Money isn’t a complicated topic, but it is often the source of frustration for most people and entities such as businesses, corporations, and even the government.

You need a budget template, whether it’s because of a large home mortgage that’s about to go into default, the credit card debt that has mounted over the years, or the government needs to raise money for a pandemic like Covid 19.

The answer to these problems usually begins with managing funds, which involves using financial plans like the budget. It’s essential to have a budget because it gives you an idea of whether or not you are making adequate money to sustain your needs, wants, and even requirements. This article guides creating a well-rounded, frugal budget through Excel and Google sheets and provides valuable information about budgets.

What is a Budget?

A budget summarizes estimations of revenue to be generated and expenses to be incurred within a specified reporting period. It is used to determine how much you will spend on each category. A budget usually includes monthly income and expenses. These variables determine whether or not you will be able to pay your monthly bills and debts. You can create a budget template for personal use or use in the workplace.

Importance of making it

A budget template lets you know how much you will be making each budgeting period and where the money is going. This way, you can understand your finances and make well-informed financial decisions. Budgets also help determine ways to save money for life’s unprecedented events and personal or organizational financial goals such as buying a house, traveling, or large purchases.

By keeping track of finances, you can use a budget to determine if you are overspending in certain areas, and then it may be time to re-evaluate your goals. Overcoming debt and saving money will require sacrifice, but it’s also a great way to start building wealth.

A budget template is used to manage finances in one place, and it’s the easiest way to track the expenses and incomes of a household, business, or other organization. This eliminates the stress and confusion of juggling multiple financial accounts and balances.

How Does it Work in Companies?

Budgets are part of a company’s financial management system. They are used to plan the activities and monitor progress toward its objectives and goals. A budget usually follows a written document called a business plan, which is created at the beginning of each year or sometimes more often.

The budgeting process typically involves consultation among executives, managers, employees, and other stakeholders, setting organizational objectives, creating a forecasted budget, reviewing, revising the budget, and getting approvals from upper management and stakeholders.

A budget template is created based on projected revenues, expenses, and capital expenditures. However, these variables have to be assessed extensively to capture all operational and sustainability needs of the company. This will often require thorough consideration of factors such as economic backdrop, revenue shortfalls, etc., that would typically not be found in a personal budget.

Different Types of Budget

Different types of budget templates are used in personal and organizational budgeting circumstances.

Common types are as follows:

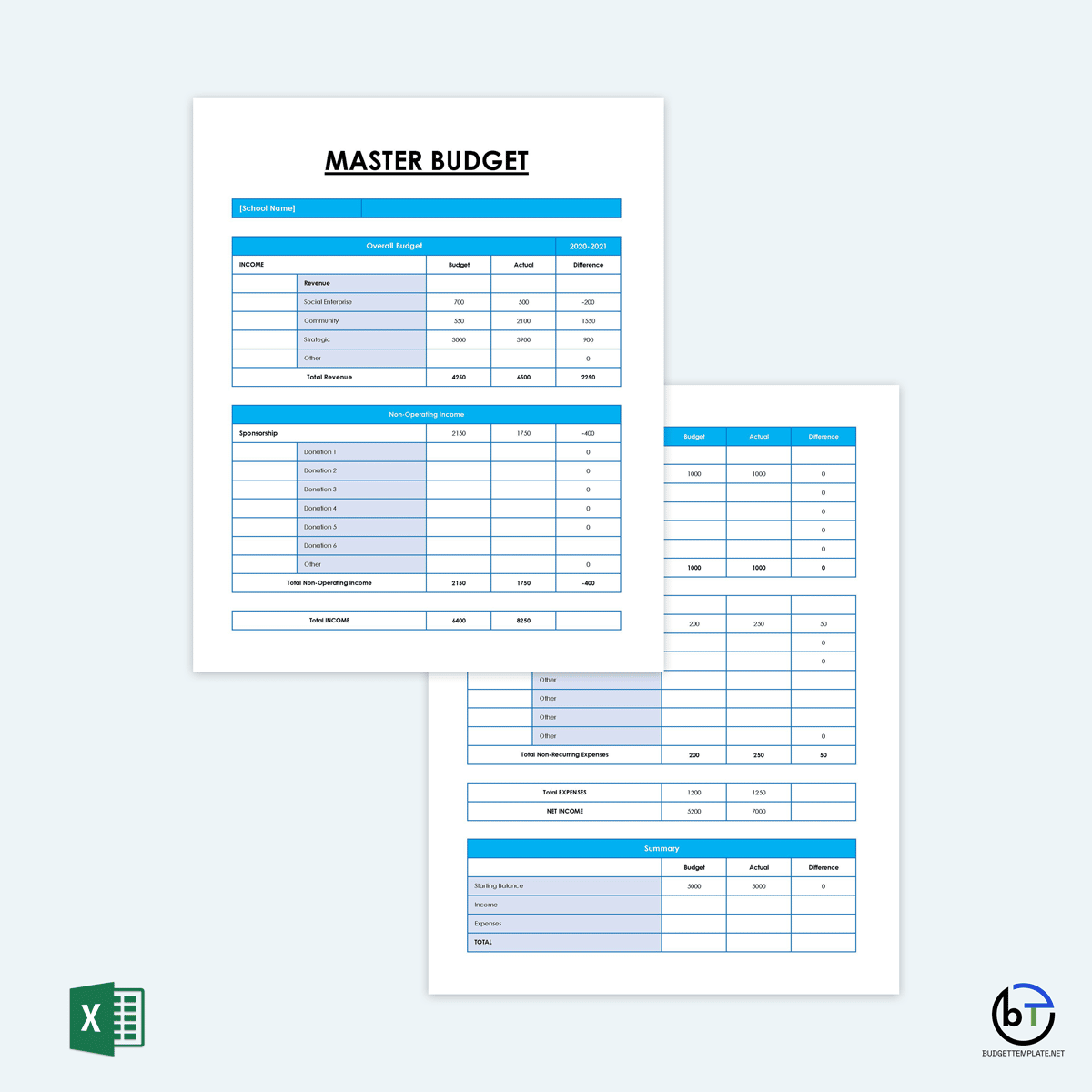

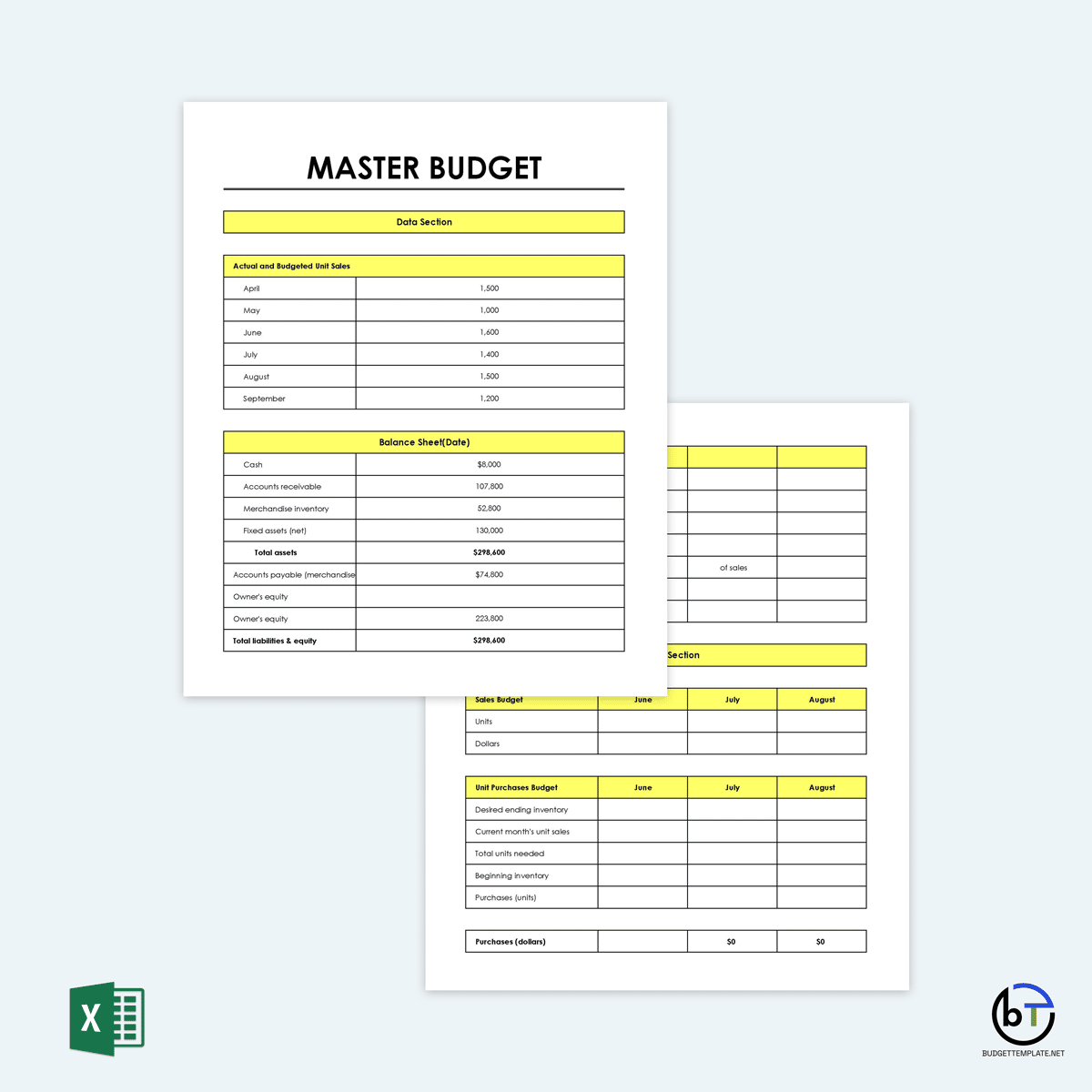

Master budget

The master budget is a broad, comprehensive outline of the company’s revenue and expenses for an entire year. It includes all major components of its budget, such as marketing, manufacturing, sales, and purchasing budgets. It is generally created at the beginning of a year or late in the previous year.

Static budget

It shows the steady (fixed) volume of income and expenses over a fixed period. Examples of fixed expenses covered in static budgets include rent. As a result, it excludes the effects of fluctuations in income or expenses caused by seasonal factors such as production and sales. Static budgets are created for planning purposes only and will typically be the starting point for budgeting company finances.

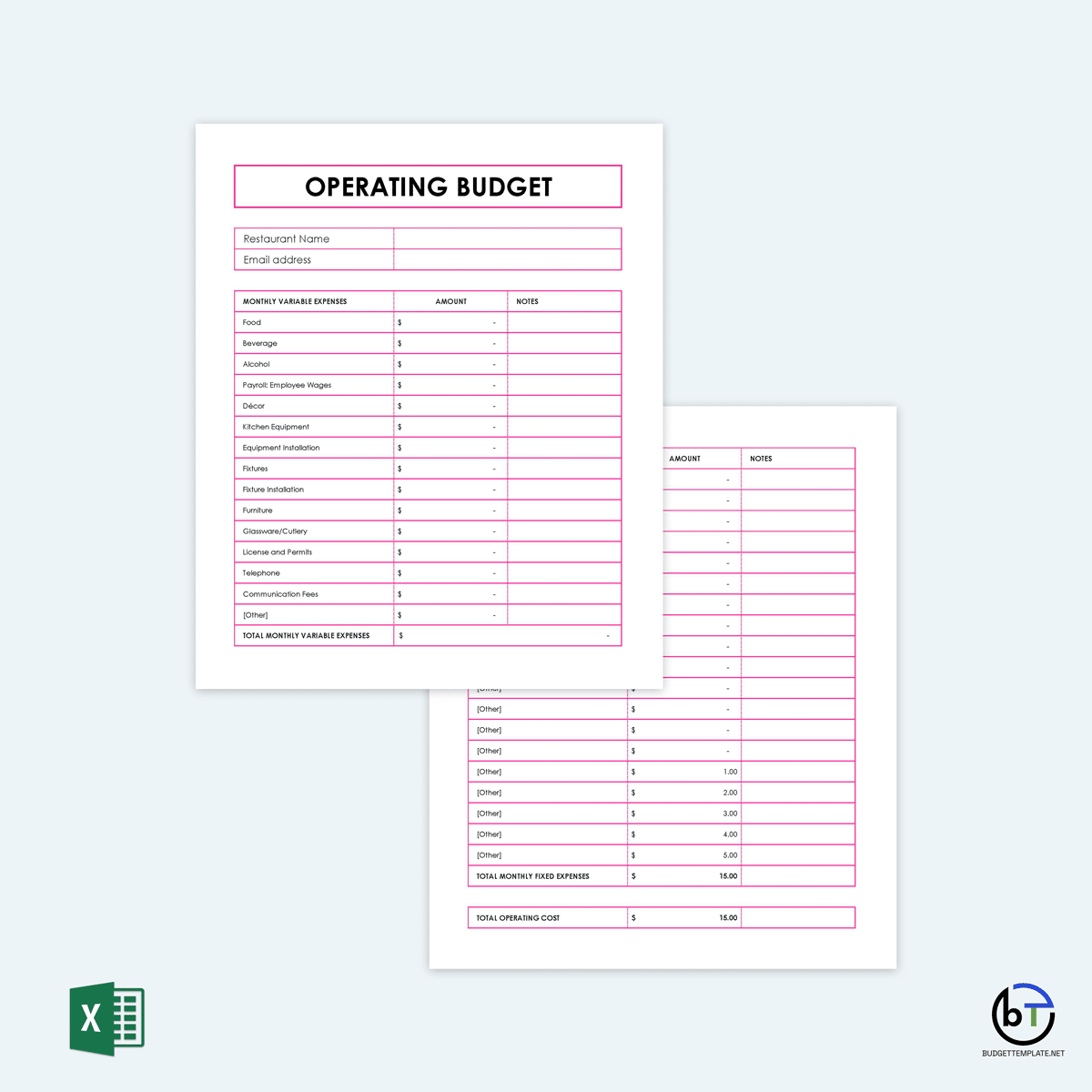

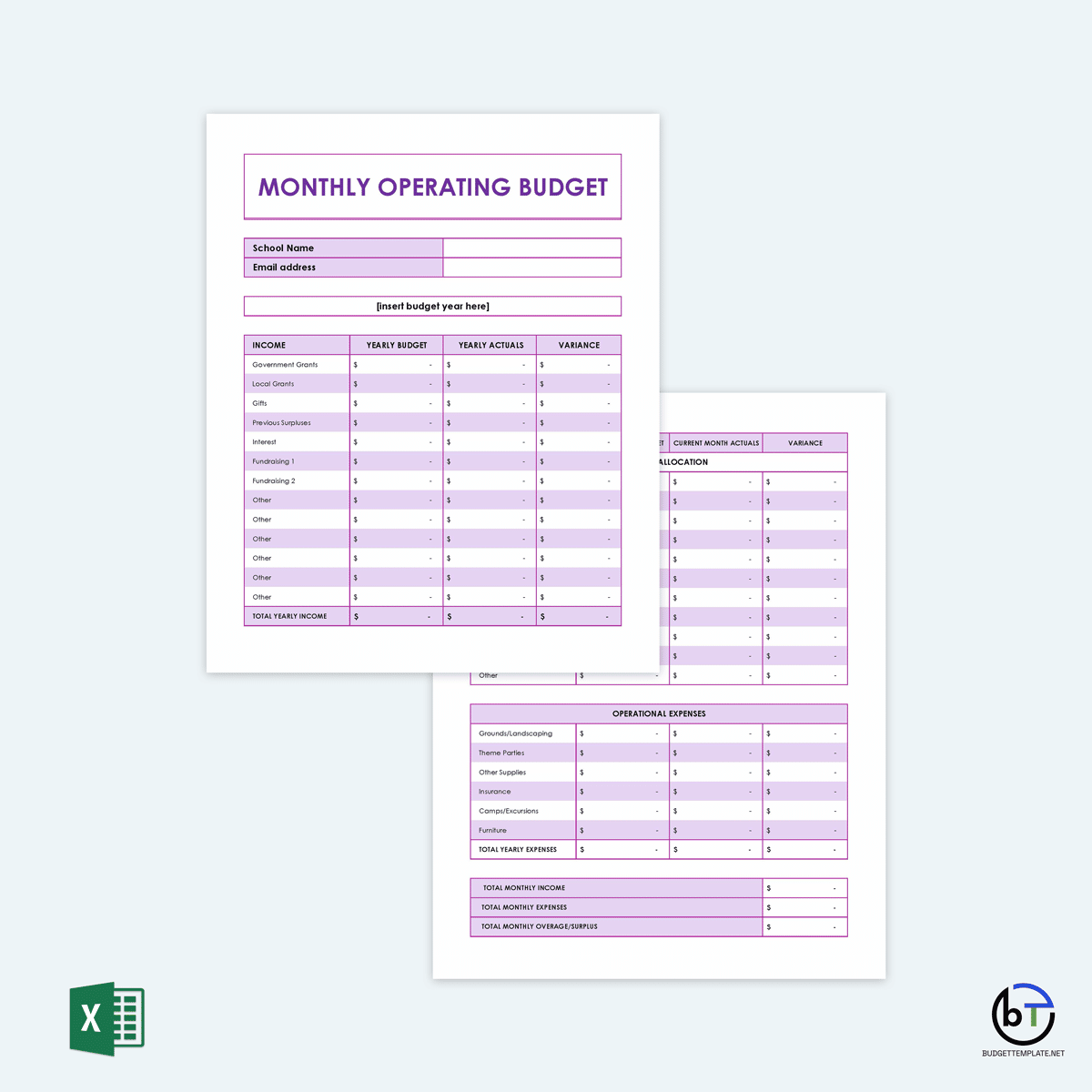

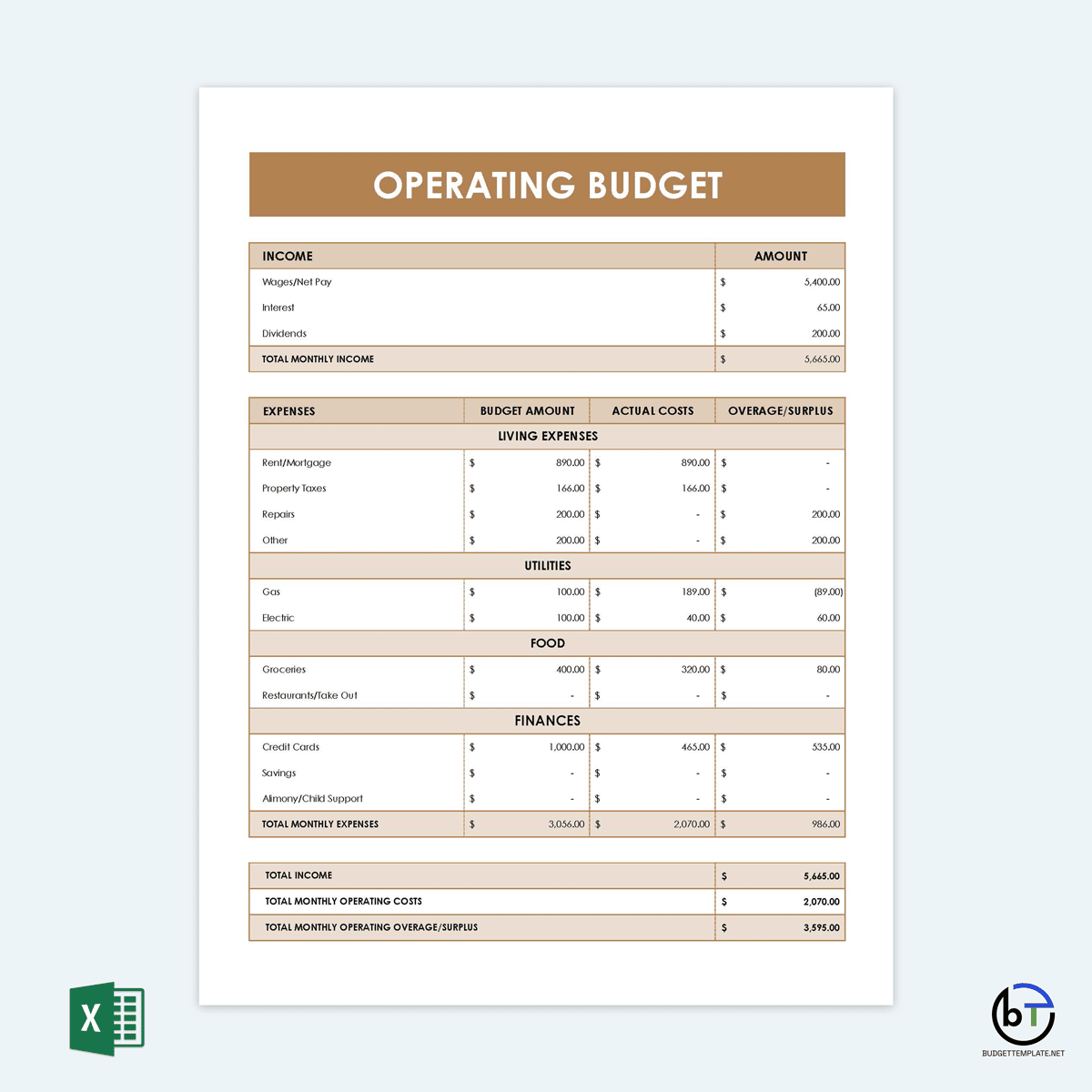

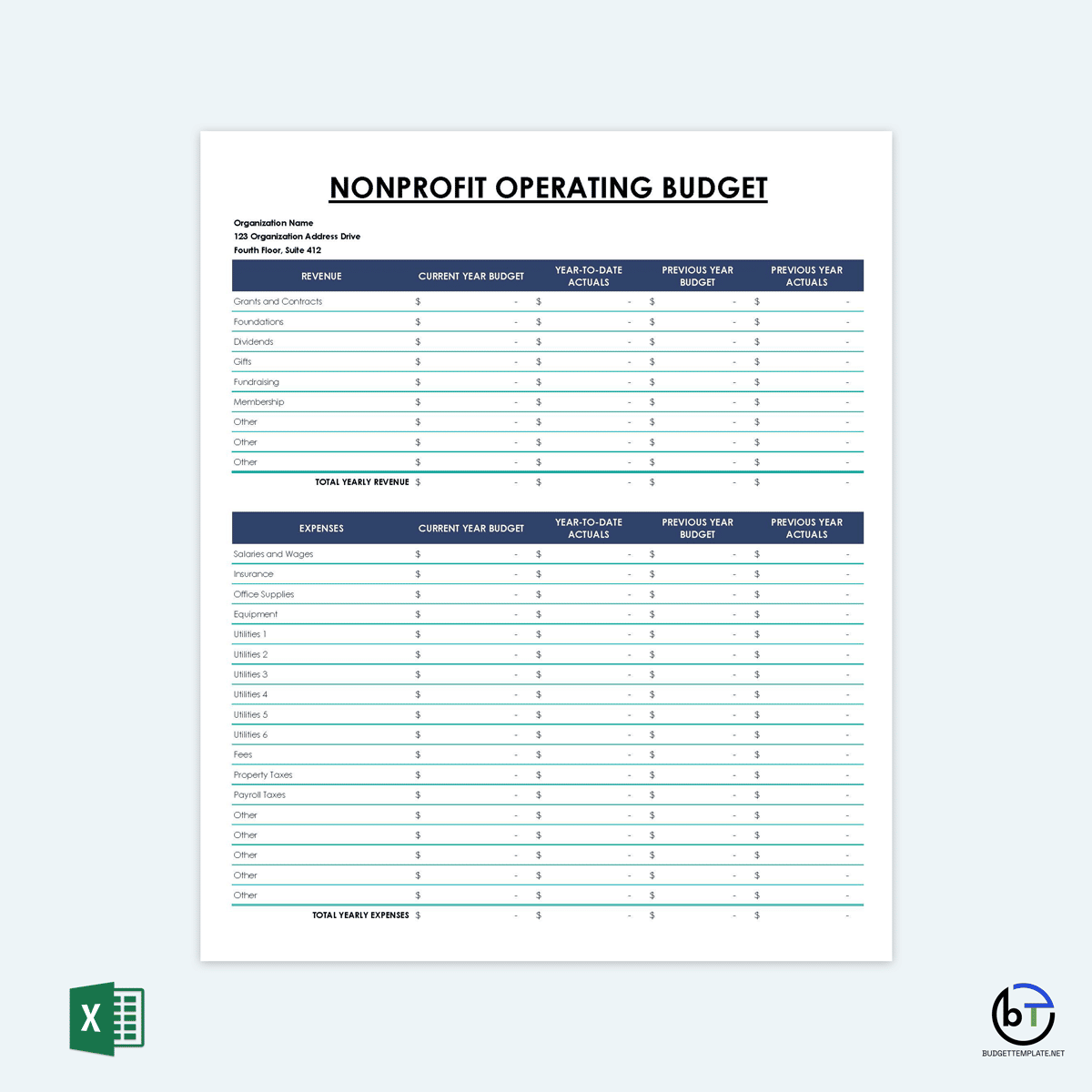

Operating budget

This is a type of budget that highlights the actual costs incurred in the operating cycle of an organization. They are created for short-term planning purposes – day-to-day operations. The budget covers operating expenses or COGS (costs of goods sold) and includes variable expenses such as labor, materials, and transportation. The operating budget template also covers overhead expenses such as fixed expenses like administrative costs, rent, insurance, taxes, and depreciation directly associated with producing goods or services.

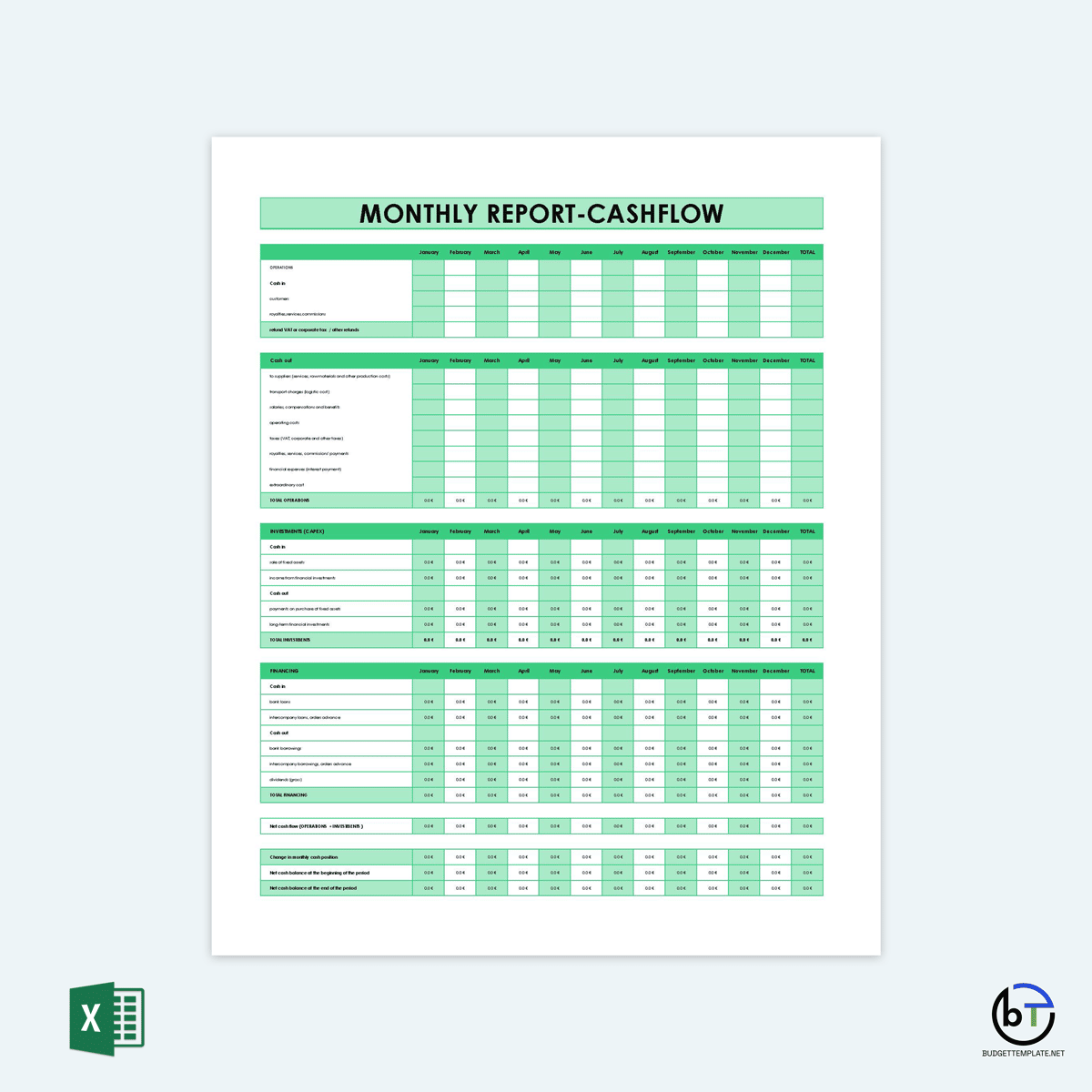

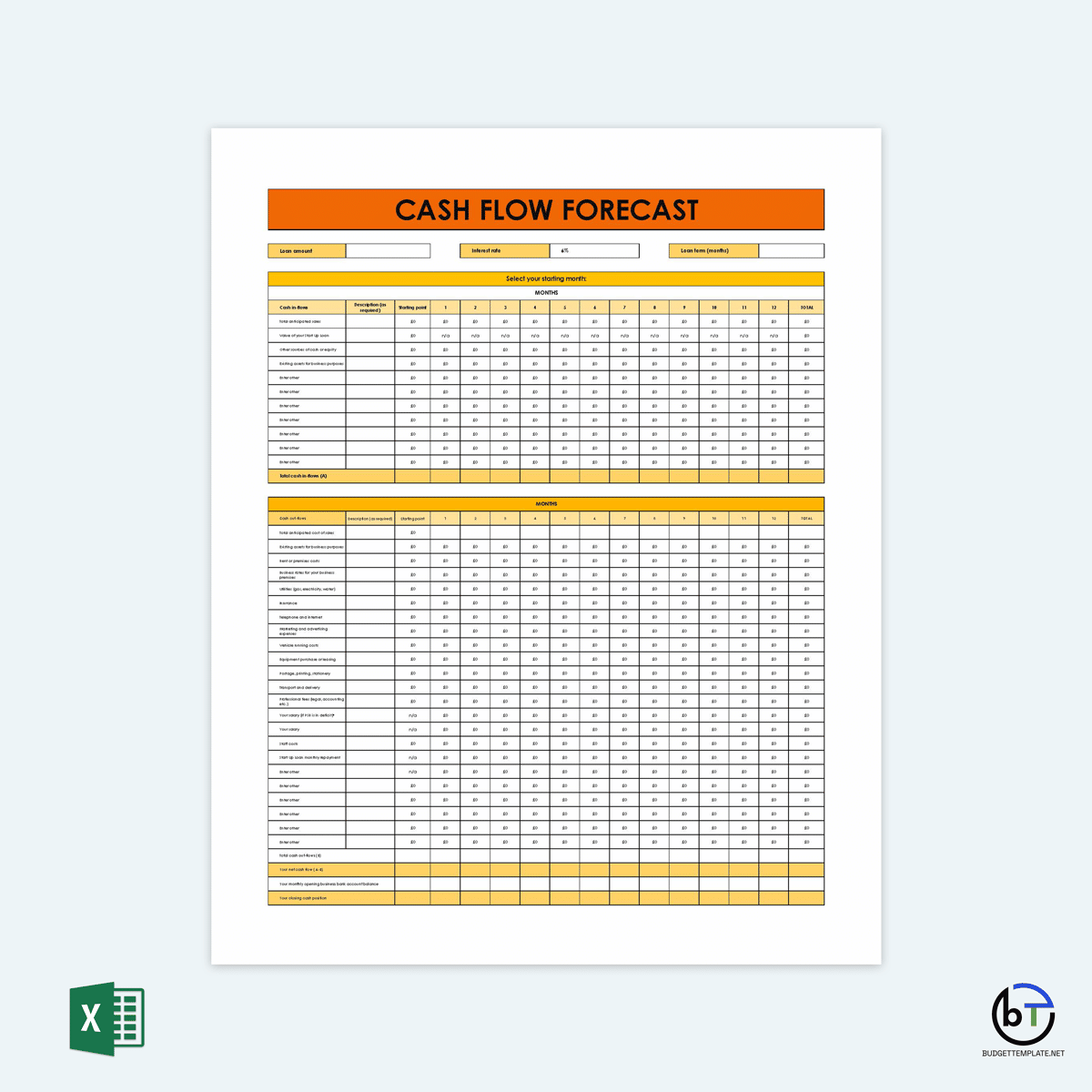

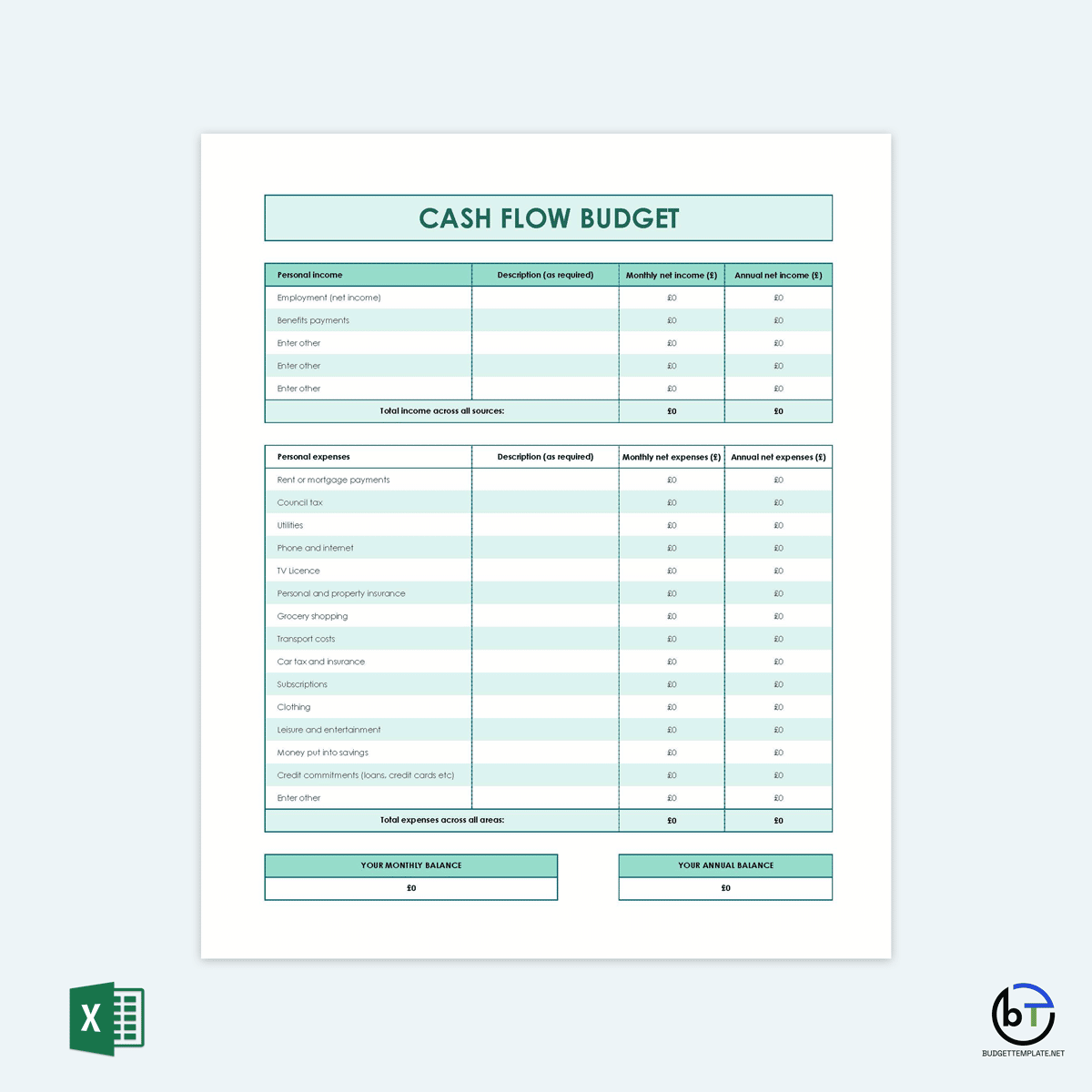

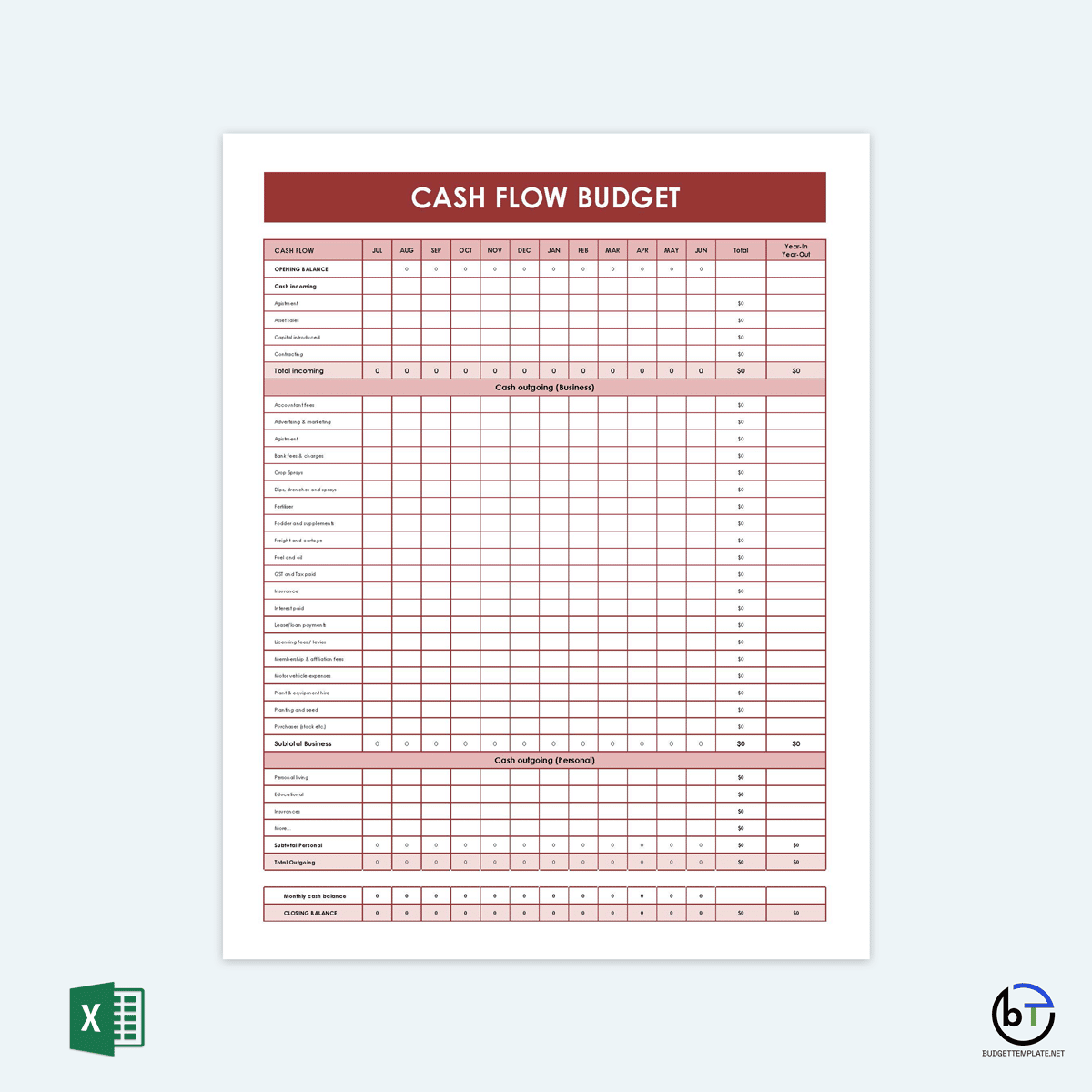

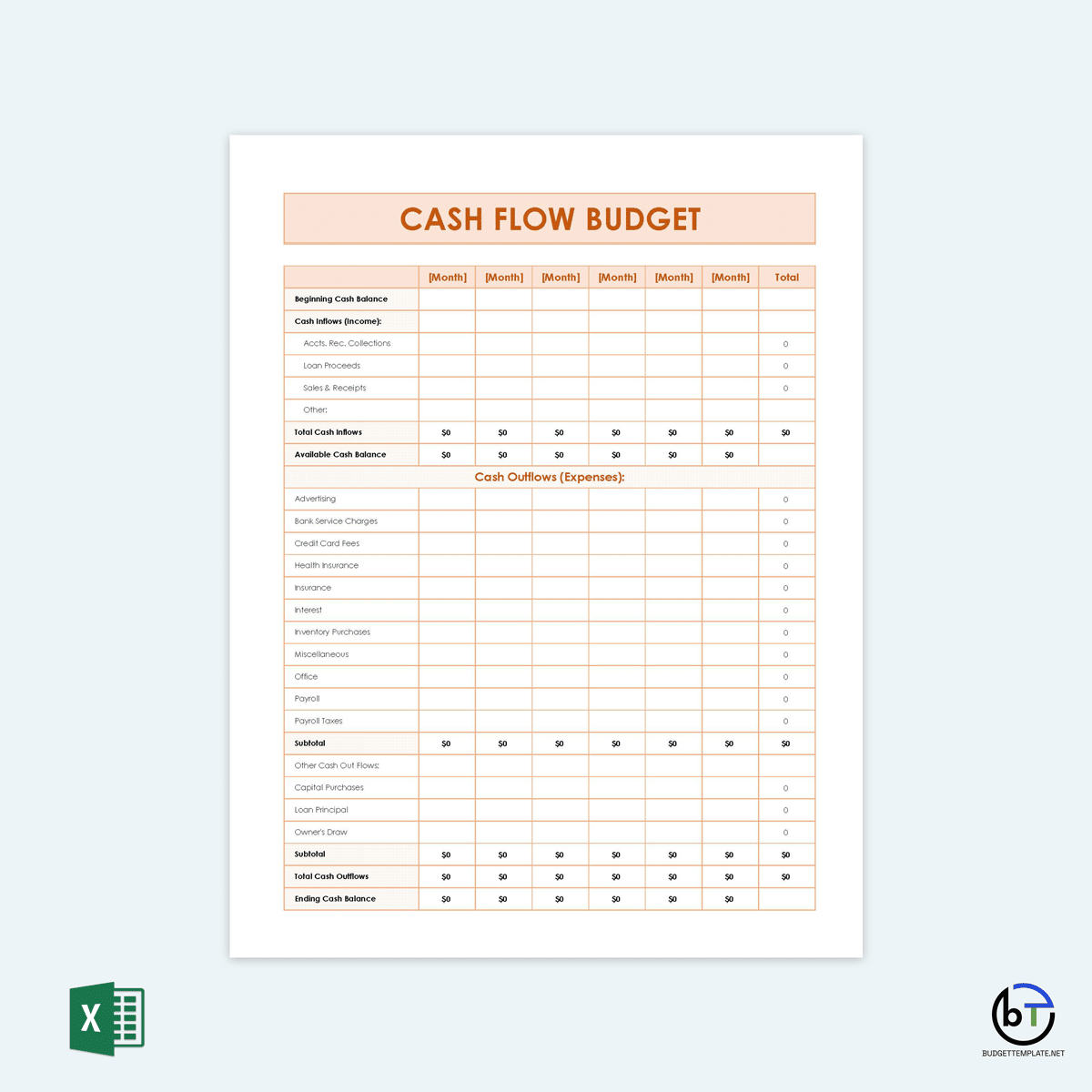

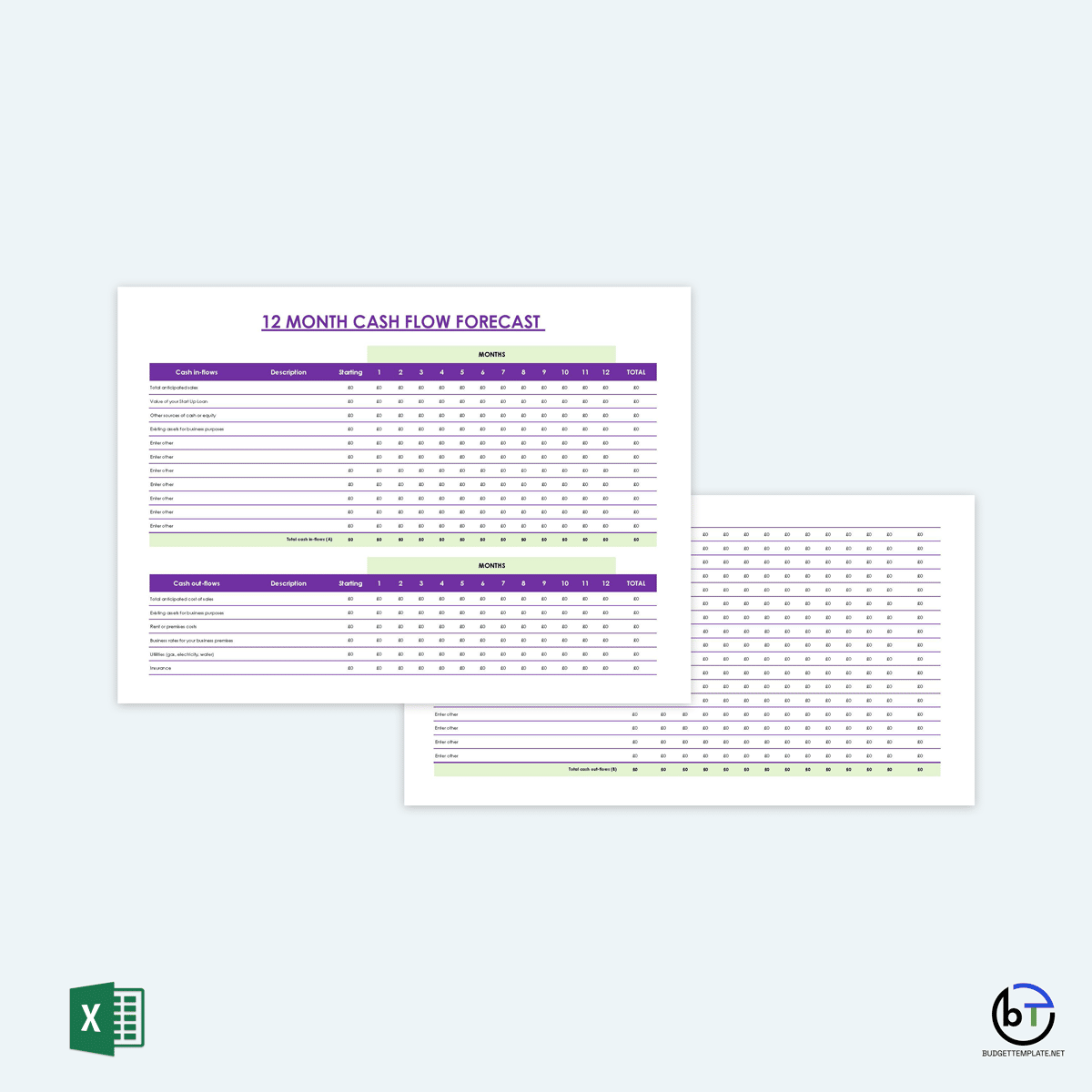

Cash-flow budget

It is a budget template that enables you to track the actual cash flow in and out of an organization/business for a certain period. It shows the amount of money paid to suppliers and vendors and collected from customers. This type of budget is helpful for those who want to estimate future expenses and revenues at a glance. This form of budget enables you to monitor your company’s finances regularly and plan on how to remain financially healthy. A cash flow budget will look at past spending practices to determine which practices are practical and which are not.

Capital budget

This type of budget is typically done only when an organization plans to make large purchases or investments (such as office buildings, technology, and so on). It emphasizes capital expenditures, which are long-term costs that are not recovered from regular operations. This budget is used for long-term fund allocations, risk management, and overall decision-making. The capital budgeting process helps the company evaluate various capital expenditure options and choices among different interest rates. In addition, a capital budget template can help you access large sums of money from banks or lenders.

Personal Budget

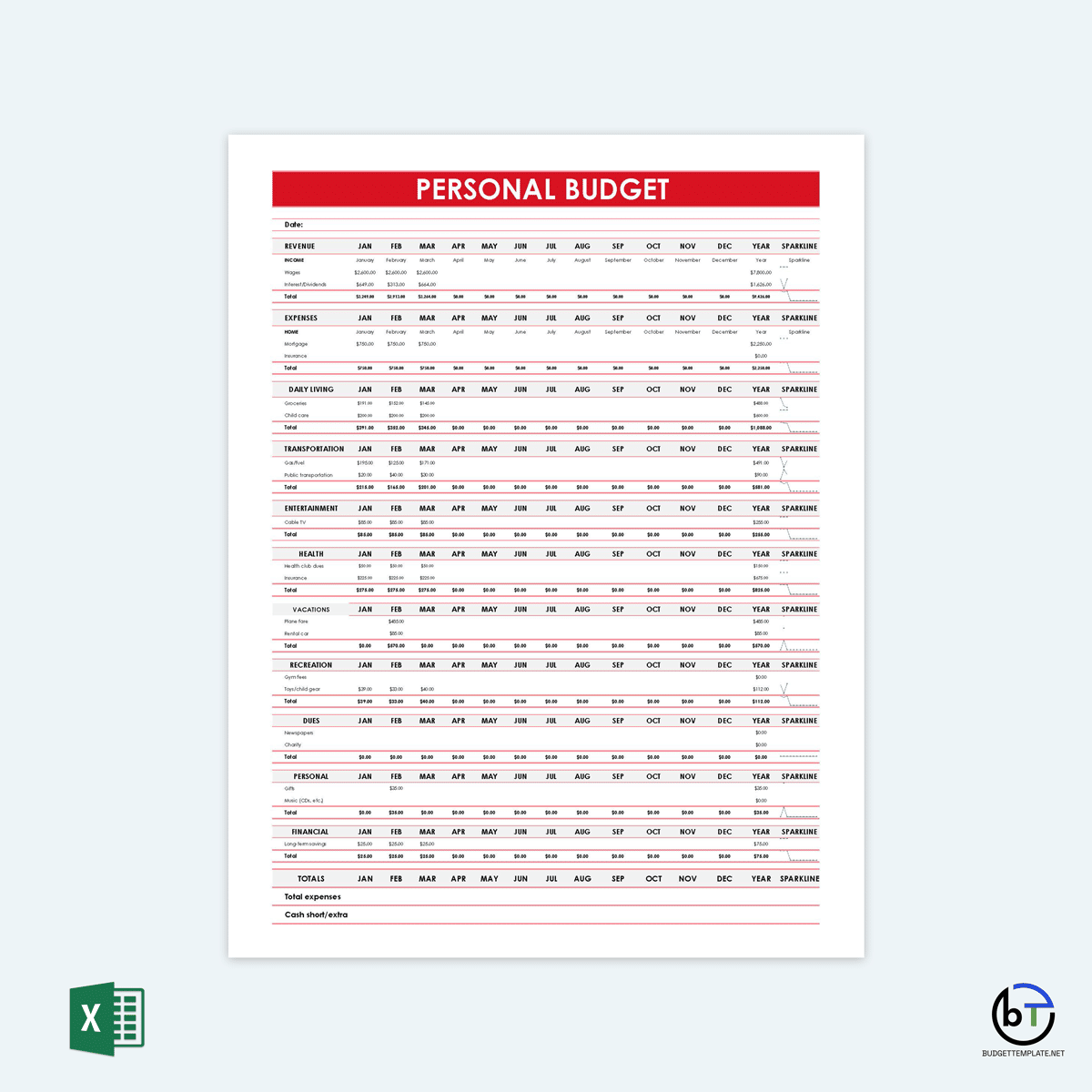

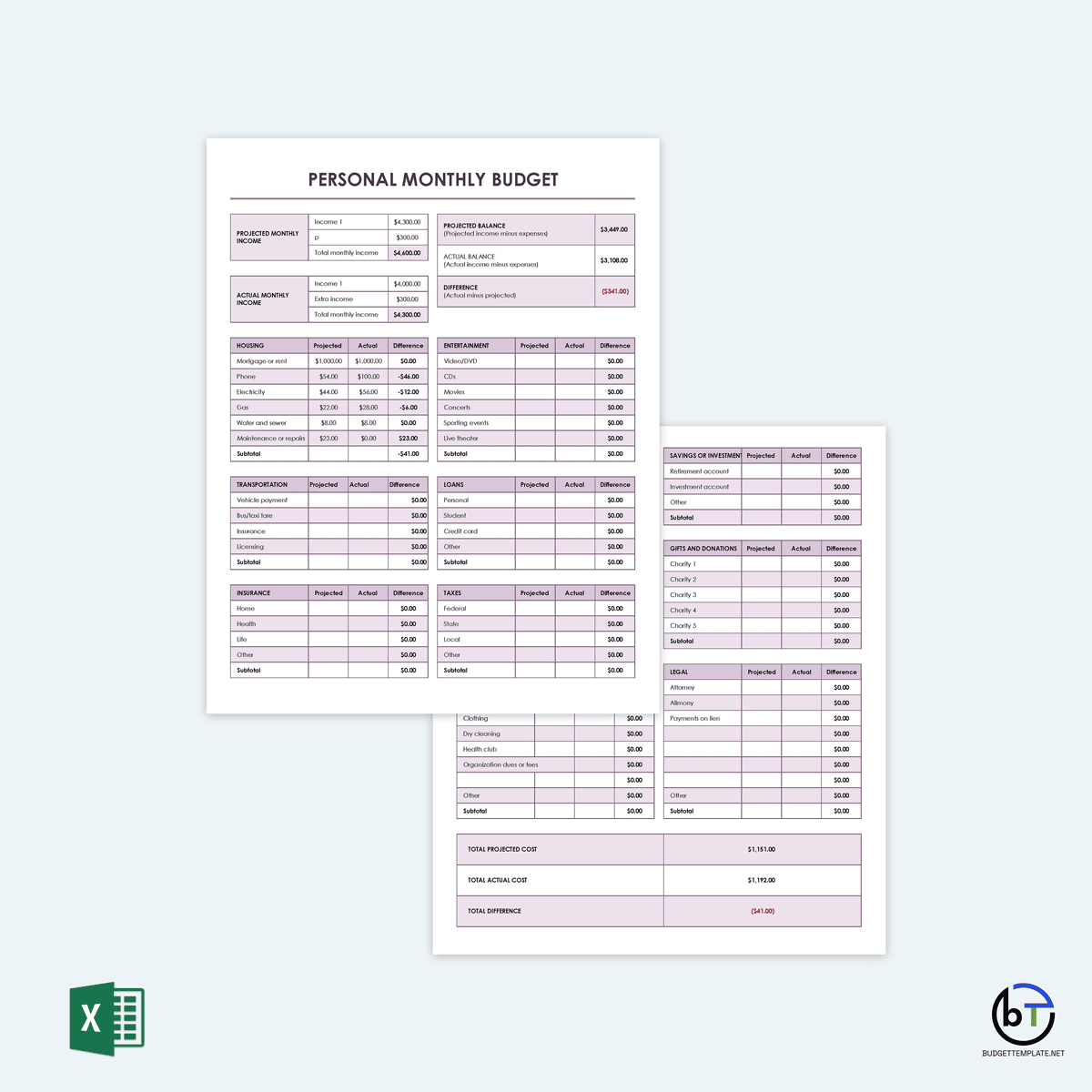

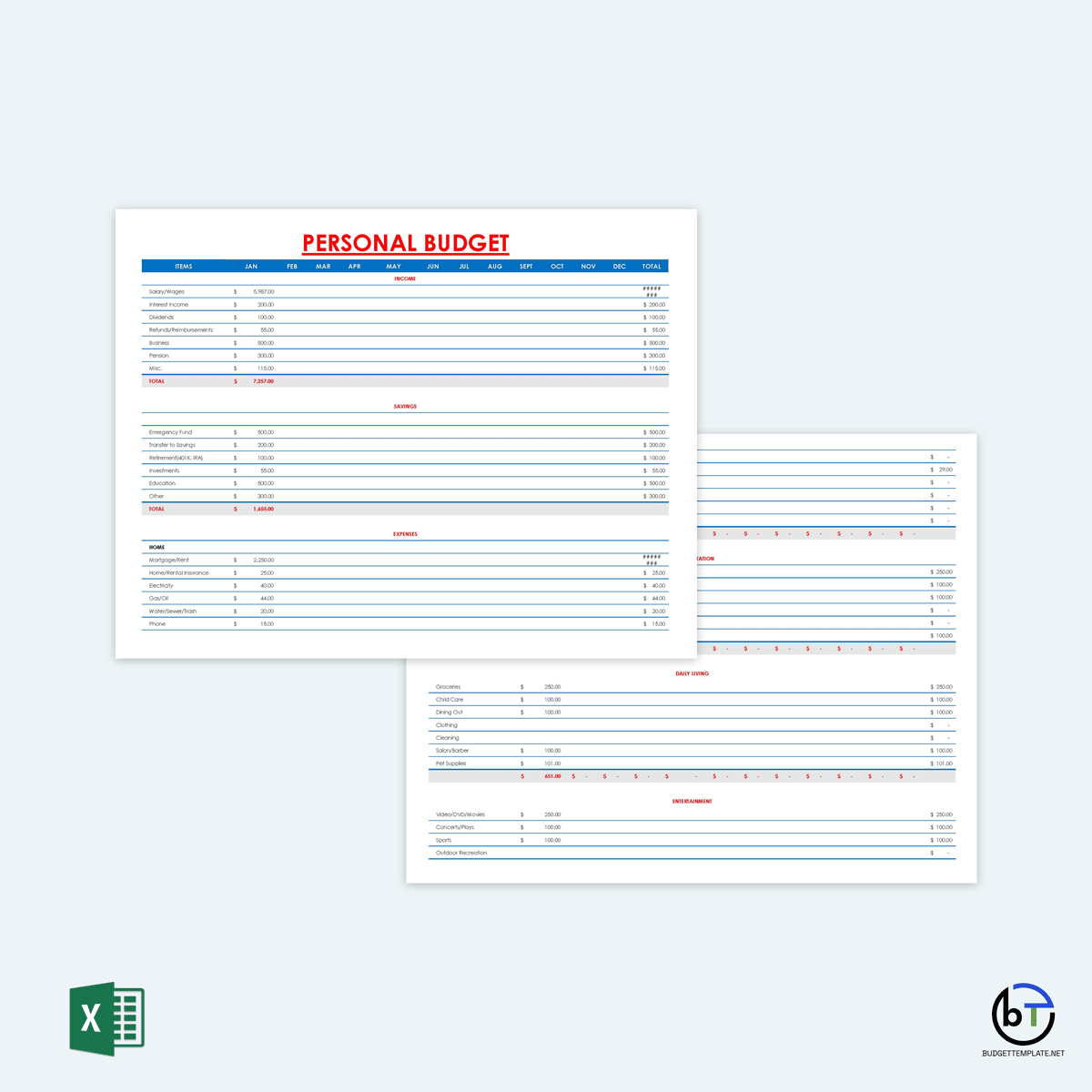

A personal or household budget is a flexible monthly budget that helps set your monthly spending plan. This budgeting tool aims to provide an overview of where your money is going each month to make better decisions about how to spend it. It is a simple, easy way to get your finances under control.

A personal budget template allows individuals to determine how much money they will have to spend on various expenses and how much savings they can turn over at the end of the month. Personal budget templates are thus planning and tracking financial tools. Developing a personal budget is essential in achieving financial independence and peace of mind.

Importance of it

With a reasonable personal budget, you can ensure that the money you earn each month is allocated correctly to meet your financial needs comfortably. Thus, the importance of a personal budget template lies in its potential to help you gain better control over your finances. First, it helps you visualize how much money is available to meet your financial needs in each budgeting period. This is possible by highlighting how much money you’re bringing in (income) and spending (expenses). Then, the personal budget template is used to balance these two variables and avoid overspending.

Creating a realistic personal budget and sticking to it allows you to set financial goals and monitor your progress towards them. You can objectively save money for future goals, like buying a house, an upcoming wedding, or retiring early.

How to Create a Personal Budget?

Creating a personal budget doesn’t have to be frustrating and time-consuming. Here is a comprehensive step-by-step process to help you as a guide:

Gather all financial papers

The first step in crafting a budget is to gather all the necessary information about your spending habits to determine how much money you spend each month. This can be done by compiling receipts from the past few months, including credit card statements, bank statements, W-2s, 1099s, receipts, and bills you’ve paid online.

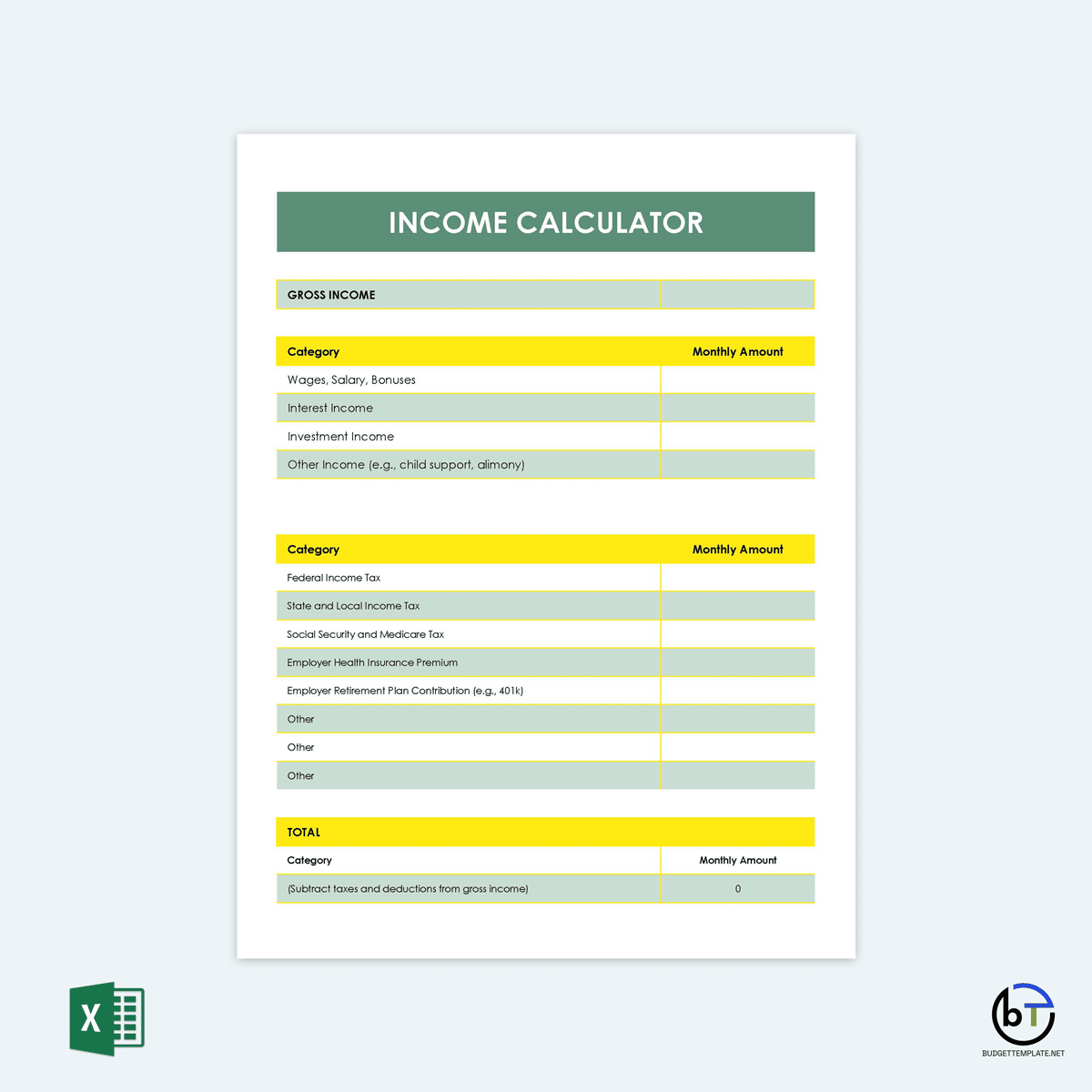

Calculate the total income

You need to include all income sources in your budget, not just the one where it is easiest (typically your salary). You should include all sources of income that impact your spending. Pull together a list of all income (salary, social security, dividends, employer reimbursements, interest from savings accounts, alimony, etc.)

Make a list of the expenses

After adding up the income and recording it in your budget, make a list of all your expenses and record them in a separate document. You need to list the category that each expense falls under and the amount you spent on each category per month. A well-rounded personal budget template category list may include the following:

- Food – Groceries and dining out.

- Housing – Rent and utilities.

- Personal Care – Haircuts, clothing, and beauty products.

- Education – Private lessons or tuition.

- Debts – Credit cards, home loans, and medical bills.

- Savings – emergency fund and retirement savings (401k).

- Entertainment – Sporting events, concerts, and vacations. Even coffee can be considered an entertainment expense on a certain level

Identify fixed and variable expenses

Next, analyze your expenses and identify fixed and variable expenses. A fixed expense does not vary from month to month, like taxes and insurance. At the same time, a variable expense varies from month to month. Examples of variable expenses are food, entertainment, and clothing.

Make the total monthly income and expenses

The next step involves looking for an average monthly total of expenses based on your spending on each category every month. Also, determine how much you are bringing in, in total.

Make adjustments according to the needs

If the amount of money earned is less than the total amount spent, you need to make critical decisions about where to cut back or what you can eliminate. Then, you can begin making adjustments to your current budget or create a new one.

How to Make a Budget Using Excel?

Creating a budget template can be challenging, especially if you’ve never done it before. But it’s not as complex as it looks. You can create budgets that are customized through the use of MS Excel.

Below is an exhaustive procedure on how to go about it:

1. Open a blank workbook

Start by opening a blank workbook. You can open a blank workbook by clicking on the “File” icon at the top left-hand side of your screen, then “New,” and creating a ‘blank workbook.’ To sum up; File>New>Blank Workbook

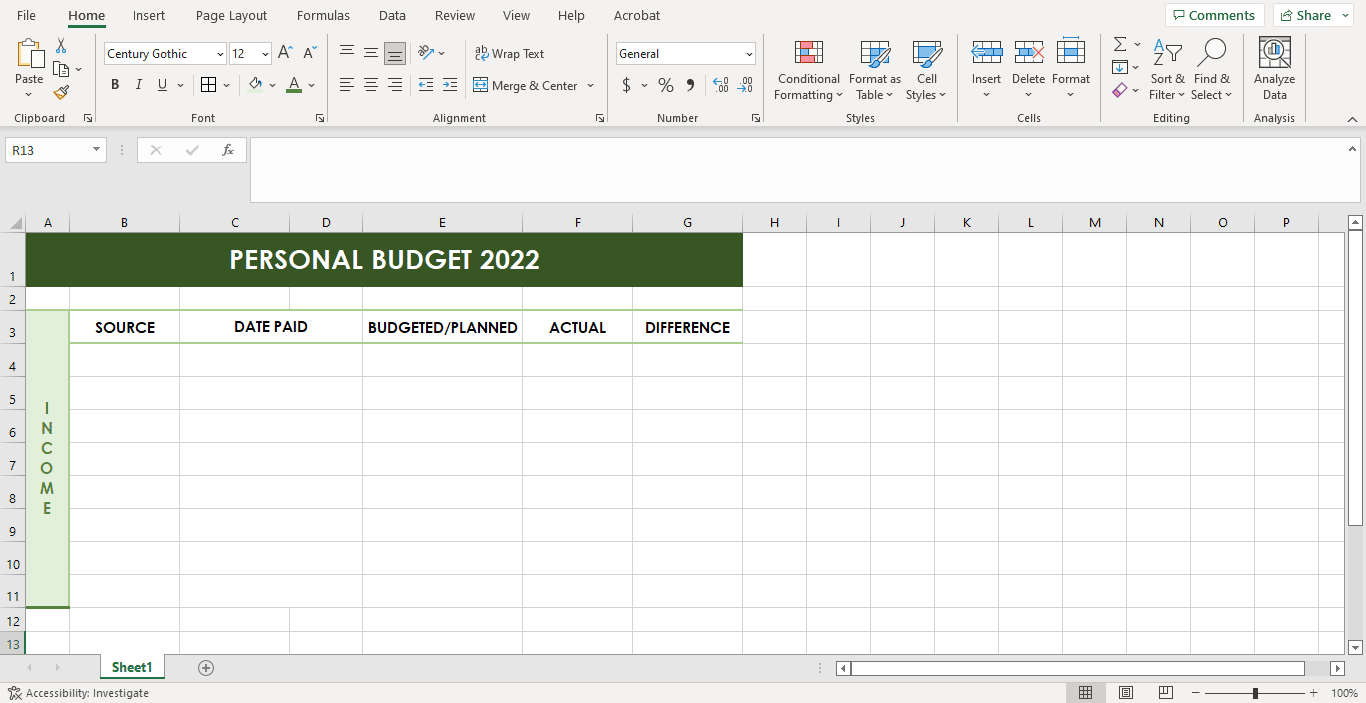

2. Set up your income tab

Next, title the budget template by selecting the first two rows in columns A to G to create space for the title. Once selected, navigate to “Merge & Center” under the “Home” menu. Title the budget appropriately, for example, “Personal budget 2022.” Then, select the rows A3-A11, merge them and label that row as “Income.”

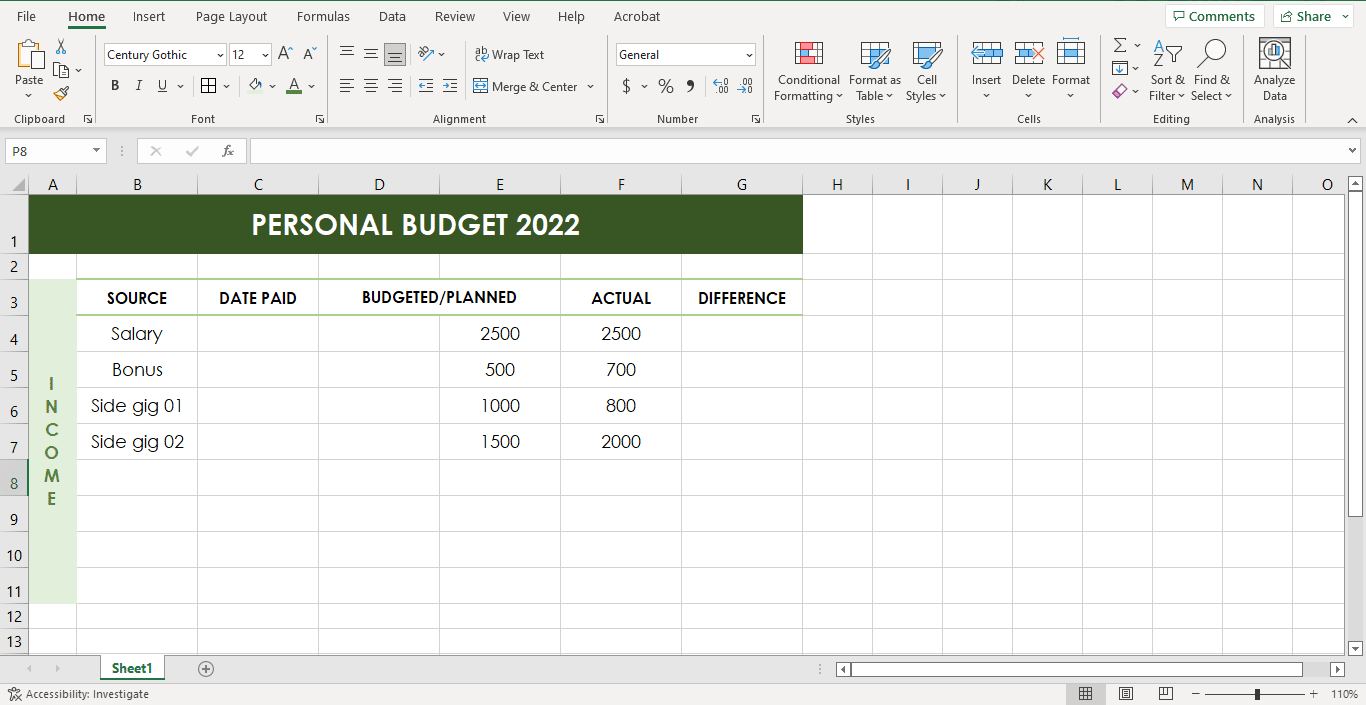

Next, input the categories under income in the third row, starting with B3. The categories include source, date paid, budgeted/planned, actual, and difference. In this case, the categories will stretch up to F3. First, record all your income sources under “sources.” Next, you are expected to input the income amounts under “planned,” “actual,” and “difference” – planned is how much you expect to earn and is the actual amount you receive.

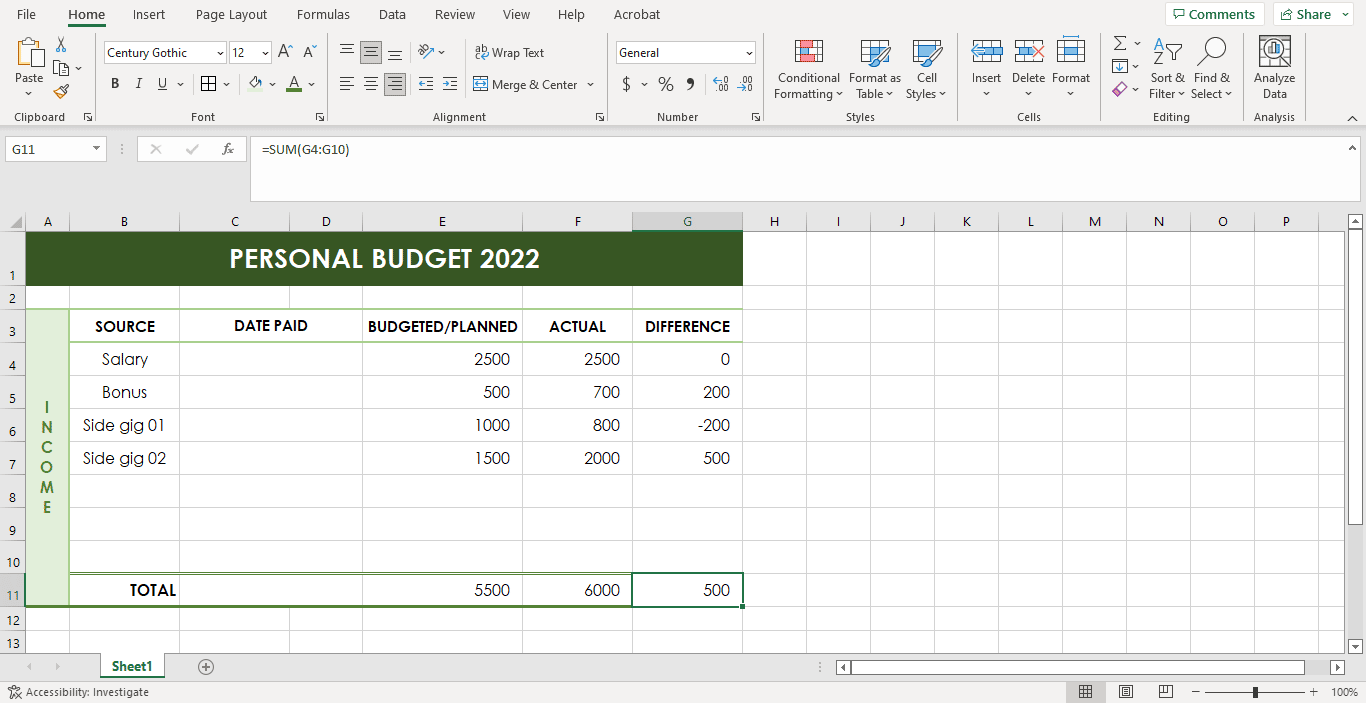

3. Add formulas to automate

First, Label “Total” row B11 as “Total.” Then you can begin inputting formulas to automate your budget process. A budget template typically requires addition and subtraction. So, to find the total “planned” income. You can do this in two approaches. One, you can select all the rows under “planned” up to D11 and select use “AutoSum” under the “Formulas” tab. Alternatively, navigate E11 and input the formula “=SUM(G4:G10).” Input the formulas for the “actual” column too. For the “difference” column, input the formula “=SUM(F4-E4) for salary, then alter the formula for other sources (each row) of income and the “total” row.

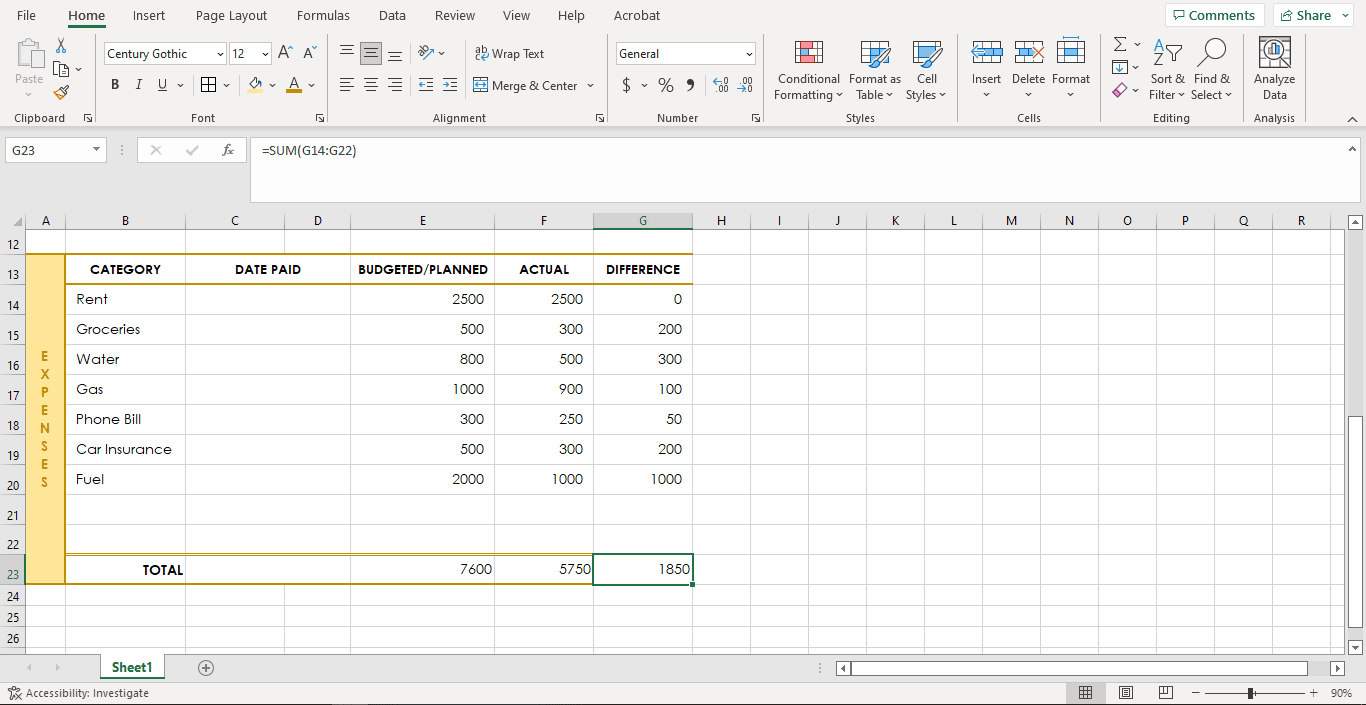

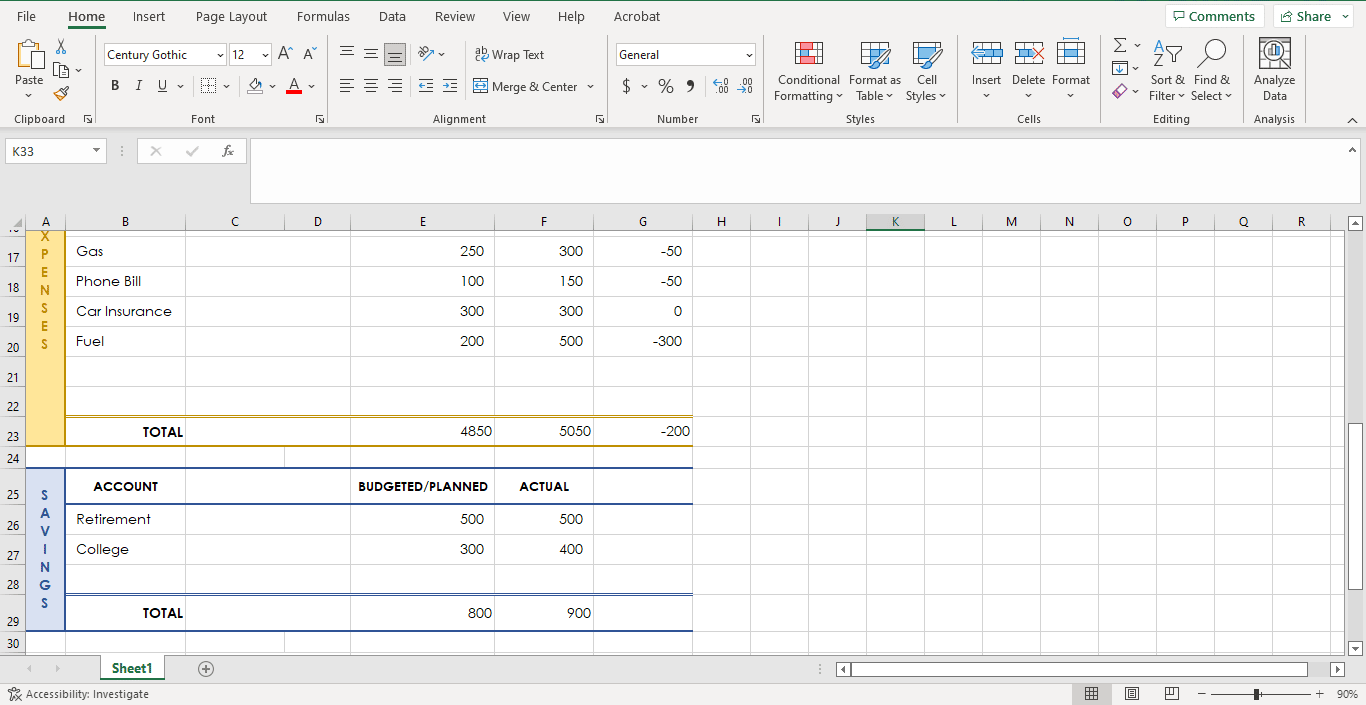

4. Add your expenses

Next, move on to add your expenses. First, “Merge and Center” rows A12 to A22 or depending on your expenses. Then label the columns under expenses as “category,” “Due date,” “Planned,” “actual,” and “difference.” Next, add formulas and make calculations. However, note that under “expenses,” the difference will be “planned-actual”; therefore, the formula will be =SUM(E13-F13) which signifies over-expenditure.

5. Add more sections if you need

Finally, finish up by adding categories that have not been entered yet in your budget template, such as savings, emergency funds, etc. This section doesn’t require a “difference” column since you can save as much as available.

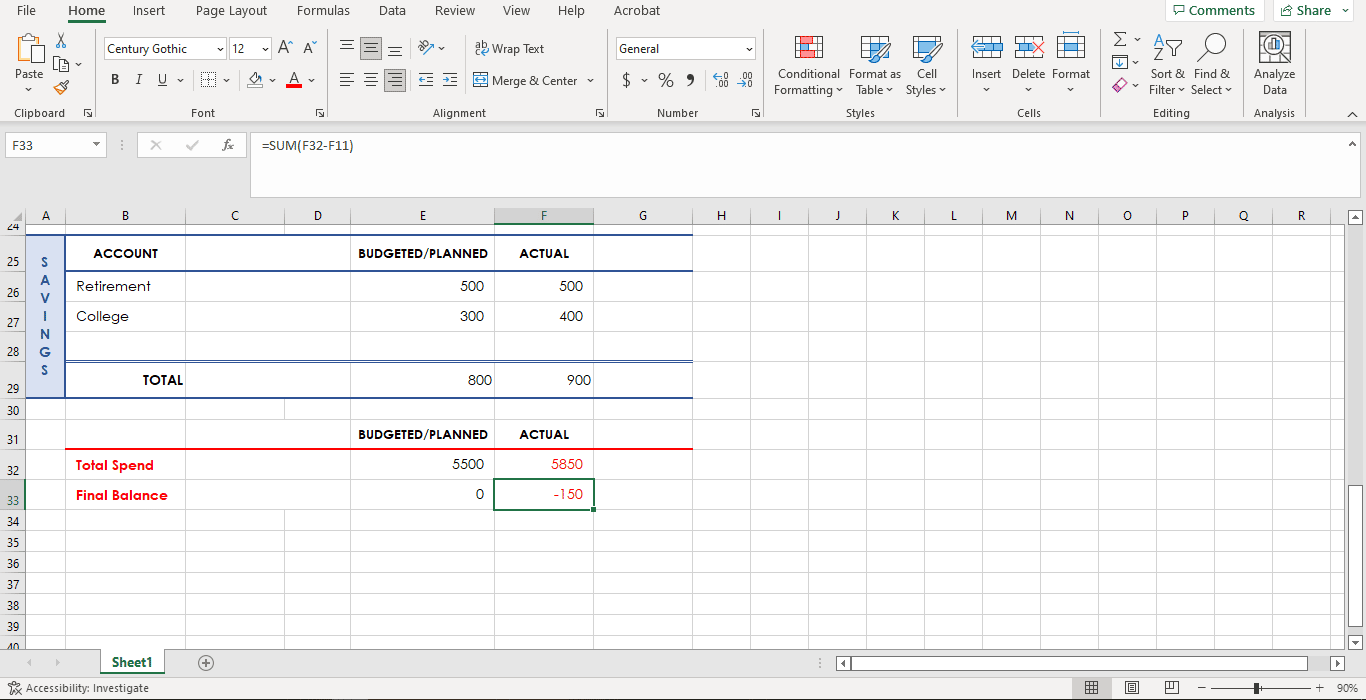

6. Calculate the balance

After creating your budget, calculate your balance. Put the total of your planned and actual income minus the total of your planned and actual expenses separately.

7. The total sum from other sheets (If you have made)

If you have made another sheet in your budget template, you can add up the sums from each sheet. First, add the values from all the sheets together in one of the sheets or a new sheet. The formula to add totals from each sheet is as follows; “=SUM(SheetName!Cell, SheetName!Cell, SheetName!Cell)”. To determine the balance, use the formula – “=SUM(SheetName!Cell-Spending Cell).”

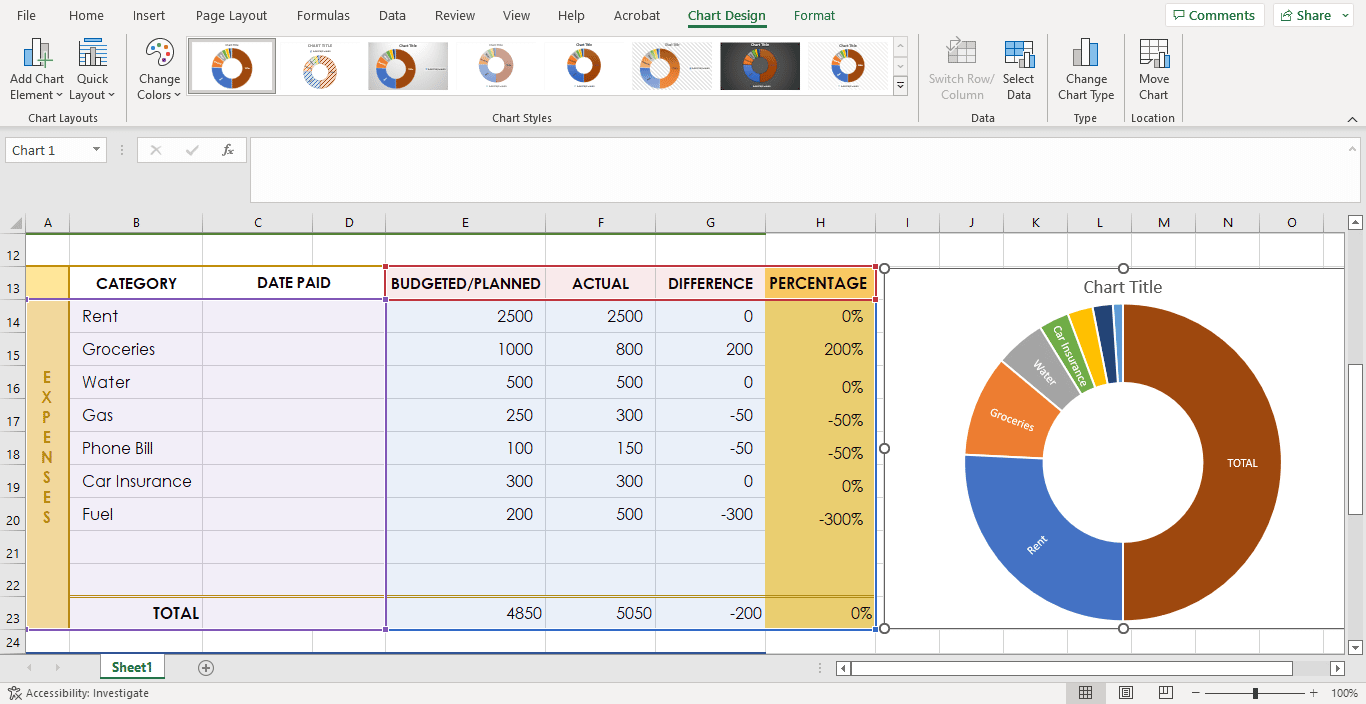

8. Make a graph

On top of these steps, you can create charts or graphs to compare your planned income with your actual income over time. For example, you can use a pie chart to represent the percentage of each category’s total expenses. But, first, determine the percentages and a column to input this information. The percentage formula is “=Category Total Cell/Actual Total Cell.” This formula should be applied for each row or expense in this case.

Since the numbers will be displayed as decimals, select the entire column and select (%) to convert them into percentages. Then select the “category” column followed by the “percentage” column and navigate to “Insert,” and select the chart you prefer. In the example below, a doughnut chart has been used.

Steps for Making a Budget by Using a Google Sheet

There are many budgeting and editing software applications available for creating budgets, but the best tools for most people are Google Sheets and Excel. Below is a guide for using Google Sheets for budgeting.

1. Open a google sheet

First, open a sheet in Google Sheets by going to your Google Drive account, selecting “New,” and choosing “Blank Spreadsheet.” Next, name your budget and describe what you are trying to track, whether it’s a personal budget or a business.

2. Create categories of income and expenses

Next, create a list of all the items you need to include in your budget. Start with listing income sources followed by expenses. Then make a separate column for the amount earned or spent on each item. You can add as many items as possible as long as they are relevant to your financial requirements. Note that you can add subcategories under each budget template category if you so desire.

3. Identify budget period

Next, identify the period you are budgeting for. Depending on your needs, you can budget daily, monthly, quarterly, or yearly. If you create a monthly budget, create multiple columns for every month that you want to track. Then, for each budget period, add three columns, budgeted/planned, actual, and difference, to capture associated income and expenses.

4. Use simple formulas

Once you have your items and periods set up, input appropriate formulas to calculate the total income and expenses during the period. Google sheets have features to add or subtract numbers both vertically and horizontally. Use addition to determine total amounts vertically for each column and horizontal subtraction to determine the difference between actual income/expenses (actual-budgeted) and budget.

5. Input budget numbers

Now you can input the budget numbers for each item. After inputting all your numbers and setting up a formula to add them together, you can see if everything is working correctly by using the sum function on your sheet and checking that it equals your target number.

6. Update the budget

Once your budget template is ready, create a reminder for yourself to check on your finances so you can make adjustments as needed. You can set your reminders as frequently as needed. Any changes in your finances, such as salary increments, should be recorded in the budget template. Keep track of your finances and always anticipate discrepancies. Your budget will become more accurate as time goes by.

Free Budget Templates

Having a budget template to work with will help you stay organized, and best of all, it will decrease the amount of time spent creating the budget. Downloadable budget templates are available for the readers on this website. The budget templates are created to suit different purposes as they are customizable; if you want to update them according to your needs, then, by all means, do so. Create a budget template that makes sense to your needs and works best for you.

Wrapping Up

Budgeting involves a considerable great deal of manual work. This includes tracking your actual income and expenses by writing everything down in a notebook or journal for one month. In addition, it is easy to forget random purchases, especially those paid in cash. It, therefore, requires discipline, patience, and a willingness to make sacrifices.

However, whether you are a student struggling with financial literacy or a business owner trying to manage your cash flow better, budgeting is the best start for everyone. This can only be possible with the use of budget templates. Therefore, it is vital to make your budget template easy to use and understand because it must provide all the relevant information that’ll help keep an eye on your money.