A business budget is a financial or administrative planning document that summarizes a business’s anticipated revenue, expenses, and profit for a specified period. Therefore, a business budget can be prepared monthly, quarterly, or annually. It is an essential tool for any business, and without it, the business owner is forced to rely on his or her memory to track the organization’s finances.

In addition, business budgets are used to ensure the financial goals and strategies are achieved and successfully implemented respectively. The business owner can thus remain organized and in control of each dollar that comes in or goes out from business accounts.

As a result, companies in multiple industries can use a business budget template, ranging from small businesses to multinational corporations, from public charities to private foundations. Having a business budget in place will help to avoid overspending, ensure that the business owner is prepared for emergencies, and allow him or her to make more informed decisions about future expenditures.

This article will help you understand the fundamentals of a business budget template and how it can be prepared for use in financial management in business.

Why Is It Important?

A business budget template is essential because it helps the business owner to understand how much money is required in a particular reporting period and where it will come from. For instance, if a company needs to purchase a new computer, they need to be able to figure out their sales projection to determine where the money for the purchase will come from. Therefore, using them helps you clarify your business’s financial future and prepare for it. This way, you can manage cash flows and allocate resources appropriately.

A business budget template is vital because it will help to track expenses and determine which ones need to be cut. Through a business budget, better financial decisions can be made. This way, a business remains operational, profitable, and sustainable. Therefore, the benefits of a business budget are both short-term and long-term. Business budgets are also used as communication tools – they’re used to demonstrate proper financial management and the potential profitability of a business to investors and lenders.

How to Manage a Business Budget

Managing your business budget is crucial in ensuring the business budget template is beneficial to a business or company. Typically, this process can be undertaken in three phases, as discussed below:

Budget preparation

This is the first step of this process. It involves setting the business’ financial objectives and what you are trying to achieve financially. When you clearly understand your goals and objectives, you can draw the business budget(s) and determine where your money will come from. Businesses will often create multiple budgets, short-term and long-term.

Budget monitoring

This step involves monitoring your business’ cash flows to ensure you stay on target and invest in the right opportunities. Budget monitoring also helps ascertain whether the business’s financial goals are being met or not.

An example of this is:

If you purchased a new computer for $2000 and your business budget template assumed that your company will make $3000 from sales but only made $2500 from sales this month, you will need to rethink purchasing a new computer and shift funds elsewhere.

Budget monitoring can be designated to one person or multiple supervisors, depending on the size of the business. A budget review schedule can also be created to facilitate this process.

Budget forecasting

The final step involves projecting the business’ revenue for the next year and determining where the money has gone. This step can last for weeks, if not months, depending on the size and the amount of data collected. This is done by analyzing your income and expenses via multiple sources such as invoices and bank accounts. Identify areas where expenses can be reduced and where revenue can be increased. Next, you can prepare a company budget forecast using a business budget template to capture the projected figures.

What to Include in a Business Budget Template?

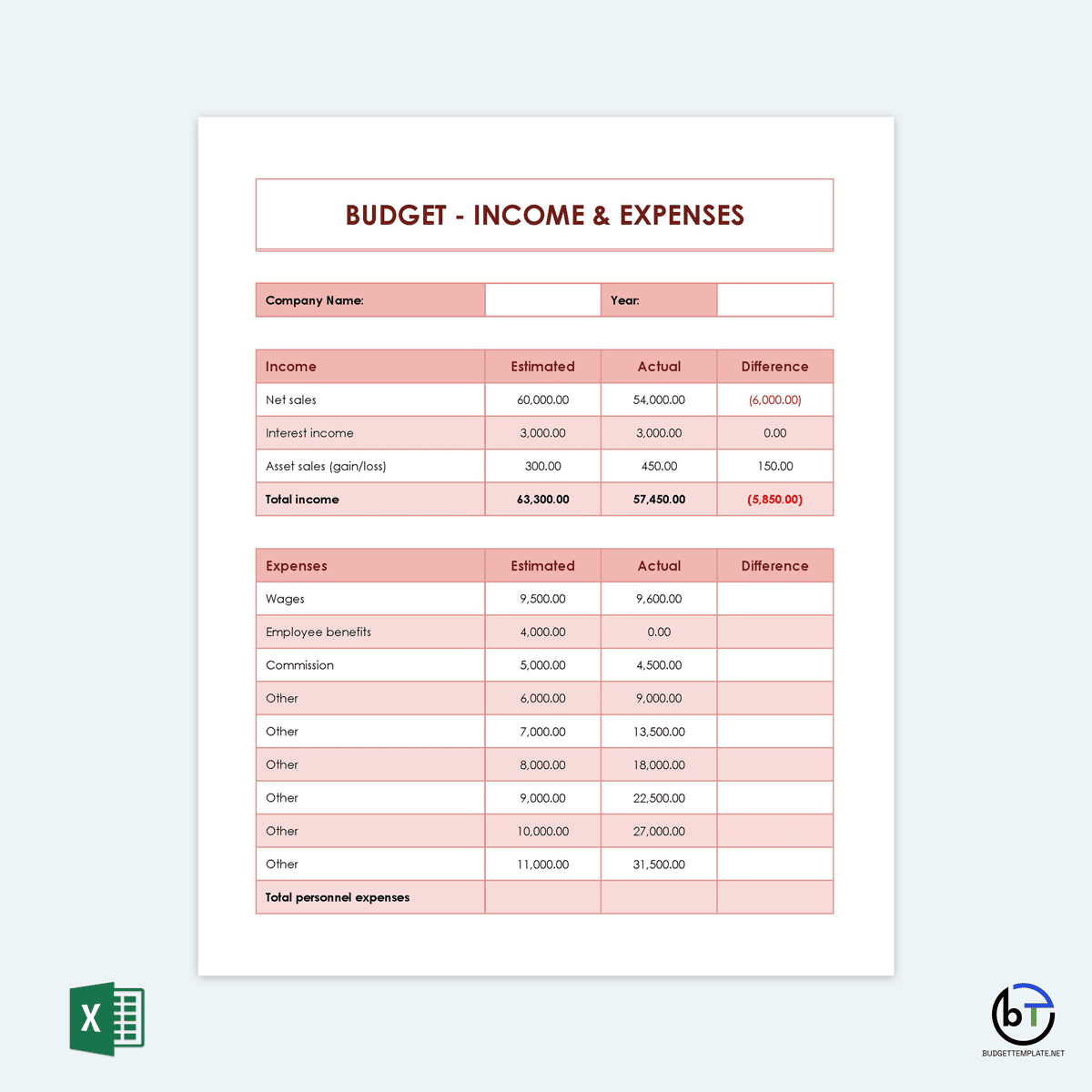

A business budget template is made up of several components. However, different companies may require varying components for their budget. Here are the main components you want to include in your business budget:

- Planned expenses

- Additional costs

- Actual costs

- Planned income

- Actual income

Planned expenses include employee wages, utility bills, loan repayments, and other anticipated costs. Planned income is generated from sales, services, or investors. Additional costs include support services such as legal fees, training, travel, marketing, etc. Actual income and expenses are determined at the end of the reporting period and reflect the actual revenue generated and costs incurred.

How to Create a Business Budget?

To create a business budget template, you need to understand the business, its structure, and where the money comes from. Start with some basic questions like what are the company’s financial objectives? And following a few simple steps, anyone can create a winning business budget quickly and easily.

These steps include:

Specify all your business income sources

Define all your business income sources such as sales, profits, investors, and other forms of revenue depending on the type of business. Identifying how much money is coming in creates a basis for determining how much is available to cover costs to be incurred during the specified period. The income sources can be identified from the profit and loss statements.

Subtract your fixed and variable expenses

This step determines the amount of money you have left over after accounting for all your income sources. Examples of business costs include employee wages, utilities, depreciation, and loan repayments. Check that you have accurate data on these costs to prepare your budget accurately. Fixed expenses will not change irrespective of your revenue, such as rent, employee salaries, loan payments, insurance, and operational utilities. Variable expenses increase with revenue, such as billable staff wages (freelancers), commissions, and advertising expenditure.

Set aside expenses for emergencies

Your business budget template should account for unprecedented events such as illnesses, machine repairs or replacements, fires, and floods. This is done to make sure that your business is protected. While it is impossible to predict when these emergencies will occur, setting aside a contingency fund ensures money allocated to other essential parts of the business is not redirected to resolve emergencies.

Create a profit and loss statement

A business budget template will include a profit and loss statement to track your business’ income and expenses at the end of each reporting period. This can be a part of your budget template or an added document separate from your budget. The goal here is to show a profit or loss on your business budget depending on whether the revenue generated was more or less than expenditures. If your company has a positive cash flow, this will be reflected in a profit. If not, it is reflected as a loss or negative cash flow.

Outline a forward-looking business budget

Now that a profit and loss statement has indicated its financial status, it is time to create a business budget. The business budget template should include items for all anticipated costs and revenues and future cost estimates for capital investments needed in the future. Creating a forward-looking business budget helps you capitalize on investments with a high ROI, which is urgent and fruitful for the business’s sustainability.

Examples of things to look out for when budgeting for your business include; massive purchases that can cause a significant dent into company finances, seasonal trends based on ascertained patterns like weather, school calendar, holidays, etc., and notable fluctuations in the previous year.

Adjust your budget (if needed)

Once your business budget template has been finalized, review it one more time to make any adjustments. Businesses are constantly changing, so be sure to consider any adjustments that may have been made since you first started creating the budget—for example, the discrepancies between estimates and actual income and expenses.

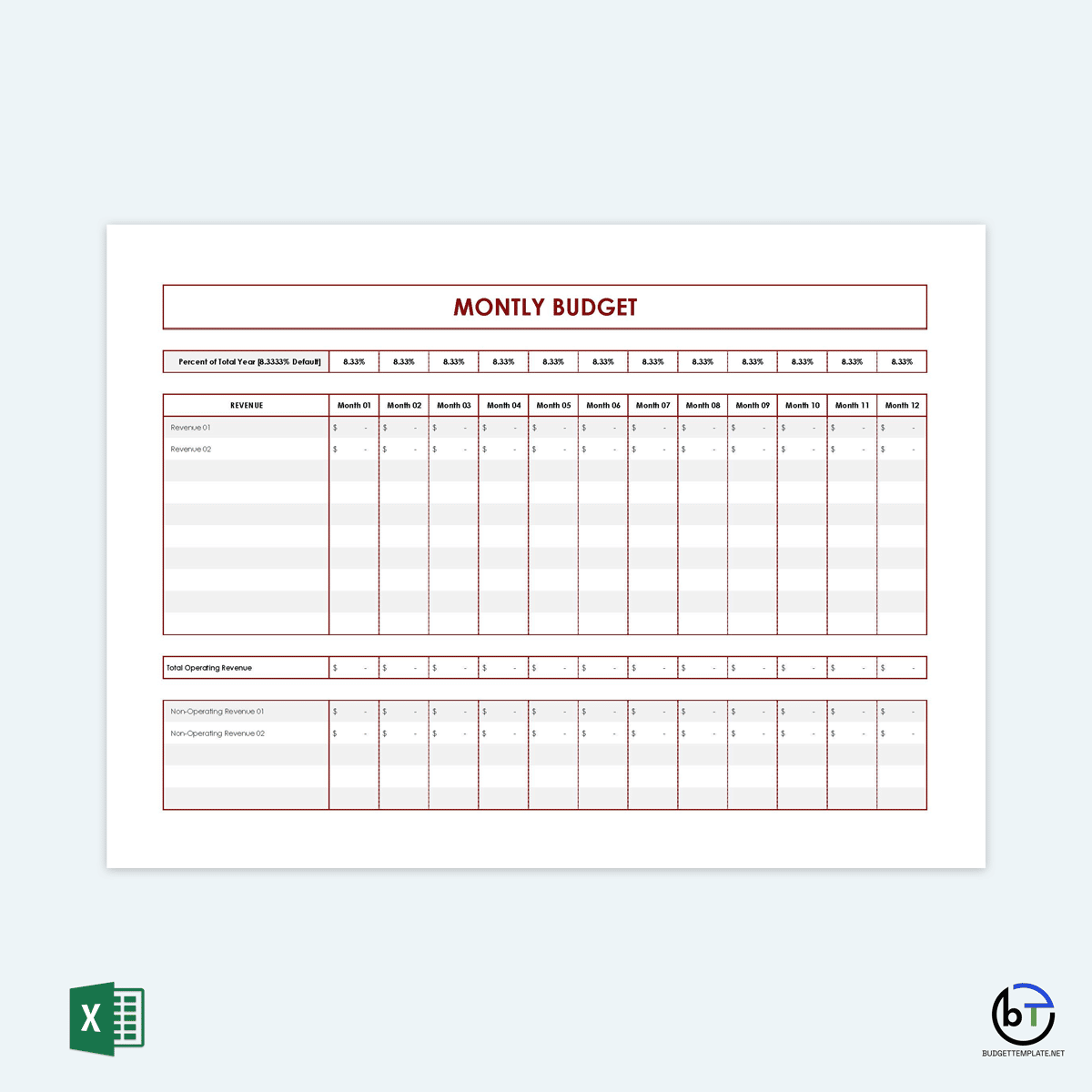

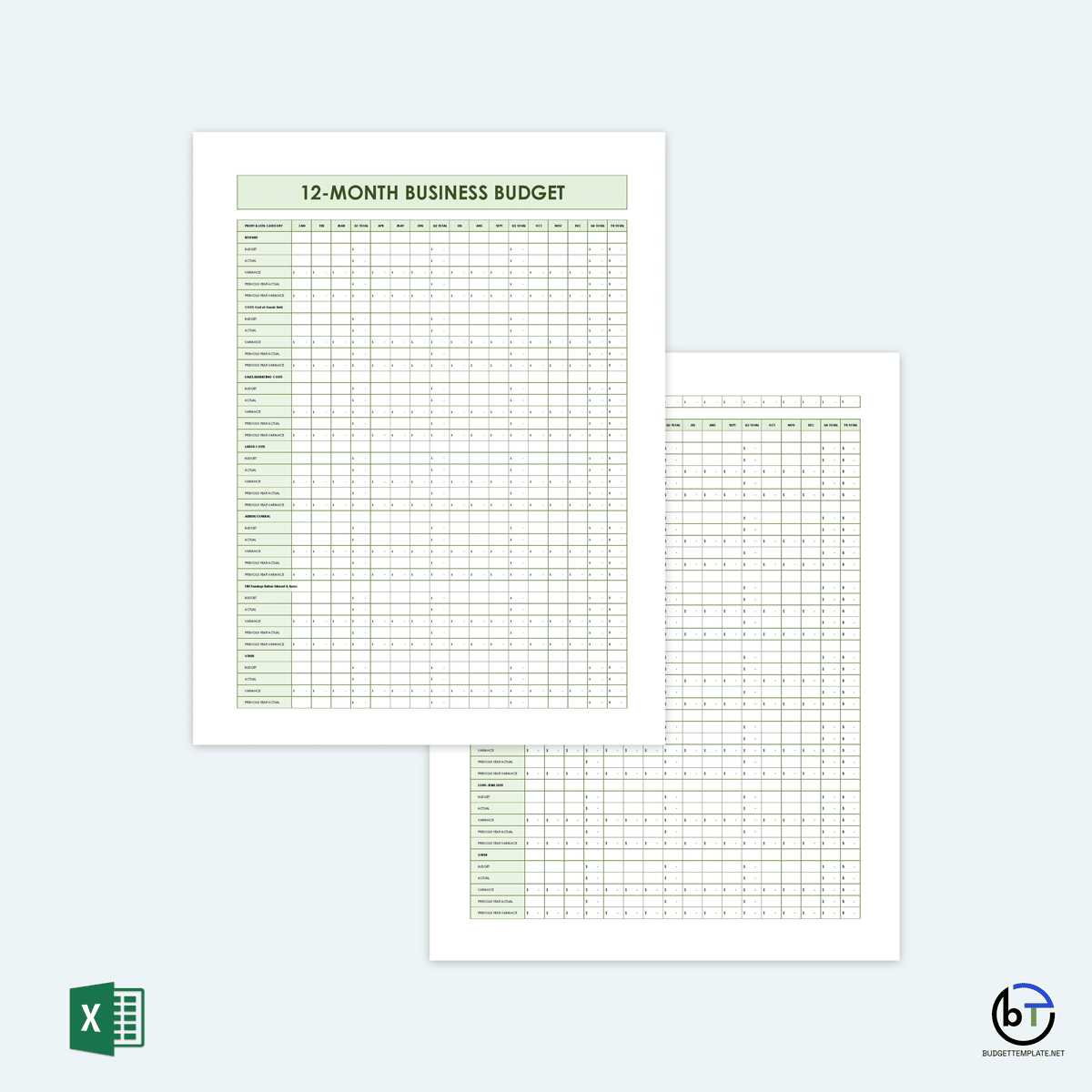

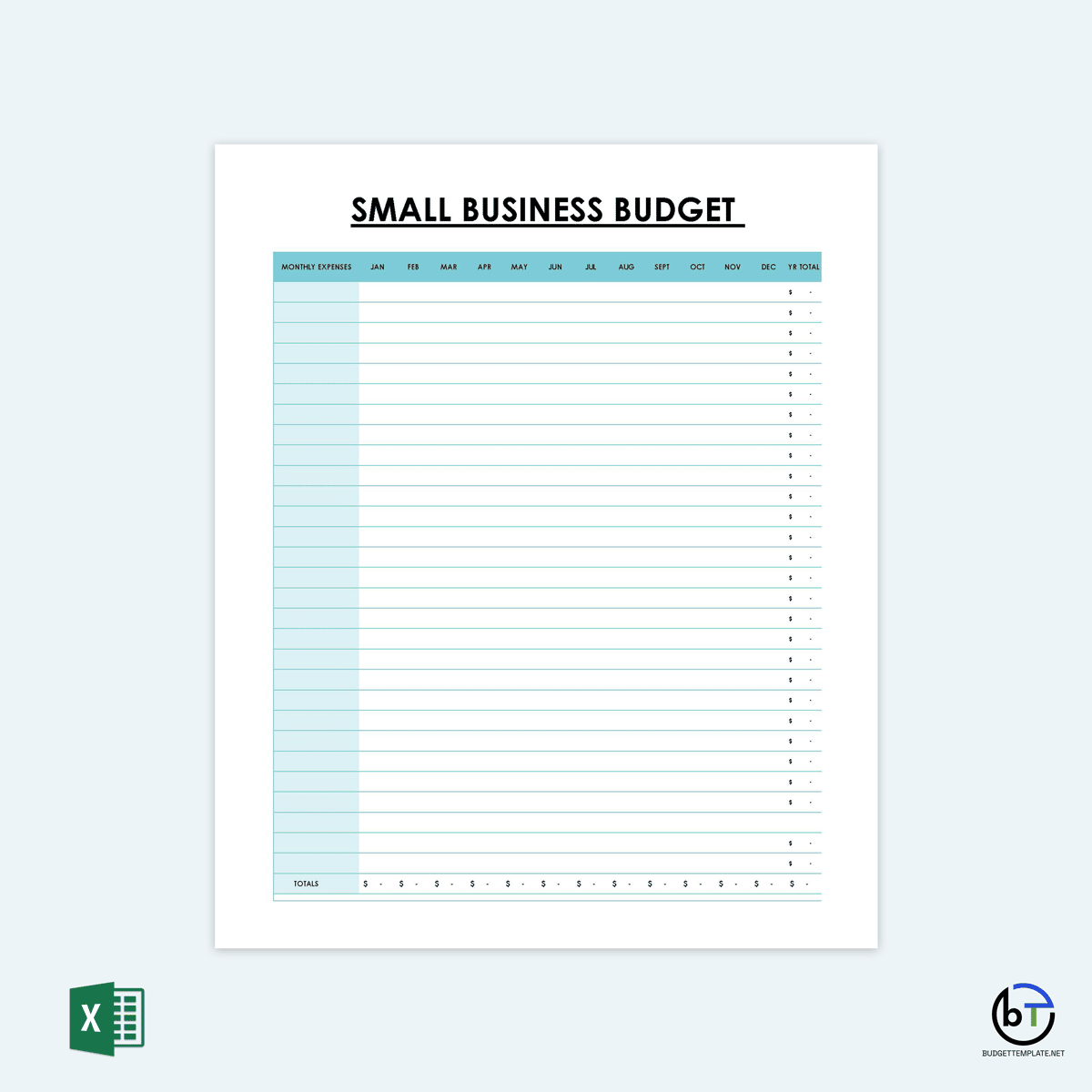

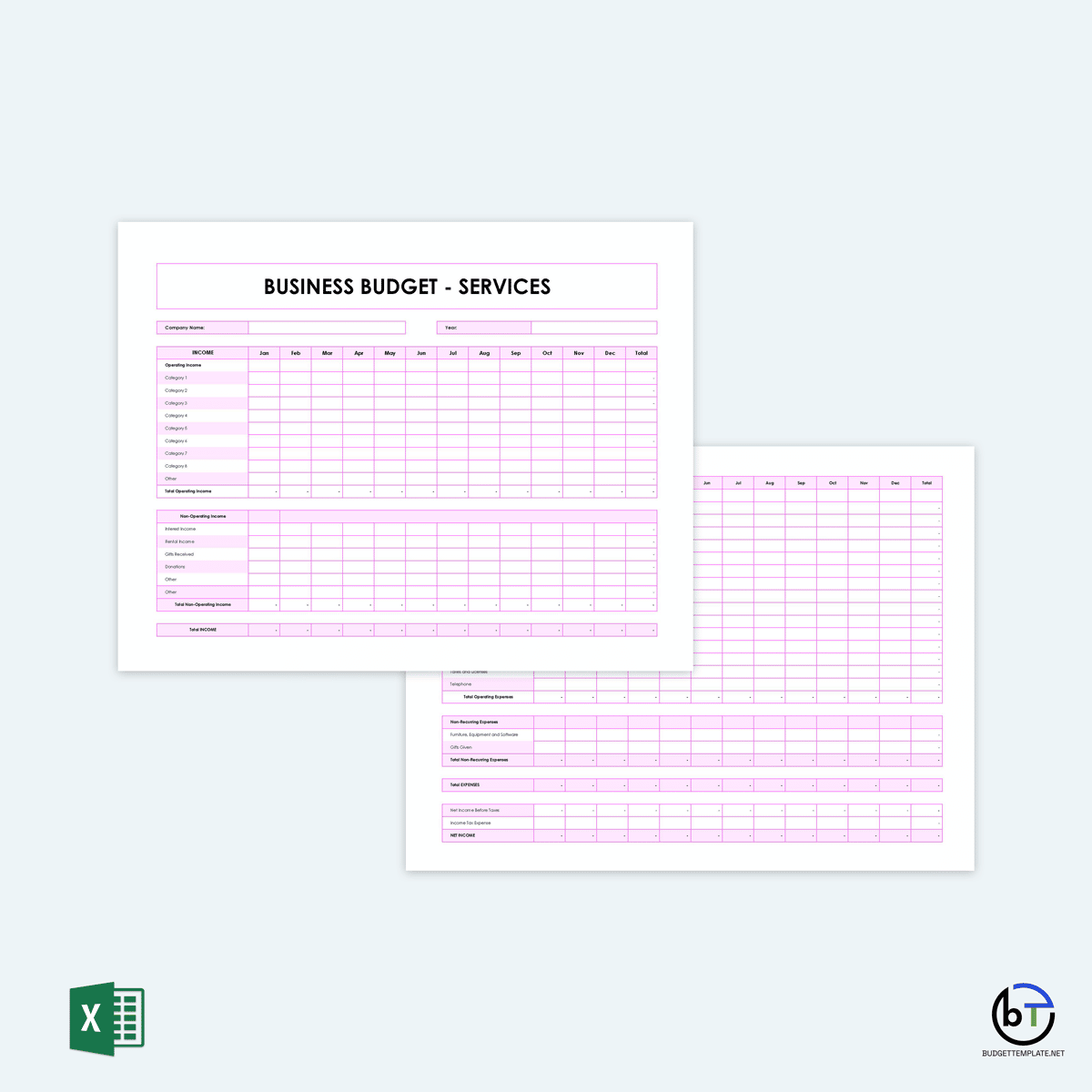

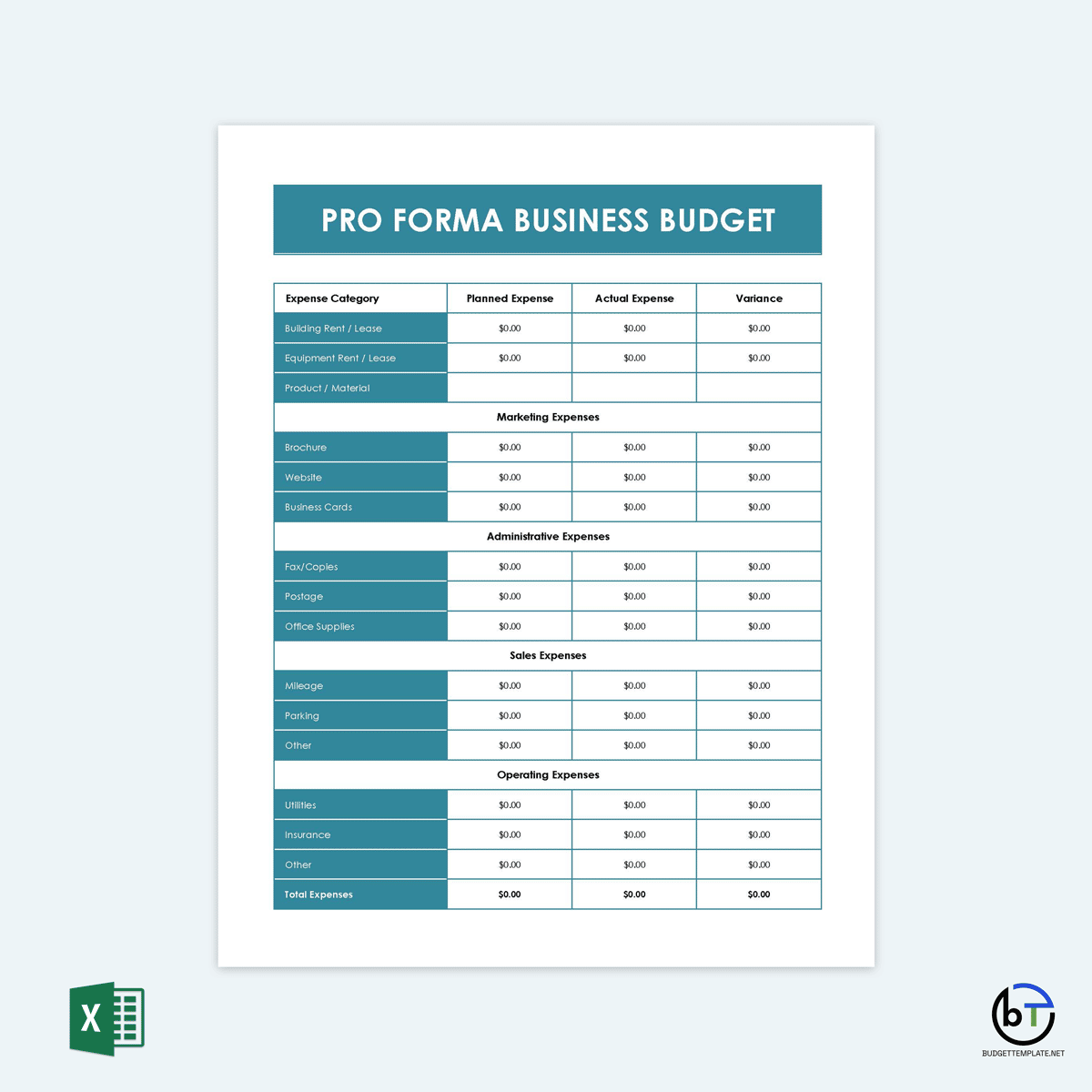

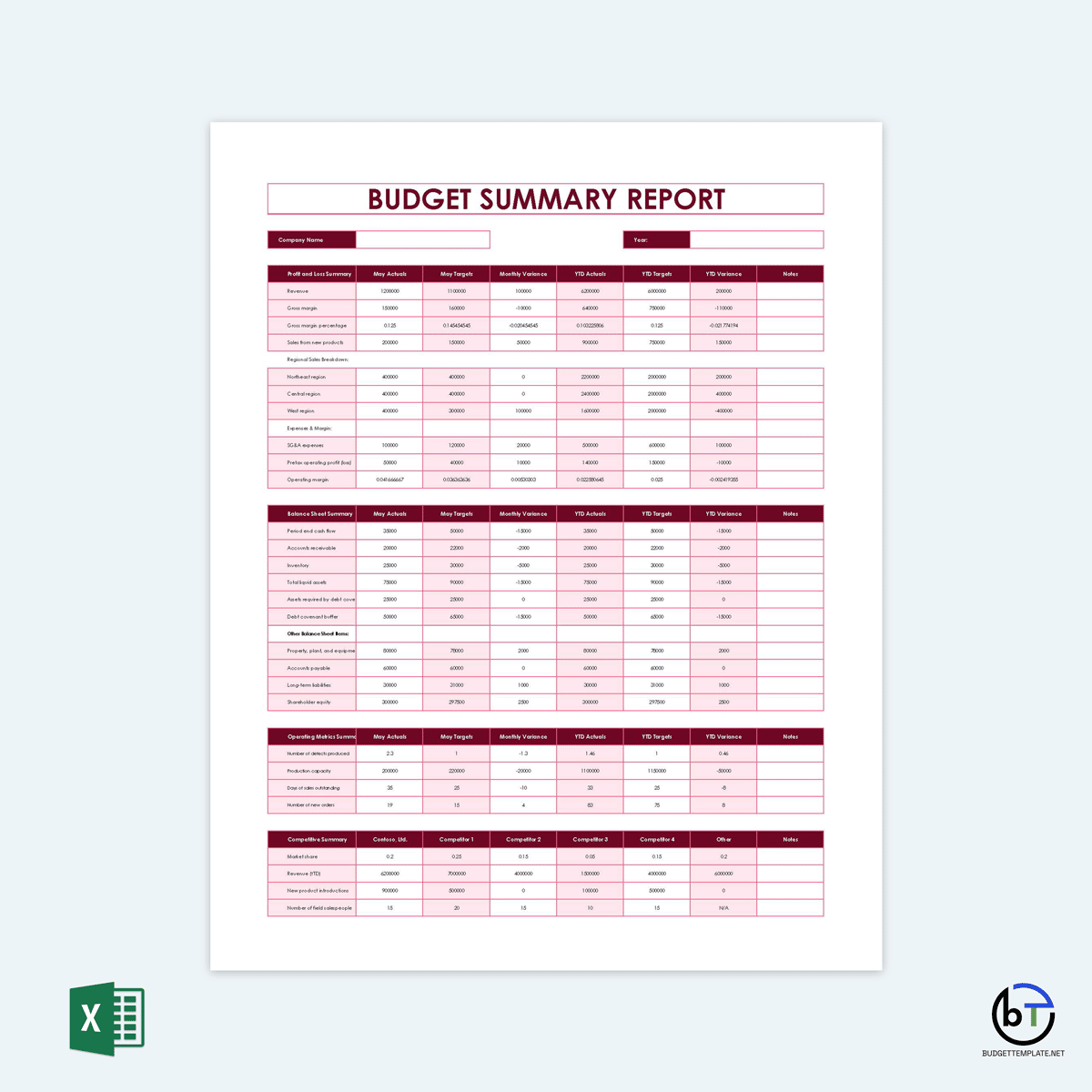

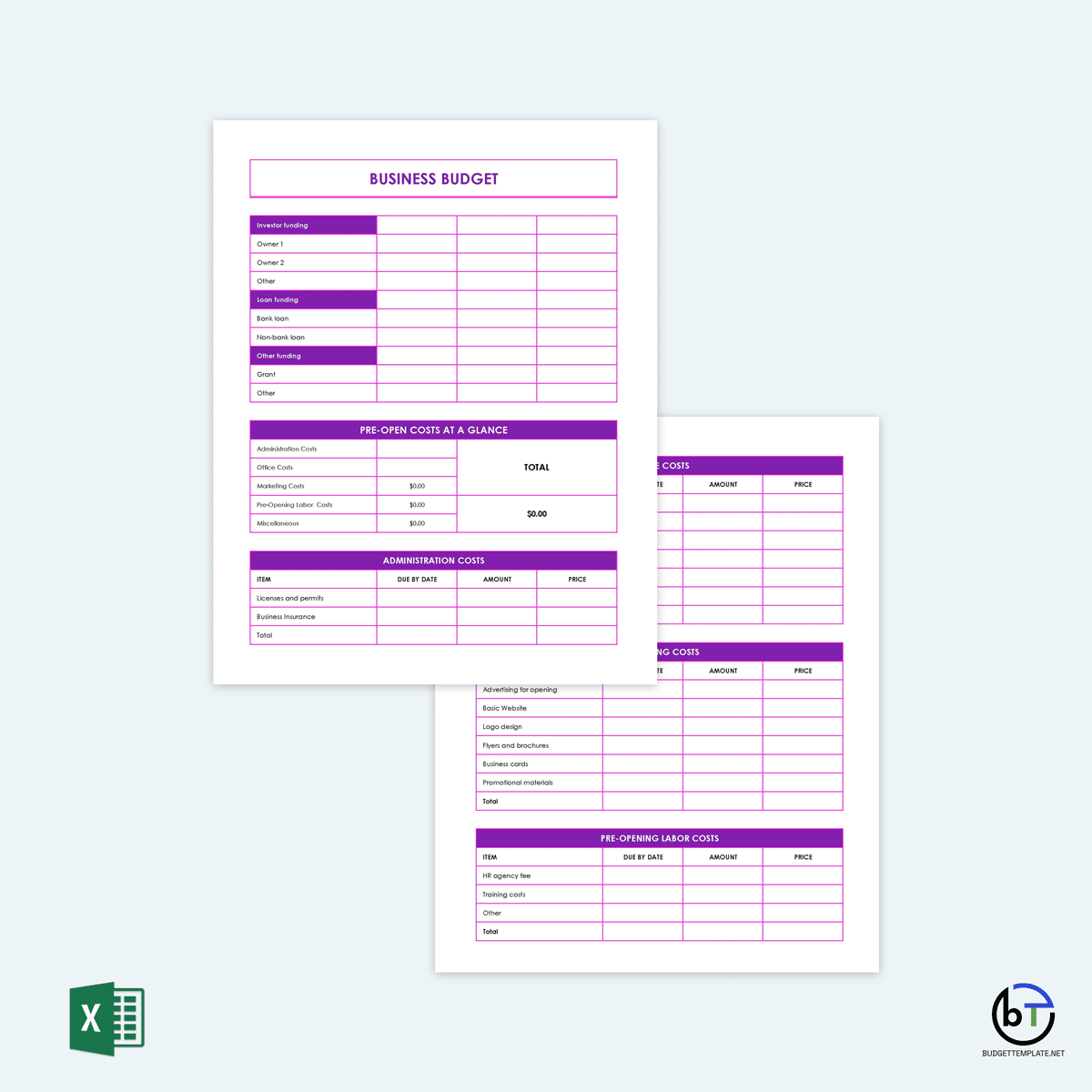

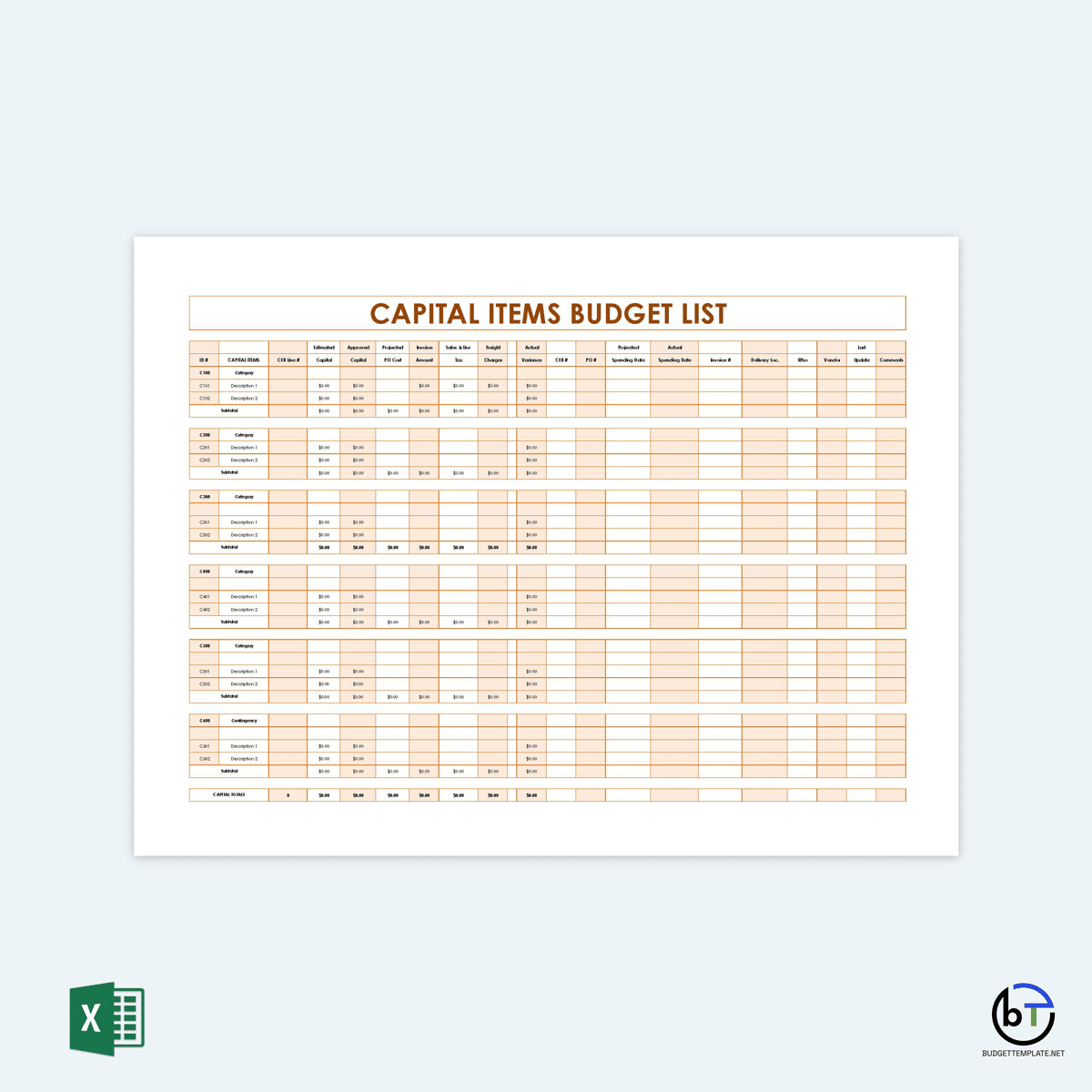

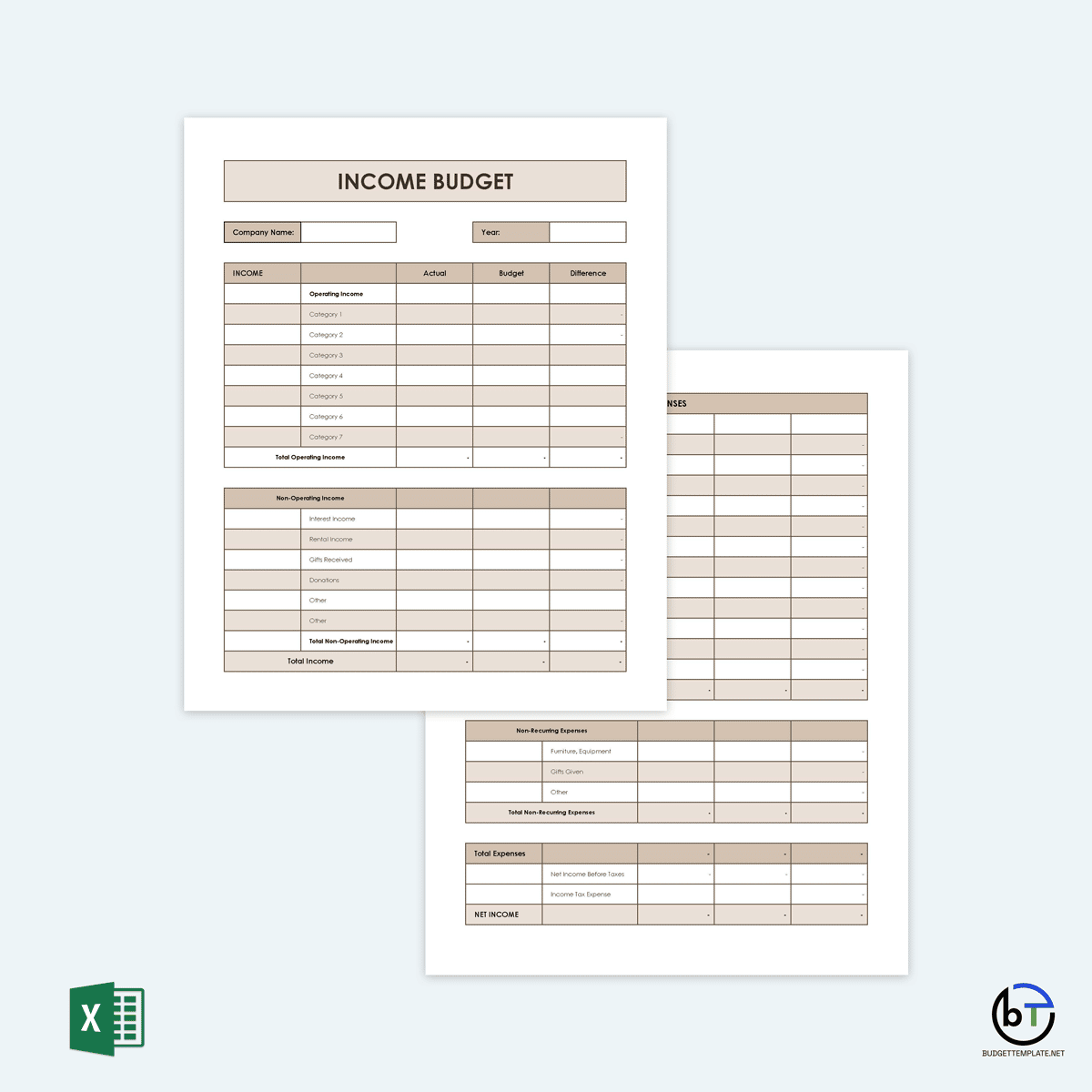

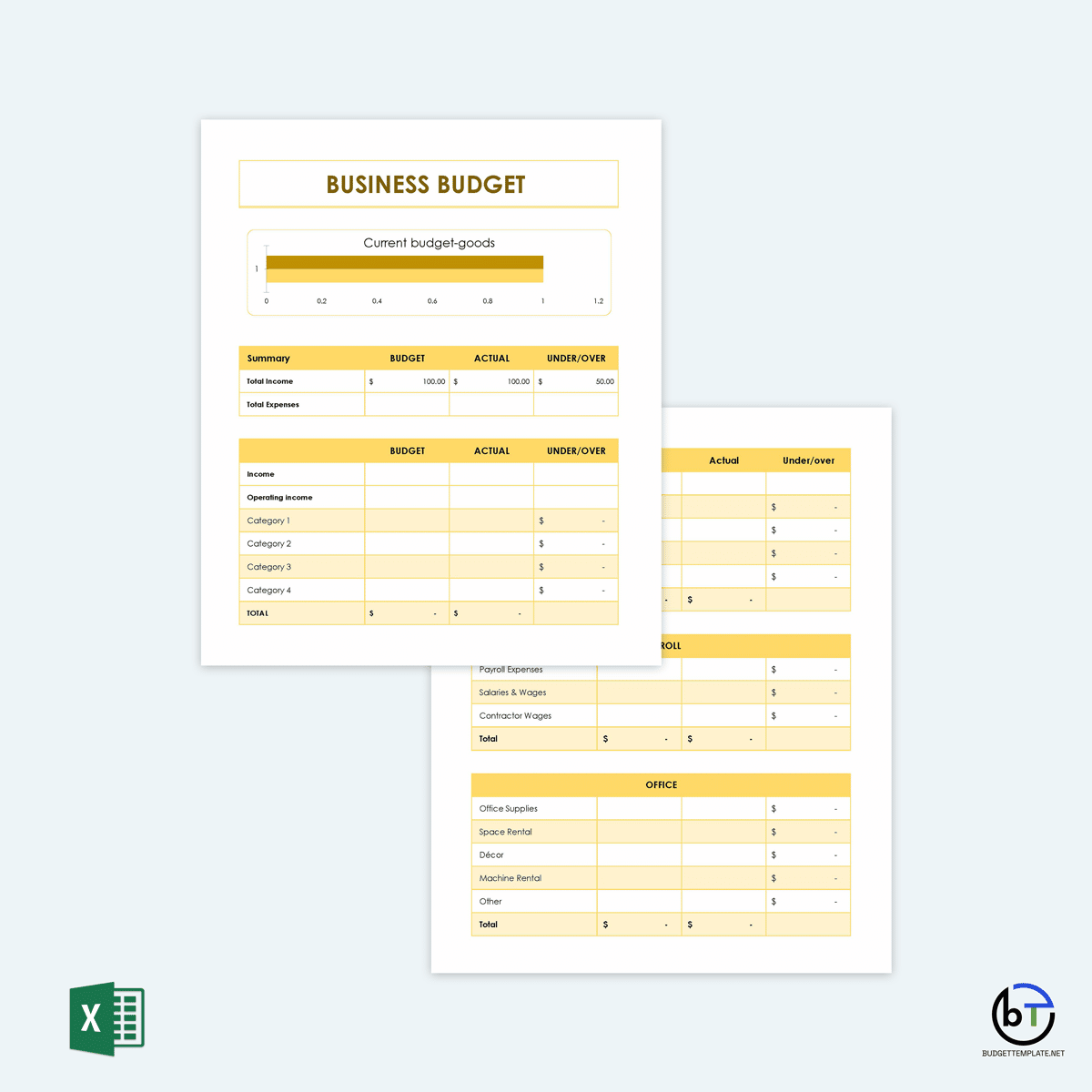

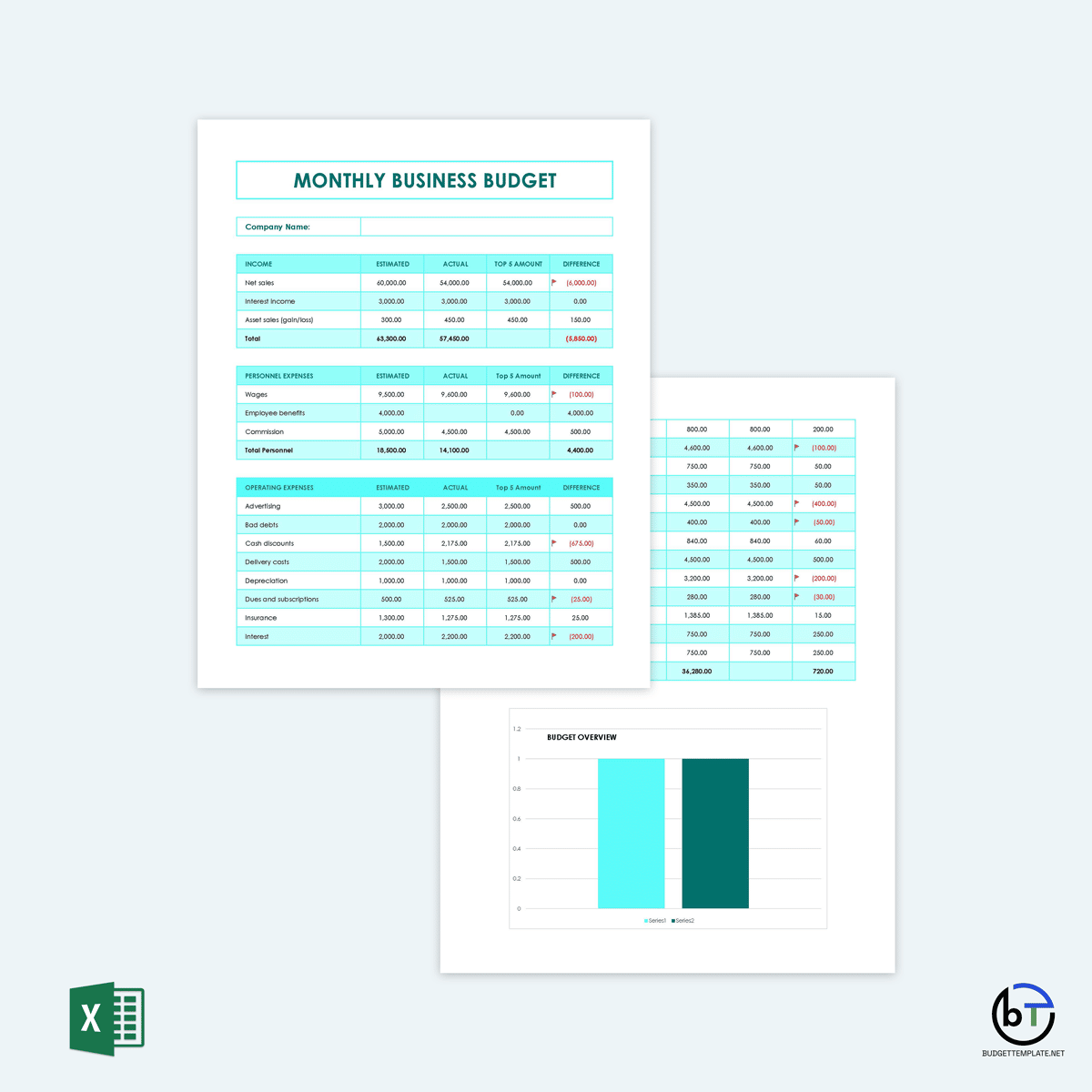

Business Budget Templates

Creating a business budget is one of the most critical tasks that every company should do regularly. Business budget templates are created to help business owners forecast, plan and manage their financial status. This website has provided the readers with professionally designed and formatted templates for creating business budgets.

For small businesses, these templates can be an effective way of helping them understand their finances. The templates are free for download and are easily customizable to align with specific business requirements. Additionally, these templates must be updated and accurate, so do not hesitate to review them regularly or whenever a change in the business structure or financial situation occurs.

Tip: Small business budget customization

Each small business venture is unique in its own right. Therefore, small businesses will have different budgeting requirements, which necessitate the customization of business budget templates. When budgeting for a small business, some factors to consider include seasonality, which affects customer buying habits, hidden costs such as shipping fees for e-commerce businesses, and trends or changes in service charges for service-based businesses. Start-ups should be thorough, considering no previous budgets or financial documents for reference when making budget estimates.

Professional Business Budgeting Tips

Creating and executing a business budget requires discipline and commitment to achieve your desired results. When creating a budget, some essential factors to keep in mind can help ensure your budgeting process goes smoothly.

They include:

- Customize your budget according to the change: When creating a business budget, it is essential to keep in mind that changes to your business can occur. Therefore, the best approach is to create a budget that can be modified as the needs of the business evolve. For example, if your business has an irregular income, such as seasonal sales in your favor, you may want to change the revenue forecast to be more predictable.

- Make sure to include all expenses: When creating a business budget template, it is easy to miss out on expenses. There are long-term and short-term expenses to consider, and every expense must be included in your budget. Ensure you have included all costs such as rent, telephone bills, insurance premiums, wages, etc.

- View it as a living document: Your business budget template should be viewed as a living document that will change in response to changes in the business. Revising your budget whenever it is updated could help prevent you from being locked into a strategy that no longer works or costs more than anticipated.

- Set goals: Businesses set goals, so why should you be any different? When creating a business budget, set a target to reach. If you want your business to grow by 10% in the next year, you need to know what steps to take to make it happen. However, be realistic with the estimated revenue and expenses. You may be tempted to overestimate the revenue and underestimate the costs to understand your financial situation better. However, the better approach is to stick with figures that you know are accurate.

- Find ways to cut costs and increase growth: Businesses make budget cuts to increase profit margins. Therefore, you should always consider ways to reduce expenses and increase revenue. Suppose you can cut another $500 per month in costs and double your revenue immediately. However, make sure not to cut costs too drastically or overspend.

Wrapping Up

Businesses should be aware of their finances and clearly understand how the money flows in and out. The suitable way to do this is to establish a business budget where you set your goals, identify your needs, and estimate the costs. The result should be a financial strategy that aligns with your goals and effectively increases revenue or decreases costs.

While creating a business budget can seem very complicated at first, with some practice, you will see how easy it is to create an effective plan for the future of your business. A successful business will create budgets according to their needs and keep an eye on the future, considering that plans often change. Creating a business budget is an essential step toward the success of any business.