Preparing a financial budget can be challenging. This is because there are different variables to consider, and it can often end up feeling more trouble than it’s worth. However, it would be best to reconsider that stance because it is worth the effort. There are a lot of benefits to putting together a financial budget because it makes it easier to see how your money is being spent. As long as you keep these benefits in mind, you shouldn’t have any problems getting started with building one up.

The budget outlines a summary of the income and expenses of your business. This way, you can make suitable and appropriate financial decisions that are beneficial to the overall goals of your business. There are many types of personal finance tools available to help you set up your budget, for example, financial budget templates. This article will provide you with all the information you need, from understanding the importance of these budgets to components you should look for when downloading your budget template.

What Is It?

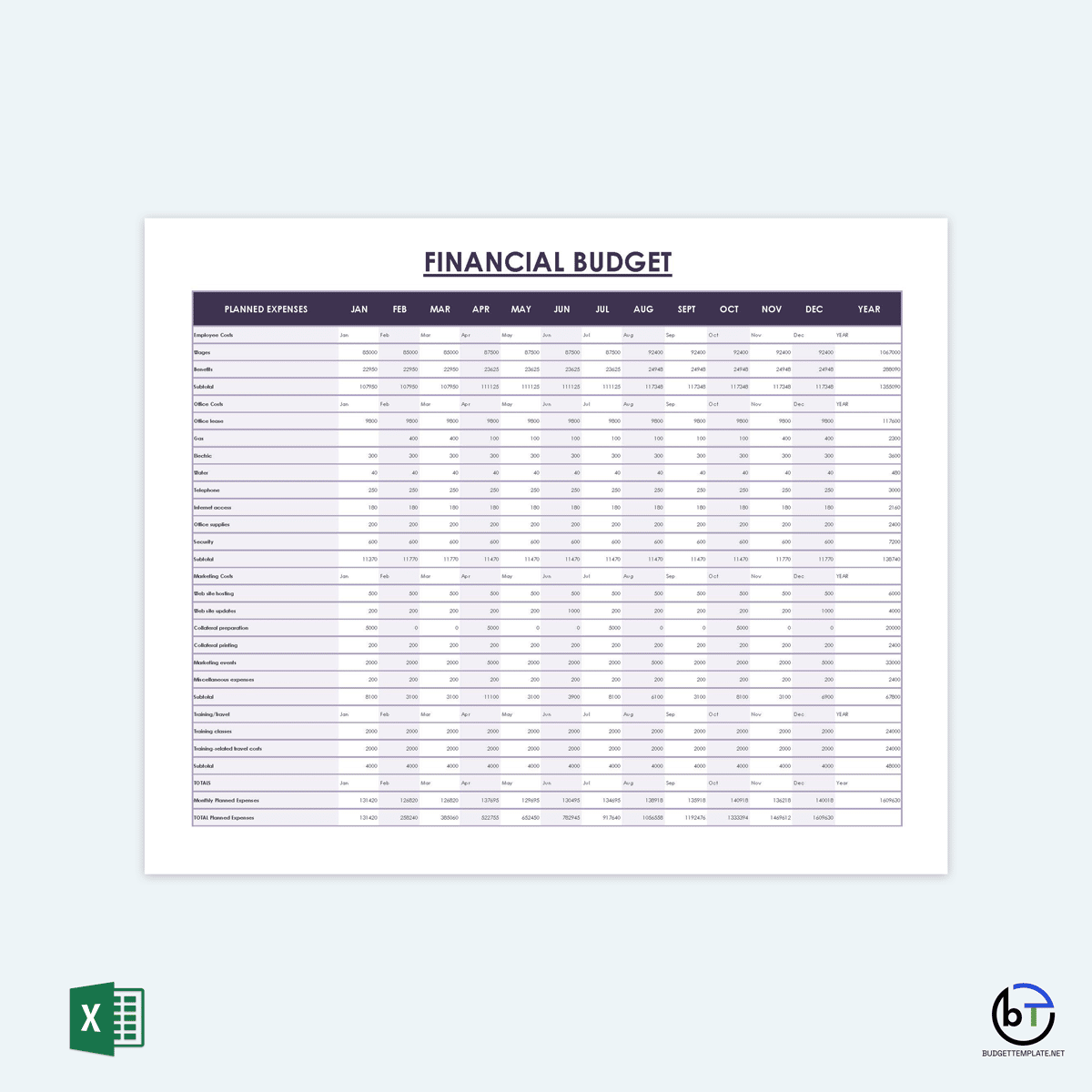

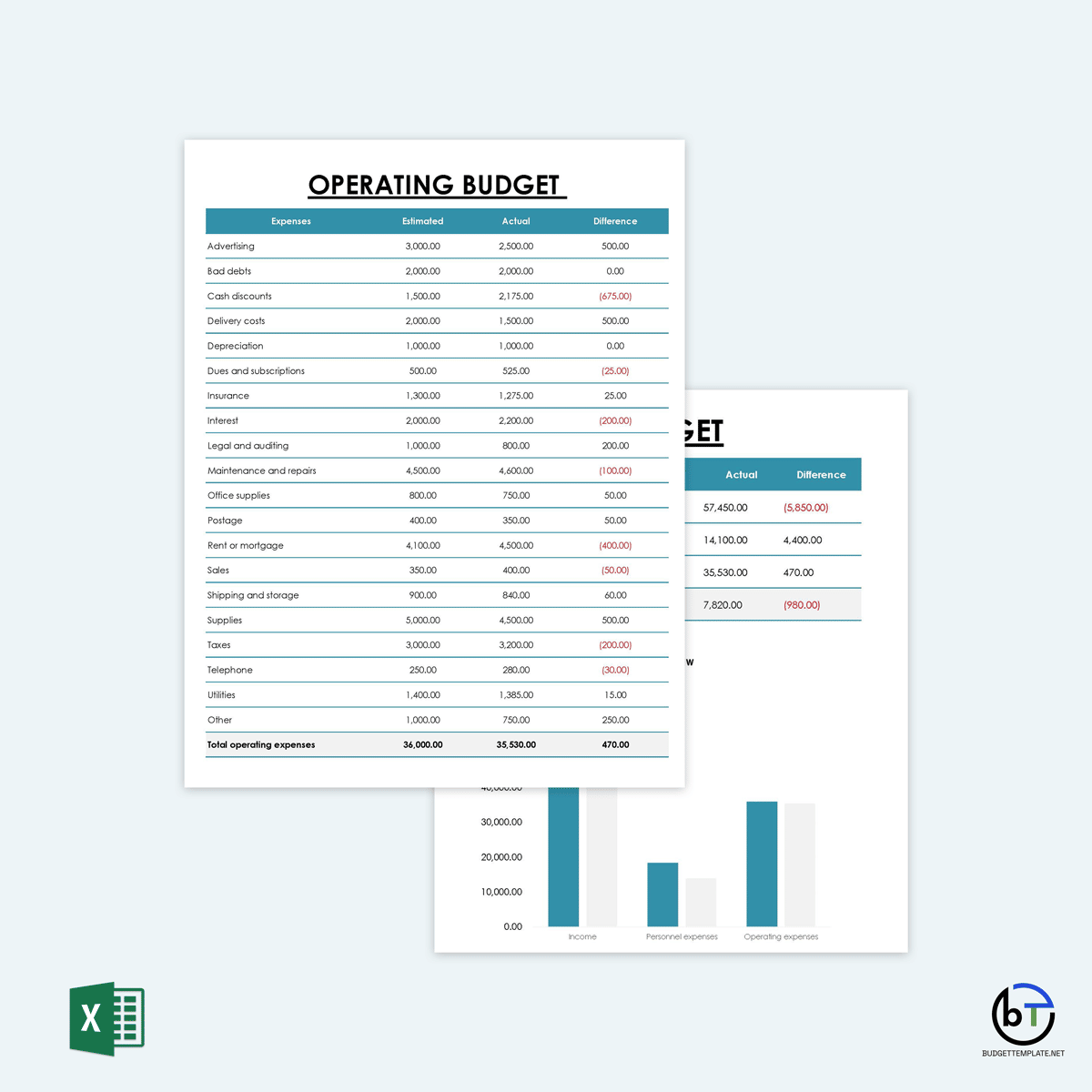

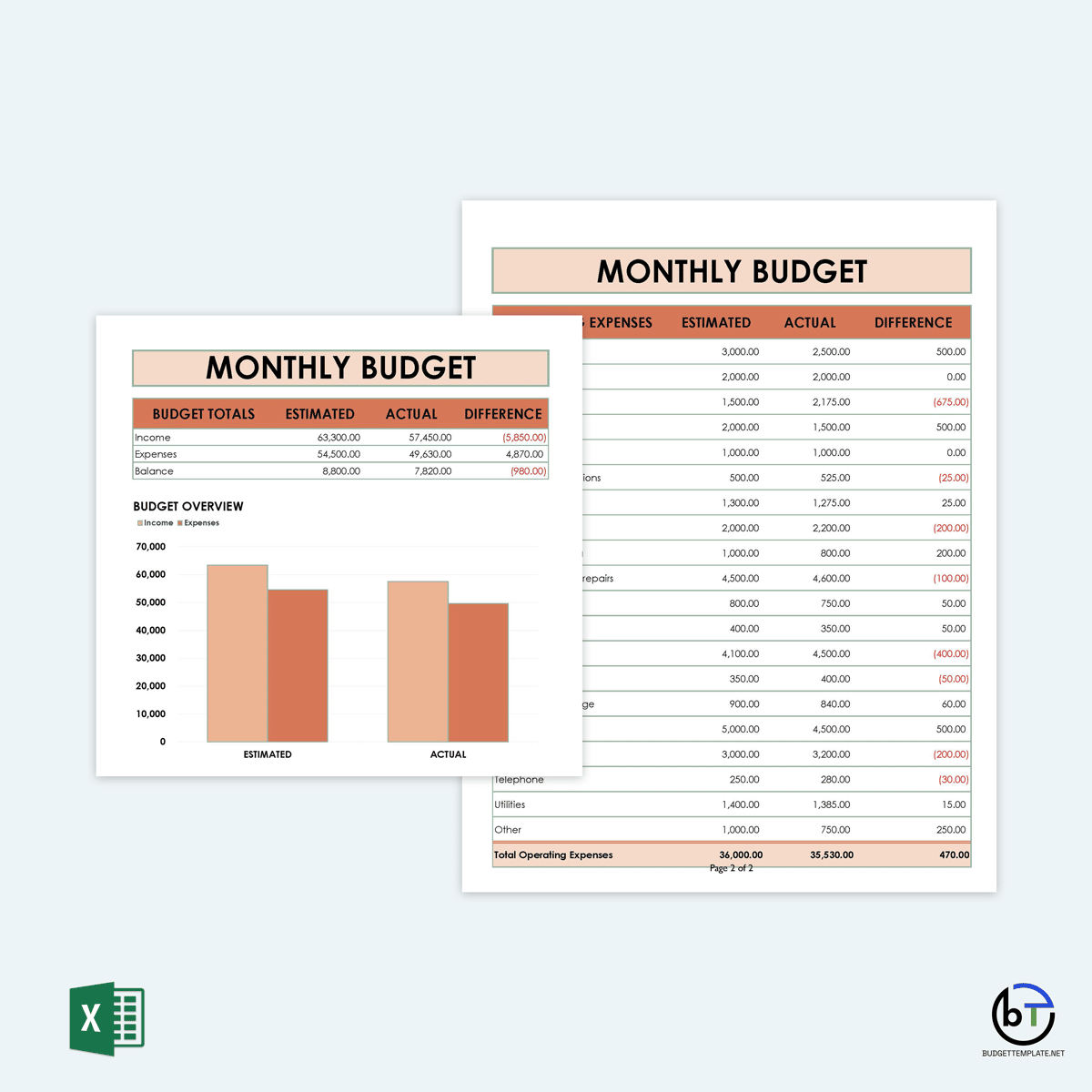

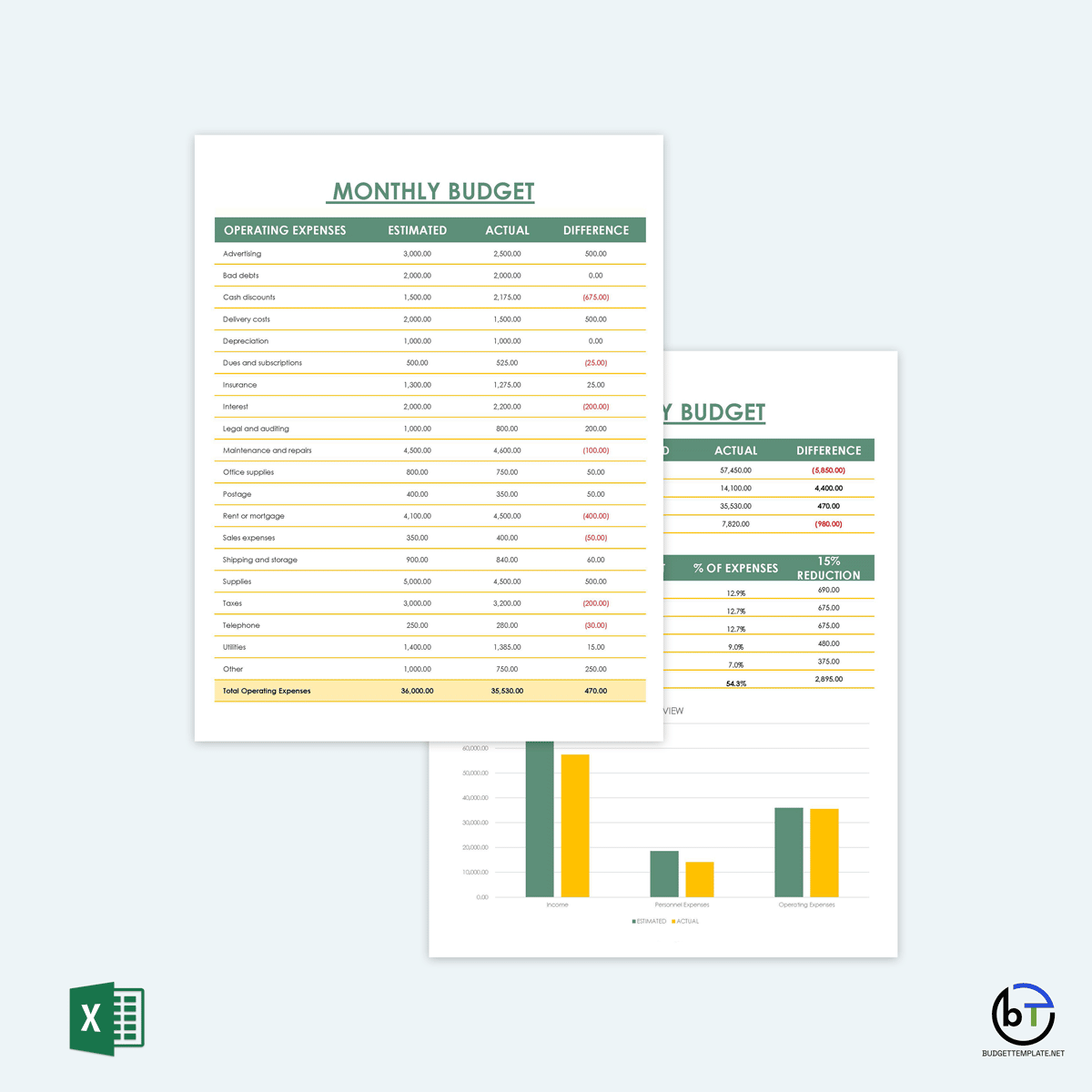

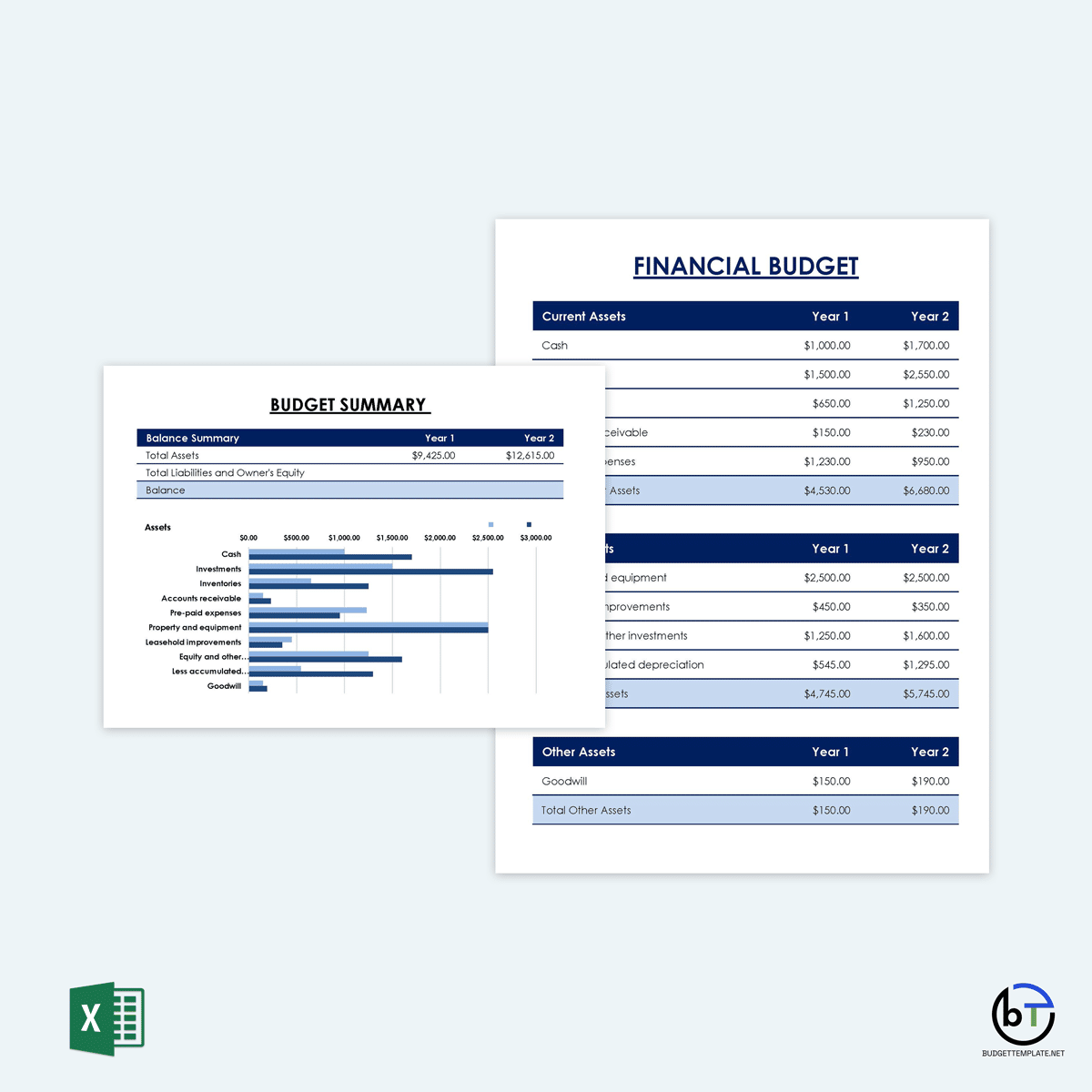

A financial budget is a financial document that gives an overview of a business’s projected income and expenses within a specified period, such as a fiscal year. It can therefore be monthly, quarterly, or annual. These budgets will look into the balance sheet, cash flow statements, and other documents that highlight the expenses and incomes of a company. A financial budget will typically come after an operating budget where all the company’s financing activities have been determined.

What Does It Do?

It is used as a planning tool. It predicts the income generated by a business and plans how the money will be allocated to the different aspects of the business to ensure both short-term and long-term goals are achieved. It reflects the financial position of a business and aids in maintaining good financial health. Through the document, businesses ensure that they’re directing money to the appropriate areas and remain profitable.

Why Prepare It?

A financial budget template’s primary purpose is to track income, expenses, and assets. It helps individuals monitor their cash flow and set various financial goals. The budget also helps with prioritizing expenses. If your income exceeds the expenses, then it’s safe to say that your business will be profitable and if not, it can prove to be detrimental to the company’s overall future. This way, management can make better financial decisions and identify where to cut spending and inject more funds.

These templates are also used to raise funding from investors. Without a financial budget, investors cannot determine how their money will result in profits. It can also guide the action items that need to be carried out within the budgeting period. Budgeting also ensures the sustainability of a business is protected and profitability is maintained or improved.

Sections of a Financial Budget

A financial budget can be a broad document as it covers every financial aspect of a business. As a result, certain sections will typically appear on the budget template.

They include:

1. Budget income statement

A budget income statement compares the projected and actual income and expenses. A cash budget evaluates the performance of individual departments and the business for the fiscal year. It shows whether the projections made earlier in the planning phases were accurate and whether company goals were achieved.

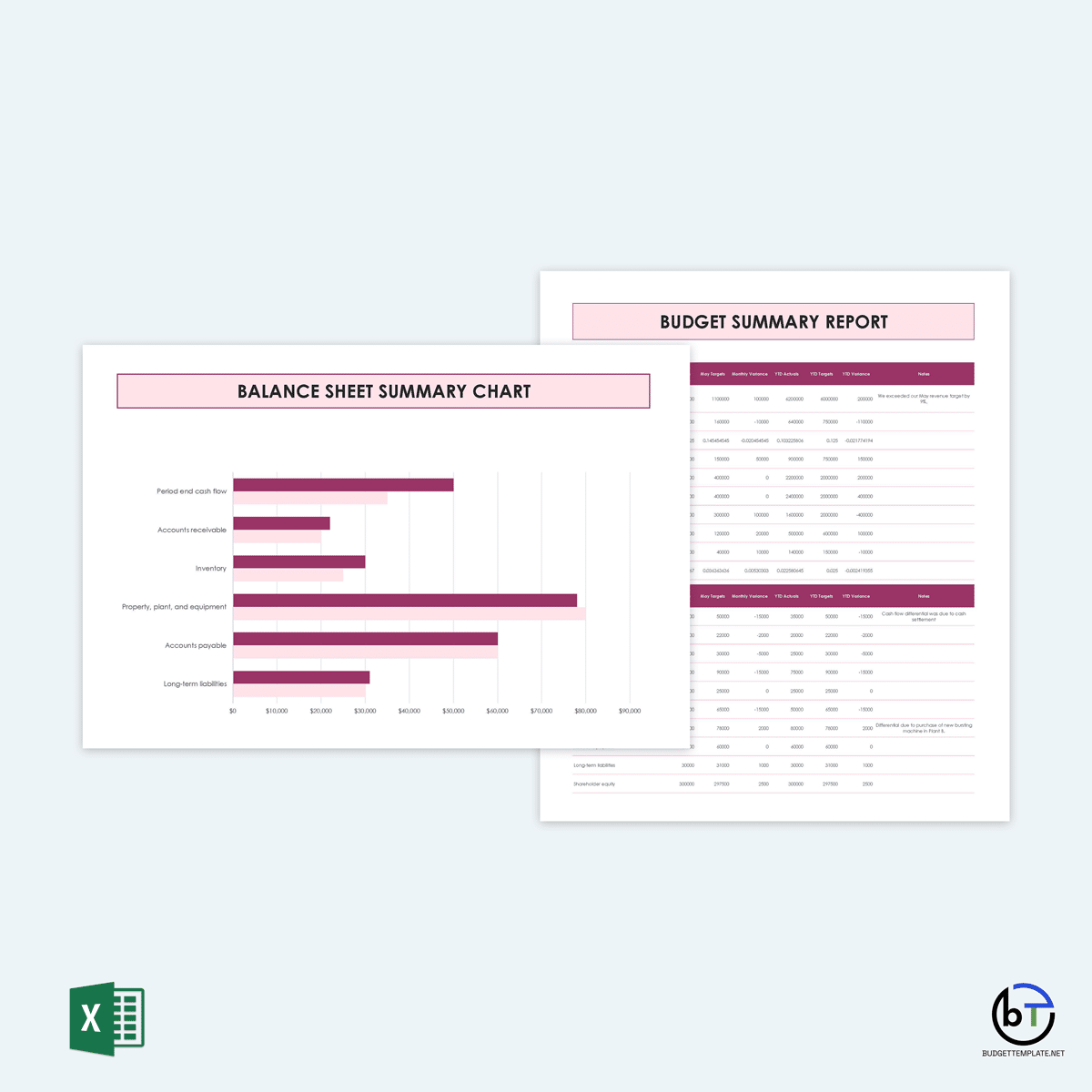

2. Budgeted balance sheet

A budgeted balance sheet balances a company’s accounts based on projected income and expenses. A budgeted balance sheet will contain the same items as a typical balance sheet. This section is ordinarily completed at the beginning of the fiscal year. The projections must be reasonable and achievable and based on previous balance sheets and income statements.

3. Capital expenditure budget

Capital expenditures work on the company’s physical assets that add value to current revenue and future expected income. Capital expenditures can include installing new equipment, developing a new product, or constructing a building. A capital expenditure budget should capture the associated costs in such situations. Factors considered when determining expenses are depreciation, the life of equipment, etc.

How to Create It?

Developing a financial budget is one step toward the success of a business or company. Whether the budget is being created from scratch or using a budget template, there are basic steps that can be followed to ensure a comprehensive and detailed budget is produced.

These steps are as follows:

Gather your financial papers

This budget allows you to evaluate your company’s performance and identify potential improvement areas. It is imperative to note that the budget is not generated daily, which would defeat the purpose. Instead, it should be prepared once a year. The budget should be data-based. Therefore, the first step should be to gather all financial documentation to provide information and data in the template. Your financial documents include the income statement, balance sheet, and profit and loss statement from the previous year.

Calculate your income

Income or revenue arguably determines how much money will be budgeted for in the financial budget template. You will gather your company’s total income from the previous year from the financial documents. It would be best to record monthly, quarterly, and annual income to picture how income is generated clearly. The revenue streams of a business will depend on its diversity.

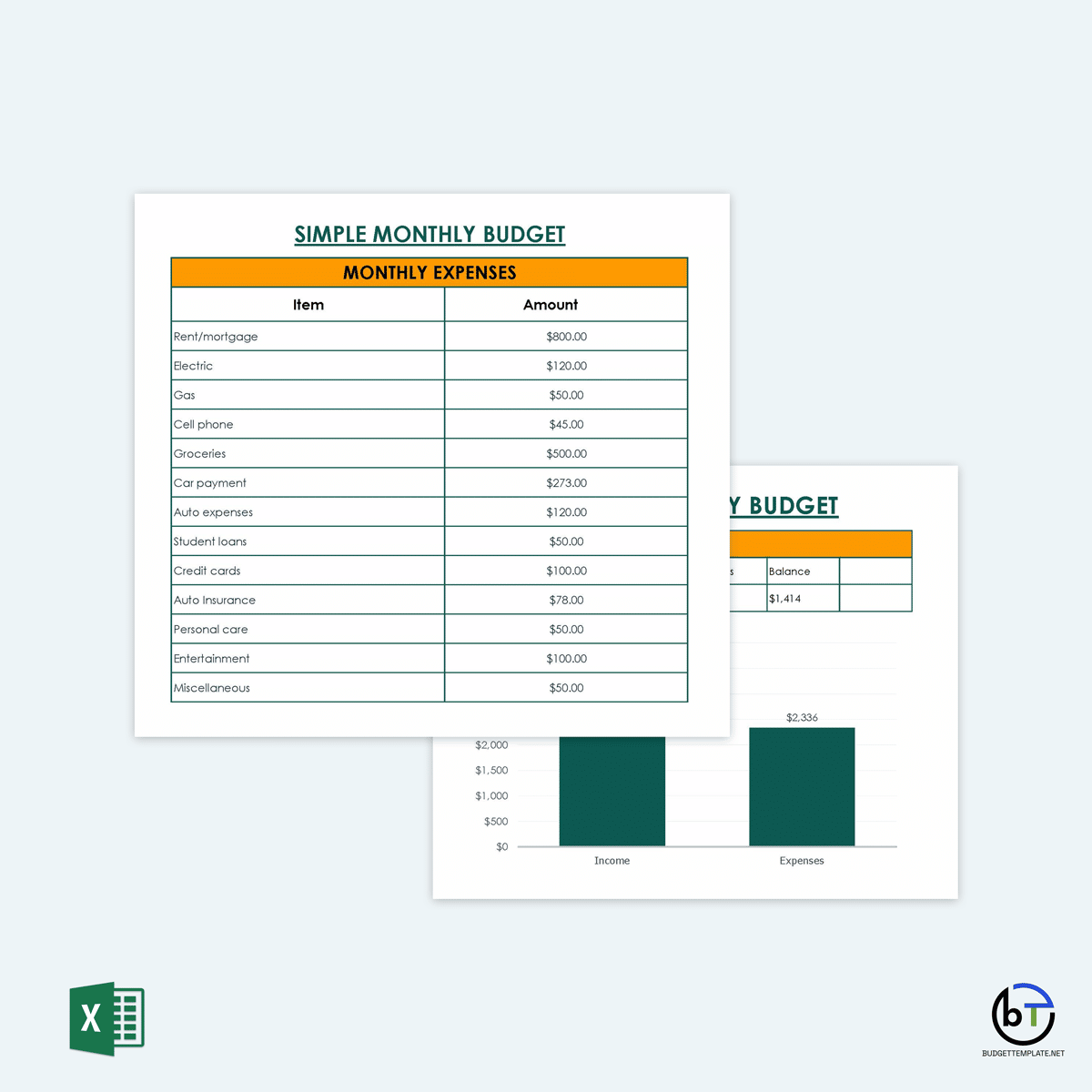

Make a list of your expenses

Once income has been determined, you should analyze and record the associated expenses. You can create a list of expenses incurred per month and annually. Such expenses include rent, utilities, production costs, marketing expenses, labor, materials, etc. This information can be obtained from receipts and bank statements.

Determine fixed and variable expenses

You will have to determine which expenses are fixed or variable. A fixed expense is a cost that is constant throughout the year. Fixed expenses refer to the costs that are not affected by the changes in sales. For instance, rent and insurance will remain the exact amount and duration over the year. Alternatively, variable expenses are those expenses that are re-calculated as a function of income and growth. Examples include wages, travel costs, utility costs, and materials expenses.

Include one-time and unexpected costs

You can include expenses that you wouldn’t have anticipated in the financial budget template. These are expenses or costs that occur in a single month or a period but are irregular. For instance, medical expenses, legal fees, and insurance payments would be included in this category.

Make adjustments according to your needs

After you have recorded the income and expenses, you should evaluate and adjust the projected amounts inclusive of your budget. For instance, if you find out that a business is not doing well, you can use your budget template to see where expenses can be cut down. Likewise, if you are doing great, some additional costs might not be included in the original financial budget template.

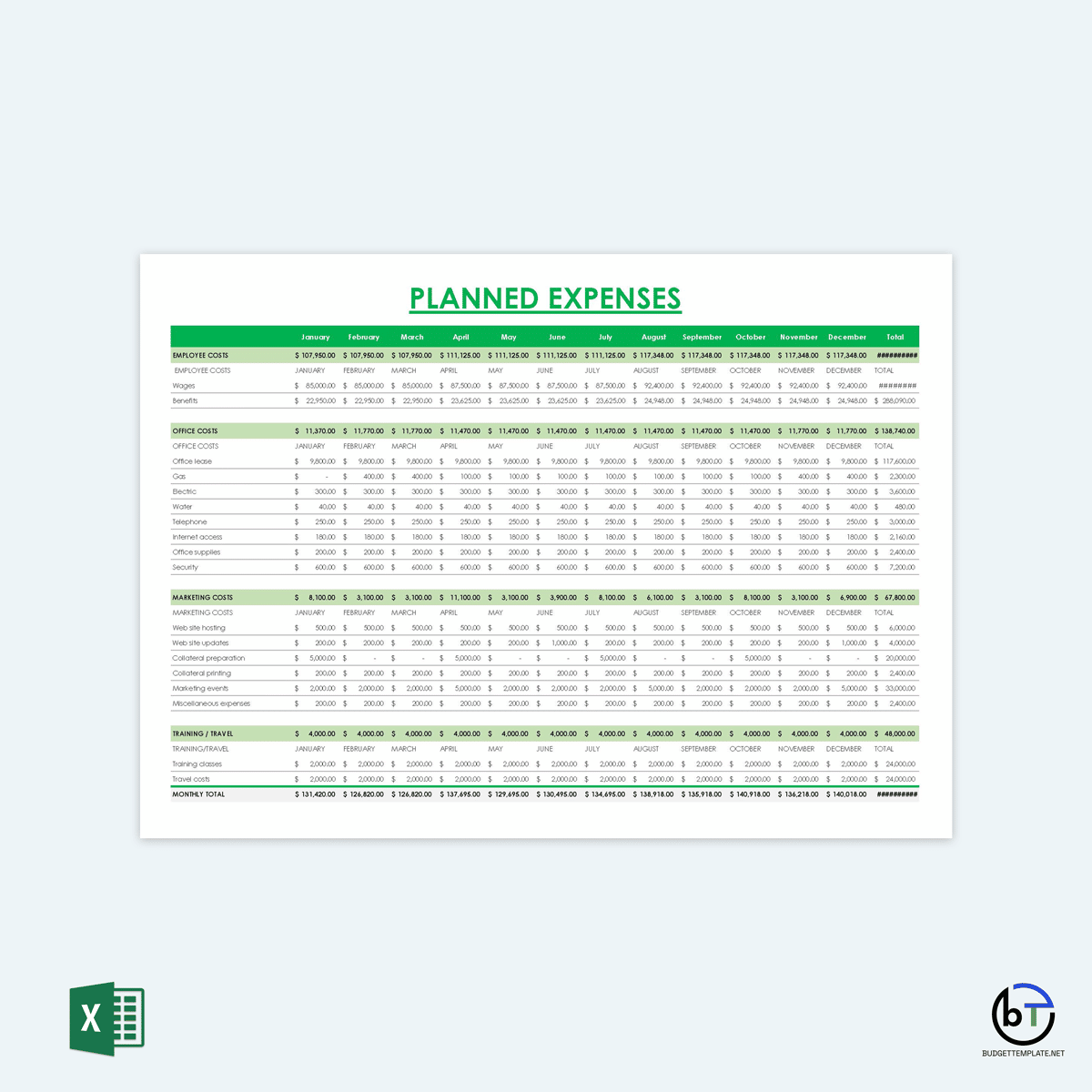

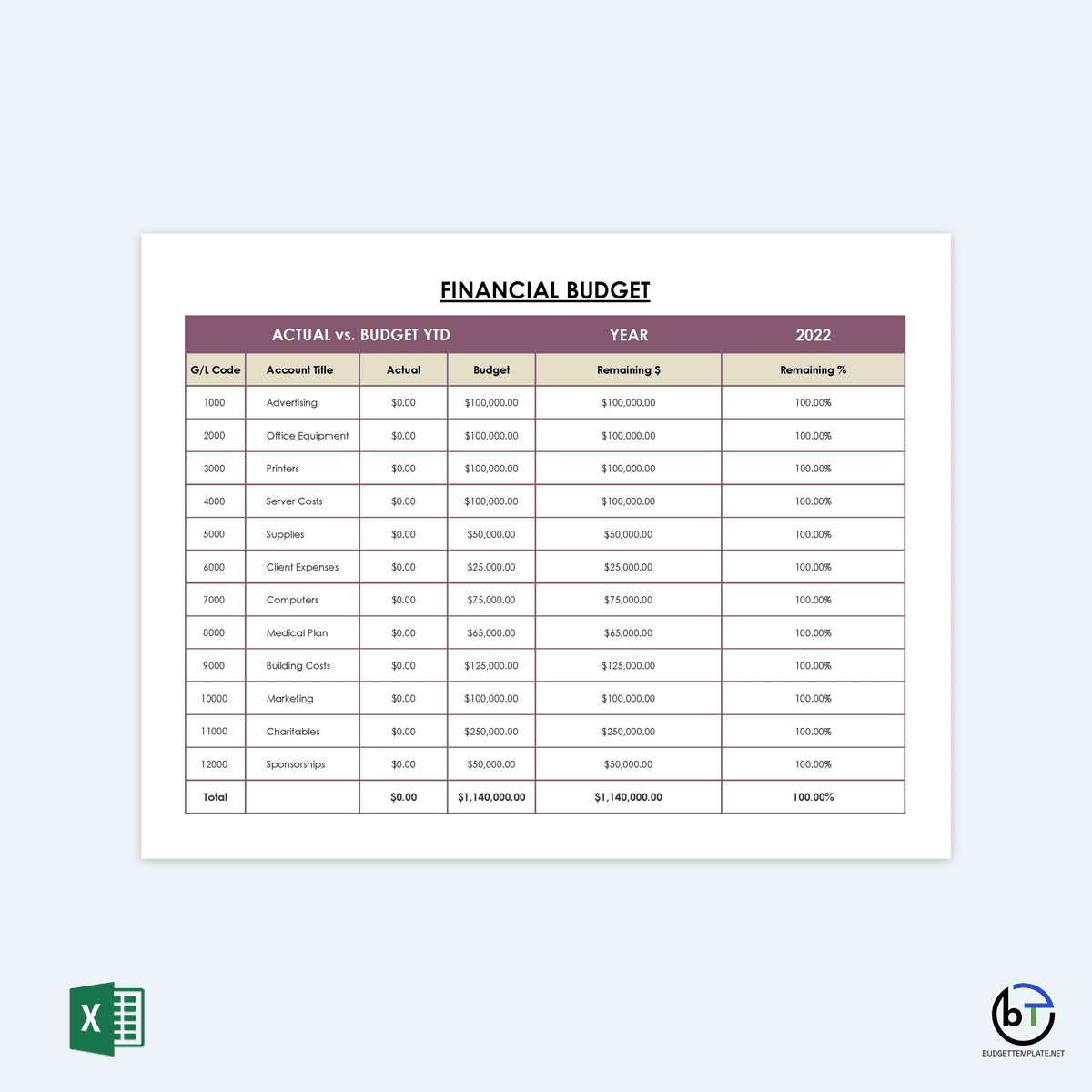

Financial Budget Planner Templates

The financial budget template is an excellent start to help you create a solid financial plan and save the most important documents. Several budget templates can be found on this website. They are free and contain the basic information one needs to prepare a financial budget. The templates are easy to download and print, customizable and uncomplicated. In addition, the templates are reusable and can be personalized to match the specific operational needs and financial preferences of each department.

Our Budgeting Advice

It would be best always to aim to have the most efficient financial budget planner. This involves paying close attention to details, taking pertinent details, and aligning it to business goals.

The tips below can increase the efficiency of your budget template:

Be conservative with the revenue

While you should be optimistic about the projected growth and profits in your financial budget, you should always aim to be conservative. This means the goal should not be to make over 500% profit margin but instead aim for a realistic profit margin. For example, a profit margin growth of 5 – 10% is more realizable. If your company revenues exceed this figure, well and good, the company will have some leftover. However, it is better than being too optimistic and budgeting for money that won’t be generated, as it ends up eating into the profits and can easily lead to losses.

Plan for growth

Growth is a vital consideration for budgeting, whether in terms of expansion, recruitments, sales, increased production, etc. Growth will typically impact income and expenses, which affects the figures you input in your budget template. Therefore, you should consistently anticipate and plan how growth will affect your spending.

Consider your long-term goals

You should be clear and detailed on your business goals. This is the focus or direction you want your company to go. For instance, if you want to open a new location in the next two years, it would be prudent to build it in your financial budget template as early as possible. Determining budgets for a period that extends more than one year into the future is always ideal as it helps anticipate future expenses and revenue streams.

Prefer paying in cash

A cash flow analysis will help ensure that you are spending your money wisely when planning the budget. This can be achieved by paying for expenses through cash and not through credit cards or loans. Cash payments are easier to track, do not apply interests, and instill good spending habits.

Resolve cash flows issues

It is good to determine the critical cash flows to the business. For instance, it might be essential to determine whether the business has enough cash to meet payroll. This will help you plan for the future, especially if the business has irregular revenue streams. It is essential to ensure that adequate cash is generated weekly every month to meet expenses and salaries.

Review and tweak your budget

Budgeting is a continuous process as there are always new factors that can affect your business. It is crucial to go over the financial budget template at least once every month and even quarterly to make necessary adjustments. Find ways to cut costs and increase savings.

Frequently Asked Questions

How to use your budget?

Once you have created the most efficient budget template, there are different ways to use it. First, you can use it to compare the performance of your business – both current and past. This will help you evaluate how well your business is faring over time, including how much revenue was generated, how much was spent and how much profit was made.

How can you account for your financial goals in your budget?

Developing a budget will typically encourage you to set a financial target – buying something, getting a new job, or going on vacation. You should set these goals at the start of the year or when you are creating your budget template. Setting goals will allow you to determine how much money is required to meet the target and how long it will take to save that amount. Therefore, financial goals are accounted for in the savings section of the budget. In addition, you can set up savings account for each financial goal.