People sometimes have trouble knowing how much they are spending every week. It can be confusing to keep track of everything and even frustrating sometimes if you realize you’re spending more than your budget allows.

A weekly paycheck budget template is a great way to keep track of spending and save money, especially if paid weekly or bi-weekly. This template helps you organize your spending habits in the form of a weekly paycheck budget to make sure that every bill is covered.

Many people find that a weekly paycheck budget template is an effective way to manage their finances and ensure that they are saving enough for the future. This article’s information will help explain what it is and how you can use a weekly paycheck budget template.

What is the Weekly Paycheck Budget?

A weekly paycheck budget is a specific budget designed for people who get paid every week or bi-weekly rather than every month. In this case, a weekly paycheck budget template makes it simple to look at how much money you make, your expenses, and how much money is available after your expenses are paid.

Each expenditure is assigned to a paycheck to ensure due dates are met. A weekly paycheck divides a monthly budget into different paycheck budgets, making it easier to keep track of your spending and make adjustments as needed to ensure that you stay within your budget and never go into debt.

Benefits of making it?

A weekly paycheck budget provides you with some distinct benefits. Some of these benefits include you learn to balance your spending and income. Using a weekly paycheck budget makes you more familiar with how much money you make monthly and spend every week. This helps keep your spending within your means, which will allow for better financial management. Finally, using a weekly paycheck budget gives you more accurate and exact figures about your spending habits.

With the help of a weekly paycheck budget template, you’ll find that your budgeting is easier to keep track of and that it will require less work for you to stay within your budget. A weekly paycheck budget allows you to plan and set aside enough money to cover your expenses. It ensures every bill will be paid on time, which can help relieve some stress and anxiety. A weekly paycheck budget also allows you to take advantage of any extra money that may come up within certain weeks or pay periods.

For Whom is it Suitable?

A weekly paycheck budget template is an excellent tool for any person. In general, this type of budget is excellent if you have a lot of flexibility in your schedule and may work at different locations or hours each week. You should consider adopting a weekly paycheck budget if you are one of the following persons:

Who gets paid more than once a month

A weekly paycheck budget can be adopted if you earn your money through self-employment, different part-time jobs, or get some extra cash from freelance work resulting in multiple paychecks. In such cases, you should adapt the template for the weekly paycheck budget to suit your needs. Using the template, you can manage your finances and ensure enough money to cover your monthly bills and that you don’t spend more than you earn.

Who lives paycheck to paycheck

Suppose you are someone who has a very tight budget and lives paycheck to paycheck every month. Then, it’d be prudent to opt for a weekly paycheck budget. This type of budget will help you know how much money you are spending every week and make it easy to save money regularly through simple savings.

Who is new to budgeting

A weekly paycheck budget can be reasonable if you are new to budgeting. Once you figure out how much money comes in every paycheck, it will be easier to plan your expenses accordingly if you are someone who wants to have a better understanding of your finances. Then, a weekly paycheck budget is a suitable choice for you. Once you have selected your weekly budget template, it is essential to adapt it to suit your style and preferences. The purpose of budgeting is not just to ensure that you stay within your income and expenses but also to manage your money better in the short term and the long term.

Note: What happens when you have too many bills due at a time?

If you have too many bills due simultaneously, it may be difficult for you to pay them. You may have to figure out the solution. The best thing you can do for such a situation is to reach out to the associated institutions such as credit card companies, landlords, insurance companies, and banks. Let them know about your situation and ask them to extend their payment due dates. This can help you evade the embarrassment of paying late fees or having to pay interest. Most companies/institutions will be more than willing to adjust the due dates to accommodate your financial situation if it means you will get to pay on time in the coming months.

Steps to Create a Weekly Paycheck Budget

Creating a weekly paycheck budget is a simple process and can be done in several minutes tops. You don’t need to be a budgeting professional to utilize this type of budget effectively. The following comprehensive steps outline how you can create a weekly paycheck budget template effectively and efficiently:

Know your paydays

First, you need to know your paydays to set up your plan accordingly. This can be determined by noting the dates on which you get paid. These dates should be noted down on a calendar or in your desk diary so that you have a record of them. If your paycheck is not fixed, you can use online calendaring programs such as google calendar. This will allow you to effortlessly make changes if there are any changes in your paydays.

Figure out your weekly income

Once you have the date of your payday, you can then figure out your gross weekly income. This can be accomplished by adding up all of your expected earnings for that week. It would be best to remember to include any bonuses, commissions, or tips that you may receive as part of your paycheck.

Write your bills on the blank calendar

Now you can determine the different items and costs included in your weekly paycheck budget template. Start by determining bills due at the end of the month, including rent or mortgage and utilities such as water, electricity, gas, and cable. If you pay for a car every month, this should also be added to your budget and any insurance costs associated with your car. Finally, note the due dates of each bill on the blank calendar to ensure you avoid missing payments.

List all expenses

This may require you to add up each monthly expense, such as groceries, gas, entertainment, clothing, dining out, etc., and then divide by the number of paychecks per week. For variable expenses, consider using the average expenses from previous months. Variable expenses can also be broken down into several expenses, for example, based on weeks.

Instead of accounting for monthly grocery expenses, account for them as a weekly expense. This will help you see how much you will be spending on each item and can help determine whether there is enough money allocated. You should include all of your bills and expenses (fixed and variable) in this list and their respective costs.

Split the expenses into mandatory and lifestyle

Now split your expenses into two categories. Mandatory expenses should include your bills and debts, rent or mortgage, utilities, and food. On the other hand, lifestyle expenses consist of optional items you may need to spend money on, such as clothing, entertainment, or holidays. Therefore, mandatory expenses should be prioritized first. This will ensure that you don’t overspend on the lifestyle items since these are optional.

Assign expenses to paycheck

Now assign your expenses to the different paychecks. This should be completed in a manner that makes sense to you. For instance, you may want to assign all of your bills to the first paycheck so that once you receive the second paycheck, you can immediately pay off your debts. Alternatively, you can assign expenses based on due dates where urgent bills such as rent, groceries, and utilities are covered first. You can use color coding for this exercise – label each expense with the same color as the paycheck.

Include savings and emergency funds

Lastly, you need to include your savings and emergency funds in your weekly paycheck plan. This will prepare you for unforeseen expenses that you may need to pay. It is essential to have these funds available, especially if you do not have an emergency fund at home and live paycheck to paycheck.

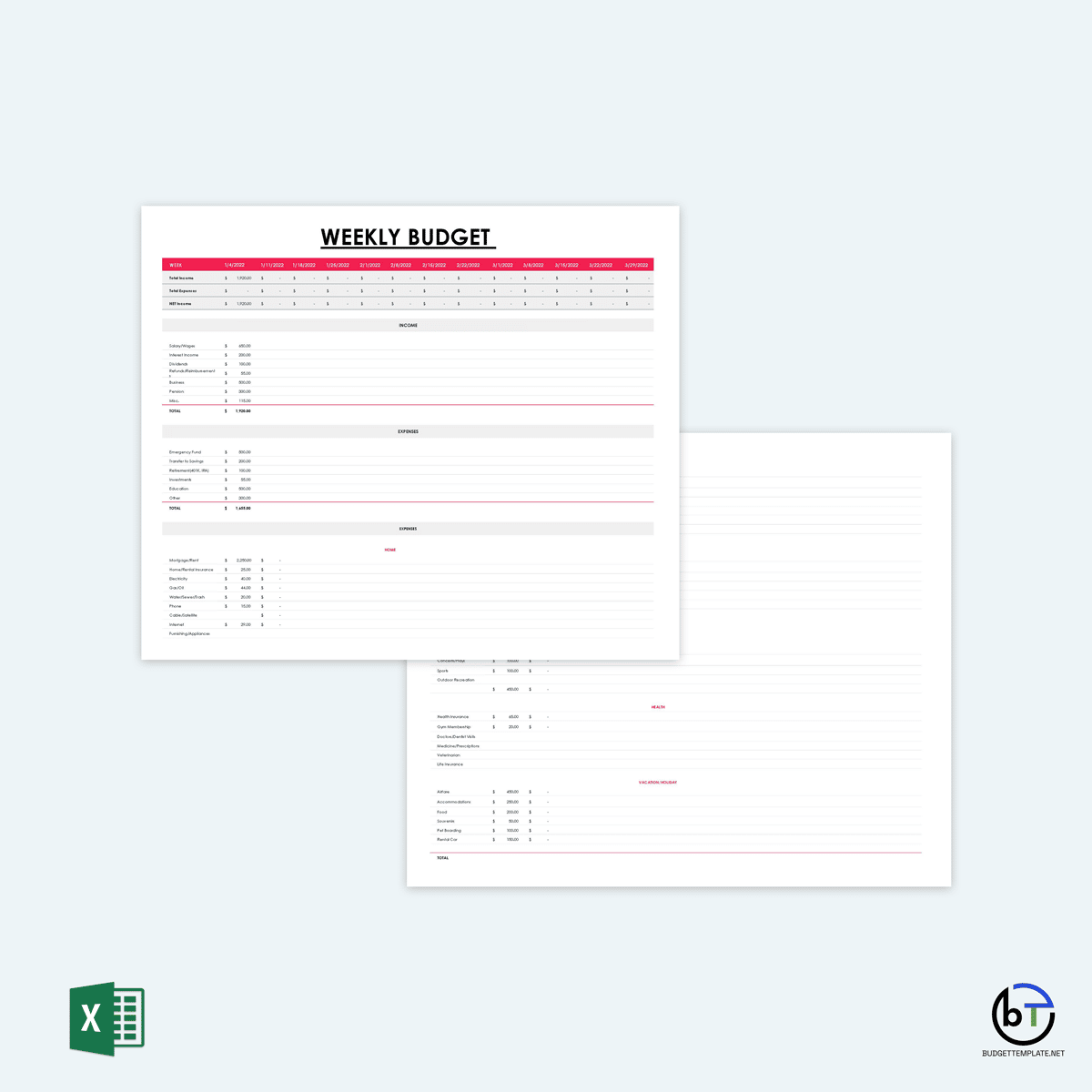

Weekly Paycheck Budget Templates

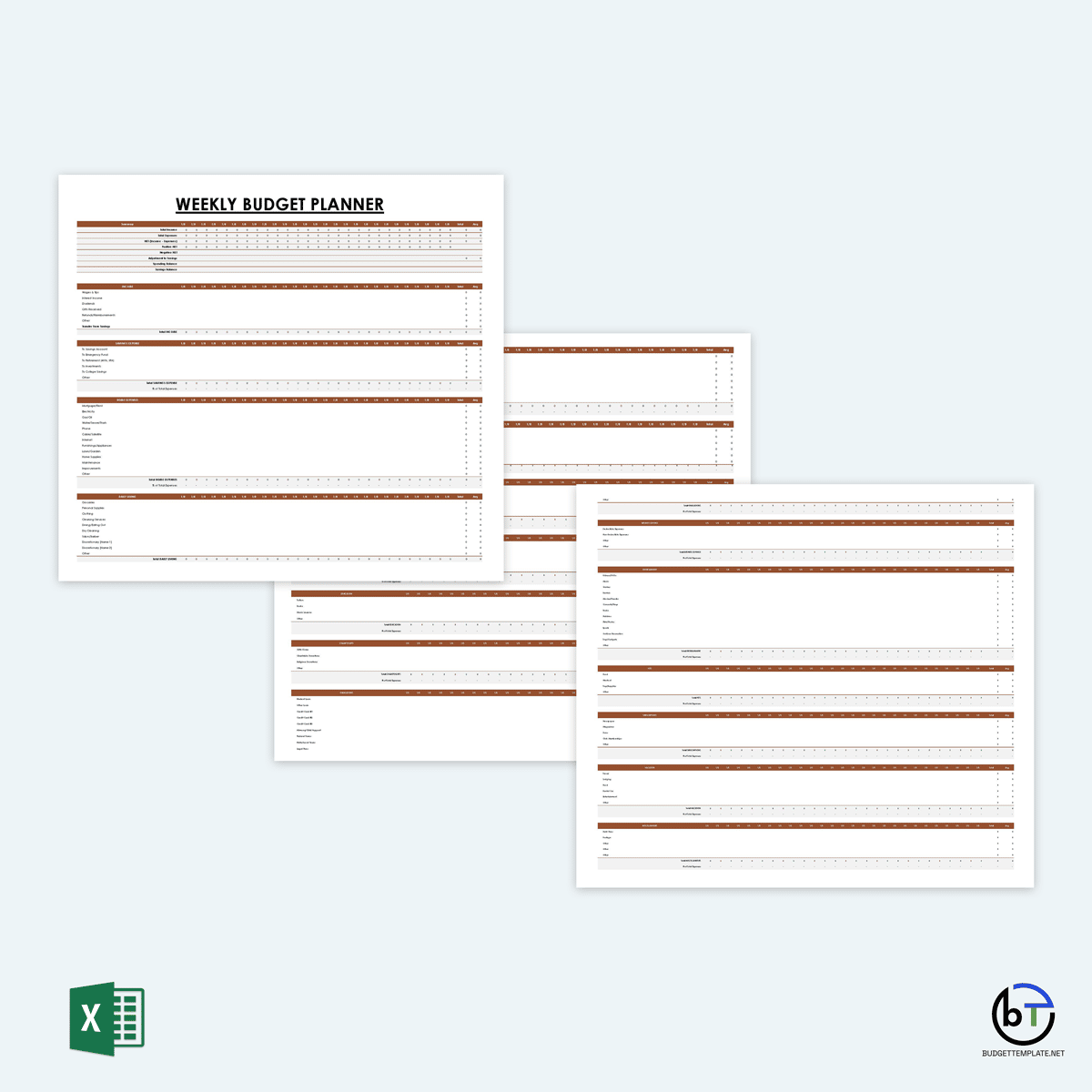

In addition to the step-by-step instructions provided above, this website has provided weekly paycheck budget templates that help you create budgets easily. The weekly paycheck budget templates are a great starting point when creating your weekly paycheck budget. These budgeting templates are also available for download on this website. These templates for the weekly paycheck budgeting are easy to personalize and free to download.

Professional Tips

Other than creating an excellent weekly paycheck budget template, there is more that you can do to manage your finances better. Below are helpful tips to aid you with your weekly paycheck plan:

1. Use leftover money wisely

Do not automatically use all leftover money that you have. Instead, it would be best to determine how much you can afford to save. For example, if leftovers are used on groceries, and you don’t know when the next payday will be, it is better to save the leftover money instead of spending it on things that may not be necessary.

2. Create a separate checking account

It may also be vital to create a separate checking account for covering bills only. Any additional money can then be moved into another account to cover future bills, investments, and savings.

3. Look for ways to cut unnecessary expenses

If you have excessive expenses to be covered by every paycheck, then look for ways to reduce these costs. Unfortunately, many people tend to use their credit cards where they end instead of cutting costs which eventually leads to more debt. Ideally, aim to have your expenses be less than 80% of your income to save at least 20% of what you earn.

4. Setup a weekly budget meeting

It’d be best to hold yourself accountable when executing your financial plan. This can be done by holding a weekly meeting with yourself and determining whether you diligently follow your weekly paycheck budget template. A 20 minutes meeting will often be sufficient. Then, review your accounts and see if things are going according to plan.

5. Think about future

When creating your weekly paycheck plan, you must think about the future expenses that you may incur. This might include expenses such as your retirement and education costs, car and home loans, kids’ college plans, or holidays that you have planned. For instance, if you want to make monthly payments for a vacation, this should be planned for a few months. Noting these expenses will ensure that they are taken care of on time.

6. Give yourself some grace period

It will often take time to adapt to the weekly paycheck budget plan. In the beginning, you are likely to feel that you are not earning enough money or spending too much as compared before. Therefore, it is imperative to give yourself some time, typically 3-4 months. Only when you feel that you have adapted can you begin thinking about making any changes to your plan.

7. Set goals

Lastly, you must set a few financial goals. These goals should be tracked over several weeks and months. This will help you determine whether you are meeting your objectives or not. For example, some achievable goals might be to save a certain amount of money each month or to have a specific spending limit per week.

Note: What if you don’t have enough money to cover all your bills?

If the weekly paycheck seems difficult to follow and you don’t have enough money to cover your expenses, you should consider changing and rethinking your strategy. For example, you can try to find a better-paying job that can help you save more some tips here. You can also ask yourself whether there are any other ways to cut down on your expenses and save some money on the side.

Tools for Setting a Paycheck Budget

A few budgeting tools can help you set up your weekly paycheck budget template. All these tools are available online, and they include:

A monthly calendar

You will need a blank calendar to easily mark down each bill’s due date and pay period. The calendar is used to assign bills to paychecks. You can either create this online through your personal finance management websites or print it out and keep it in your bill reminder folder.

Budgeting templates

There are a lot of online weekly paycheck budget templates that you can use. These templates have different categories and will help you sort out your finances. The templates are distinctively designed to include features that improve efficiency and convenience. They can be paid or free, and it is up to you to select one that meets your needs.

Free Templates

Final Thoughts

A weekly paycheck budget template can help you manage your finances better if you are disciplined. Without a weekly paycheck budget plan, you will be tempted to spend more than what you earn, leading to financial troubles in the future. However, with a weekly paycheck budget template, you will be able to make better decisions and create more significant financial goals. It is about learning how to manage your money and figure out how much is enough for you. If traditional budgeting doesn’t suit your earning capacity, you can always consider budgeting per paycheck as it is equally as effective if well implemented.