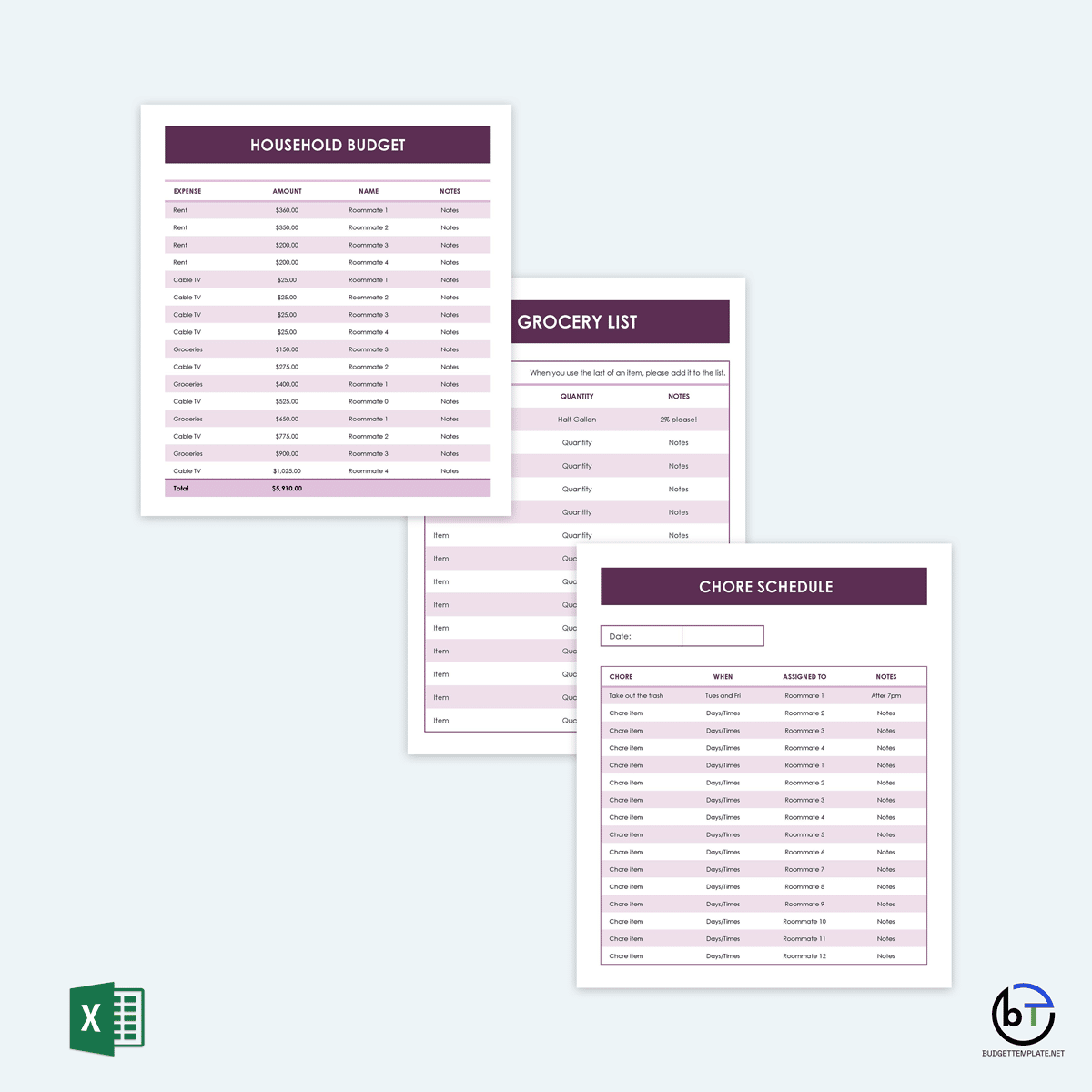

Household Budget Templates

There are free downloadable household budget templates that are easy to use. The templates are pre-formatted and pre-structured to help you focus on the contents of the documents. This also means that they can be re-used as they are uniform and require consistent information to be indicated. In addition, the household budget templates reduce the risk of errors by providing a framework of the necessary elements. This website has provided a list of free pre-formatted financial templates for you to download and use if you want to save money, manage your finances, or want an easy way to outline your financial needs and goals.

Smart Budgeting Tips

There are several practices that a budget maker should consider using. These practices will help make the budgeting process more efficient.

They include the following:

- Track your spending: The budget maker should consider tracking their actual spending habits for the month and comparing them to the household budget. It will help them identify instances where they went over budget or saved money. It also helps them identify areas that require additional spending. Finally, the budget maker will be able to use the information obtained to adjust the household budget.

- Analyze at the end of the month: An end-of-month analysis should also help identify if the budget maker is spending more than they are bringing in or if money is leftover. The budget maker can use this information to either adjust the areas they are overspending or decide on what to do with the extra money. If the budget maker is saving money, they can decide to allocate the extra money to their retirement or emergency fund. They can also opt to use it to pay off their debts or use the money to make unique or large purchases like a new car.

- Be realistic: The household budget should contain spending and saving realistic goals. Creating a realistic budget help ensure that the budget maker does not overspend. It ensures the creation of a sustainable financial plan. A realistic household budget eases the budget maker’s ability to stick to the budget.

- Keep a sharp eye on your spending: The budget maker should keep a sharp eye on their spending habits as it determines how much is saved. Even small expenditure adds up and may impact their saving goal. Sticking to the budget and adopting better spending habits helps ensure that the budget maker has more disposable income.

- See if any bank can assist: The budget maker should also consider seeking the bank’s help by asking them to state goals or limit their spending. Seeking external helps keep the budget maker even more accountable for each dollar and cent spent. They should also consider using banking apps that track spending. They will ease the budget maker’s ability to keep a more precise record of their actual spending compared to their budget. It can then alert them when or if they overspend.

- Be money smart: The budget maker should be smart about how the budget is created and kept records. Keeping a clear record of how much money has been spent and saved will help the budget maker monitor progress. They can then determine if they are saving money over time or need to make some adjustments.

Tip: How to budget money?

The budget maker should begin by cutting back on spending to budget money. They can achieve this by cutting back on luxuries and investing in more affordable or cheaper brands. Next, the budget maker should calculate their income and select a budgeting method. A simple method is the 50/30/20 method. Finally, they should monitor, track or manage the budget through regular check-ins.

Frequently Asked Questions

How do you live on a budget?

An individual can live on a budget by tacking and comparing their spending to the budget they created. If the individual’s spending aligns with their budget, they’re on the right track. However, this needs to be a recurring event. Some difficulties may be experienced along the way.

What is a balanced budget?

A balanced budget is a financial management document achieved if the expenses and income are equal. The budget makes neither profit nor loss.

How do you keep a budget?

To keep a household budget, the budget maker should regularly track their spending to understand where money is going and where they would like it. The budget maker can achieve this by checking their account statement, categorizing their expenses, taking the money consistently, exploring options, and finally identifying where changes can be made.

How do you figure out a budget?

The budget maker should start by conducting a financial self-assessment to figure out a budget. Once they understand where they are financially and where the budget maker wants to be, they can select a budgeting plan. The budgeting plan should work with the budget maker’s current circumstances.