An annual budget is a formal document that shows a company’s financial record and estimated finances for one year. This document needs to have a defined scope that entails the expenses and the projected income for that period. Plus, any company creating a yearly budget must have first properly balanced their books.

This means the income that has been estimated must be able to cover the expenses for that year. Yearly budget templates also allow companies, individuals, the government, and any other organization to plan their financial activities for the year correctly.

The yearly budget template is an essential formal document that outlines the expenses, inflow, and other financial records of a company, individual, government, and organization for a particular year. This document’s role in any company is imperative to its survival as it ensures there is an action plan to handle all forms of finances for that year.

A yearly budget template is incredibly essential to the growth of any company as it allows you and the rest of the team to operate with a realistic budget that will help in smoothly running the company’s affairs. If your company is embarking on completing a particular project, this budget will also consider this. However, it is quite different from a project budget, but the latter influences the former when a company starts to plan its financial activities based on its five-year plan.

Importance of It

The yearly budget template is a vital formal document that every company, organization, and even individual needs when planning their financial activities. Furthermore, one of the perks of having an annual budget is that it allows the company or individual to set their goals properly. With the help of this budget, you can decide on the most critical aspects of the business and determine your spending ability. Furthermore, by allowing you to set defined goals, you can effectively monitor your progress in different aspects of the business for long-term growth.

It is also a great way to review your ability to expand your company. The budget gives you a sense of direction. It provides a suitable platform for hiring new staff, setting new goals, and capitalizing on opportunities concerning your company objectives. Furthermore, A yearly budget template is a great way to predict the expenses such as bonuses, salaries, and other benefits for employees. Plus, you can use a yearly budget to reduce the stress of tax preparation and create new lines of credit for your business.

Steps of Preparing a Yearly Budget

You must have a yearly budget as a fully functional company to have a smooth working year free from financial issues. It is an essential document to avoid financial complications during the year.

Therefore, to get things right and set yourself up financially for the year, there are a few steps you need to follow:

1. Decide how to prepare a budget

In deciding how you will prepare a budget; two methods guarantee success. These are, based on the previous year’s budget and the Green-field budget.

So, let us look at these intricate elements in preparing a budget:

1.1. Based on the previous year’s budget

This method outlines how the present budget will differ from the previous year’s. It would be best to look at what happened in last year’s budget and understand the issues and complications. This allows you to adjust the figures for the current year to avoid any issues and accommodate new expenses for the year.

If your company had two branches last year but this year is looking to open one more branch, then the budget will have to be adjusted to suit the expenses that come with opening a new branch. However, you already have a solid financial record based on what was obtained in the previous year. In retrospect, the yearly budget for the previous year acts as a foundation on which you develop the current annual budget.

1.2. Green-field budget

On the other hand, a green-field budget is a formal document that does not have any foundation to build on. However, this kind of budget requires you to segment the information and expenses into different bits for easy allocation of funds. Due to the complexity of this type of budget, it can be difficult to compress all information into one space. Therefore, you can split the budget into different activities depending on the goals for that year.

A green-field budget is done in stages. If you are adding a new branch to expand your company, you can segment the budget into operations, investment, maintenance, and partnerships. To further simplify the process, you can create sub-segments in each area. Operations can have staff training, materials, tools, and others. Investment can be divided into digital currencies, fixed deposits, and others if an individual wants to create a green-field budget.

2. Review loss and profit statements

Now that you have decided how to create your budget, the next step is to look at the previous year’s financial statement. You need to ask yourself pertinent questions like, what contributed to profit and the loss last year or the previous two years in the company? What are the necessary and unnecessary expenses that were seen in those years? The answers you get will help you plan and avoid similar dire situations as in the past.

By looking at the average of the numbers you saw from the previous budget based on the profit and loss statements, you can adjust the gross margin, investments, and other financial activities for the coming year. The profit and loss statements provided will allow you to see what needs to be done to avoid the problems of previous years. You can then adjust the figures to accommodate new objectives so that the company can continue to function as it expands.

3. Examine capital expenses

Productivity is an essential aspect of a thriving company and organization; therefore, examining the capital expenses for the year is necessary. When we talk about capital expenses, we mean things like machinery, equipment, furniture, and other things contributing to the workflow. So, with the new branch, you are looking at, since that is the example we are going within this article, you need to consider the employees’ equipment.

Also, remember that there are some tools that you will need to update for your employees to function regularly and thoroughly. That must be included in the budget as well. Examining the capital expenses can significantly impact the productivity and revenue of your company. Plus, evaluating the capital expenses can also help you invest in better tools that will enhance the company’s operations. However, whether new or updated tools, all the information needs to be appropriately documented in the yearly budget.

4. Estimate operating expenses for the year

There are recurring costs that your company will undoubtedly always have. These operating expenses are categorized into two separate entities: Administration and operations; Contributions to reserves.

4.1. Administration and operations

This category relates to the cost used to effectively run the company’s affairs daily. So, you can have costs for maintenance and utilities. Plus, costs like employee benefits, wages, and training are part of administration and operations. You need to understand what costs you incur each year, whether administration or maintenance.

Look at your costs on insurance, taxes, training, wages, or benefits. Plus, examine the costs you incur on maintenance, testing, product management, equipment, or other areas in terms of operations. It is imperative to find out your priorities and plan toward those areas.

4.2. Contributions to reserves

There are different contributions you make to reserve accounts each year as a company. In creating the budget, you must look at this part of the expenses. How much are you contributing to reserves? Plus, comparing the figures with other expenses and financial records will help you plan better. Some companies adjust the figures they contribute based on their priorities. This is how this budget provides a guide for estimating operating expenses based on the set goals for the year.

5. Calculate your cash flow

You must create a cash flow statement to see how you can handle essential expenses. For example, if you need to get a set of new equipment for the employees, do you have the financial capacity to do so? By using your income statements, you can correctly calculate your cash flow to quickly get the necessary items essential for the company’s growth. Of course, your turnover rates are also instrumental in calculating your cash flow, so that needs to be sorted as well.

6. Put the budget in your finance system

Your finance system relates to the company’s revenue and expenses for some time. Therefore, it is advisable to divide the projected budget by each month in the year. Then, after every month, you should review the revenue and expenses to see if it tallies with your estimation. Then, as each month unfolds, you can see how the entire budget looks. Then, your finance system will show you some adjustments for the next month to align with the yearly budget.

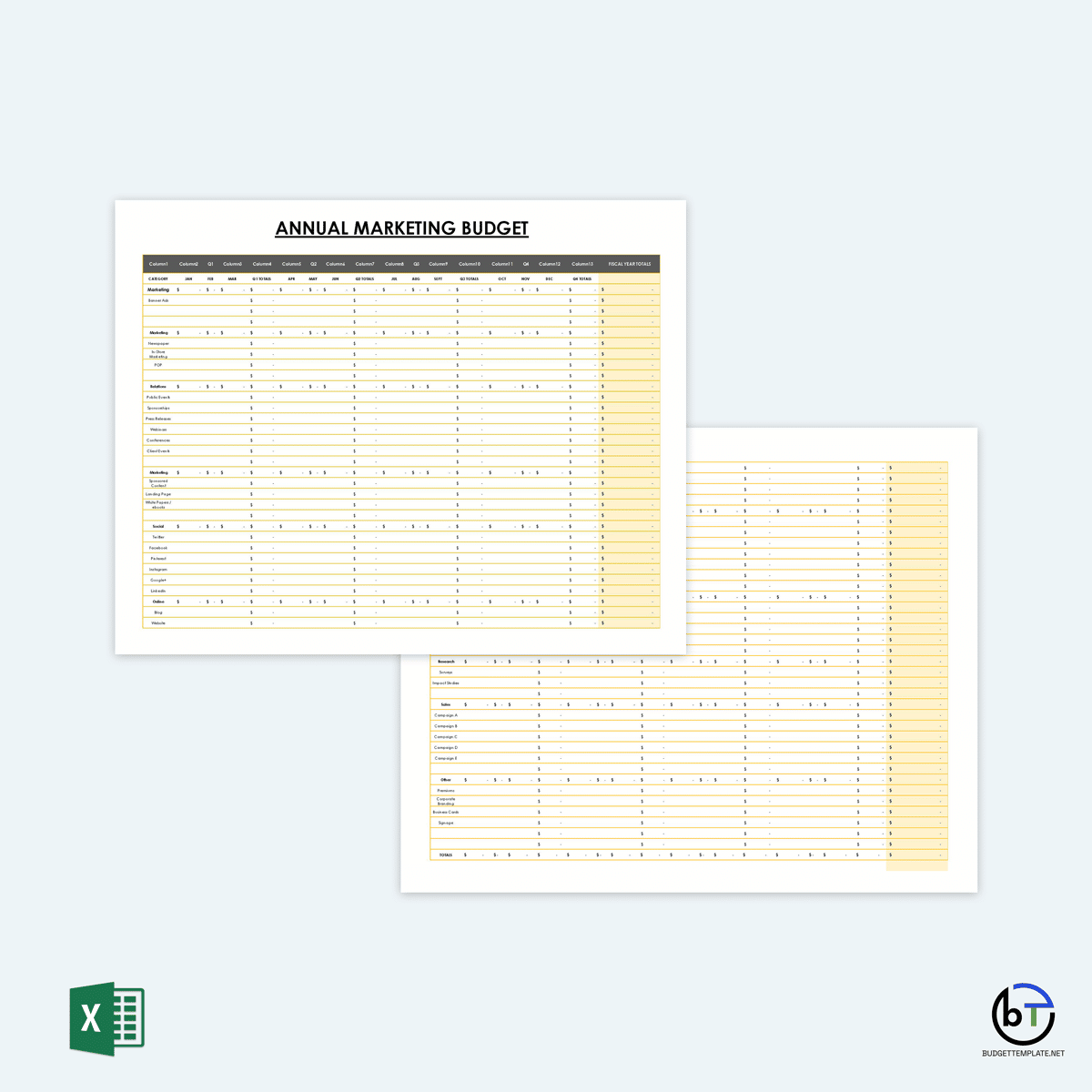

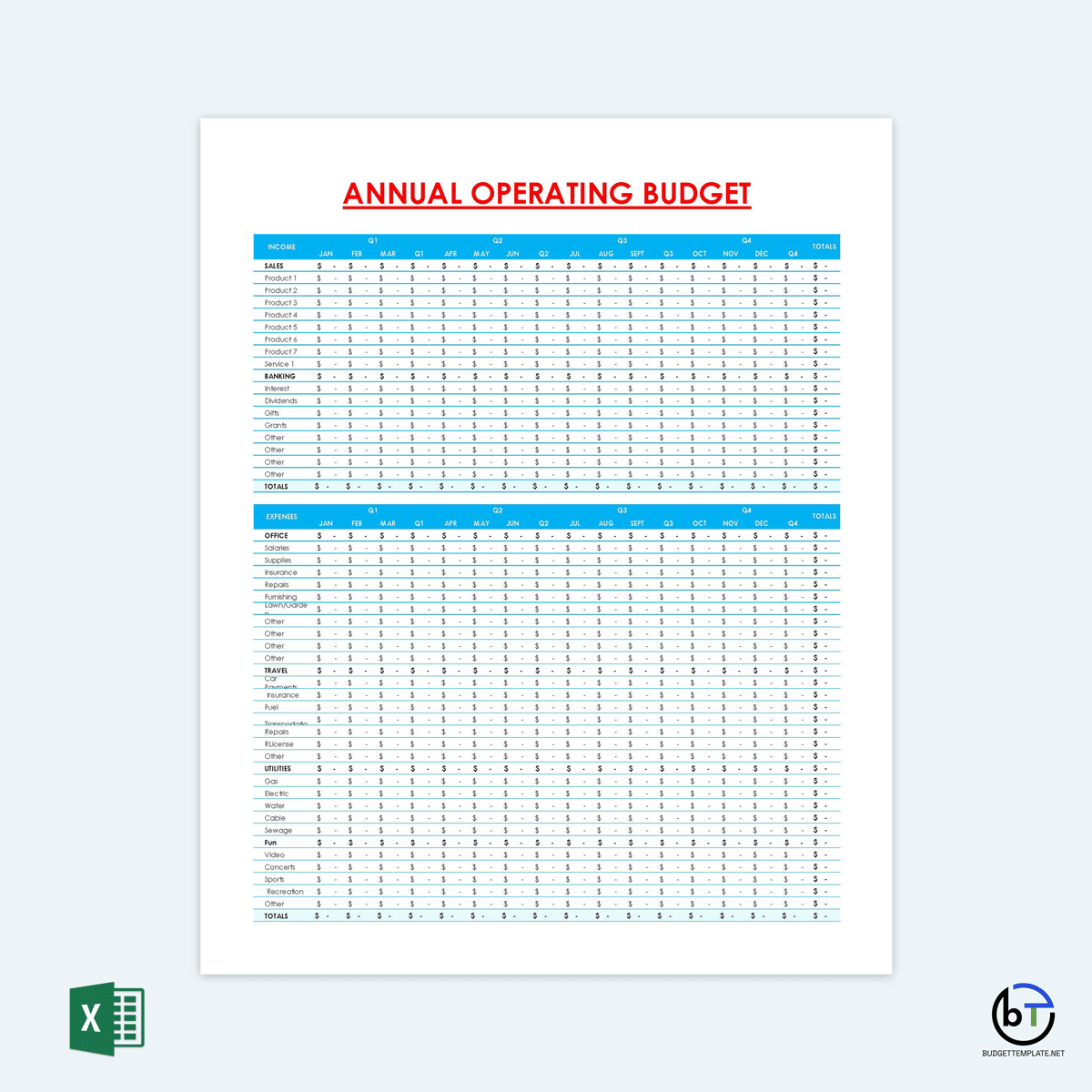

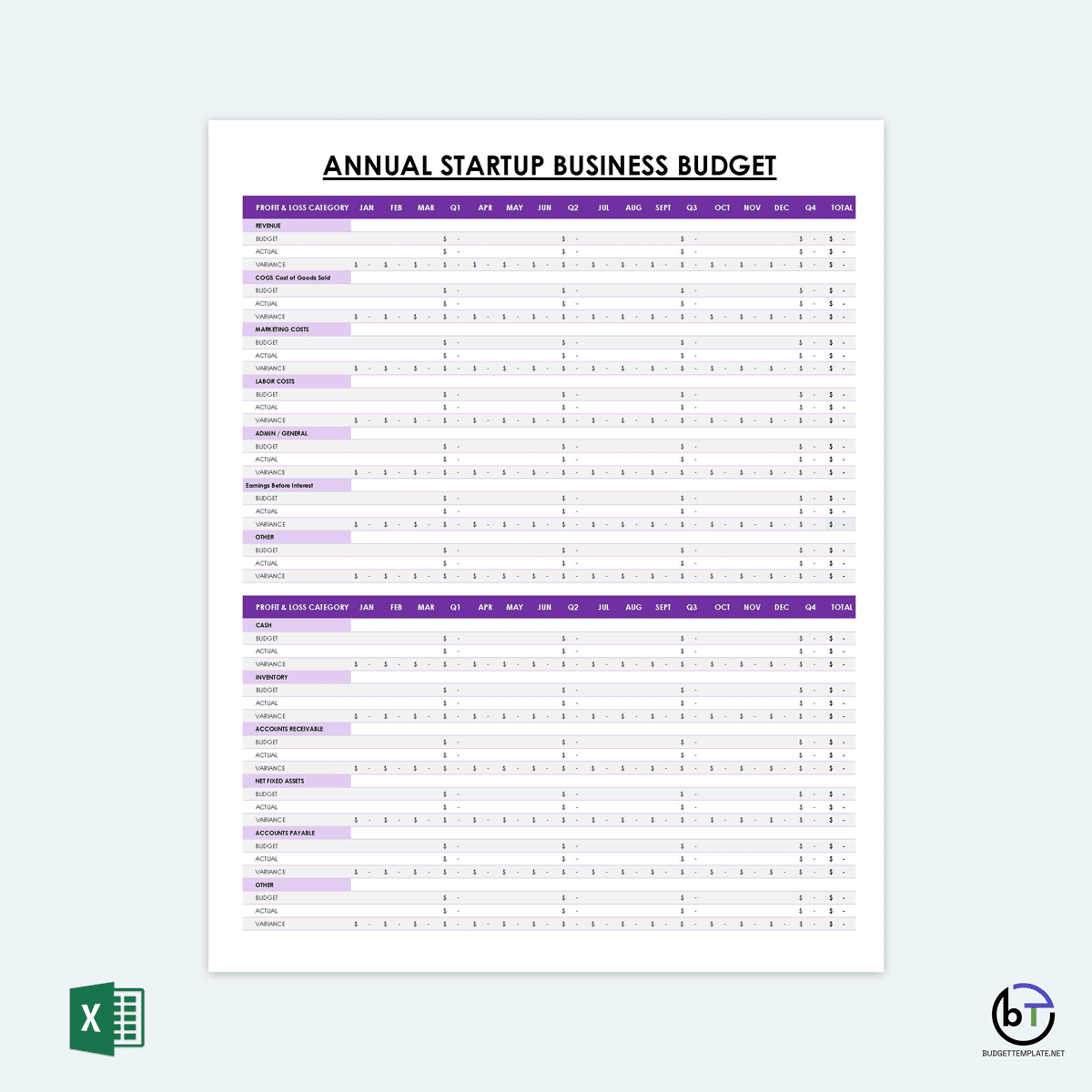

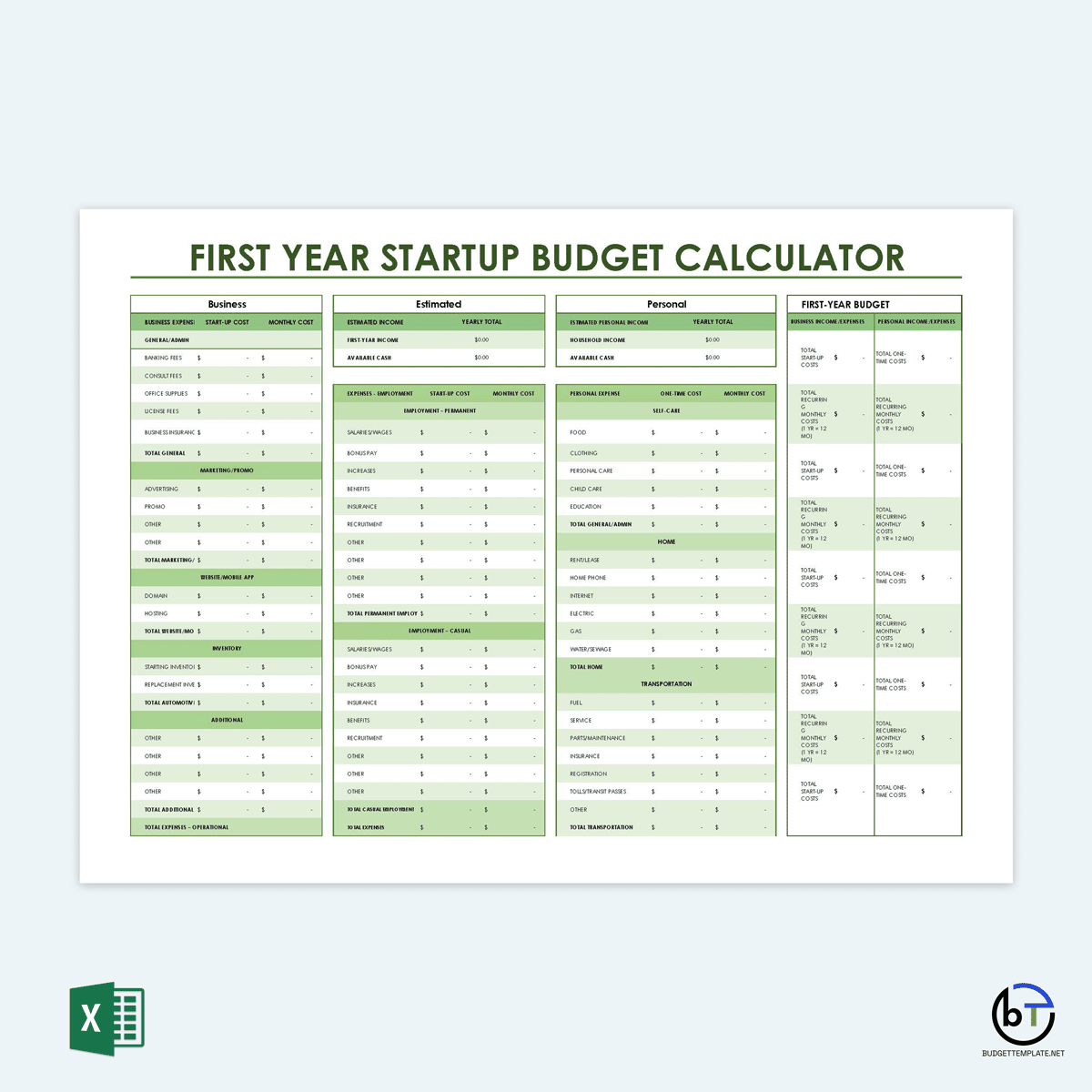

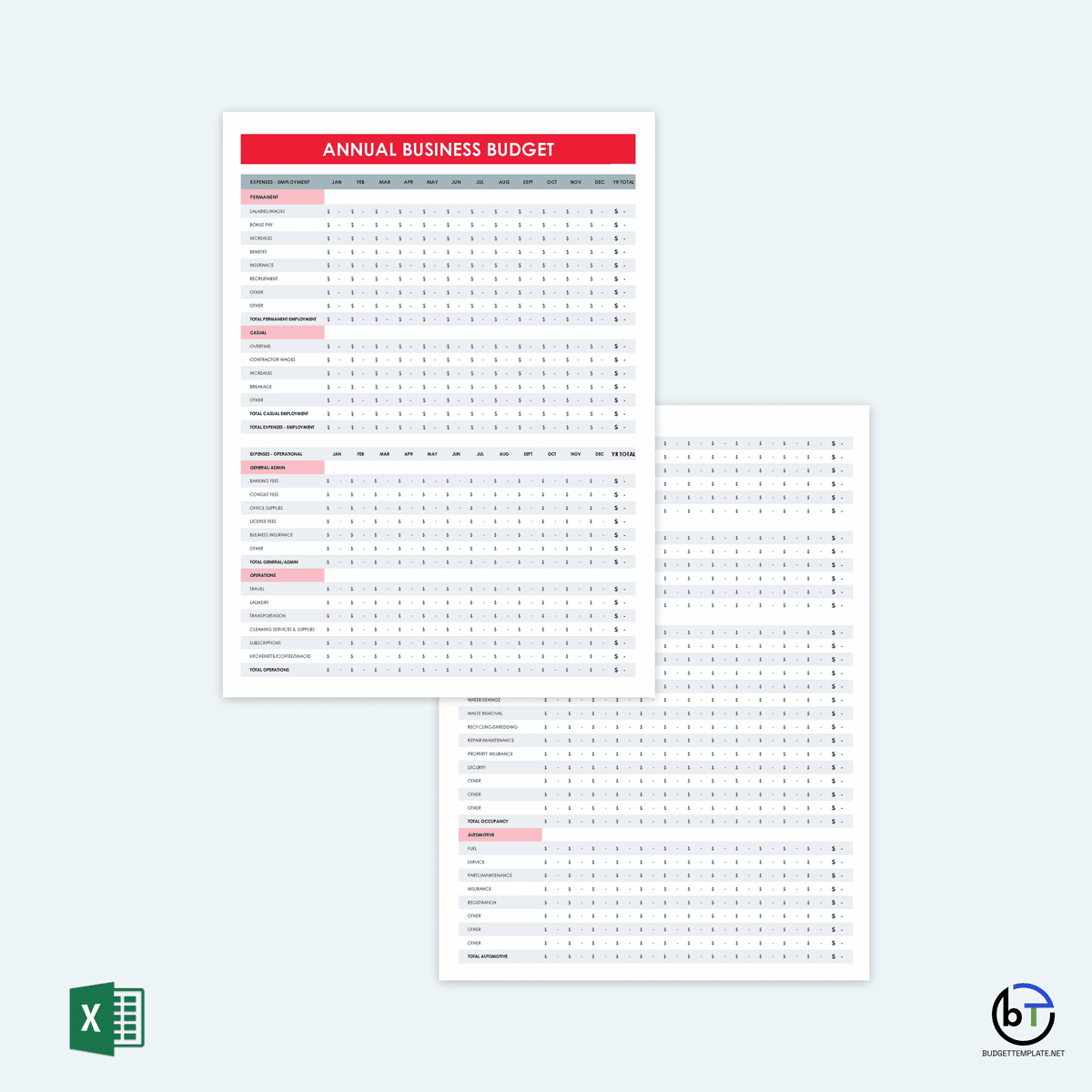

Yearly Budget Templates

Whether you want to prepare a budget based on the previous year or you have the green-field budget in mind, this website has free download yearly budget templates that fit your company. These yearly budget templates have been tested and trusted for their credibility and incredible ease for different companies. It is best to have a yearly budget template to work with; it makes planning easier. In addition, we have simplified the process for you; all you have to do is access templates that best suit your objectives.

Clever Budgeting Tips

Although, some essential steps to prepare a quality and adequate yearly budget have already been mentioned. However, some more tips will help you properly plan your finances for the year:

Consult with other departments

It would be complicated to estimate expenses on your own, especially when there are some experts in those fields of endeavor. Therefore, it would be great for you to consult with departments and understand the current trends, costs, and expenses needed for their areas to thrive. This allows you to set a realistic value for things that you need.

Imagine purchasing new laptops for employees and going with half of the money because the appropriate department was not consulted. Consulting with departments knows how operations will soothe the budgeting process.

Be realistic

You would not want a situation whereby the company cannot pay salaries in the middle of the year because you underestimated the expenses. You must be realistic, as tempting as it might be to overestimate your revenue. Look at what was obtained in the previous years; are there any improvements? What investments have been put in place to ensure that your revenue will increase?

These questions will help you to avoid overshooting the revenue and neglecting expenses. There must be a balance, so setting realistic goals and objectives with the budget will remove any future complications.

Begin early

Preparing a yearly budget can be a long and tiresome endeavor. Plus, it is not a document you want to rush to prepare. So, if you want to prepare for the next year, it is best to start probably around September and October. Then, you can have a sense of what has happened in the current year.

In addition, as you prepare your budget early, you can adequately consult with other departments and make the proper estimations without overshooting or underrepresenting any figures.

Wrapping Up

There are a lot of intricacies involved in preparing a yearly budget template, and it is based on your understanding of these areas that will determine productivity and a smooth financial year. First, remember that your budget has to address your company specifically; you can take cues from the templates that have been given.

But, it is imperative to note that each budget for the year, although similar, is uniquely based on adjustments and market trends. Finally, your budget should be clear and concise without ambiguity for easy comprehension and implementation.