A zero-based budget is developed disregarding the expenses or costs of the prior year while requiring justification for all expenditures. Therefore, any expenses included in this type of budget are purely based on the necessity and continuous operations of the business. Zero-based budgeting is thus a technique that adopts this approach of financial management and is not reliant on the budget history of the company. This method allocates every dollar generated to priority operational and strategic goals such that the resulting figure is zero.

Businesses, individuals, or households can use zero-based budget templates to plan and manage their finances.

Note that each financial goal (expenses) has to be justified. The zero-based budget is then prepared from zero (zero-based) in the next reporting period.

How Does it Work?

ZBB allows businesses to focus on specific functional programs, projects, or departments (e.g., marketing and production) whose contribution to the business can be justified at that particular budgeting period. This allows individuals or businesses to align the budget with strategic goals and direct funds to these goals based on necessity and return on investment. In addition, zero-based budgets can progressively allocate funds to specific functional areas over time, enabling the user to compare the impact of the allocations. Finally, due to the objectivity of zero-based budgets, they favor programs, projects, and departments that directly boost revenue and production because these areas are more accessible to justify than other indirect areas such as customer service.

Fundamentals of ZBB, According to Deloitte

Zero-based budgeting involves examining each expenditure of the company from its operations, structure, culture, and systems against the strategic goals and objectives of the company. Zero-based budgets are based on certain fundamental aspects.

According to Deloitte, they include:

- The budget is not tied to the previous budgets or spending. This way, budget allocation is not considered supplementary to existing spending, nor is it based on historical trends. Instead, the urgency and necessity of an activity is the primary consideration.

- Budget cuts are applied across the board. Budget cuts are not limited to specific categories or expenses in zero-based budgeting. Therefore, budget cuts can be done strategically depending on the company’s goals and needs at a particular moment in time.

- This enables a company to budget for specific activities or service levels with objectivity. Consequently, this promotes a “do the right things with the right amount” approach rather than a “do more with less” approach since the company can align its spending objectives with the necessary activities of a function or operation. Therefore, extensive knowledge of all departmental activities is required.

- Funding is directed or allocated to activities or programs aligned with the corporate strategy. Therefore, zero-based budgets are adaptive as they can be created to align with the overall business strategy and departmental missions, which are bound to change with time. In addition, since zero-based budgets are created from scratch each budgeting period, they reduce redundant spending – continuously prioritizing spending on the same activity or department.

Zero-based Budgeting v/s Traditional budgeting

The main difference between traditional and zero-based budgeting is that the latter has no history of previous budgets or spending. The emphasis of a zero-based budget is on spending what is necessary. In contrast, the former strategically allocates resources based on past usage of resources and future profitability. Zero-based budgeting, on the contrary, focuses solely on the current activities and expenditures.

Zero-based budgets focus on which activities should be prioritized, whereas traditional budgets consider how activities should be done to minimize expenses.

Traditional budgets are incremental– that is, expenditures are increased every year. Typically, budget increments range from 1-to 10%. The previous budget is used as the base. Conversely, expenses on a zero-based budget require justification regardless of how much was spent in the previous budgeting period. Therefore, the budget starts from scratch – from zero. Traditional budgeting is more accounting-oriented, while zero-based budgets are decision-oriented.

Traditional budgets are also known to have a narrow scope, whereas zero-based budgets have a broad scope since they focus on every area of expense. In addition, traditional budgets can consistently focus on specific cost areas, whereas zero-based budgets have to be adjusted to align with present company strategies.

How to Start Budgeting?

Although zero-based budgeting may be challenging, it is a potent financial tool. Therefore, adopting zero-based budgets can improve the financial decision-making of a company.

Below are the basic steps of using a zero-based budget template for budgeting:

Know your income

Firstly, understanding your finances and cash flow is extremely important. The aim is to identify the main contributors to the company’s income. It will enable you to determine the income available for allocation to different activities, projects, or departments. Know how much income will be received – sales, accounts payable, interests, loans/credit, etc.; determine when it will be received. This information can then be used in the zero-based budget templates.

List your expenses

Expenses are required for any business to operate. First, identify the general areas of management or operation expenses such as accounts payable, advertising, equipment maintenance, employee salaries, etc. Next, list the specific expenses. For example, if you require a new car for work because you work at an offsite location and drive there every day. This expense can be justified when the zero-based budgeting method is applied because it will affect your productivity.

Categorize your expenses

List the different types of expenses that your business will incur. This will enable you to develop budget allocations for assets (i.e., accounts payable) and liabilities (i.e., employee salaries) and produce detailed estimates of expenses by function or department, e.g., administration, production, etc. This will enable you to decide how much of an activity or department’s budget should be allocated to that particular area. These will be considered in a zero-based budget template based on necessity. Additionally, you can categorize the expenses into wants and needs

Evaluate the costs

Once the expenses have been identified and categorized, evaluate the costs by function or department and against the target income or other business objectives for the reporting period. This will enable you to determine if the costs are reasonable or justifiable. If they are not, it is highly recommended to make changes to eliminate unnecessary activities.

Streamline

Next, create a framework for executing the provisions of the zero-based budget template. Determine the activities that will be performed and the proper implementation order. The selected processes can be automated and standardized.

Execute

Lastly, execute the zero-based budget developed from the template. At this point, the zero-based budget template is complete and ready to be implemented. Monitor how well the zero-based budget template works and whether it achieves its intended objective.

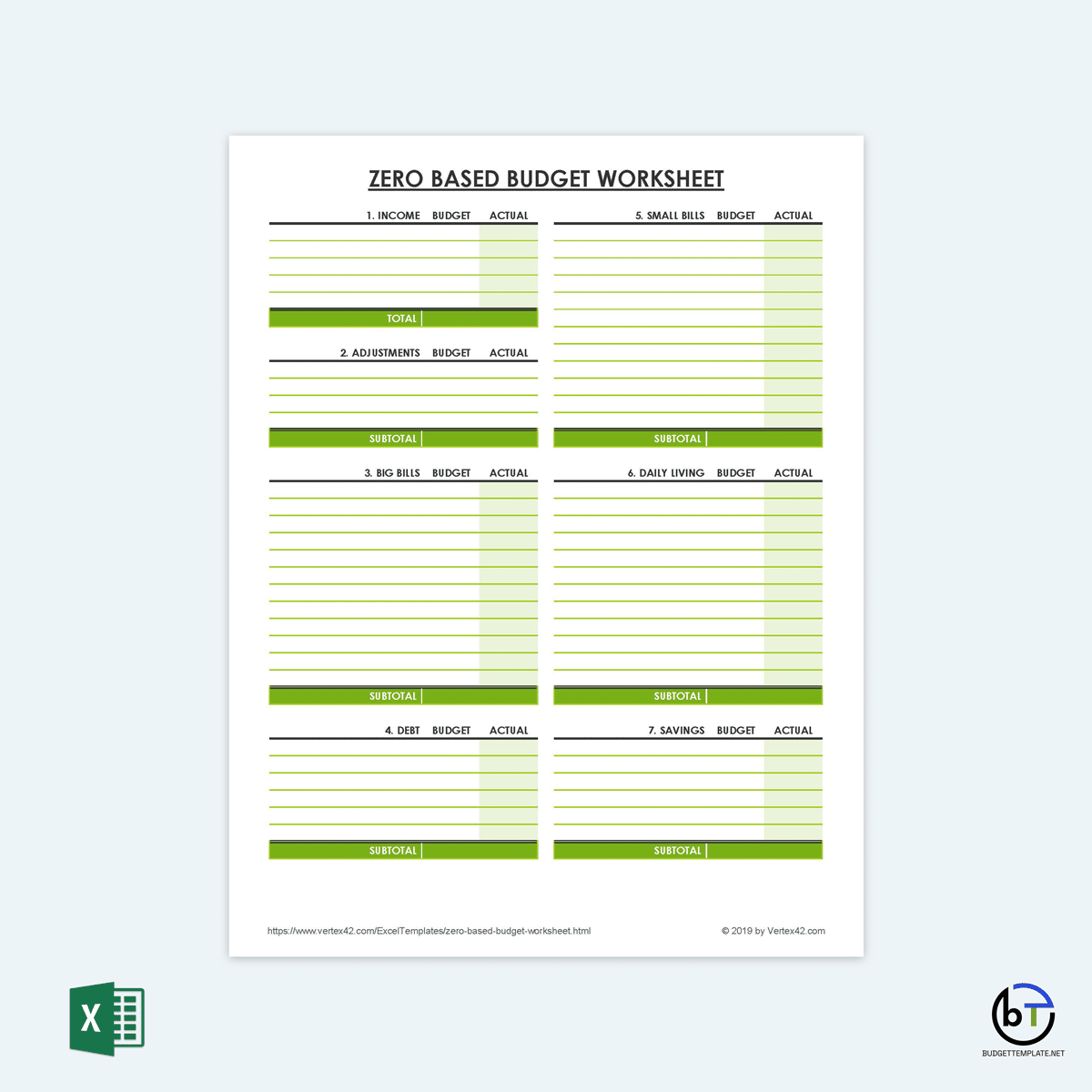

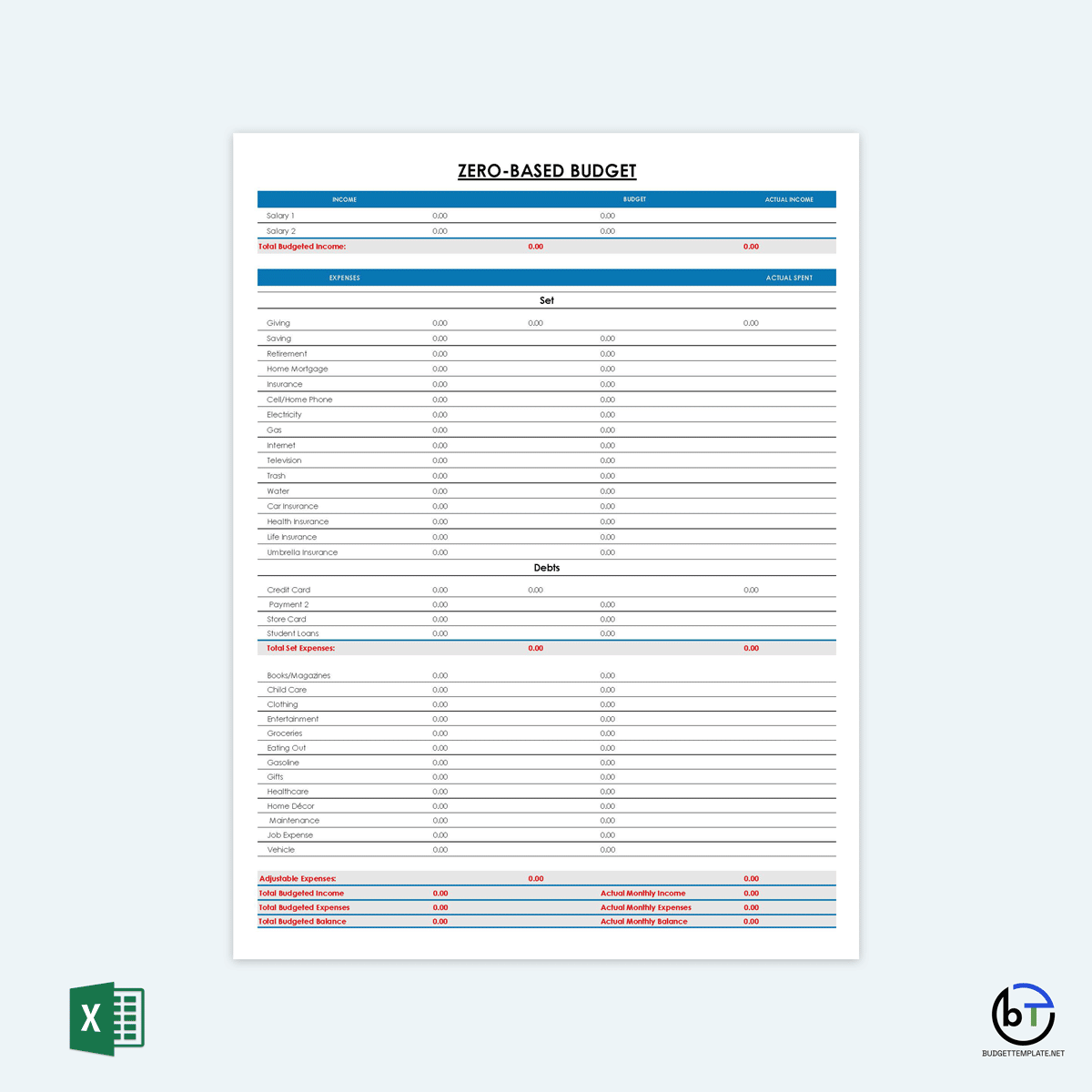

Zero-based Budget Templates

Zero-based budget templates are ideal for businesses managed by executives at lower levels but can also be utilized for personal budgeting. This website has provided the readers with such templates. These templates use a standardized format that allows easy translation across different ownerships or companies. The best thing about zero-based budget templates is that they can be easily modified to incorporate specific company goals. Moreover, the templates are free for download.

Best Practices for Business

Zero-based budget templates can be highly beneficial to the business if well executed. Several ways you can increase the effectiveness of your zero-based budget template include:

Adopt a positive approach

The objective of the zero-based budget should be to allocate the income and cut expenses to maximize profit, minimize waste and maximize efficiency. This positive approach ensures that resources are freed up and distributed where needed, thus fostering growth. However, the zero-based budget’s goal should not be to cut costs without explaining what happens to the saved revenue.

Identify the quick wins

The zero-based budget should initially focus on more stable areas that will generate significant savings with minimal disruptions to the functionality or operation of primary activities. Also, it can focus on areas where indirect costs are not clearly defined, for example, departments with overhead such as sales and administration. These departments can cut costs to obtain revenue to be redirected to other areas where direct and immediate profits can be realized.

Assemble your team to make it

Cooperation is vital in zero-based budgeting. A multi-departmental team should be involved in creating a zero-based budget. Zero-based budgeting focuses on each business function, project, activity, or program independently to ascertain its significance towards strategic goals. Thus, parties conversant with these areas must be present. The team can comprise sales, production, IT, etc., and a C-level executive. In addition, third parties can be involved to mediate where compromise must be made.

Select the right planning

Zero budgeting requires considerable amounts of data that affects spending to be analyzed. This includes productivity ratios, input costs, activity volumes, etc. Therefore, adopting the right financial plan can reduce the workload and complexity of the process. A suitable financial planning tool can be used to this effect.

Plan for sustainability

A zero-based budget template should be progressively reviewed. It would be best to move to other business areas once money allocations have been directed towards prioritized categories and successfully implemented. This way, the ZBB approach remains sustainable without neglecting specific departments.

A Few Advantages and Disadvantages

There are numerous advantages to using zero-based budgeting in the business world. However, it is associated with certain disadvantages. They include:

Advantages of a zero-based budget

The advantages of a zero-based budget template include:

- Zero-based budget templates increase budgeting efficiency by allocating finances towards areas, activities, or programs with the most impact. This is also because every expense has to be justified.

- Zero-based budgets promote collaboration and communication within departments and the company in general. However, each department’s contribution toward company goals must be considered before making allocations.

- Redundant activities can be eliminated. This way, funds can be redirected towards more productive and profitable, and money can be saved. Businesses that use zero-based budget templates can save 10 – 25%.

Disadvantages of a zero-based budget

Some of the downsides of using a zero-based budget template include:

- Zero budgeting involves a large team, resulting in issues significantly when compromised. Also, it may require qualified and specialized personnel. Therefore, some departments may be disadvantaged in terms of money distribution.

- Other areas may be overlooked by prioritizing some activities, projects, and departments. This may damage certain aspects such as the business’s brand image, customer service, and other aspects whose productivity and contribution towards revenue are often not direct.

- Zero budgeting can be complex and challenging. This is because of the time, research, and analysis involved in zero budgeting. This may end up dragging the process, unlike traditional budgeting. Traditional budgeting is easier and faster.

Final Thoughts

Zero-based budgeting is an excellent tool for businesses in need of better profitability. If well implemented, it will enhance the company’s stability, efficiency, and overall performance. Companies adopting zero-based budgeting must be aware of the risks involved with implementation. However, it is a necessary evil. Executives and managers are optimistic that this process will lead to significant changes in the company’s performance and its role in decision-making processes.